Clouded Judgement 12.1.23 - Net New ARR Starts to Rebound + AWS ReInvent Recap

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Amazon ReInvent

This week Amazon had their annual AWS ReInvent conference. Couple takeaways for me:

2024 is shaping up to be the “prototype to production” year for AI. This year, there was tons of experimentation. There were also quite a few questions around cost and compliance. On the former - we’ll see a lot of these experiments translate to production facing apps in 2024. And on the latter - there will be more guardrails and structure in place to appease some of the compliance questions. On the cost piece - there were a number of folks who made statements like “we can’t roll out this chatbot / CoPilot to our entire user base becasue our costs would explode!”

AWS fully embracing the breadth over depth approach. They want to offer up developers as many options as possible. When it comes to foundation models, outside vendors like Anthropic, AI21 Labs, Cohere, Meta Llama, Stability as well as Amazon’s Titan models are all available on Bedrock. Amazon was clear in their beliefs that there won’t be “one model to rule them all” and instead users will embrace choice. When it comes to vector search / support, they will make that available in all of their databases

Customizations are coming. General purpose GenAI tools dominate the market today, but the tooling layer is starting to emerge to allow enterprises to fine tune models to their specific data.

A strong data foundation is critical for an effective AI strategy! This was repeated quite a few times

AI tends to be additive budget for large enterprises. Right now thinking isn’t as much “when we spend more on AI we have to reduce spend elsewhere.” Of course this happens in some instances, but generally it felt like it was all additive budget as companies are in the exploration phase

AWS was coming from behind on the AI front (relative to Microsoft), but has made a number of recent strides that suggest they’re heading in the right direction. Time will tell if they can execute! But early signs seem positive

Some Positive Trends on Net New ARR

We’re about 80% of the way through earning season and can start looking at signs for overall trends. One that stood out to me - net new ARR growth seems to be rebounding. When I look at the median YoY growth in net new ARR added, Q3 ‘23 was the first quarter in a while where the median has gone positive. Is this a sign that software headwinds have bottomed? Amazon and Snowflake have both made comments recently that Cloud Optimizations are starting to play second fiddle to net new workload growth. Frank Slootman at Snowflake said: “people have really driven themselves through these processes and rationalized themselves and are now in a good place to move forward. You can only optimize and rationalize so much. At some point, it's diminishing returns. People get tired of us and they're moving on to things that are now new and interesting, namely preparing for enabling AI and ML technologies.” And Adam Selipsky at Amazon said “many customers have completed their cost optimization, and we’re hopeful for increased growth. Looking at the mid to long term, we feel very optimistic about the outlook for strong AWS growth. We’re still in the early days of the cloud.”

