Q1 ‘25 earnings season for cloud businesses is now behind us. The 60 companies that I’ll discuss here (which is not an exhaustive list, but is still comprehensive) all reported quarterly earnings sometime between April 23rd – June 11th. In this post, I’ll take a data-driven approach in evaluating the overall group’s performance, and highlight individual standouts along the way. As a venture capitalist, I naturally cater my analysis through the lens of a private investor. Over my years as a VC, I’ve had the opportunity to meet with hundreds of entrepreneurs who are all building special companies. Through these interactions, I’ve built up mental benchmarks for metrics on which I place extra emphasis. My hope is that this analysis can provide startup entrepreneurs with a framework for how to manage their businesses around SaaS metrics (e.g., net retention and CAC payback).

Overall Trends

When looking at the aggregate net new ARR added in Q1, it doesn’t pain the best picture. Net new ARR added was down 28% from Q1 last year. And no, this wasn’t all because of leap year last year (that would only account for a ~3% delta at most)

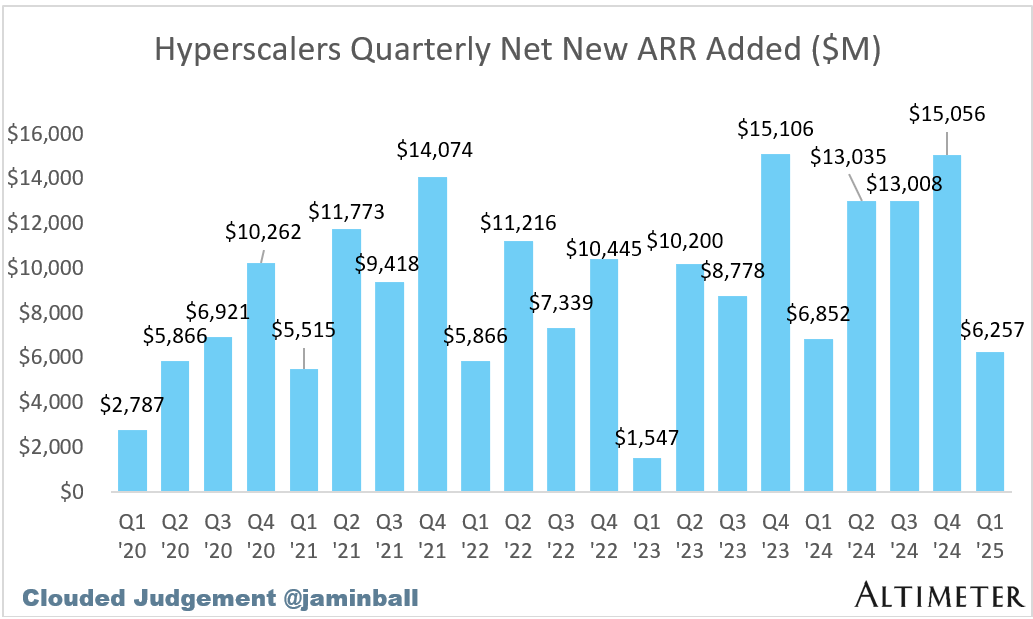

The Hyperscalers (AWS, Azure, Google Cloud) also declined net new adds year over year, but not by as much.

