Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Reinventing Founder Friendliness - Back to the Future

This week I joined Ed Sim (Founder and Managing Partner at Boldstart Ventures) on Harry Stebbings podcast to chat about the state of venture backed companies heading into 2024 and 2025. You can find the recording here. We all jumped on after Ed and I had this brief tweet exchange that we unpacked more on the podcast. I really enjoyed the conversation we had, and wanted to give a quick summary of what we chatted about here. Setting the stage for our convo was the increase in startups either shutting down or being acquired / acquihired recently. The big cash piles raised in 2021 are starting to get smaller, and we dug in on how investors and founders should be thinking about the world.

If we rewind the clock back to 2021, the venture funding market went crazy. I pulled some data from Pitchbook that you can see below (screen was for US based companies that they categorize as “software”).

There are certainly some deals that happened in 2023 that haven’t announced yet (there’s always a lag), so I’d expect the 2023 bar to be slightly higher once everything has announced. Regardless - the takeaway should be clear. In 2021 and the first half of 2022 (when most of the 2022 activity happened) we essentially crammed 5 years worth of funding into an 18 month period. Series Bs and Cs were raised when companies were at the typical Series A milestones. Normal round sizes doubled or tripled. Every type of investor was broadly operating in a “risk on” mindset given the ZIRP environment, and the venture capital ecosystem was no exception. Before this ZIRP period, companies would generally raise a round, hit the next milestone, and then raise another round 18-24 months later. This all shifted in 2021. Companies were able to easily raise rounds before hitting any of the prerequisite milestones investors used to look for.

The challenge with a number of the 2021 rounds, is that if the world ever shifted to more of a risk off attitude, or just less risk on, companies would have to “catch up” on these milestones. Well, we all know this happened. Now, in order to raise an up round from a 2021 round, companies most likely will have to hit a significant number of milestones. The big challenge facing a number of companies today - as the large cash balances from 2021 start to shrink, what happens if they haven’t hit all the milestones needed to raise another round, or an up round? And what if the path to hitting those milestones even 5+ years out isn’t clear?

Many companies raised rounds in 2021 who thought they had product market fit. Or who thought their market was 10x bigger than it actually was. Or who thought they had differentiated enough from their competition or from large incumbents. The ZIRP period created a lot of confusion given software buying was happening at a break neck pace - and it was easy to think you had differentiated product market fit because your business momentum (ie revenue) suggested you did. But the buying environment had changed in that period - there wasn’t any pressure on costs, and procurement guardrails completely relaxed. As we exited that ZIRP period and returned to normal, all of a sudden companies started asking themselves “do we really need this product or can we do it ourselves? Is this company really that much better than the version from the large incumbent we get for free?” etc etc. The environment got tougher for EVERYONE. Just about every company who set a forward plan in 2021 missed that plan.

Startups should all be asking themselves one key question today: Have we really built something that has differentiated product market fit and can sustainably exist as a standalone company? Or are we essentially walking dead but on endless life support with our big cash balance?

The perceived answer across the board to this question in 2021 was a clear yes. Now, it’s not so obvious. And in many cases, the answer is actually no, but no one really wants to accept that yet. The biggest challenge I see today - while 2021 cash balances are getting smaller, there’s still quite a bit of runway left in the system. And companies are taking false comfort in still having 2+ years of cash. So they aren’t asking the above question now because they don’t feel the pressure to.

The primary reason for this post is to encourage everyone (founders and board members) to ask this question now. For founders - it’s perfectly ok to come to the conclusion that you don’t have product market fit. It’s better to come to that realization today than grinding for 2 more years only to realize it then when your cash balance has dried up and all of a sudden you have no leverage in an acquisition. I think investors can often times put too much pressure on founders to “stick it out.” The time to ask these questions is now, when you still have cash. At the same time - the answer to this question is never clear and obvious. It takes quite a bit of time for everyone around the table (founders, execs, investors) to reach a consensus. This process can take 6+ months! Even more reason to start the convo today.

Another reason to ask the question today - if the answer turns out to be “we really don’t have a realistic path forward as an independent company” then you go into action mode and look for a soft landing for the company (ie something like an acquisition). The challenge will be, over the next 12-18 months I believe there will be a lot of companies coming to this same conclusion…And there are only so many acquirers out there. You want to be in front of the rush, not in the middle of the stampede.

