Q1 earnings season for Cloud businesses is now behind us. The 54 companies that I’ll discuss here (which is not an exhaustive list, but is still fairly comprehensive) all reported quarterly earnings sometime between April 29th — June 9th. In this post I’ll take a data-driven approach to evaluate the overall group’s performance, and highlight individual standouts along the way. As a venture capitalist at Redpoint Ventures, I’ll try to cater my analysis through the lens of a private investor. Over my time at Redpoint, I’ve had the opportunity to meet with hundreds of entrepreneurs who are all building special companies. Through these interactions, I’ve built up mental benchmarks for metrics on which I place extra emphasis. My hope is that this analysis can provide startup entrepreneurs with a framework for how to manage their business around SaaS metrics (e.g., net retention and CAC payback).

Public SaaS Valuations

The last couple months have been extremely volatile for technology (particularly SaaS) stocks. We saw the Vix (an index that measures volatility) hit an all-time high of 82, surpassing its previous max of 80 during the financial crisis of 2008. We saw the Nasdaq quickly drop ~30%, only to fully recover and hit all-time highs last week in a dramatic V-shaped recovery. We saw businesses like Zoom trade at >60x NTM revenue, exceed quarterly expectations by >60%, and nearly double year-end revenue guidance. And finally, the tech IPO markets showed their strength when ZoomInfo successfully priced its IPO to raise ~$1Bn. This represented the largest software IPO in the last decade, and one of the highest revenue multiples for a tech IPO over the same time period. Overall, the basket of 54 SaaS stocks analyzed in this post have created roughly $300Bn in market cap this year alone. As a retail investor, investing equally across this basket of companies at the beginning of the year would have yielded a 37% return year-to-date (while the S&P is down 1% and the Nasdaq is only up 9%). To many, this might seem surprising given the current state of the country, given the struggle for racial justice, the tragedy of Covid-19, and our current high unemployment rates.

So what’s driving the massive tide lifting SaaS stocks? There isn’t one obvious answer, but rather a confluence of factors. First, there are a number of industries that are significantly affected by Covid-19 — travel, hospitality, casinos & gaming, retail, restaurants, etc. Large hedge funds and institutional investors have rotated out of positions in these industries and need somewhere to park this money. What better place than in business with highly predictable SaaS revenue streams, many of whom are seeing Covid tailwinds as digital transformations are pulled forward. Companies like Zoom, Datadog, and Fastly have all seen demand for their products spike. Furthermore, the unit economics of these SaaS businesses are incredibly attractive. Companies like Twilio, with high net retention of 143% (a metric I’ll get into more later), can afford to add 0 new customers over the next year and still grow 43% annually. This is astounding, and something no other industry can claim. The lifetime value of each customer (the value of all future cash flows from that customer) is often multiples greater than the cost to acquire them. The combo of predictable revenue streams, high (and in some cases accelerating) revenue growth, and attractive unit economics have made SaaS an incredibly attractive market throughout these turbulent times. The interesting nuance, of course, is that not all cloud businesses have benefited equally. In our current environment, the high-growth category leaders have seen disproportionate gains compared to their lower growth, “value stock” counterparts. Zoom, Crowdstrike, Bill.com, Twilio, Coupa, Fastly, Zscaler and others have all blown past pre-Covid levels to hit all-time highs in the last couple weeks. But Microsoft, Adobe, Intuit, New Relic and other value stocks have either struggled to nudge past pre-Covid highs or haven’t completely rebounded yet. Overall, this flight to quality has lifted cloud businesses, and compounded to lift the top cloud businesses even more. The bigger question remains what will happen when the economy stabilizes and large institutional investors rotate back into the abandoned industries like travel and hospitality. Only time will tell if the “Covid-bump” for cloud businesses will last!

Q1 Big Winners

Coming out of Q1 there were a few businesses that in my mind stood out as “Big Winners.” These companies showed a combination of incredibly strong results, robust outlooks, and attractive unit economics. The public markets rewarded all of them handsomely. I’ll take a closer look at each of these businesses in the sections below.

