Clouded Judgement 10.10.25 - The ChatGPT App Store Moment

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

The ChatGPT App Store Moment

OpenAI just had their app store moment, and we may look back on it as one of the most significant announcement of the company’s history. The company introduced “apps” inside ChatGPT, and a development platform called Apps SDK to help develops build custom native ChatGPT apps. You can now call an app by name, “Spotify, make me a playlist,” “Expedia, find me a flight,” “DoorDash, order my usual,” and ChatGPT will handle the interaction in-line, blending natural language, APIs, and lightweight interfaces into a single conversational flow. It’s a simple but profound shift: ChatGPT is no longer just a reasoning engine, it’s becoming an interface to the internet itself. A super-app.

If that sounds familiar, it should. The move feels reminiscent of the early days of the iPhone, when the App Store first unlocked a new wave of software innovation. But it’s probably even earlier than that today, closer to the era of mobile web apps, when developers were building lightweight wrappers around browser constraints, experimenting with what was possible inside a small screen and a limited sandbox. Today’s ChatGPT apps feel the same way. They’re integrations and not native experiences. They connect external services through things like Model Context Protocol and a small set of exposed primitives like context and API calls. They work, they’re magical at times, but they’re still early. And we’ve seen a version of this before (when OpenAI launched custom GPTs). That never really took off, but this feels different.

The analogy to early mobile web is an important one. Those first “apps” were clever but constrained. Slower, less functional, and dependent on the capabilities the browser exposed. Then Apple opened up deeper APIs, and developers began building true native experiences that could access sensors, storage, notifications, and local compute. That’s when the App Store truly took off. The same evolution feels inevitable here. As OpenAI expands its SDK and gives developers access to richer APIs (things like user memory, persistent state, and action execution) we’ll see the first generation of true native ChatGPT apps. These won’t just be integrations, they’ll be full applications designed from the ground up to live inside a conversational interface, with their own logic, persistence, and interactivity.

At that point, ChatGPT will start to feel less like a product and more like a platform, a place where users spend their time, transact, and interact with services. The apps already launching from companies like DoorDash, Uber, Spotify, Figma, Canva, Expedia, and others are the equivalent of the early web experiments that hinted at what was to come. But as usage compounds, an ecosystem will form. Discovery, ranking, monetization, and distribution will follow, and ChatGPT will evolve into something that looks a lot like an operating system for intelligence.

That platform shift also changes what OpenAI itself is becoming. Behind the scenes, the company is building massive data centers, custom compute hardware, distributed serving infrastructure, and the software orchestration on top to make it all efficient. It’s easy to think they’re doing this just to train their next model or serve inference, but it’s much bigger than that! They’re scaling a cloud. When you combine that infrastructure with a growing developer ecosystem and a user base measured in the hundreds of millions, the parallels to AWS or Azure become hard to ignore. Those platforms built the cloud for compute. However, the initial hyperscalers (AWS, Azure, GCP) built out clouds to scale SaaS applications and services. Those looked a lot more like CPU workloads. They weren’t an “AI Cloud Hyperscaler”

OpenAI might end up building the cloud for intelligence, the cloud for AI. A platform where developers deploy not code, but reasoning. In many ways Oracle had a second mover advantage, starting OCI much closer to the AI buildout, and they could build cloud services more focused on serving AI workloads. OpenAI is doing this to the extreme.

And if that’s where this is heading, then these early “apps in ChatGPT” may just be the first glimpse of a new software platform being born - one where the browser, the operating system, and the cloud all collapse into a single interface powered by intelligence. And maybe one day they’ll have the enterprise super app :) The interface to interact with the long tail of SaaS providers (could Satya’s prediction of SaaS being turned into a dumb database become true??). We’ll save that for a follow up post.

In closing, the generational companies always find a way to redefine themselves, and stack “S-Curve” opportunities on top of themselves. OpenAI was first the “model company.” Then it was the “ChatGPT company.” Now it’s the “Super App”? The opportunity and potential keeps getting larger and larger

