Clouded Judgement 11.18.22

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Can You Beat the Market Investing Businesses With in 10x+ NTM Revenue Multiples?

This week I saw the below tweet and it got me thinking - can you beat the market investing in software businesses at a >10x NTM revenue multiple?

I decided to run the numbers. I looked at the period of 2015 - 2020 (right up until Covid, so excluding the Covid bubble) and picked out all of the cloud software companies that at one point in time were trading at >10x NTM revenue. My list is imperfect as I haven’t included companies that were acquired pre 2020 (for example companies like Mulesoft are not in the below analysis). However, the sample size is large enough to draw conclusions from. Overall, out of my set of 96 cloud software companies, there were 49 that at one point traded >10x NTM from 2015 - 2020. That’s just over 51%.

I then looked at the date each company first hit that 10x level, and compared the stock price on that day to the stock price today (or the price at which a company was acquired for if it was acquired after 2020). The chart below shows the annual CAGR for each company from the time they first hit 10x NTM to today.

Couple interesting callouts for me:

Market doesn’t always get it right - lots of companies in there who hit 10x that in hindsight never should have

Of the companies who hit >10x NTM revenue at some point, 33% ended up with a CAGR >20% from the time they hit 10x to today. That’s higher than I would have thought (especially the end point is today, a relative low point in time)

One other cut is to look at each company CAGR from the time they hit 10x to today, and compare it to the NASDAQ CAGR from the same time. By doing this we can essentially answer the question of “of companies to trade at 10x+ NTM revenue, which ended up preforming better than the market?” The data is below. The last few sections might be confusing - how the data is calculated is taking the company CAGR and substracting the NASDAQ CAGR. So in the “beat the market by >20% bucket” I’m looking at “>20%” on an absolute basis. If the NASDAQ CAGR was 5% and company CAGR was 26%, then it would fall in that bucket (26% - 5% >20%)

Couple interesting callouts for me:

53% of companies who hit 10x NTM revenue ended up having better returns than the market. I’d say without a doubt the answer to “can you beat the market investing >10x NTM rev” is an emphatic “yes!”

I’m using stock prices as of yesterday’s close. Clearly we’re at a point in time where multiples are quite depressed. So one could argue I’m picking a “relative low” as the end point. This should be washed out when comparing to market returns given both are at lows

This analysis also leaves out companies who did have a great return after they hit 10x NTM revenue, but have fallen off a cliff recently. Twilio, for example, had a 37% IRR from the time they hit 10x NTM revenue to Feb ‘20 (right before Covid). Over the same period, the NASDAQ had a 20% CAGR. Using today as a universal end date will understate the number of businesses who investors could have made good money on investing at >10x NTM revenue

Net net - you can still have great returns investing in businesses >10x NTM revenue

Quarterly Reports Summary

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

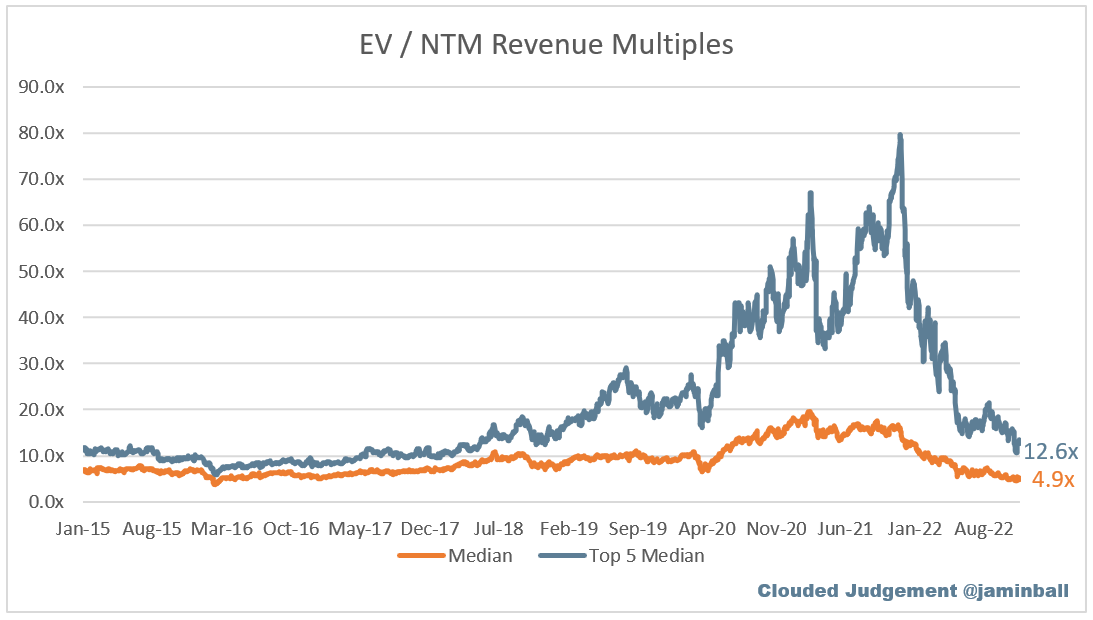

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 4.9x

Top 5 Median: 12.6x

10Y: 3.8%

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 7.4x

Mid Growth Median: 5.3x

Low Growth Median: 2.3x

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Growth Adjusted EV / NTM Rev