Valuation Metrics

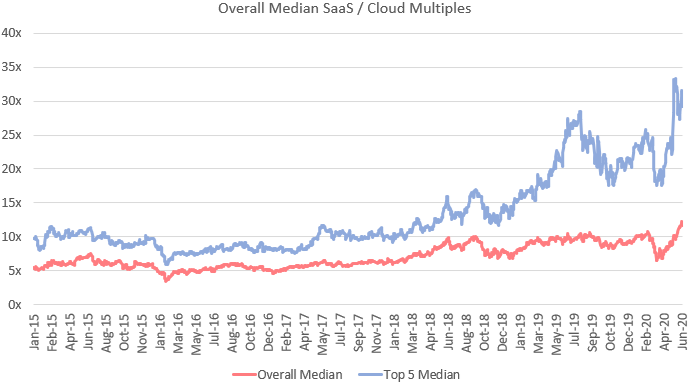

Before getting into the Q1 data, it’s important to frame the conversation around valuations. Just about all cloud companies are valued off of a multiple of their revenue. That is, their Enterprise Value / NTM (Next Twelve Months) Revenue. We use forward revenue estimates as a company’s future outlook determines its worth. As you can see from the chart below, we’re currently at all-time-high revenue multiples and valuations, albeit in the middle of a global pandemic. Median forward revenue multiples for all cloud businesses currently sits right around 12x, and the median of the top 5 multiples has expanded the most.

Doubling clicking one layer further, we see high-growth businesses have seen the greatest multiple expansion since Covid. In the below chart I define High Growth as >30% projected NTM growth, Mid Growth as 15%-30% and Low Growth as anything <15%.