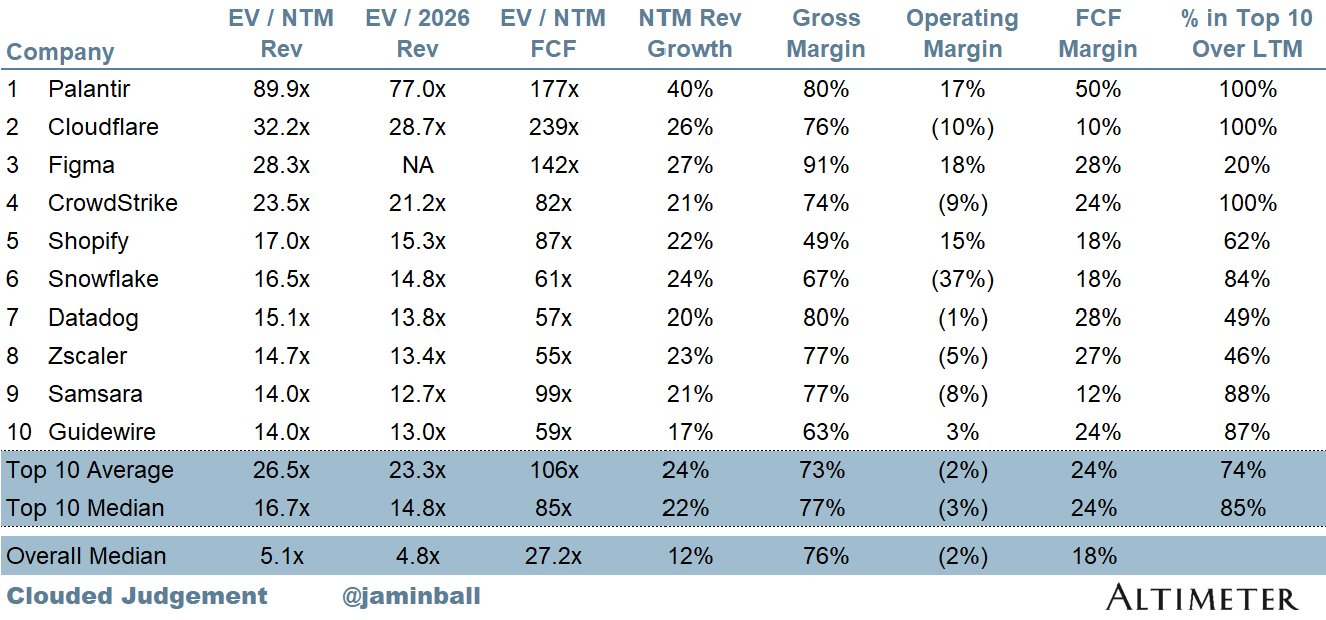

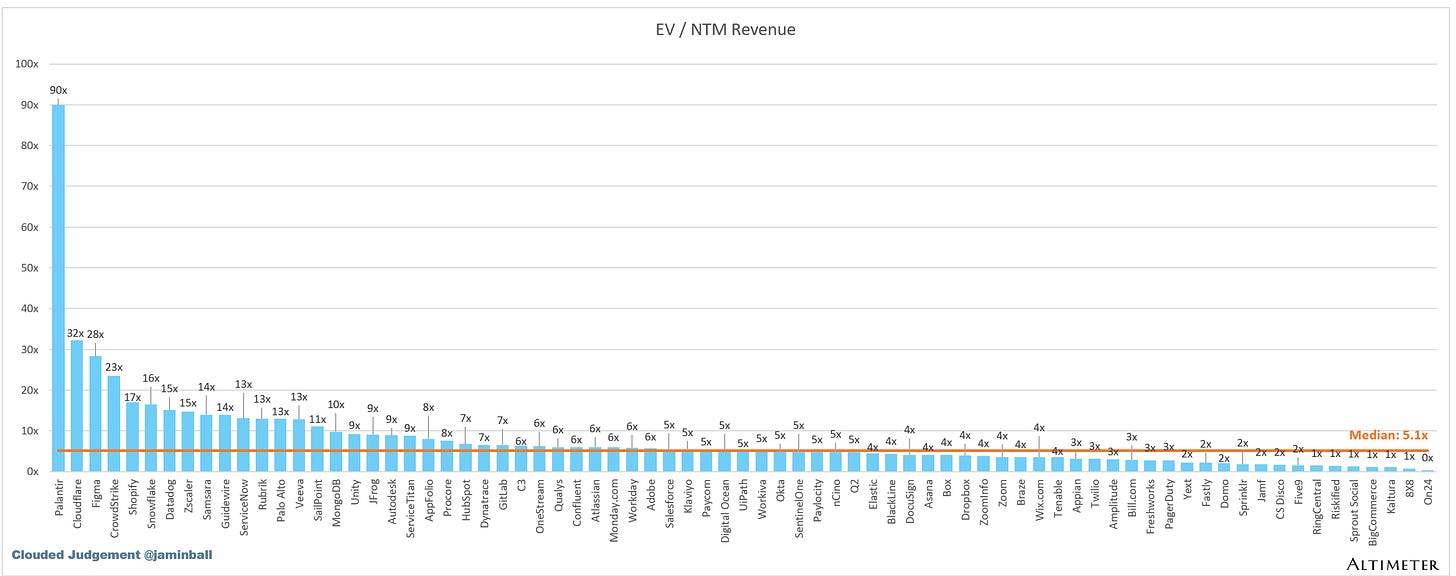

Top 10 EV / NTM Revenue Multiples

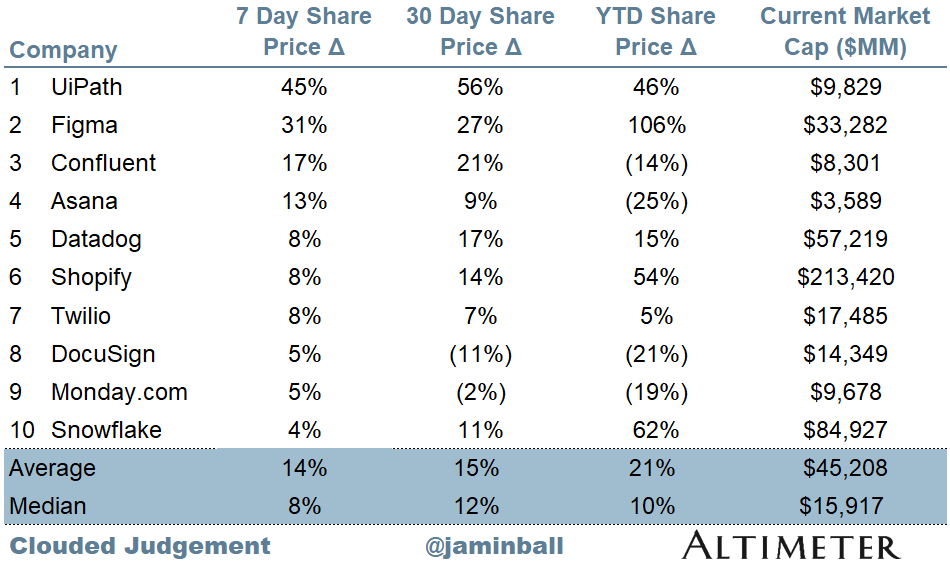

Top 10 Weekly Share Price Movement