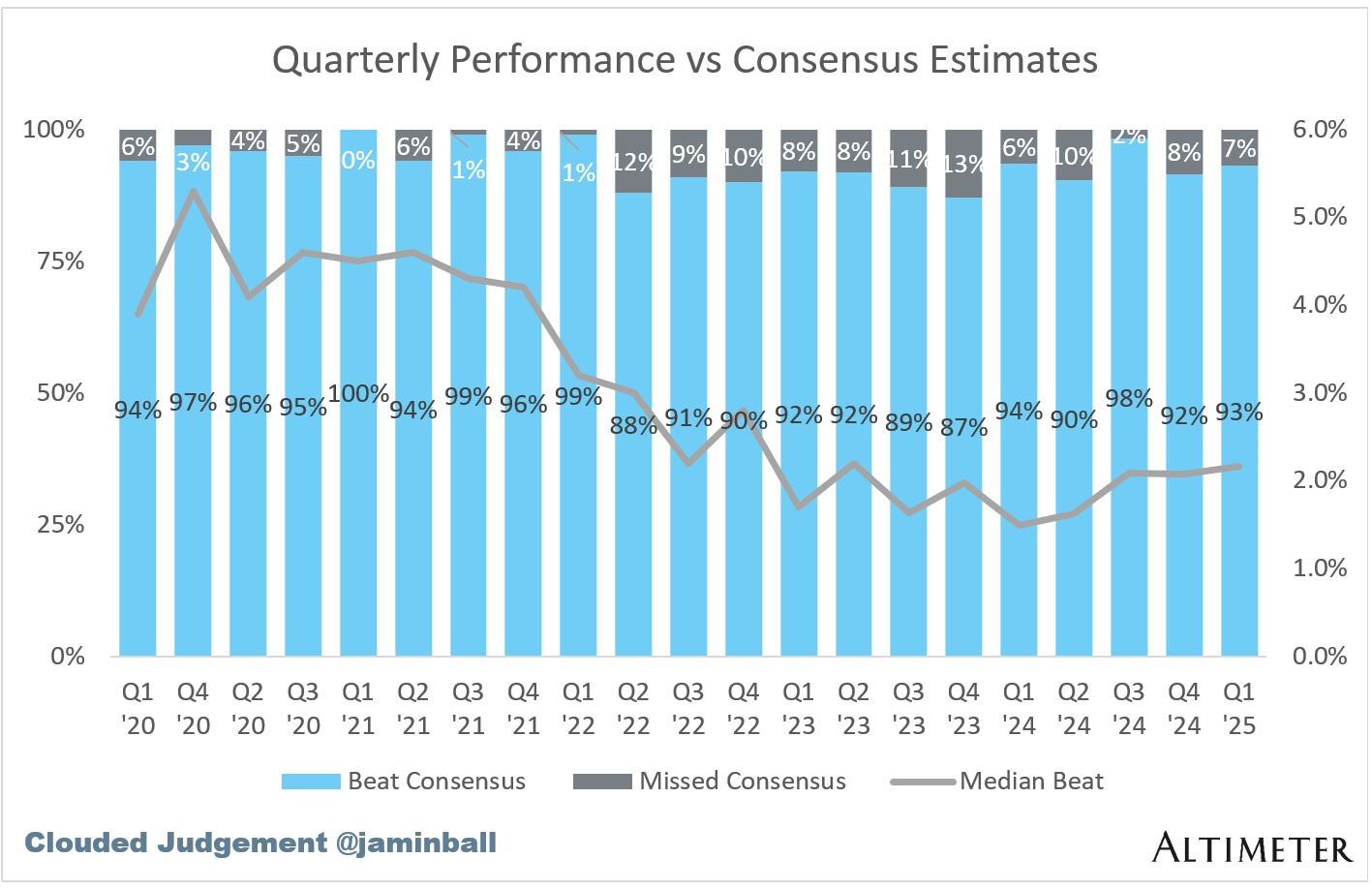

Let’s get into some high level data. If we look at the percentage of companies beating Q1 consensus estimates it ticked up to ~92%. The median beat was ~2.2%