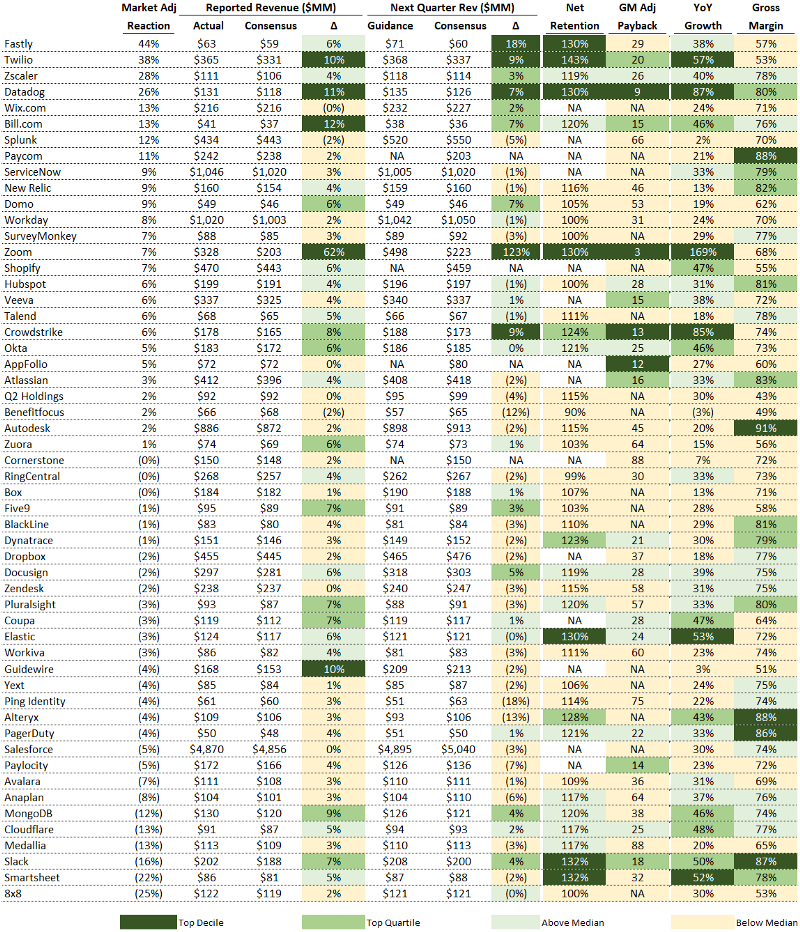

Q1 Results Relative To Consensus Estimates

Beating consensus revenue estimates are the first aspect of a successful quarter. So what are these consensus estimates and who creates them? Every public company has a number of equity research analysts covering them who build their own forecasted models, which combine guidance from the company and their own research / sentiment analysis. The consensus estimates are the average of all the individual analysts’ projections. Generally when you hear “consensus estimates” it refers to revenue and earnings (EPS), but for the purpose of this analysis we’ll just be looking at revenue consensus estimates (as this is the metric these companies are valued off). For every public company the expectation is that they’ll beat consensus estimates, because companies often guide research analysts to the lower end of their internal projections. They do this to set themselves up to consistently beat estimates, demonstrating momentum. Cisco, for example, famously beat earnings expectations for 43 straight quarters in the 1990s.

It’s also important to note that when a company is providing guidance for the “next quarter,” they are (in some cases) already halfway through that quarter due to the timing of earnings calls. By then, they generally have a good sense for how the quarter is going and can guide ever so slightly under their internal projections. As the data shows below, the median “beat” of quarterly consensus estimates was ~4% in Q1.

As you can see from the data below the vast majority of cloud businesses beat the consensus estimates for Q1.

As you can see from the data above, 94% of businesses beat their Q1 revenue consensus estimates. The median beat was 3.9%, a top quartile beat was anything >6.3%, and a top decile beat was anything >9.6%. And as you can see from the data, the results are nearly identical from companies with March and April quarter ends.

So how did our “Big Winners” perform in Q1 relative to consensus estimates? Bill.com, Datadog, Twilio and Zoom were all top decile performers. Crowdstrike, Fastly and Shopify were top quartile. Zscaler was above median.

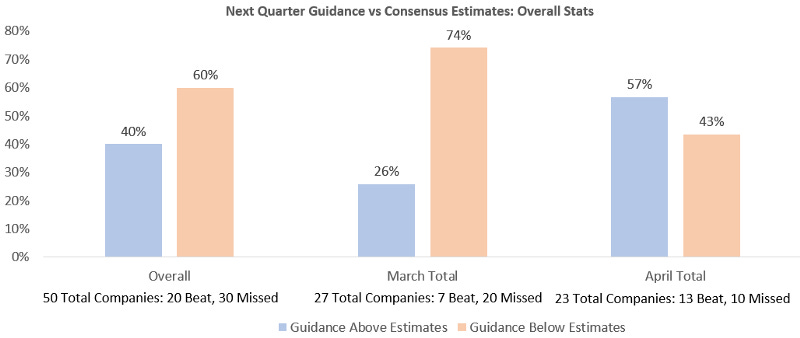

Next Quarter’s Guidance Relative to Consensus Estimates

Guiding above next quarter’s consensus revenue estimates is the second factor of a successful quarter. Generally, companies will give a guidance range (e.g., $95M — $100M), and the numbers I’m showing are the midpoint. Providing guidance that is greater than consensus estimates is a sign of improving business momentum, or confidence that the business will perform better than previously expected. The concept of guiding higher than expectations is considered a “raise.” When you hear the term “beat and raise” the beat refers to beating current quarters expectations (what we discussed in the previous section), and the raise is raising guidance for future quarters (generally its annual guidance, but for this analysis we’re just looking at the next quarters guidance).