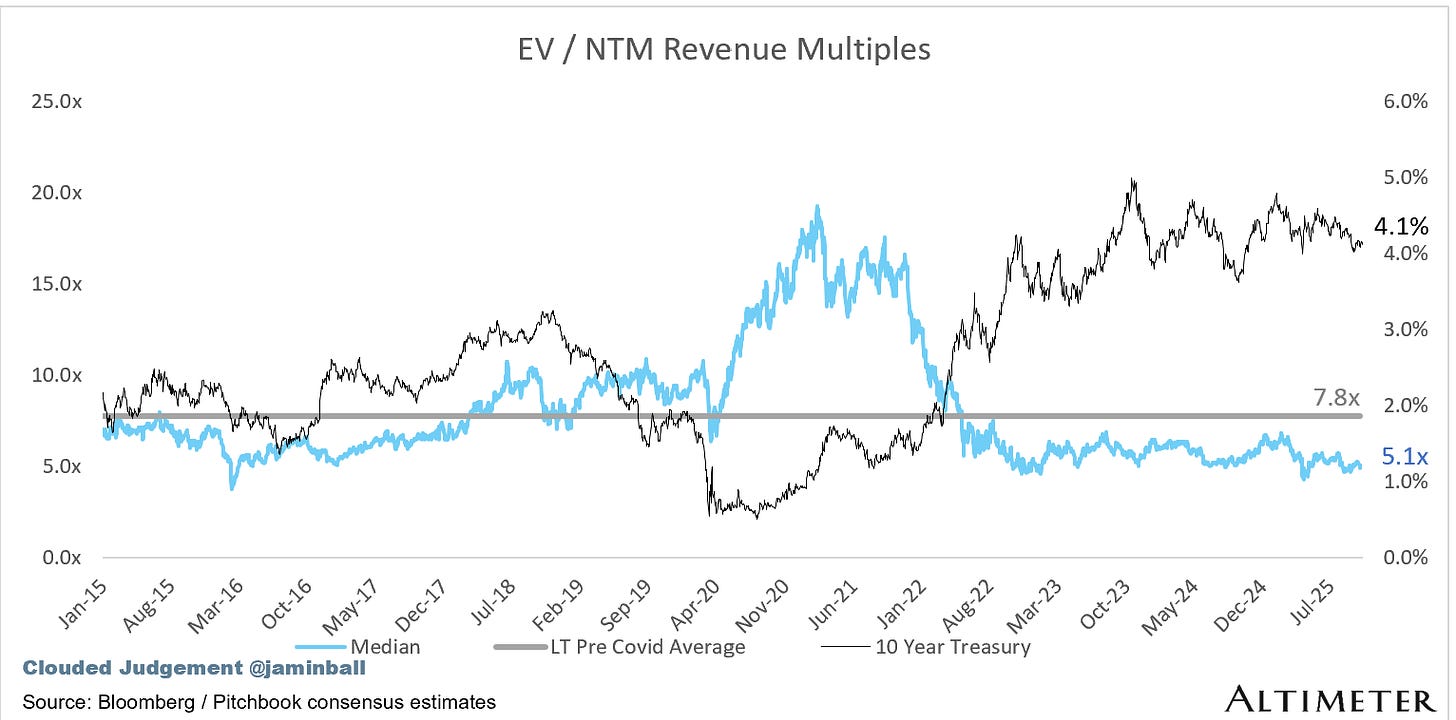

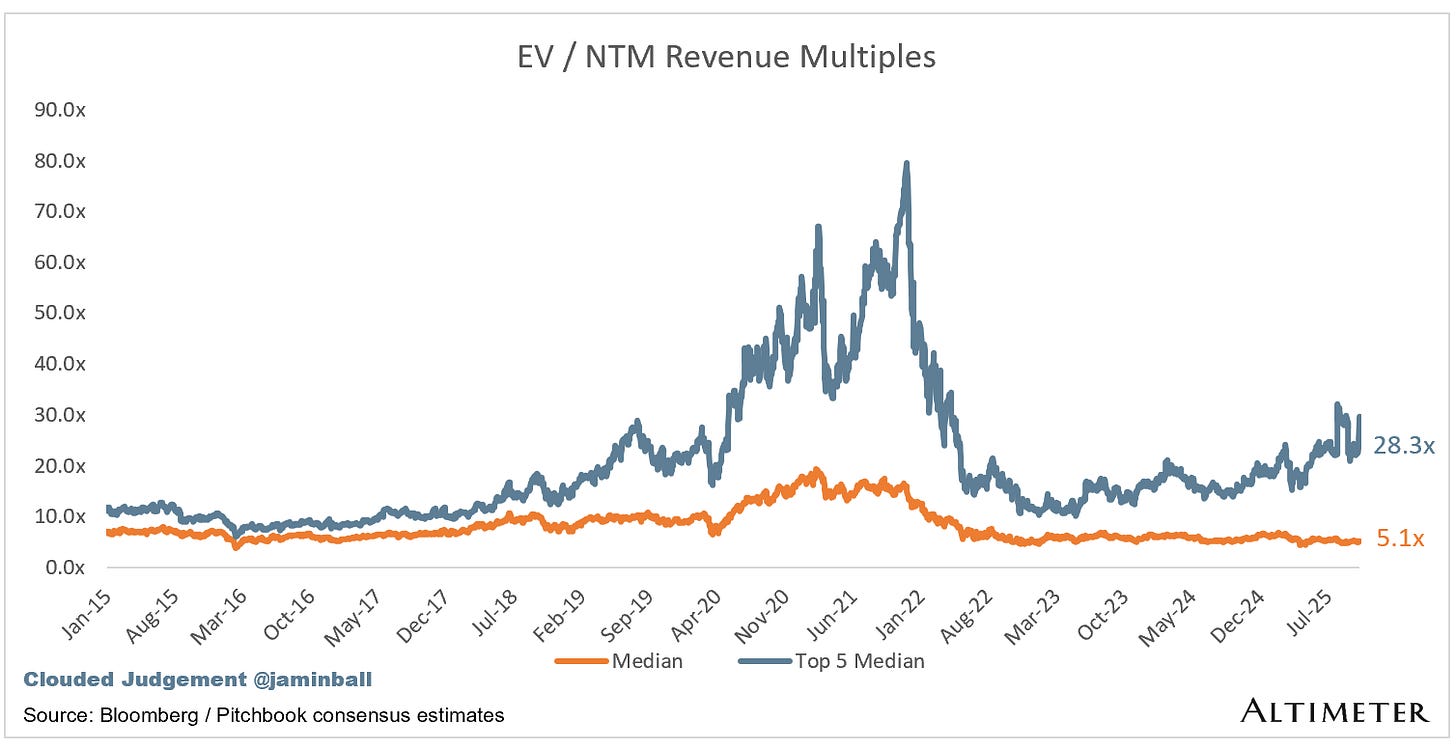

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.1x

Top 5 Median: 28.3x

