Clouded Judgement 10.18.24 - From Systems of Record to Systems of Intelligence

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Systems of Record » Systems of Intelligence

There’s a long-held belief in enterprise software that building a lasting moat requires a system of record. Salesforce is the system of record for customer data, Workday for employee data, and ServiceNow for IT data, to name a few. The idea is that the central repository of critical business data forms the core value. But while this central database is important, it's not the whole story.

The real value—and the true lock-in—comes from the workflows and integrations that are built around these systems of record. These applications are not just repositories; they are tools designed for humans to input and manage data. At their core, they’re interfaces built to help employees take information from one source and enter it into another, often manually. These systems rely on people sitting in front of screens, navigating the user interface (UI) to input, process, and move data through various workflows. This human-centered design has made these systems essential for companies, and replacing not only the data but the workflows tied to them is where the true switching cost lies.

With AI, however, this dynamic could radically change. One of AI’s greatest strengths, particularly with large foundation models, is its ability to process unstructured data—data that humans today manually enter into systems of record. Sales reps, for instance, hate entering data into Salesforce after every call, and managers often find this data inaccurate or incomplete, making forecasting a challenge. But what if an AI could do that work instead? Imagine an AI that listens in on a sales call, identifies the person on the other end, extracts relevant details like company size, pain points, competitors, deal size, and then automatically enters that data into the system. The role of the human UI disappears, replaced by an AI agent seamlessly interacting with the system of record.

This shift means that the emphasis moves away from the UI or front-end application, which was historically designed to help humans enter and manipulate data. Instead, the focus shifts to the database and making it as efficient and flexible as possible for AI agents to work with. In the AI-first future, the real value won't lie in complex interfaces for human users, but in how well the system can gather, store, and process data autonomously. AI will not only capture data but also create workflows around it, without the need for human intervention.

As a result, we may see a fundamental change in how enterprise applications are built. The traditional model of a front-end application tied to a database like Oracle and a series of manual workflows might give way to AI-native applications built on AI native databases, where the database takes center stage. These AI applications will be designed to operate on top of centralized data repositories— like a data lakes or lakehouse —where AI agents gather and process information from a wide array of unstructured sources. This will make the underlying database even more critical, as workflows will be automated, reducing the need for humans to manually move data from system to system.

In this new AI-driven world, the traditional moats built by systems of record could weaken. The reliance on human-driven UIs and manual processes will fade, and the value will shift to how efficiently AI can gather and act on data - data apps will emerge. Companies that embrace this shift could build more flexible, AI-powered systems that are more scalable and less reliant on manual workflows, fundamentally changing the way enterprise software operates. The world needs an AI database to power AI native apps.

We’ll also need an entirely new set of tools and infrastructure to process and manage these workflows. What happens if a long running workflow with many steps times out or runs into a processing error? Do you start over at the beginning or go back to the last step pre failure? How do you monitor all of these workflows running in parallel? How do you evaluate their output? In short - we’ll need an explosion of new infra to support AI native apps.

If you’re building any kind of AI native application to disrupt cloud based systems of record, I’d love to speak with you!

Top 10 EV / NTM Revenue Multiples

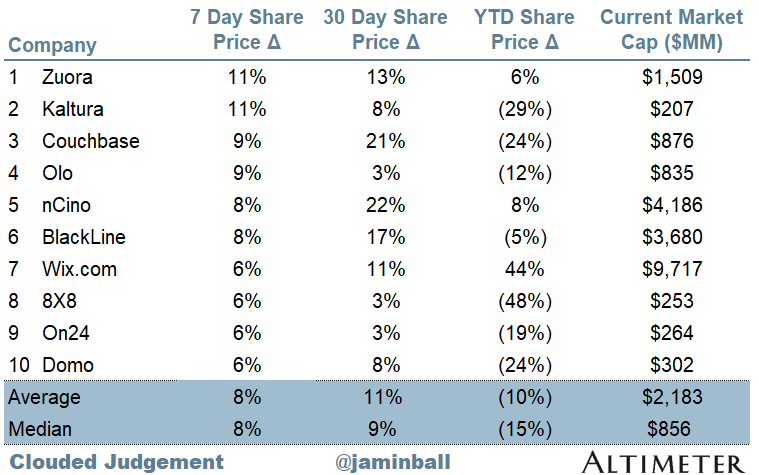

Top 10 Weekly Share Price Movement

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.6x

Top 5 Median: 17.1x

10Y: 4.1%

Bucketed by Growth. In the buckets below I consider high growth >27% projected NTM growth (I had to update this, as there’s only 1 company projected to grow >30% after this quarter’s earnings), mid growth 15%-27% and low growth <15%