As you can see from the data below, there was a difference in the percentage of raises from March to April. My guess here is that there was even more uncertainty around the pandemic’s effects in March, and because of this companies were more conservative in their guidance. They were preparing for the worst. A month later two things happened. Future estimates had more time to be revised down, and companies had a much better sense for the pandemic’s impact on their business. Therefore they didn’t feel the need to guide so conservatively (with a bigger cushion). Here’s the data:

As you can see from the data above, 40% of businesses guided above their Q2 revenue consensus estimates. The overall guidance outlook median came in 1% under consensus estimates. A top quartile guidance raise was anything >1.9%, and a top decile guidance raise was anything >7.4%. Of the companies that provided a guidance raise, the median raise was 3.6%.

So how did our “Big Winners” perform in Q1 relative to consensus estimates? Crowdstrike, Datadog, Fastly, Twilio and Zoom were all top decile performers. Bill.com was barely outside the top decile and Zscaler was above the median.

Growth

Demonstrating high growth is the third aspect of a successful quarter. This metric is more self-explanatory so I won’t go into detail. The growth shown below is a year-over-year growth for reported quarters. The formula to calculate this is: (Q1 ’20 revenue) / (Q1 ’19 revenue) -1.

As you can see from the data above the median growth rate was 31%, a top quartile growth rate was anything >42%, and a top decile growth rate was anything >53%.

So how did our “Big Winners” perform in Q1? Bill.com, Crowdstrike, Datadog, Twilio and Zoom were all top decile performers. Shopify was in the top quartile, and Fastly and Zscaler were above the median.

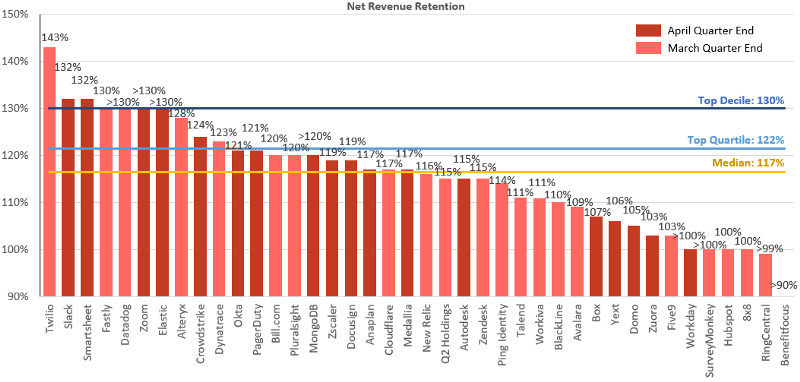

Net Revenue Retention

High net revenue retention is the fourth aspect of a successful quarter, and one of my favorite metrics to evaluate in private SaaS companies. It is calculated by taking the annual recurring revenue of a cohort of customers from 1 year ago, and comparing it to the current annual recurring revenue of that same set of customers (even if you experienced churn and that group of customers now only has 9, or anything <10). In simpler terms — if you had 10 customers 1 year ago that were paying you $1M in aggregate annual recurring revenue, and today they are paying you $1.1M, your net revenue retention would be 110%. The reason I love this metric is because it really demonstrates how much customers love your product. A high net revenue retention implies that your customers are expanding the usage of your product (adding more seats / users / volume — upsells) or buying other products that you offer (cross-sells), at a higher rate than they are reducing spend (churn). Here’s why this metric is so significant: It shows how fast you can grow your business annually without adding any new customers. As a public company with significant scale, it’s hard to grow quickly if you have to rely solely on new customers for that growth. At $200M+ ARR, the amount of new-logo ARR you need to add to grow 30%+ is significant. On the other hand, if your net revenue retention is 120%, you only need to grow new logo revenue 10% to be a “high growth” business.

I’ve looked at thousands of private companies, and over time have come up with benchmarks for best-in-class, good, and subpar net revenue retention. Not surprisingly, these benchmarks match up relatively well with the numbers public companies reported. I generally classify anything >130% as best in class, 115% — 130% as good, and anything less than 115% as subpar. For businesses selling predominantly to SMB customers, these benchmarks are all slightly lower given the higher-churn nature of SMBs. I consider >120% best in class for companies selling to SMBs (like Bill.com). Here’s the data from Q1 earnings:

As you can see from the data above, the median net revenue retention rate was 117%, a top quartile net revenue retention rate was anything >122%, and a top decile net revenue retention rate was anything >130%. The one point to note: not all companies report this number. It’s fair to assume that the majority of companies who don’t report this metric probably fall into the subpar category. Because of this, the median, top quartile, and top decile numbers mentioned above probably are better than reality.