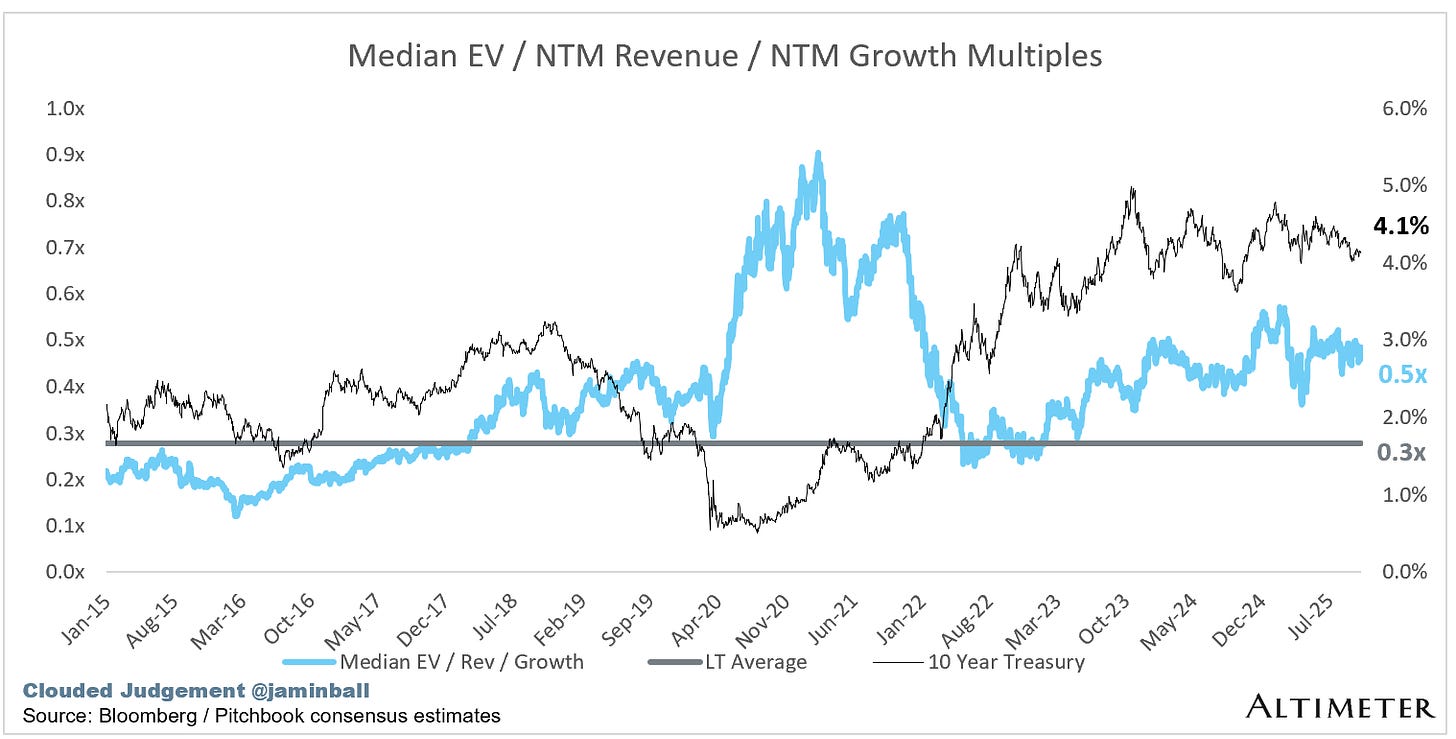

10Y: 4.1%

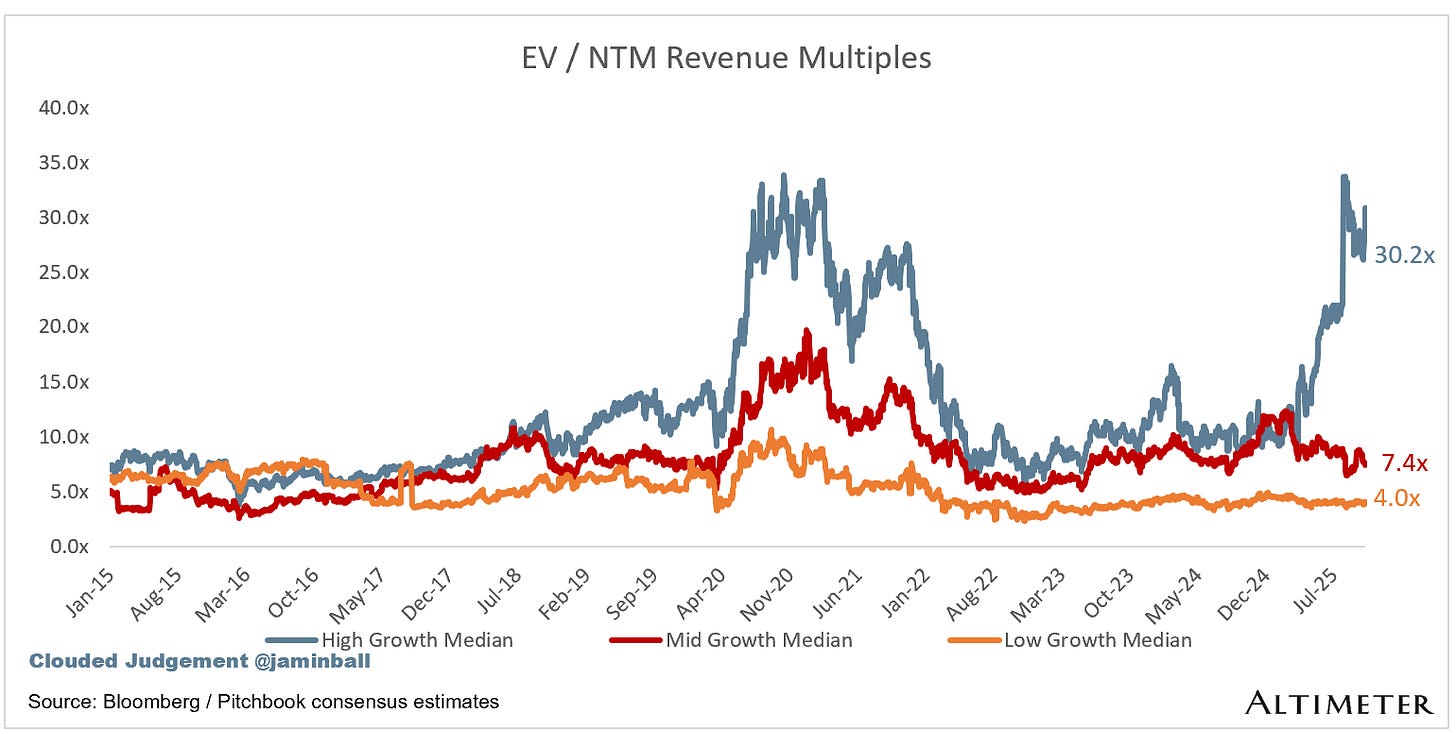

Bucketed by Growth. In the buckets below I consider high growth >25% projected NTM growth, mid growth 15%-25% and low growth <15%

High Growth Median: 30.2x

Mid Growth Median: 7.4x

Low Growth Median: 4.0x

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to its growth expectations.