High Growth Median: 11.8x

Mid Growth Median: 8.5x

Low Growth Median: 3.9x

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

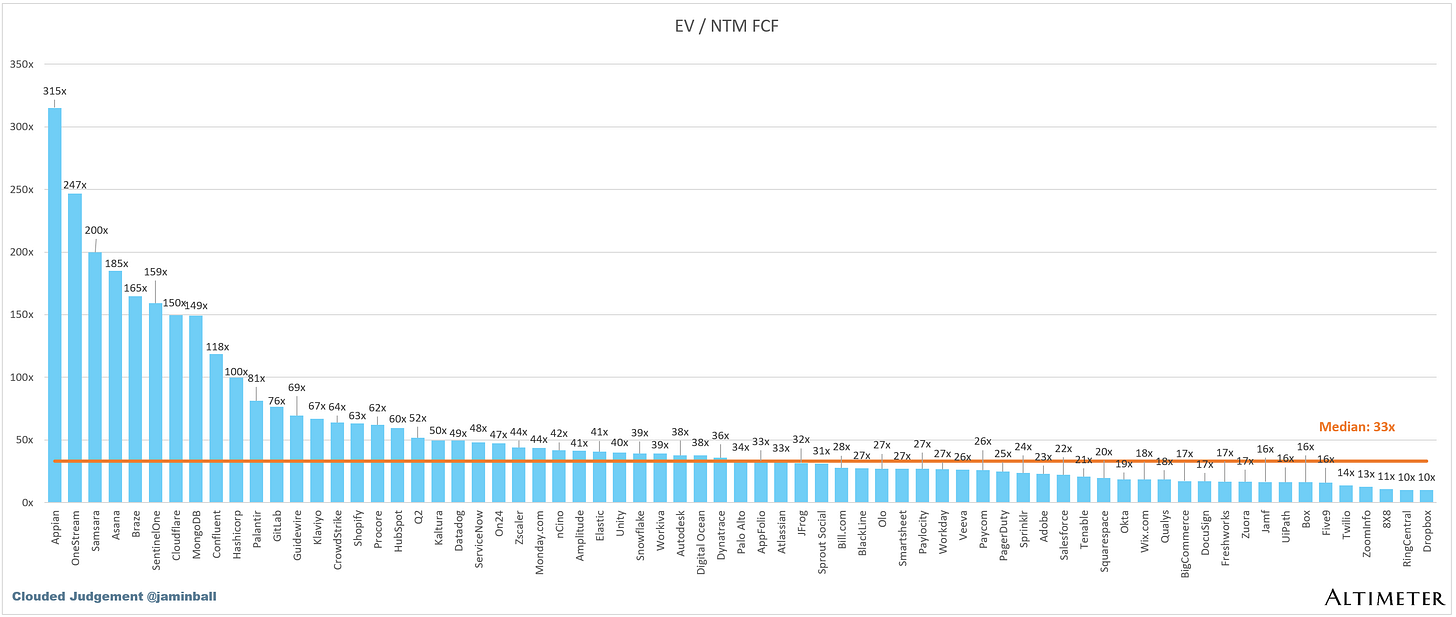

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 12%

Median LTM growth rate: 16%

Median Gross Margin: 75%

Median Operating Margin (9%)

Median FCF Margin: 16%

Median Net Retention: 110%

Median CAC Payback: 41 months

Median S&M % Revenue: 40%

Median R&D % Revenue: 24%

Median G&A % Revenue: 17%

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

I have to disagree with the basic your premise of your 10.18.24 post, which (as I read it) asserts that AI will be able to subsume a business application's capabilities and functionality sometime in the near future. AI and generative AI will be able to a lot of things, especially in assessing and managing unstructured data, but the technology is nowhere near ready to deal with the complexity and ambiguity of enterprise-level processes currently handled within the structure of a specific business application. Decades of development have gone into these core applications to be able to deal with the mission critical details and nuances. Agents can do a lot of things, but we are about to discover their practical limits as well as the growing chore of curating and maintaining them. Sure, Salesforce might be more easily replaced by AI than an ERP or supply chain management application where 'sort-of' and 'on-the-job training' doesn't work for critical processes. Even so, an agentic Salesforce (already announced and on its way) will accomplish the same thing and available many years before a generic AI developer can have something better to offer. The key difference between AI and past disruptive technologies is that AI is an additive technology for business software, not a foundational one like GUIs or the cloud.

The emphasis on who UI's are built for is a super interesting point. At the end of the day, it makes sense to me that humans tell their preferences at regular intervals to their own personal UI (Call it a personal AI), and then that AI works off that to interface with all different applications/UIs. My example from today is how google now fills in your credit card information, or one click shopping