Clouded Judgement 10.21.22

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Data Engineering Survey

The folks at Airbyte are running a survey of data engineers. Please consider completing it if your profession is in the data space. I’ll share the results here! Link: https://docs.google.com/forms/d/e/1FAIpQLSf0l5tGZ2dhs2G7lk1gxvBe2VyWEuQ68dkNN5ixlE-bvTy8VQ/viewform

Are Software Companies Cheap or Fairly Valued?

It’s an important question I get all the time, and the answer isn’t as clear as some may suggest. When just looking at the numbers, the median cloud software NTM revenue multiple is 5.0x. That’s against a long-term median of 7.8x. That’s 36% below the long term average! And to get ahead of some questions, the long term average I’m using is from 2010-2020 (so excluding the crazy multiples of Covid). I’m using that time period because there really weren’t any cloud software companies around before that. Here’s where the nuance comes in. The average 10Y in the period of 2010 - 2020 was ~2.3%. Right now it’s 4.2%. My back-of-the-envelope math suggests that for every 1% move in the 10Y we should expect ~15% change in multiple. In other words, given the 10Y is about 2% (on an absolute basis) higher than what it was in the period I’m using as my long term multiple average, we should expect that the current median is ~30% below the long term average of 7.8x. And that’s right about where we are. So just based on rates, software is probably fairly valued at the moment.

However, there’s a very credible argument that if we do enter a more meaningful recession next year, estimates for 2023 are currently too high. And if forward estimates come down then valuations should as well (lower multiple due to lower growth + that multiple applied to a lower base of revenue). I think we’ve seen numbers come down for software companies, but not as much as they should if we do enter a more meaningful recession.

So will we enter a meaningful recession? I honestly don’t know. Predicting macro is hard. So far my takes on inflation and rates not getting as high have been wrong. I didn’t think we’d get rates >4%, and the fed funds rate will definitely get over that mark. I’m a perpetual optimist, so I’m still optimistic we won’t see a deep recession next year. But there’s a lot of very smart people out there who know a lot more about macro than I do who are saying we will.

The silver lining? Even if the consensus was for a deep recession, I think software will preform much better than feared. But that still means we might see a period of deep estimate cuts before companies “prove” how resilient they are.

The real silver lining? We’re talking pretty short term in the bear case. Over a longer term arch the slope of innovation is as steep as it’s ever been, and I’m quite excited about a ton of both public and private businesses right now. In 2 years, I think the rate environment looks different than it does today. I don’t think it goes back to ZIRP, but I think it looks closer to the average from 2010 - 2020 than what it does today. Additionally, 2 years from now I think an initial wave of a deeper recession (if we do end up getting one), will be more in the rear-view mirror. Net net? With a 2 year time horizon, I think even in the bear case there’s some really compelling opportunities right now in software that have me quite excited. And as I mentioned last week, I still think there’s a real chance CPI is so lagging that inflation cools faster (but again, I’ve been wrong on this point so far this year…), and the rate environment is better next year than anticipated.

I know this post might sound more bearish, but I’m just trying to distill some of the short term risks. I’m still as excited as ever!

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

SaaS businesses are valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.0x

Top 5 Median: 15.4x

10Y: 4.2%

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 10.4x

Mid Growth Median: 5.1x

Low Growth Median: 2.8x

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Growth Adjusted EV / NTM Rev

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

Operating Metrics

Median NTM growth rate: 21%

Median LTM growth rate: 30%

Median Gross Margin: 74%

Median Operating Margin (25%)