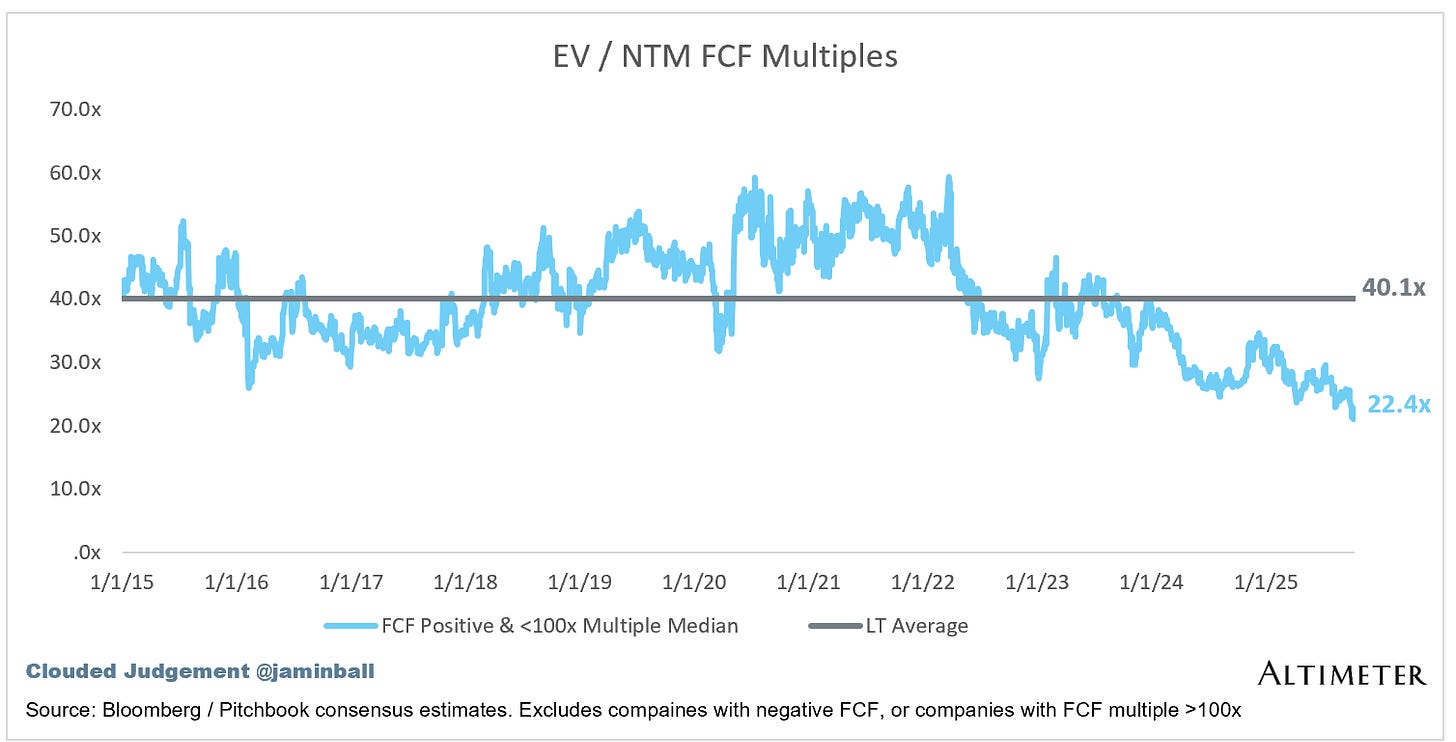

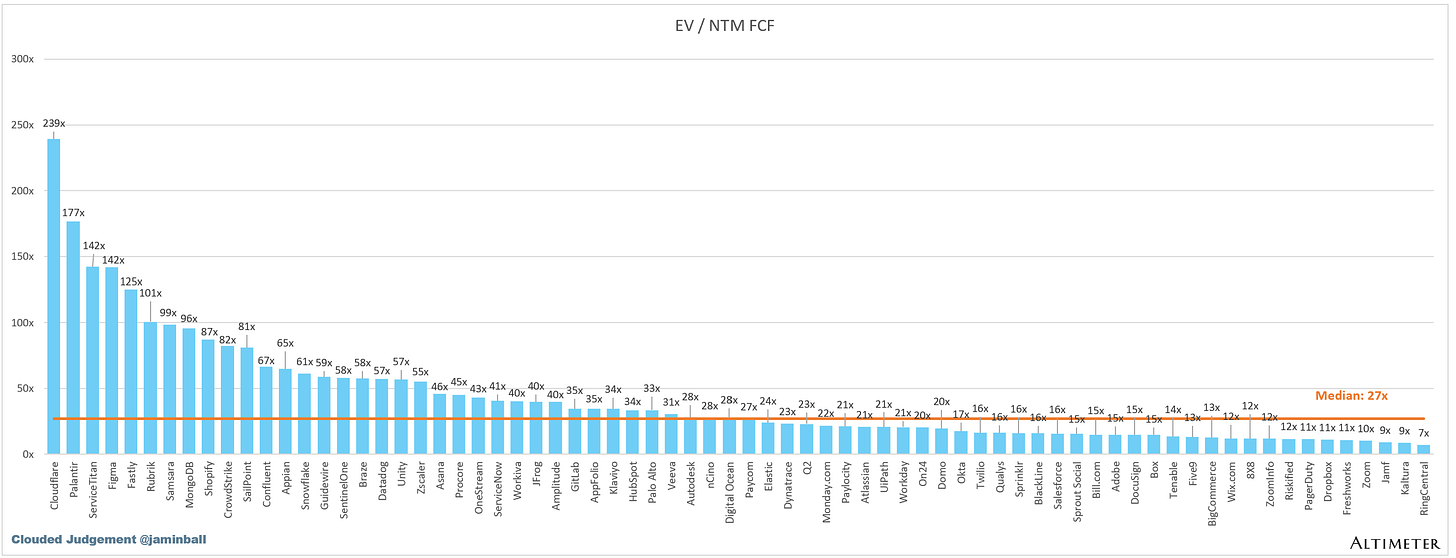

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

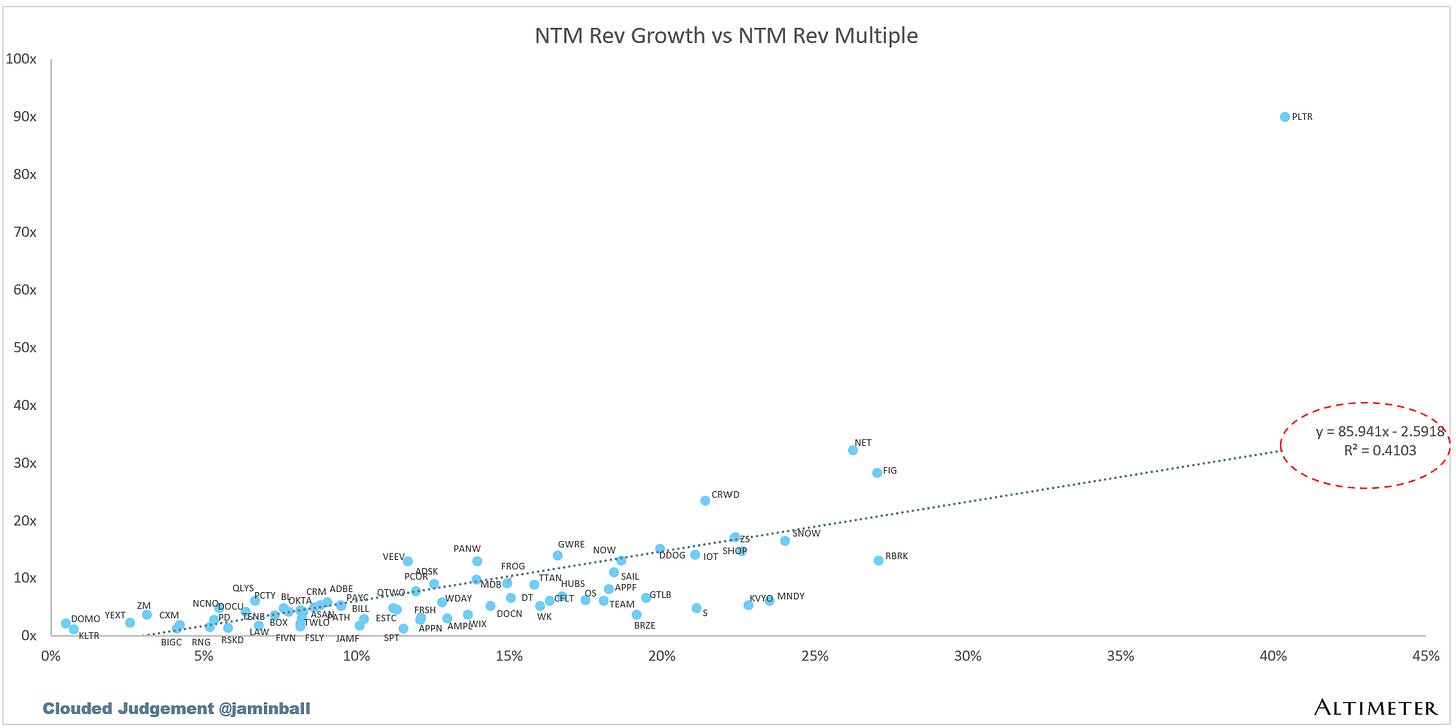

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 12%

Median LTM growth rate: 14%

Median Gross Margin: 76%

Median Operating Margin (2%)