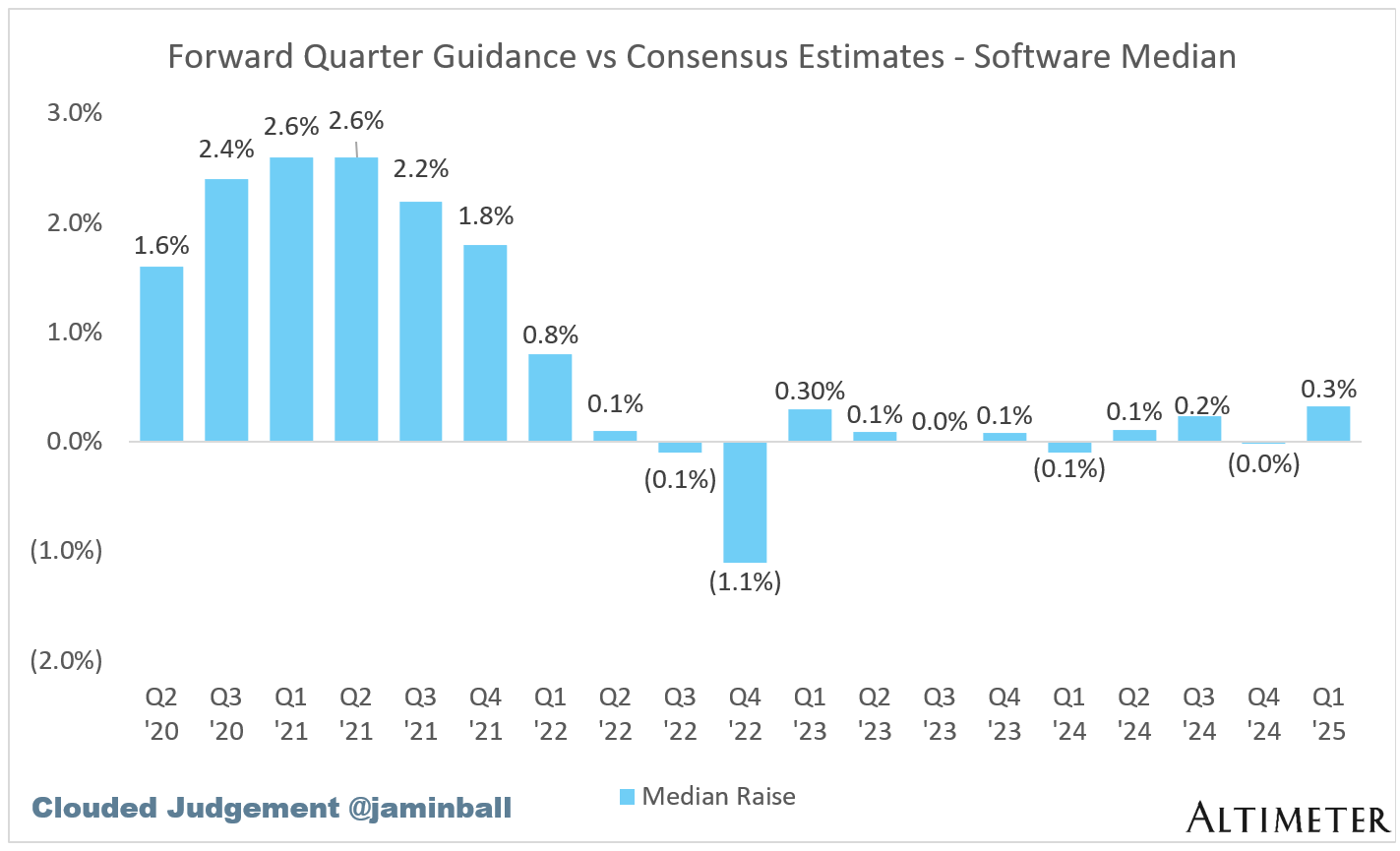

Of course, the above chart shows historical (ie lagging) data. What’s more interesting is the outlook - are companies giving us any hints that the things are improving (or degrading)? When we look at guidance for Q2 relative to consensus we’ll see things jumped back up after the Q4 lull. 67% of companies guided above consensus (up from 50% last Q), and the median guidance was 0.3% above consensus.

And with that let’s jump in to the Q1 ‘25 earnings recap.

Q1 Top Performers

If you don’t have time to read the rest of this article, here are the companies who I believe really stood out (from a financial perspective). They represent my “Q1 Top Performers.” This is not an indication of who I think will preform the strongest in the future, but a look-back on who preformed the best in Q1.

Q1 Revenue Relative to Consensus Estimates

Now let’s dive in to the financial results of Q1 starting with revenue. Beating consensus revenue estimates is the first aspect of a successful quarter. So what are these consensus estimates and who creates them? Every public company has a number of equity research analysts covering them who build their own forecasted models, which combine guidance from the company and their own research / sentiment analysis. The consensus estimates are the average of all the individual analysts’ projections. Generally when you hear “consensus estimates” it refers to revenue and earnings (EPS), but for the purpose of this analysis we’ll just be looking at revenue consensus estimates (as this is the metric these companies are valued off). For every public company the expectation is that they’ll beat consensus estimates, because companies often guide research analysts to the lower end of their internal projections. They do this to set themselves up to consistently beat estimates, demonstrating momentum.