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

Operating Metrics

Median NTM growth rate: 18%

Median LTM growth rate: 30%

Median Gross Margin: 74%

Median Operating Margin (25%)

Median FCF Margin: 1%

Median Net Retention: 120%

Median CAC Payback: 35 months

Median S&M % Revenue: 48%

Median R&D % Revenue: 28%

Median G&A % Revenue: 20%

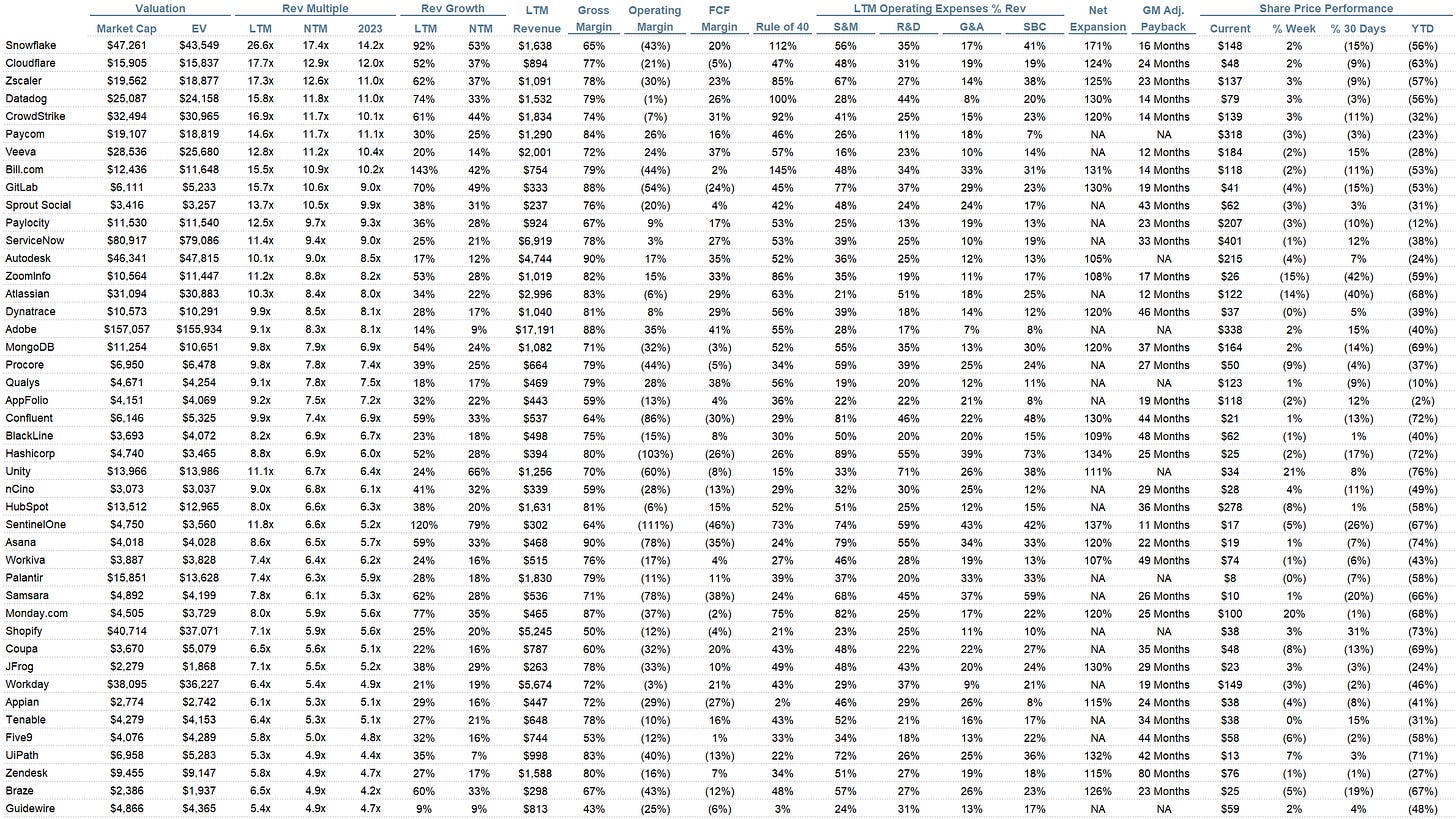

Comps Output

Rule of 40 shows LTM growth rate + LTM FCF Margin. FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

When the market makers decide it's over, it's over.

Thanks for another thoughtful analysis. It seems overall that the market is kind of "fairly valued" at this point given historical comparisons. I wonder what the catalyst for higher multiples would be again - besides just lower interest rates.