These are all really hard conversations to have, but incredibly necessary. There are also many late stage companies who will never get back to the valuation they raised at in 2021 (when thinking about an exit, not just the price a venture firm is willing to pay in a round…). When looking at historical multiples for software companies, trading at a >10x multiple typically puts you in the top 15% of all public software companies at any given point in time. If you’re valued at $10B, but sitting at $200m ARR growing 30%, the reality is it’s going to take a really long time to truly be worth $10B, unless you can somehow sustain 30% growth without decelerating for ~7 straight years. If you find yourself in this bucket acknowledge it, and then act on it. Be up front with your employees, don’t kick the can down the road, when you need to raise capital realize there’s nothing wrong with a down round! Do it without structure, keep it clean, and reset the expectations for the company. For some, this will be a down round IPO. Just like layoffs were taboo until everyone was doing them, so will down rounds. And then everyone will realize they’re perfectly fine to do. Public company valuations go up and down every day (sometimes significantly). The reality is private company valuations do as well, there just isn’t a market that makes this obvious.

As I’m writing this post, I’m realizing that a readers takeaway may be “look at this VC with his I’m holier than thou attitude sitting on his high horse spewing advice in absolutes like he knows everything…” I hope that’s not your view, but I acknowledge that it can sound like that…I think there’s a lot of things left unsaid today in the investor / founder relationship because folks are afraid of having the hard convos. We need to reinvent what it means to be founder friendly. I’m writing this in a more blunt tone not because I think I know everything, but because I think it’s really important. Have these conversations today. I’ve also buried the lead here, but a lot of the challenges today really arose from the really high valuations (and dollars raised) from 2021. An acquisition at $200m can be life changing for founders, or it can be worth nothing if they raised $250m at $1B valuation back in 2021. Founders should always be aware of what metrics would be required to exit at the valuation they’re raising at under standard exit multiple assumptions (I hope my weekly posts help shed light on what “standard” multiples are). You should also know what it takes to raise your next round under “conservative” assumptions (not hype), and what you’re signing up for.

Raising a big round before finding product market fit can really limit your financial upside! It all sounds great in the moment with lower dilution, but there’s no free lunch.. The public markets are the great equalizer, and founders should always keep an eye on how public markets value companies like theirs. And I do see investors and founders repeating a lot of the mistakes from 2021 today, especially in the AI domain. I hope this post provides a bit of a cautionary tale of raising a mega round ahead of your metrics. Public market investors felt all the pain in the 2022 down market. In venture markets, I think we’re only 10% into the pain that we’ve delayed given the large cash balances of startups. 2025 is probably the year of max pain in the venture ecosystem.

To end this post on a more positive note - I’m seeing an INCREDIBLE cohort of companies today. They’re getting fit from the early days, operating efficiently, and building their businesses the right way. Valuations have come down (this is good for everyone!) and we’re in the middle of a massive technology shift. As an investor, it’s impossible to know if we’ve hit the bottom or not in terms of valuations. But I do know we’re in the bottom third of the valuation reset, and in the early innings of a massive technological shift. This is a great combo - and also great for companies who are being started the right way.