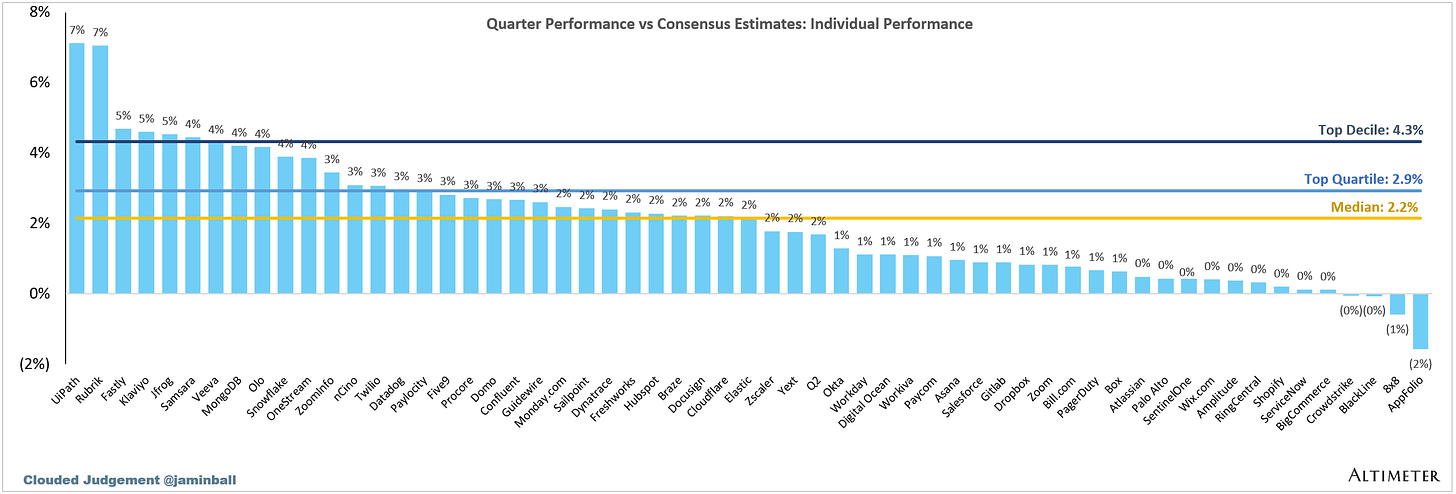

As you can see from the data below most cloud businesses beat the consensus estimates for Q1.

Next Quarter’s Guidance Relative to Consensus Estimates

Guiding above next quarter’s consensus revenue estimates is the second factor for a successful quarter. Generally, companies will give a guidance range (e.g., $95M -$100M), and the numbers I’m showing are the midpoint. Providing guidance that is greater than consensus estimates is a sign of improving business momentum, or confidence that the business will perform better than previously expected. The concept of guiding higher than expectations is considered a “raise.” When you hear the term “beat and raise” the beat refers to beating current quarter’s expectations (what we discussed in the previous section), and the raise is raising guidance for future quarters (generally it’s annual guidance, but for this analysis we’re just looking at the next quarter’s guidance).

Historically, the median guidance “raise” was in the 2-3% range. The last few quarters have all been quite low.