Median FCF Margin: 0%

Median Net Retention: 120%

Median CAC Payback: 33 months

Median S&M % Revenue: 48%

Median R&D % Revenue: 28%

Median G&A % Revenue: 20%

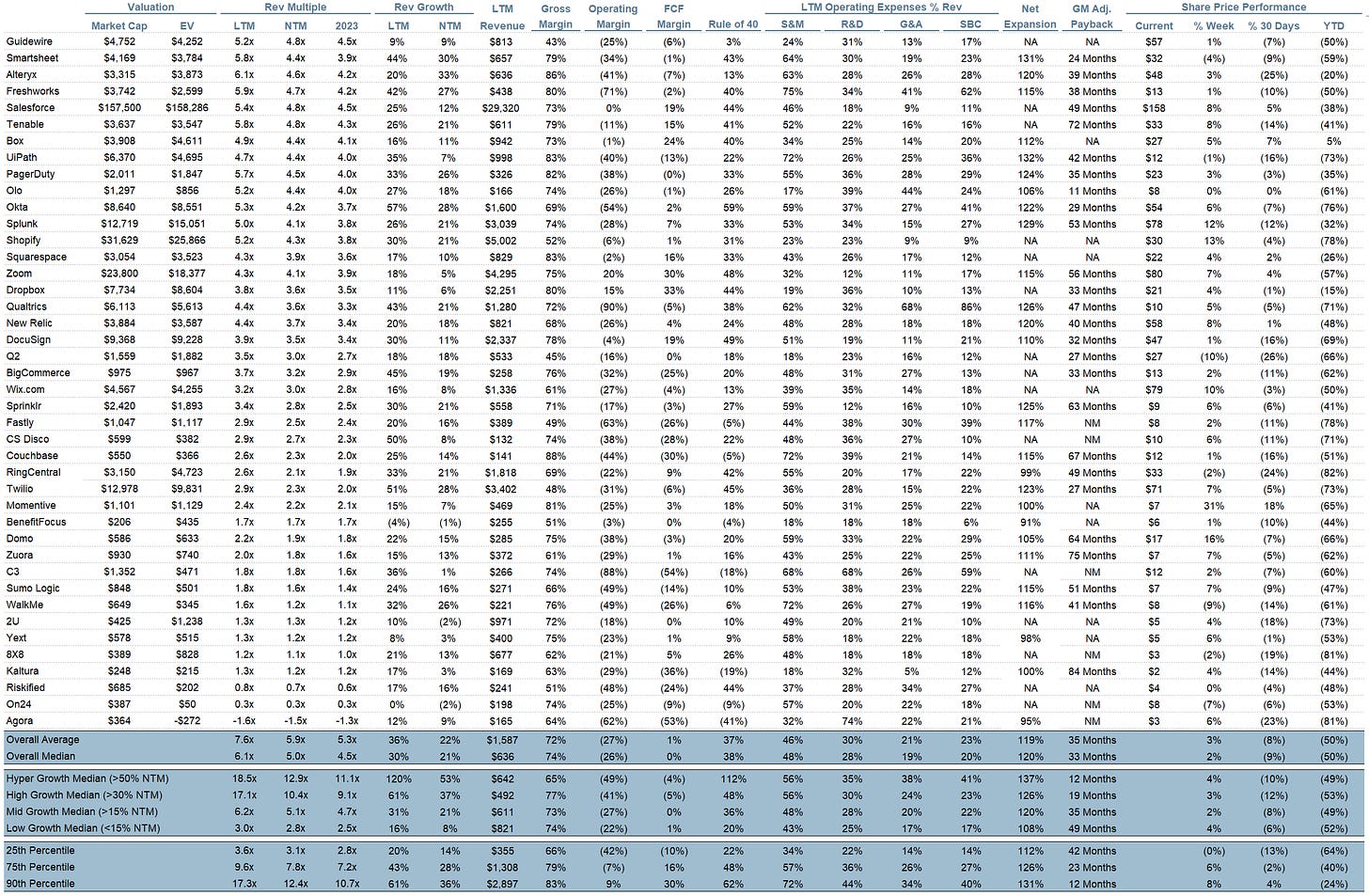

Comps Output

Rule of 40 shows LTM growth rate + LTM FCF Margin. FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.