So how did our “Big Winners” perform in Q1? Datadog, Fastly, Twilio, Zoom and Bill.com were all top decile. I’m including Bill.com here because 120% net retention selling to SMBs is phenomenal. Crowdstrike was in the top quartile, and Zscaler was above the median.

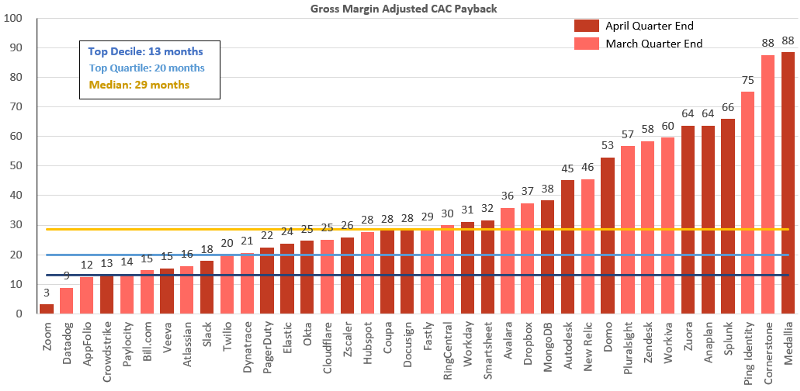

Sales Efficiency: Gross Margin Adjusted CAC Payback

Demonstrating the ability to efficiently acquire customers is the fifth aspect of a successful quarter. The metric used to measure this is my second-favorite SaaS metric (behind net revenue retention) — Gross Margin Adjusted CAC Payback. It’s a mouthful, but this metric is so important because it demonstrates how sustainable a company’s growth is. In theory, any growth rate is possible with an unlimited budget to hire AEs. However, if these AEs aren’t hitting quota and the OTE (base + commission) you’re paying them doesn’t justify the revenue they bring in, your business will burn through money. This is unsustainable. Because of the recurring nature of SaaS revenue, you can afford to have paybacks longer than 1 year. In fact, this is quite normal.

All that said, Gross Margin Adjusted CAC Payback is relatively simple to calculate. You divide the previous quarter’s S&M expense (fully burdened CAC) by the net new ARR added in the current quarter (new logo ARR + Expansion — Churn — Contraction) multiplied by the gross margin. You then multiply this by 12 to get the number of months it takes to pay back CAC.

(Previous Q S&M) / (Net New ARR x Gross Margin) x 12

A simpler way to calculate net new ARR is by taking the current quarter’s ARR and subtracting the ending ARR from one quarter prior. Similar to net revenue retention, I’ve built up benchmarks to evaluate private companies’ performance. I generally classify any payback <12 months as best in class, 12–24 months as good, and anything >24 months as subpar. The public company data for payback doesn’t match up as nicely with my benchmarks for net revenue retention. The primary reason for this is that public companies can afford to have longer paybacks. At $200M+ ARR, businesses have built up a substantial base of recurring revenue streams that have already paid back their initial CAC. Their ongoing revenue can “fund” new logo acquisition and allow the business to operate profitably at paybacks much larger than what private companies (with smaller ARR bases) can afford.

Most public companies don’t disclose ARR (and when they do, it’s often not the same definition of ARR as we use for private companies). Because of this we have to use an implied ARR metric. To calculate implied ARR I take the subscription revenue in a quarter and multiply it by 4. So for public companies the formula to calculate gross margin adjusted payback is:

[(Previous Q S&M) / ((Current Q Subscription Rev x 4) — (Previous Q Subscription Rev x 4)) x Gross Margin] x 12

Here’s the payback data from Q1. Not every company reports subscription revenue, so they’ve been left out of the analysis.