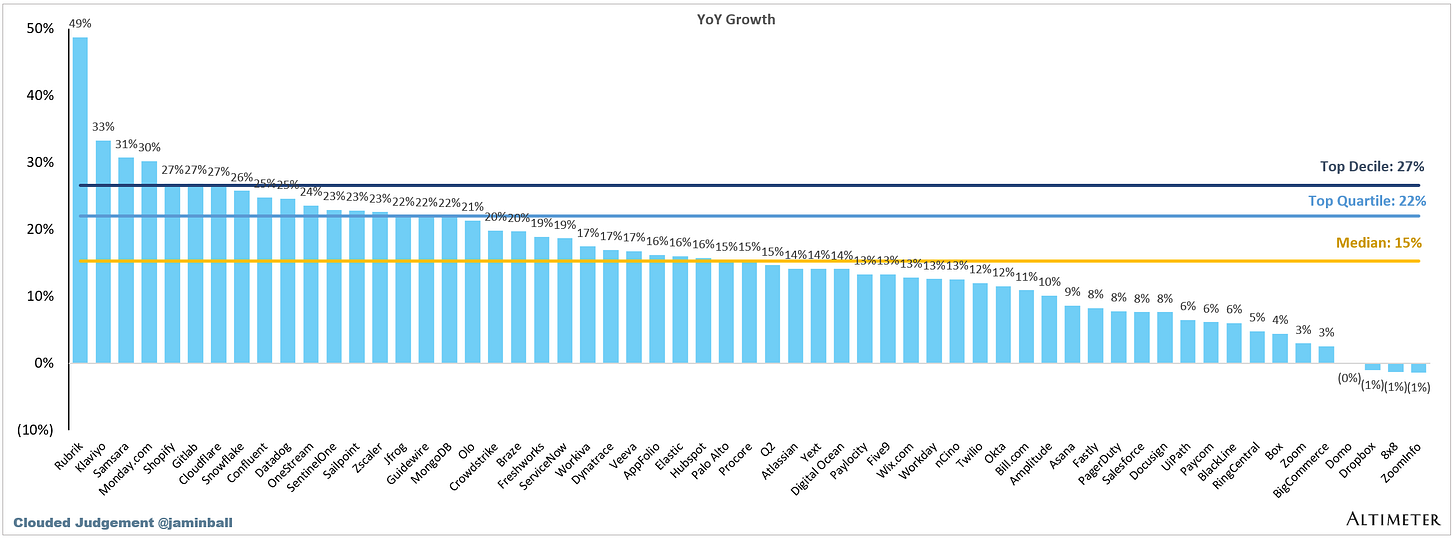

Growth

Demonstrating high growth is the third aspect of a successful quarter. This metric is more self-explanatory, so I won’t go into detail. The growth shown below is a year-over-year growth for reported quarters. The formula to calculate this is: (Q1 ’25 revenue) / (Q1 ’24 revenue) - 1.

The overall software universe quarterly YoY growth has come down meaningfully from highs, but has started to stabilize.

FCF Margin

FCF is an important metric to evaluate in SaaS businesses. Profitability is often the big knock against them, however many generate more cash than you might imagine. I’m calculating FCF by taking the Operating Cash Flow and subtracting CapEx and Capitalized Software Costs. The big caveat in FCF – it adds back the non-cash expense of SBC. This is controversial, as it harms shareholder returns by increasing the number of shares outstanding over time (dilution). This matters a lot more when stock prices are going down, and management teams often grant additional shares to make employees whole (thus increasing dilution even more)

Net Revenue Retention

High net revenue retention is the fourth aspect of a successful quarter, and one of my favorite metrics to evaluate in private SaaS companies. It is calculated by taking the annual recurring revenue of a cohort of customers from 1 year ago, and comparing it to the current annual recurring revenue of that same set of customers (even if you experienced churn). In simpler terms — if you had 10 customers 1 year ago that were paying you $1M in aggregate annual recurring revenue, and today they are paying you $1.1M, your net revenue retention would be 110%. The reason I love this metric is because it really demonstrates how much customers love your product. A high net revenue retention implies that your customers are expanding the usage of your product (adding more seats / users / volume - upsells) or buying other products that you offer (cross-sells), at a higher rate than they are reducing spend (churn).

Here’s why this metric is so significant: It shows how fast you can grow your business annually without adding any new customers. As a public company with significant scale, it’s hard to grow quickly if you have to rely solely on new customers for that growth. At $200M+ ARR, the amount of new-logo ARR you need to add to grow 30%+ is significant. On the other hand, if your net revenue retention is 120%, you only need to grow new logo revenue 10% to be a “high growth” business.

I’ve looked at thousands of private companies, and over time have come up with benchmarks for best-in-class, good, and subpar net revenue retention. Not surprisingly, these benchmarks match up relatively well with the numbers public companies reported. I generally classify anything >130% as best in class, 115% — 130% as good, and anything less than 115% as subpar. For businesses selling predominantly to SMB customers, these benchmarks are all slightly lower given the higher-churn nature of SMBs. I consider >120% best in class for companies selling to SMBs (like Bill.com). Here’s the data:

Sales Efficiency: Gross Margin Adjusted CAC Payback

Demonstrating the ability to efficiently acquire customers is the fifth aspect of a successful quarter. The metric used to measure this is my second-favorite SaaS metric (behind net revenue retention) : Gross Margin Adjusted CAC Payback. It’s a mouthful, but this metric is so important because it demonstrates how sustainable a company’s growth is. In theory, any growth rate is possible with an unlimited budget to hire AEs. However, if these AEs aren’t hitting quota and the OTE (base + commission) you’re paying them doesn’t justify the revenue they bring in, your business will burn through money. This is unsustainable. Because of the recurring nature of SaaS revenue, you can afford to have paybacks longer than 1 year. In fact, this is quite normal.