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.9x

Top 5 Median: 17.5x

10Y: 4.0%

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 15.7x

Mid Growth Median: 8.6x

Low Growth Median: 4.3x

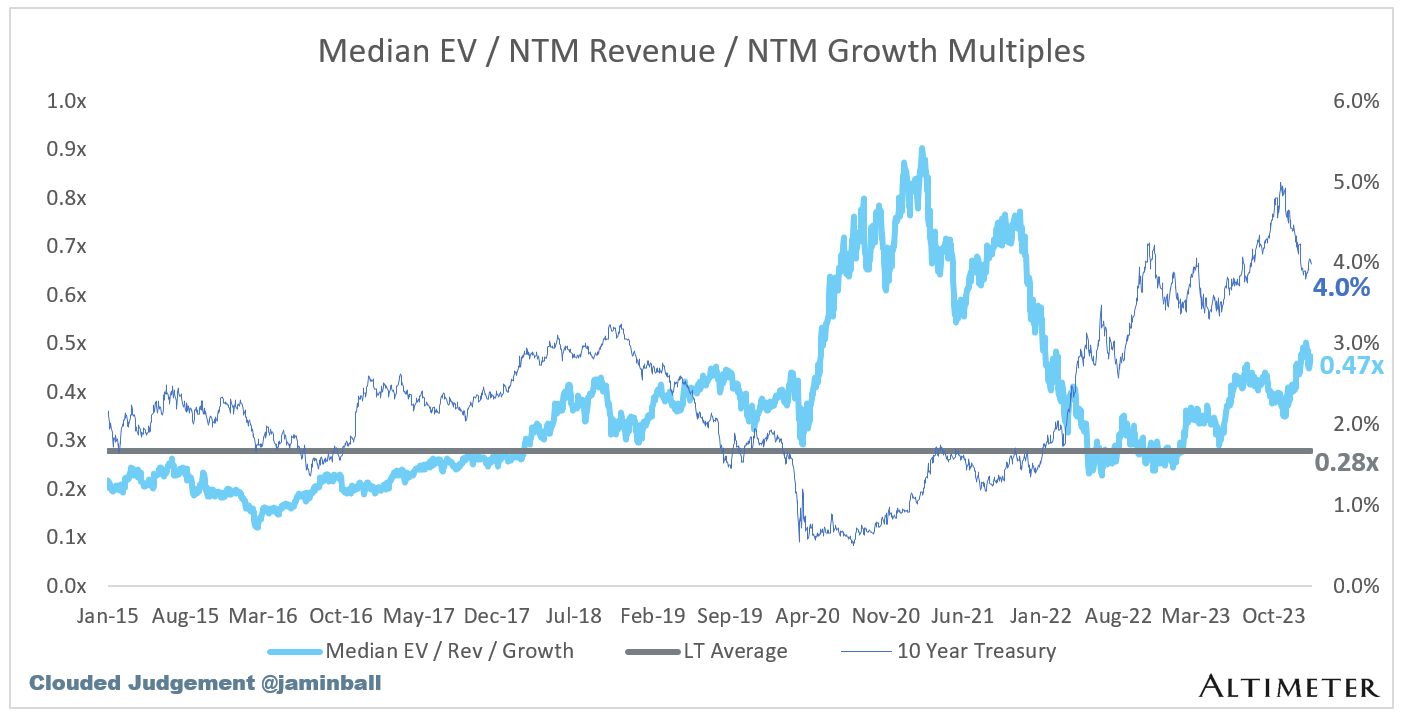

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

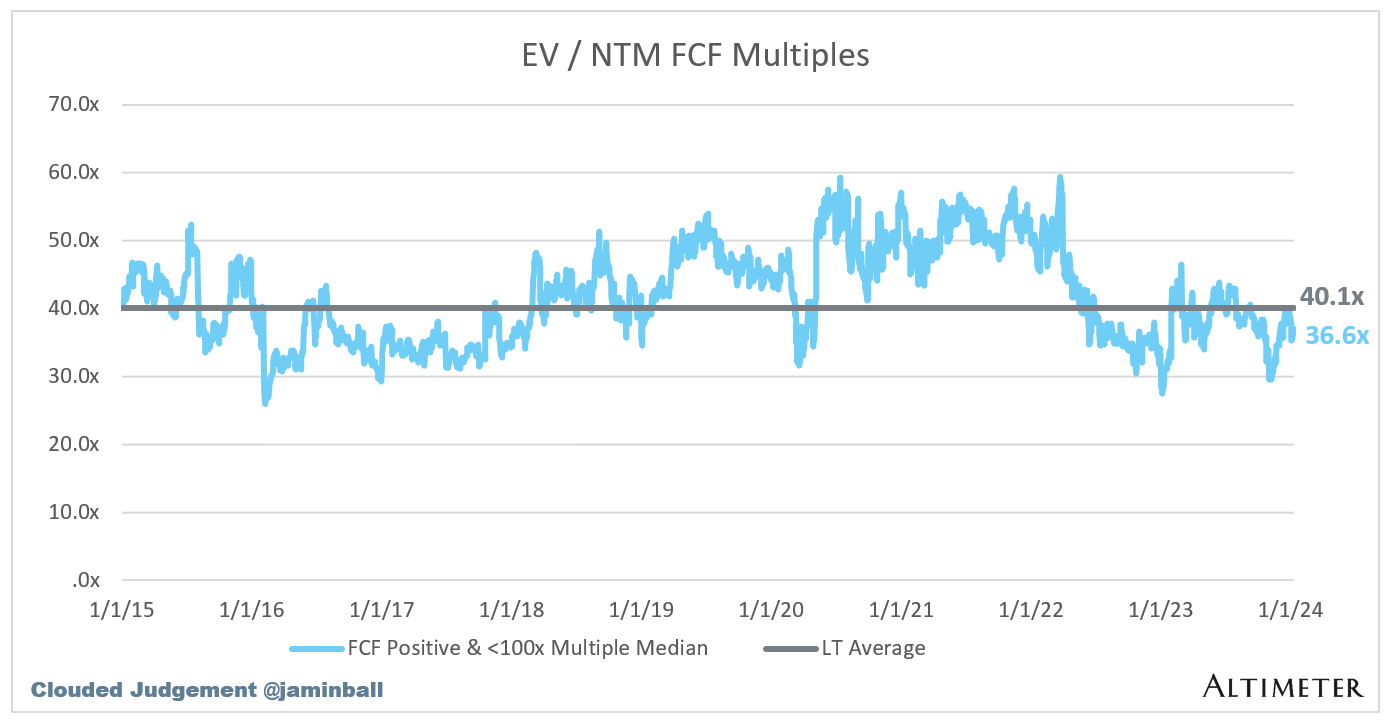

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 13%

Median LTM growth rate: 20%

Median Gross Margin: 75%

Median Operating Margin (13%)

