Clouded Judgement 11.12.21

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Snowflake

Karl Keirstead from UBS came out with his quarterly quarterly Snowflake customer checks report. Here’s a summary of his takeaways:

“Key takes include: 1. We didn’t hear anything to hint at slowing momentum for

Snowflake in 3Q/Oct. The tone from customers in terms of their spending growth was quite bullish and consistent with prior quarters. The results posted by AWS and Microsoft Azure in 3Q21 were outstanding and data analytics is a major and early cloud use case. 2. We didn’t pick up any evidence of rising competitive threats and if anything, AWS Redshift might be falling behind in the race. 3. We do hear push-back on Snowflake’s pricing/spend, but the push-back is not on unit costs per se, but rather the volume of data and therefore spend that can occur given strong usage. 4. Spending with focused “data science/ML” vendors (Databricks, DataRobot, Dataiku, H2O) appears to be up appreciably. It is clear to us that this is emerging as a new and fast-growing software end market that Snowflake has an opportunity to go after more earnestly.”On Valuation: Valuation: “On Street CY22/FY23 estimates, Snowflake shares trade at 67x revs. While the second highest revs multiple in the Software sector, in our view this is deserved given 100%+ growth at a $1 billion+ revs run-rate. Given the strength of our checks and re-rating of the Growth Software sector, we’re raising our PT from $320 to $440, based on a CY23/ FY24 EV/Sales multiple of 50x (prev. 36x), a premium to the peer group given the early penetration of the data analytics opportunity.

Quarterly Reports Summary

Top 10 EV / NTM Revenue Multiples

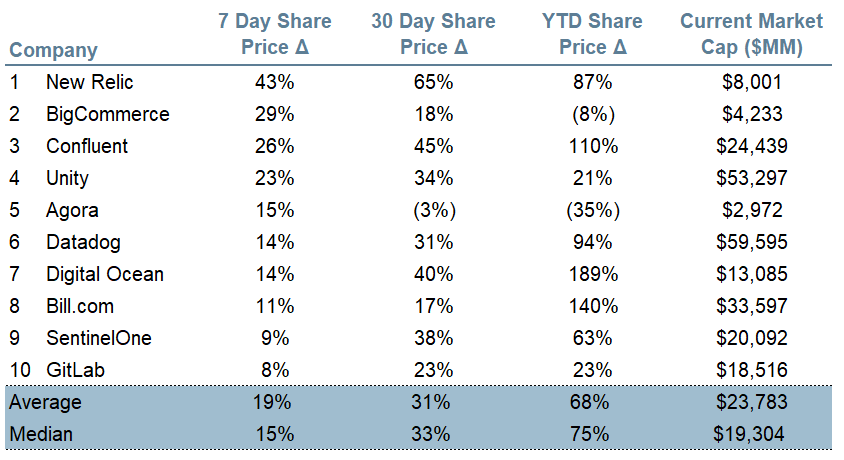

Top 10 Weekly Share Price Movement

Update on Multiples

SaaS businesses are valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 16.0x

Top 5 Median: 74.7x

3 Month Trailing Average: 15.9x

1 Year Trailing Average: 16.1x

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 21.0x

Mid Growth Median: 13.8x

Low Growth Median: 7.1x

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Growth Adjusted EV / NTM Rev

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

Operating Metrics

Median NTM growth rate: 24%

Median LTM growth rate: 32%

Median Gross Margin: 74%

Median Operating Margin (19%)

Median FCF Margin: 5%

Median Net Retention: 119%

Median CAC Payback: 25 months

Median S&M % Revenue: 44%

Median R&D % Revenue: 28%

Median G&A % Revenue: 22%

Comps Output

Rule of 40 shows LTM growth rate + LTM FCF Margin. FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.