All that said, Gross Margin Adjusted CAC Payback is relatively simple to calculate. You divide the previous quarter’s S&M expense (fully burdened CAC) by the net new ARR added in the current quarter (new logo ARR + Expansion - Churn - Contraction) multiplied by the gross margin. You then multiply this by 12 to get the number of months it takes to pay back CAC.

(Previous Q S&M) / (Net New ARR x Gross Margin) x 12

A simpler way to calculate net new ARR is by taking the current quarter’s ARR and subtracting the ending ARR from one quarter prior. Similar to net revenue retention, I’ve built up benchmarks to evaluate private companies’ performance. I generally classify any payback <12 months as best in class, 12–24 months as good, and anything >24 months as subpar. The public company data for payback doesn’t match up as nicely with my benchmarks for net revenue retention. The primary reason for this is that public companies can afford to have longer paybacks. At $200M+ ARR, businesses have built up a substantial base of recurring revenue streams that have already paid back their initial CAC. Their ongoing revenue can “fund” new logo acquisition and allow the business to operate profitably at paybacks much larger than what private companies (with smaller ARR bases) can afford.

Most public companies don’t disclose ARR (and when they do, it’s often not the same definition of ARR as we use for private companies). Because of this we have to use an implied ARR metric. To calculate implied ARR I take the subscription revenue in a quarter and multiply it by 4. So for public companies the formula to calculate gross margin adjusted payback is:

[(Previous Q S&M) / ((Current Q Subscription Rev x 4) -(Previous Q Subscription Rev x 4)) x Gross Margin] x 12

Here’s the payback data from this quarter. Not every company reports subscription revenue, so they’ve been left out of the analysis (or I’ve estimated their % subscription revenue). Some software companies also have seasonality in the “payback.” Because many companies don’t actually disclose ARR I’m calculating a swag of ARR based on subscription rev.