Median FCF Margin: 8%

Median Net Retention: 112%

Median CAC Payback: 39 months

Median S&M % Revenue: 43%

Median R&D % Revenue: 26%

Median G&A % Revenue: 17%

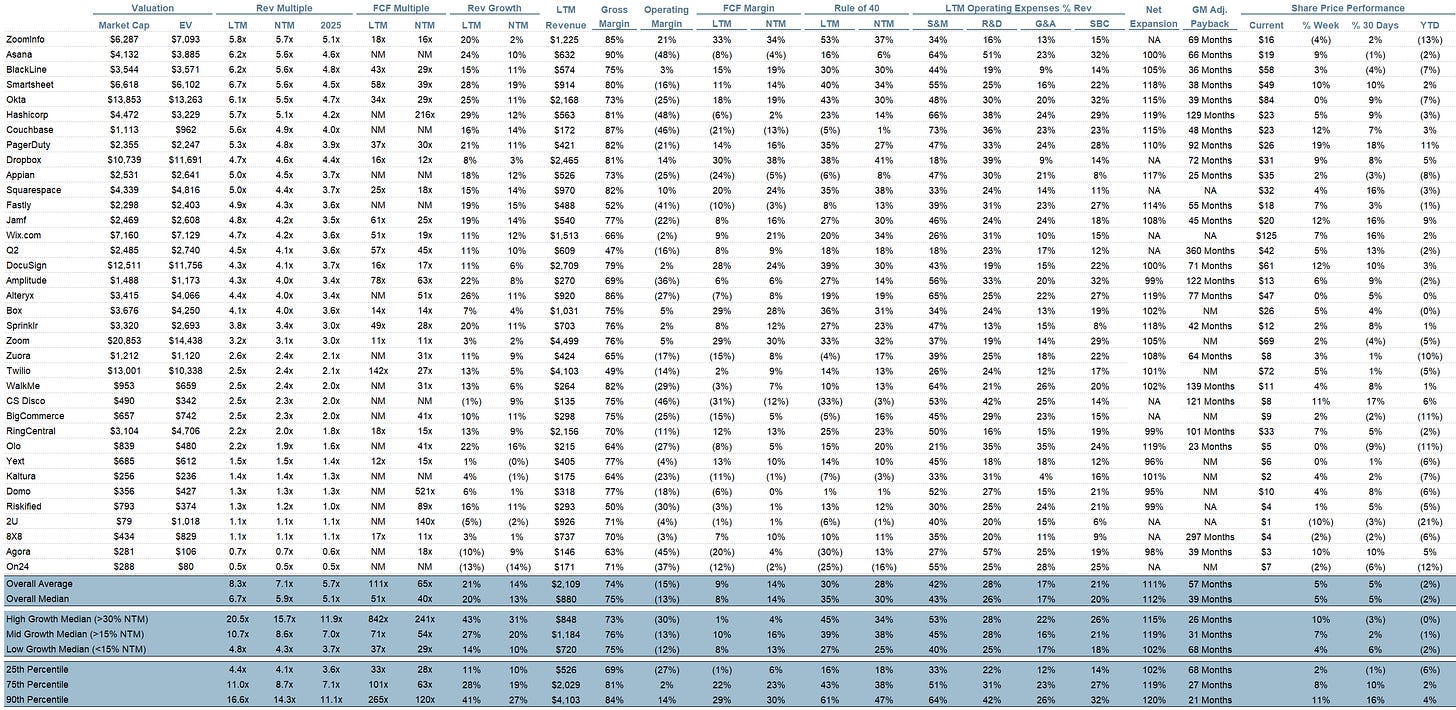

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

I appreciate this newsletter, Jamin, particularly bridging private<>public valuations to ground our thinking. On first principles I agree with this post- the challenge is neither side (founder<>investor) has incentive aligned to having this hard convo. Founders admitting lack of PMF is a death knell and investors lose their call option in the portfolio plus have to actually help unwind a business which is not in the kurtosis side of the distribution and therefore spending any time on it is wasted.

It follows that if you want to see this happen- it would take some sort of real catalyst. Have you looked into how an Altimeter “zombie fund” could work?

Hey Jamin, thoughts on All-In podcast comments from last week stating eventual price and margin compression on software given that companies are substituting software for creating internally? Specifically high cost software. I´m curious in your take and what you see in the market getting disrupted short or medium term?