Clouded Judgement 10.4.24 - Voice: The Next Computing Paradigm

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Voice: The Next Computing Paradigm

OpenAI released some pretty cool features over the last two weeks. The first was pushing advanced voice mode to everyone. The second was announcing their speech-to-speech Realtime API. Both of these get us much closer to having human like interactions with an AI. And I think this is a big deal! Voice is the natural way we communicate in the real world - As AI interactions start to resemble human conversations, I anticipate a Cambrian explosion of voice applications (same goes for video). This is an exciting future!

Here's why the speech-to-speech API matters so much. Historically models could only accept a text input, and only give a text output. In order to build a voice experience you needed to string together multiple tools. You'd use something to handle all of the network infrastructure and optimization. Then you'd use a speech to text provider to convert the audio file to text to feed into the model. The model runs inference and then spits out text, that is feed into a text-to-speech provider. That audio file is then sent over the network and played out the speaker in the application. This creates two "issues" 1) All of that conversion takes time. Stringing together multiple processes just increases the lag / wait time from one speaker to the other, and to have a human like interaction the latency needs to be <300ms. 2) Converting an audio file to text is a form of compression. And when you compress a file you loose data. There's important context in an audio file that goes away in text. The tone of voice, which words are emphasized, etc These two "issues" make it harder to create human like experiences. Either they aren't real time (because so much extra work has to happen in the background), or they lack a true emotional connection when it's all text based OpenAI launching the speech-to-speech API is a huge first step in creating truly human-like experiences with AI

And when it comes to the network infrastructure - many builders will first try web sockets or vanilla WebRTC. It's a good way to start, but as you scale, performance issues will be felt (web sockets aren’t sophisticated in how they handle packet loss or network congestion). Instead, start from a solid foundation with something like LiveKit. LiveKit provides a lot of the magic that makes Advanced Voice Mode from OpenAI so powerful. If you want to learn more about how to build with LiveKit, check out this blog or play around in their playground

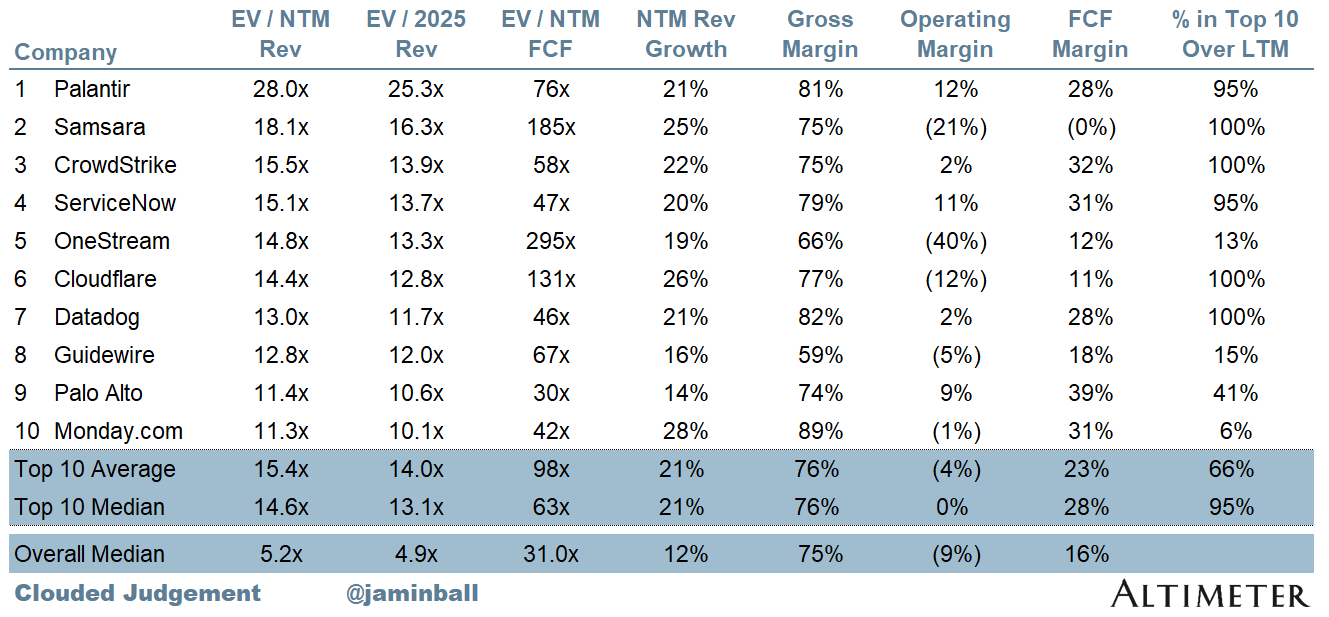

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.2x

Top 5 Median: 15.5x

10Y: 3.8%

Bucketed by Growth. In the buckets below I consider high growth >27% projected NTM growth (I had to update this, as there’s only 1 company projected to grow >30% after this quarter’s earnings), mid growth 15%-27% and low growth <15%