Median FCF Margin: 18%

Median Net Retention: 108%

Median CAC Payback: 32 months

Median S&M % Revenue: 37%

Median R&D % Revenue: 24%

Median G&A % Revenue: 15%

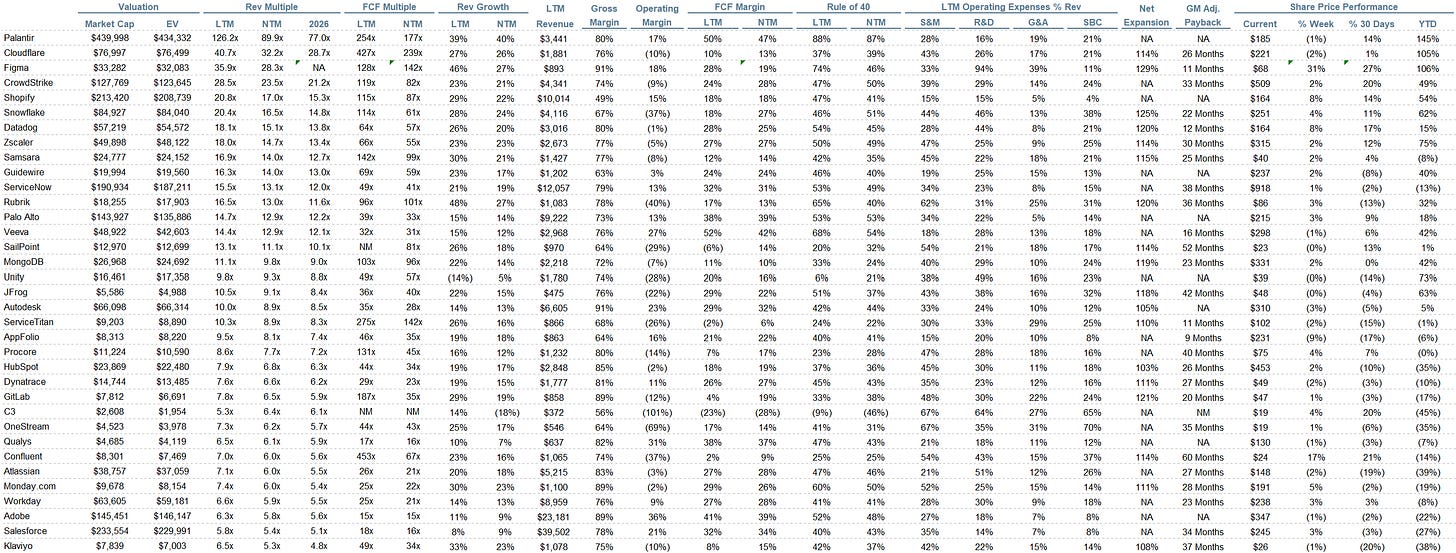

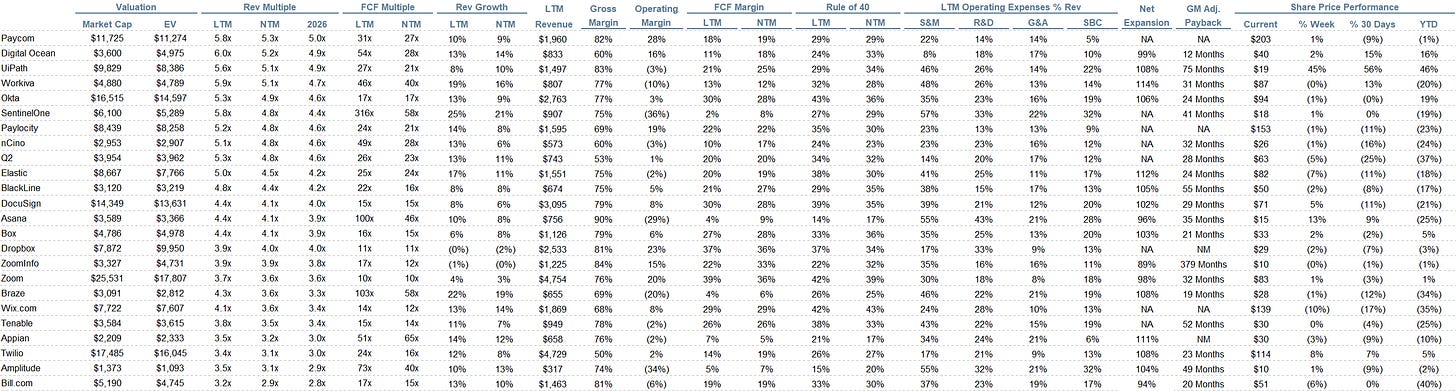

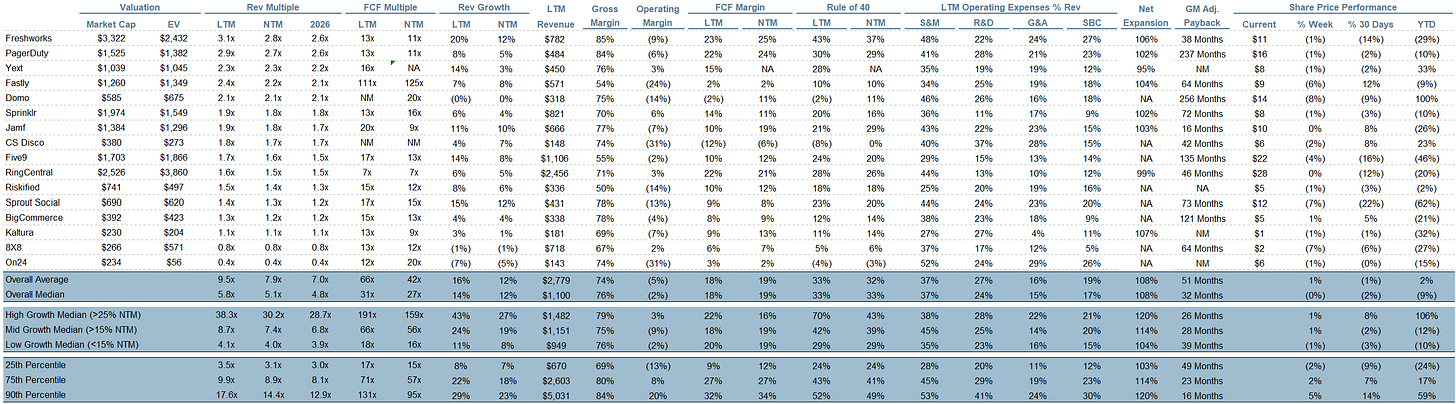

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12. It shows the number of months it takes for a SaaS business to pay back its fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP (”Altimeter”). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

👍

This is what everyone should know about Obama’s legacy (and subscribe to me)

https://open.substack.com/pub/sergemil/p/how-obama-islamized-america-and-the