Clouded Judgement 1.15.21

We’re back! I took a brief hiatus over the winter Holidays to take some time off, then started a new job, but we’re back in action! Every week I’ll provide updates on the latest trends in SaaS valuations, earnings announcements, and highlight any significant news. Follow along to stay up to date!

Highlight of the Week - Morgan Stanley Q4 CIO Survey

I’ve been shouting on top of this soap box before, but we’re in the early innings of cloud adoption. There’s just so much room to run going forward. Morgan Stanley survey shows CIOs estimate that only 26% of their workloads currently run in the cloud

Top 10 EV / NTM Revenue Multiples

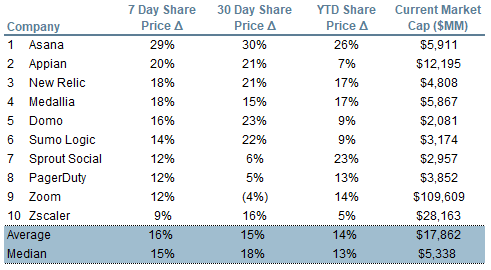

Top 10 Weekly Share Price Movement

Update on Multiples

SaaS businesses are valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

Overall Stats:

Overall Median: 18.1x

Top 5 Median: 47.3x

3 Month Trailing Average: 16.7x

1 Year Trailing Average: 13.1x

Bucketed by Growth:

High Growth Median: 32.5x

Mid Growth Median: 18.8x

Low Growth Median: 7.9x

Operating Metrics

Median NTM growth rate: 21%

Median LTM growth rate: 30%

Median Gross Margin: 74%

Median Operating Margin (14%)

Median FCF Margin: 5%

Median Net Retention: 115%

Median CAC Payback: 24 months

Median S&M % Revenue: 44%

Median R&D % Revenue: 25%

Median G&A % Revenue: 18%

News

Snowflake announced that data providers on their Data Exchange have growth 300% since April ‘20

Zoom announced a follow-on offering, selling $1.75B of new shares. This offering raises money for the company, and also dilutes existing shareholders

Zoom announced that they have sold 1M Zoom Phone seats in just under 2 years from the product hitting general availability.

Crowdstrike announced a $750M unsecured senior notes offering. Not many cloud businesses can raise straight debt, but Crowdstrike generates quite a bit of FCF so they can raise the non-dilutive capital

Docusign announced a $600M convertible note offering (0% coupon), as well as a $500M credit facility

Box announced a $315M convertible note offering

Comps Output

Rule of 40 shows LTM growth rate + LTM FCF Margin. FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Thank you for the continued posts and congrats on the new role at Altimeter? Would you be willing to make your comps table excel available to the public, similar to the BVP cloud index comps?

In your new role at Altimeter, at what stage will you be looking to invest in cloud businesses?