High Growth Median: 9.8x

Mid Growth Median: 8.2x

Low Growth Median: 4.0x

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 12%

Median LTM growth rate: 16%

Median Gross Margin: 75%

Median Operating Margin (9%)

Median FCF Margin: 16%

Median Net Retention: 110%

Median CAC Payback: 41 months

Median S&M % Revenue: 40%

Median R&D % Revenue: 24%

Median G&A % Revenue: 17%

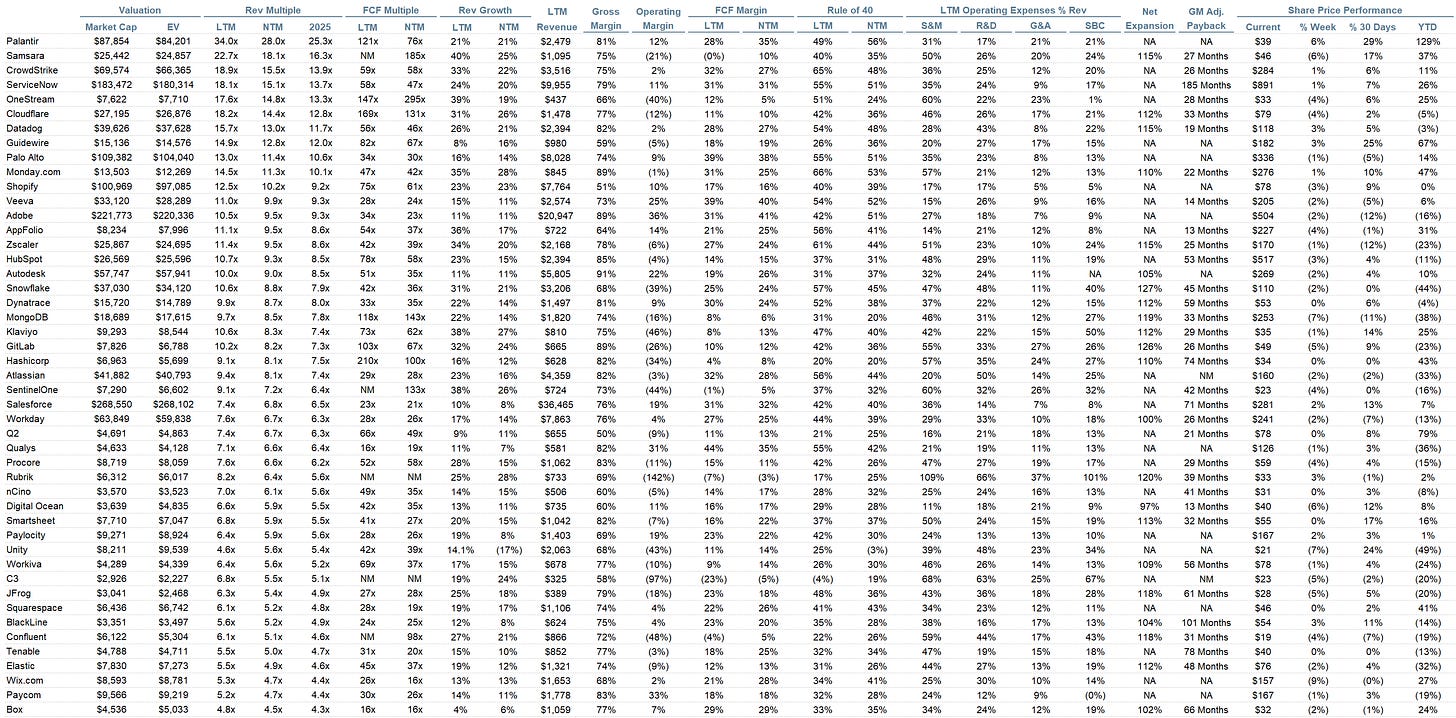

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter Capital is an investor in LiveKit.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.