Quarterly Reports Summary

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

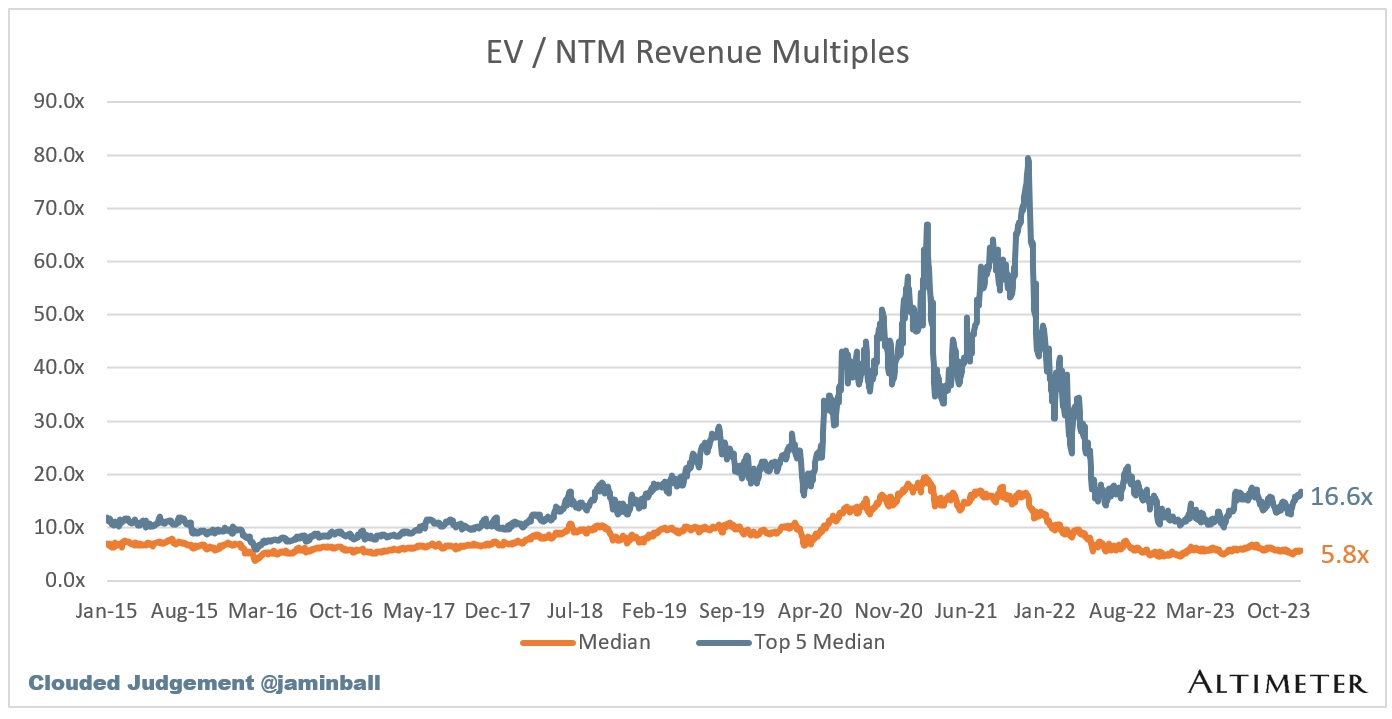

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.8x

Top 5 Median: 16.6x

10Y: 4.3%

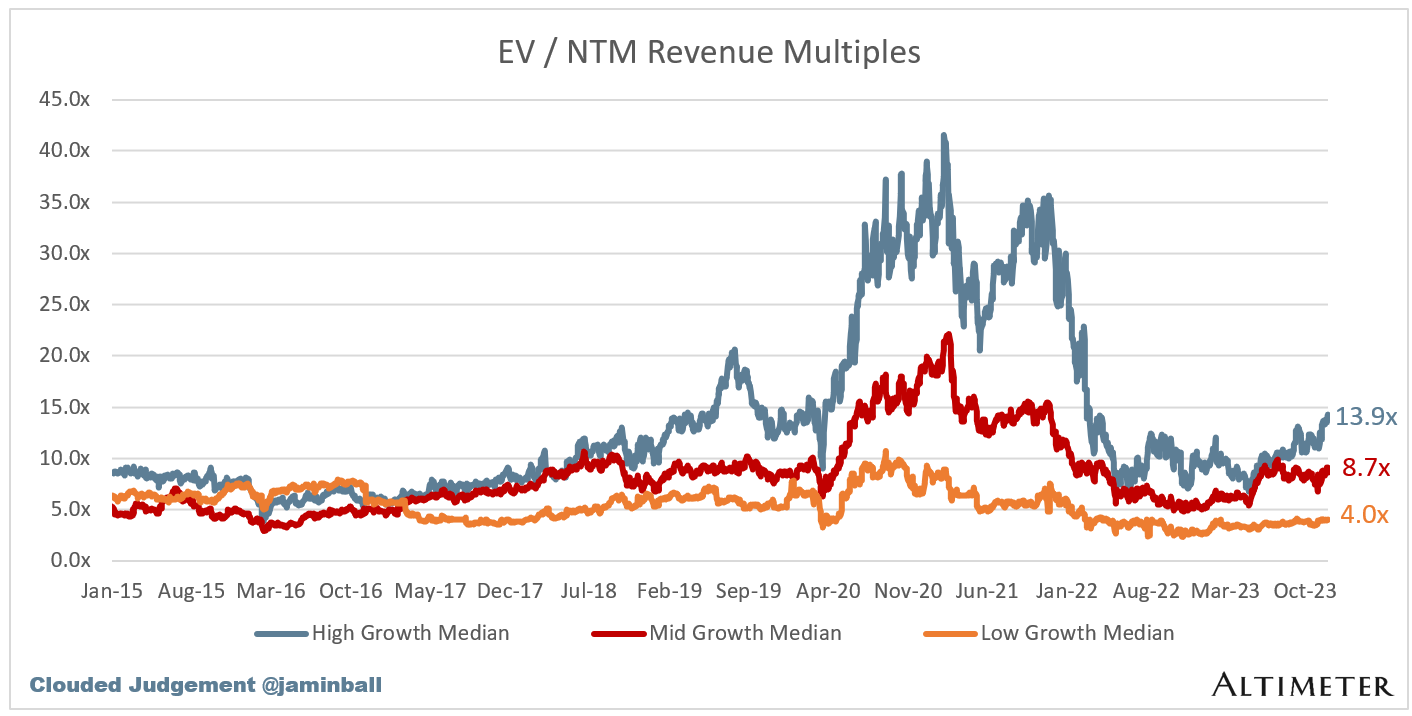

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 13.9x

Mid Growth Median: 8.7x

Low Growth Median: 4.0x

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

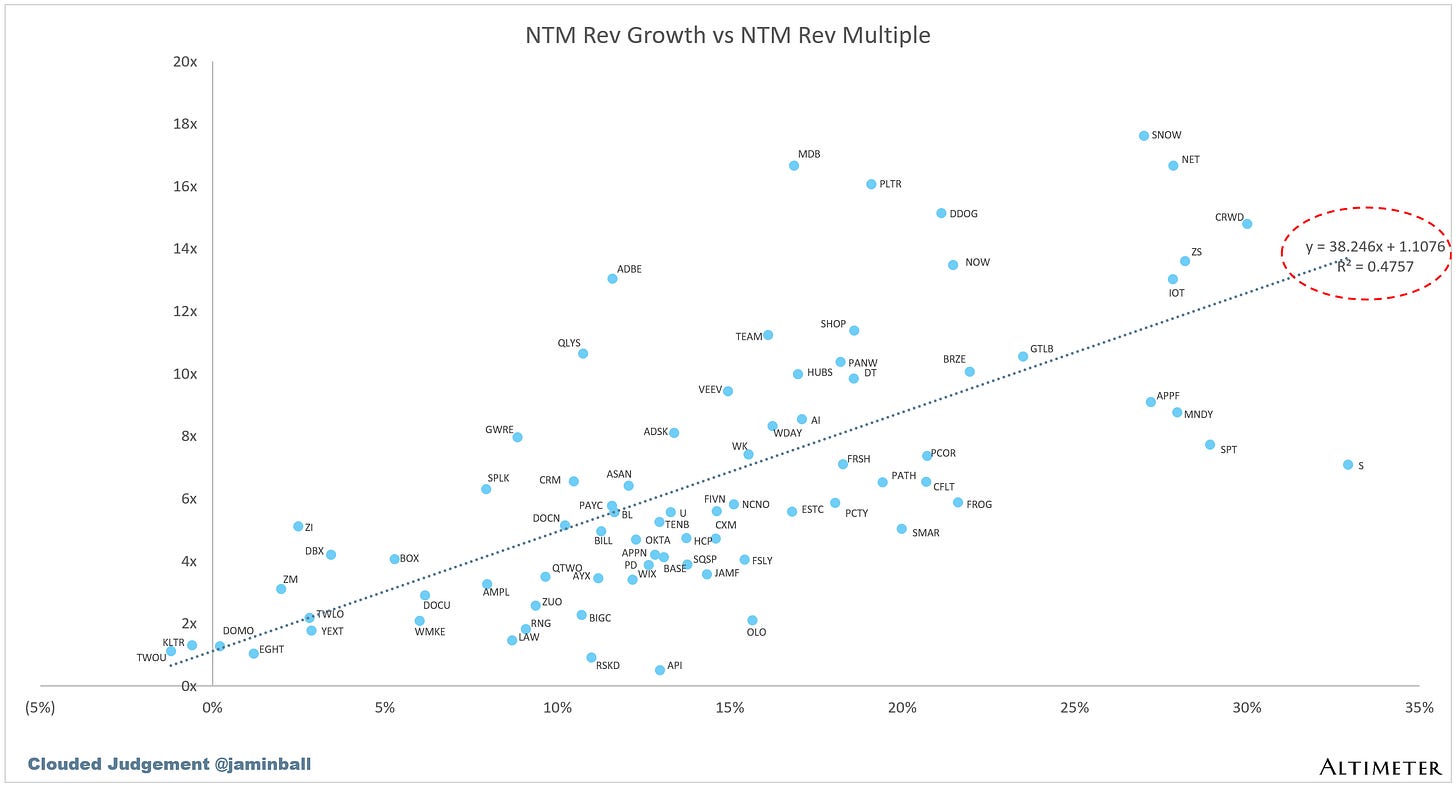

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 14%

Median LTM growth rate: 20%

Median Gross Margin: 75%

Median Operating Margin (15%)

Median FCF Margin: 8%

Median Net Retention: 112%

Median CAC Payback: 36 months

Median S&M % Revenue: 42%

Median R&D % Revenue: 26%

Median G&A % Revenue: 17%

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Dear Jamin, Much appreciate these insights. Wonder if it would be impossible to try following -

1. EV TO NTM FCF (Next 12 months FCF) for last 10 Y for all cloud - Computing 10-15 Y Median instead of average in a graph &/ table?

2. EV TO NTM Rev (Next 12 months Rev) for last 10 Y for all cloud - Computing 10-15 Y Median instead of average in a graph &/ table?

Hey Jamin -- hope all is well. Where do you find the ARR figures for this set?