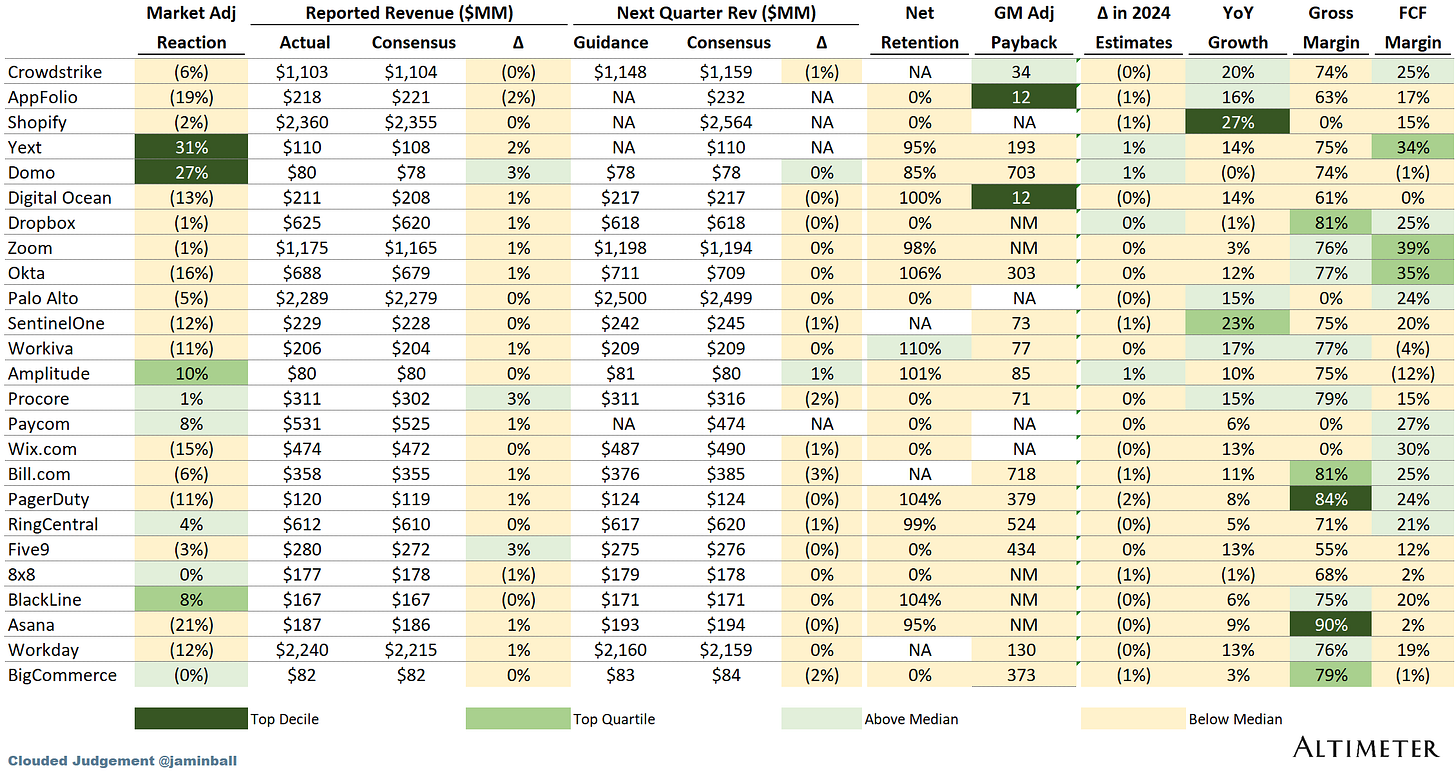

Change in 2025 Consensus Revenue Estimates

Tying all of these metrics together is another one of my favorites: the change in revenue consensus estimates for the 2025 calendar year. Heading into Q1 earnings, analysts had expectations for how each business would perform in 2025. After earnings, that perception either changed positively or negatively. It’s important to look at the magnitude of that change to see which companies appear to be on better paths. Analysts take in quite a bit of information into their future predictions — exec commentary on earnings calls, current quarter results, macro tailwinds / headwinds, etc., and how they adjust their 2025 estimates says a lot about whether the outlook for any given business improved or declined.

Change in Share Price

At the end of the day what investors care about is what happened to the stock after earnings were reported. The stock reaction alone doesn’t represent the strength of a company’s quarter, so the below data has to be viewed in tandem with everything discussed above. Oftentimes the buy-side expects a company to perform well (or poorly), and the company’s stock going into earnings already has these expectations baked in. In these situations the stock’s earnings reaction could be flat. However, it’s still a fun data point to track.

What I’ve shown below is the market-adjusted stock price reaction. This means I’ve removed any impact of broader market shifts to isolate the company’s earnings impact on the stock. As a hypothetical example: Let’s say a day after a company reported earnings their stock was up 4%. However the market that day (using the Nasdaq as a proxy) was up 1%. This implies that even without earnings that company would likely have been up 1%. To calculate the specific impact of earnings on the stock we need to strip out the broader market’s movement. To do this we simply subtract the market’s movement from the stock’s movement: (% Change in Stock) - (% Change in Nasdaq)

Wrapping Up

Here’s a summary of the key stats for each category we talked about, and how the “Big Winners” performed. Hopefully this provides a blueprint for every entrepreneur out there reading this post on how to preform as an elite public company.

The Data

The data for this post was sourced from public company filings, Wall Street Research and Pitchbook. If you’d like to explore the raw data I’ve included it below. Looking forward to providing more earnings summaries for future quarters! If you have any feedback on this post, or would like me to add additional companies / analysis to future earnings summaries, please let me know!

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Would be great to rank these by stock based comp abuse. It is the most abused aspect of corporate finance and the US tech sector is the worst offender. It's a de-facto tax on shareholders levied by insiders, on top of their already very generous pay packages. It acts as a huge drag on total shareholder returns and it also introduces huge distortions to share prices as companies seek to disguise the dilution by buying stock in vast quantities at any price, stretching the market cap far from economic reality based on fundamentals. Through this lens, some of these companies are just ticking time bombs waiting for the next dot-com correction. I welcome your views.

The combination of public company data with benchmarks you’ve developed through private market experience makes this especially valuable. I appreciated the clarity around metrics like gross margin adjusted CAC payback and net revenue retention — these are often discussed but rarely explained so thoroughly.