As you can see from the data above, the median gross margin adjusted payback was 29 months, a top quartile gross margin adjusted payback was anything <20 months, and a top decile gross margin adjusted payback was anything <13 months.

So how did our “Big Winners” perform in Q1 relative to consensus estimates? Crowdstrike, Datadog and Zoom were all top decile performers. Bill.com and Twilio were top quartile. Fastly and Zscaler were above median.

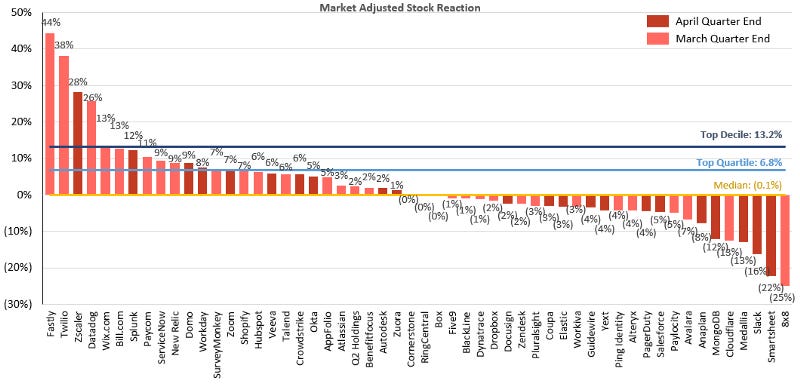

Change in Share Price

At the end of the day what investors care about is what happened to the stock after earnings were reported. The stock reaction alone doesn’t represent the strength of a company’s quarter, so the below data has to be viewed in tandem with everything discussed above. Oftentimes the buy-side expects a company to perform well (or poorly), and the company’s stock going into earnings already has these expectations baked in. In these situations the stock’s earnings reaction could be flat. However, it’s still a fun data point to track.

What I’ve shown below is the market-adjusted stock price reaction. This means I’ve removed any impact of broader market shifts to isolate the company’s earnings impact on the stock. As an example, a day after SurveyMonkey reported earnings their stock was up 9%. However the market (using the Nasdaq as a proxy) was up 2% that same day. This implies that even without earnings SurveyMonkey would likely have been up 2%. To calculate the specific impact of earnings on the stock we need to strip out the broader markets movement. To do this we subtract the market’s movement from the stocks movement: (% Change in Stock) — (% Change in Nasdaq)

Wrapping Up

This quarter has been a wild ride for SaaS businesses. As a group they’ve performed quite well during these volatile times in the broader market, and in that sense the future looks bright.

Here’s a summary of the key stats for each category we talked about, and how the “Big Winners” performed. Excluding the share price reaction, Datadog and Zoom are the only two companies to perform at Top Decile levels across every metric and are my Elite Performers of Q1! Hopefully this provides a blueprint for every entrepreneur out there reading this post.

The Data

The data for this post was sourced from public company filings, Wall Street Research and Pitchbook. If you’d like to explore the raw data I’ve included it below. Looking forward to providing more earnings summaries for future quarters! If you have any feedback on this post, or would like me to add additional companies / analysis to future earnings summaries please let me know!

Very insightful article! Thank you!

I had a question though. Some other websites mention the metric CAC Ratio: The CAC ratio provides insight into the ultimate profitability of S&M investments. It is calculated by multiplying new annualized quarterly revenue by gross profit and dividing by S&M expense for the quarter. A CAC ratio of .5 shows that half of the investment is paid back within a year, and assuming low churn, paid back in full in two years.

Is this the same as gross margin adjusted CAC ratio you mention? The calculation was different so wanted to check.

If SHOP is included, would love to see CHWY and so PTON.

PTON runs monthly subscriptions. It's like AAPL and is a powerful company(S/W and H/W)