Clouded Judgement 11.13.20

Every week I’ll provide updates on the latest trends in SaaS valuations, earnings announcements, and highlight any significant news. Follow along to stay up to date!

Highlight of the Week - Earnings Reports

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

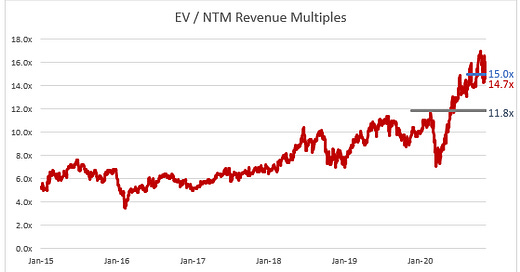

Update on Multiples

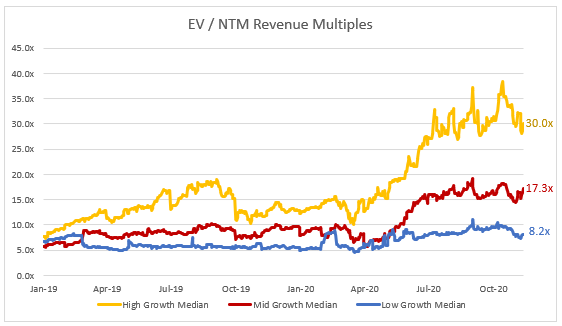

SaaS businesses are valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

Overall Stats:

Overall Median: 14.7x

Top 5 Median: 37.7x

3 Month Trailing Average: 15.0x

1 Year Trailing Average: 11.8x

Bucketed by Growth:

High Growth Median: 30.0x

Mid Growth Median: 17.3x

Low Growth Median: 8.2x

Operating Metrics

Median NTM growth rate: 20%

Median LTM growth rate: 31%

Median Gross Margin: 74%

Median Operating Margin (15%)

Median FCF Margin: 5%

Median Net Retention: 116%

Median CAC Payback: 25 months

Median S&M % Revenue: 43%

Median R&D % Revenue: 25%

Median G&A % Revenue: 17%

News

BigCommerce announced a ~$350M follow on offering. ~$70M of primary (new stock issued) and ~$280M of secondary (existing shareholders selling)

Zendesk announced a partnership with WhatsApp

Comps Output

Rule of 40 shows LTM growth rate + LTM FCF Margin. FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.