Clouded Judgement 11.4.22

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Fed Update

On Wednesday the fed hiked rates 75bps. This was expected. Prior to Wednesday, the consensus was a 75bps hike in November, 50bps hike in December, and 25bps hike in January. Initially the market moved up as some of the initial headlines suggested the Fed is starting to set themselves up for a slowdown in hikes. However, by the end of Powell’s press conference the market moved much lower. A couple things stood out. He said the data suggests they may ultimately move to higher levels (on rates) than they thought in the September meeting. He also made it very clear they will hike into a recession as their number 1 goal is curbing inflation (even at the expense of starting a recession). He also called out that if they do in fact hike into a deeper recession they could “use their tools to respond if they overtighten” (paraphrased quote).

Powell is taking a very firm stance here. In many ways he has to. However, he will keep this tone of “higher rates for longer” until he doesn’t. That sounds like an obvious and simple statement, but I don’t think we’ll get a gradual shift in his tone. I think we’ll get a more sudden one once the data is more clear. The below tweet rang true with me.

The takeaway here being the Fed will keep this very hawkish tone for some time, but it doesn’t mean that will be the course of action they take in the future. They’re data dependent, and to the extent the data starts to shift, everything they’ve said historically will go out the window. Powell also said in May, after the first 75bps hike, that 75bps hikes won’t become the norm. Well, ever since the first 75bps hike, every incremental hike has been 75bps. I expect Powell’s tone to continue throughout the year, but let’s see what happens in 2023. The prevailing narrative today is “higher for longer” and that’s what moved the market down on Thursday

Macro Impacts on Software Performance

So far we’ve had ~30 cloud software companies report Q3. Let’s did into some stats:

Median Q3 beat: 2.5%

Median Q4 guidance raise: 0.0% (50% guided above consensus, 50% guided below consensus)

Looking back historically the median beat across the entire universe each quarter was in the 4-4.5% range. That started to come down this year in Q1 and Q2, where the median beat was in the ~3-3.5% range.

When we look at guidance raises, historically the median “raise” (meaning looking at the midpoint of guidance vs consensus estimates 1 quarter forward) is ~2-2.5%. That figure dropped dramatically last quarter, where the median raise in Q2 was just 0.1%.

I’m calling these numbers out specifically to make this point - this quarter the median beat is lower than it has been historically. And that’s after guidance from Q2 (for Q3) was much lower than historical standards. So, we’re seeing smaller beats on consensus estimates for Q3 that were already low do to weaker guidance after Q2. After Q2 when guidance across the board was very conservative it was fair to ask is management just being conservative or are they seeing some weakness. After seeing about 1/3 of cloud software companies report Q3’s already, and seeing the size of the quarterly beats come in lower than normal (again off of lower guidance), it’s pretty clear we are definitely seeing headwinds across the board. I understand I’m not saying anything novel here, but I wanted to put some numbers behind it.

Let’s look at Datadog, which has historically been one of the best performing software companies. If we look at the net new ARR added each quarter (using annualized revenue as a proxy for ARR which isn’t great, but it’s the closest we’ll get), you can see that they have been adding less less net new ARR each quarter. Anecdotely (not specific to Datadog), I’ve heard a big driver of net new ARR slowdown is a slowdown in upsell motions

This Q they added $121M of net new ARR

Q2 added $172M

Q1 added $146M

Q4 '21 added $224m

Q3 '21 added $146M

The trend in Q3 ‘22 isn’t a great one. Similarly we can look at the number of $100k+ ACV customers Datadog has added in the last few quarters:

Q3: 180

Q2: 170

Q1: 240

Q4 '21: 210

Q3 '21: 190

Similar to net new ARR, new $100k+ ACV customers isn’t heading in the right direction (although it did tick up in Q3). The point of this is simply to show that even the best of the best are still facing headwinds. And the fact that companies like Atlassian, Cloudflare and Twilio all fell as much as they did afterhours shows me that forward estimate revisions really haven’t been priced in yet. Multiple compression from rate environment is priced in. But forward estimates coming down is not fully priced in

Quarterly Reports Summary

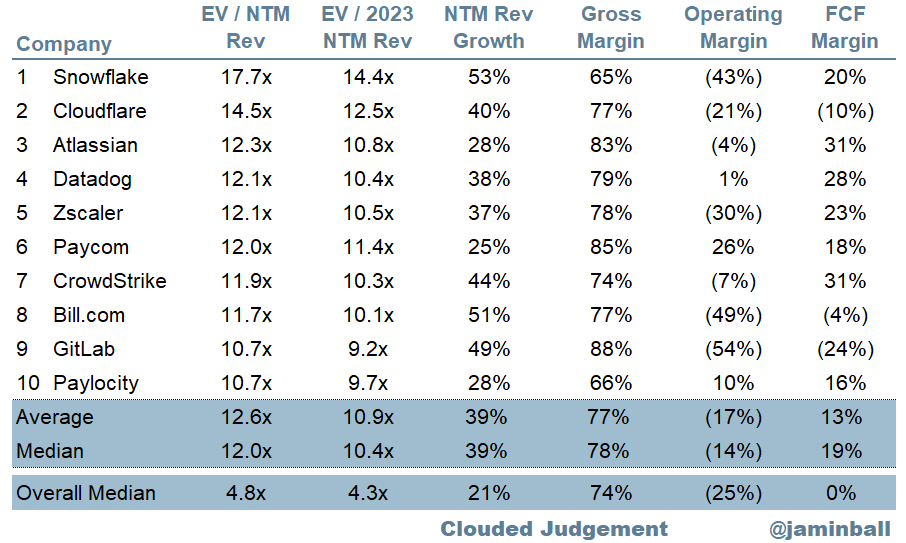

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

*BenefitFocus announced they’re getting acquired

Update on Multiples

SaaS businesses are valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 4.8x

Top 5 Median: 12.3x

10Y: 3.3%

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 8.3x

Mid Growth Median: 5.0x

Low Growth Median: 2.7x

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Growth Adjusted EV / NTM Rev

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

Operating Metrics

Median NTM growth rate: 21%

Median LTM growth rate: 31%

Median Gross Margin: 74%

Median Operating Margin (25%)

Median FCF Margin: 0%

Median Net Retention: 120%

Median CAC Payback: 33 months

Median S&M % Revenue: 48%

Median R&D % Revenue: 28%

Median G&A % Revenue: 19%

Comps Output

Rule of 40 shows LTM growth rate + LTM FCF Margin. FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.