Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Macro Update

the 10Y rate dropped to 3.9% this week. That’s the lowest it’s been since the summer, and down nearly 25% from where it was just two months ago. That’s a huge move in rates in such a short window. Just in the last week we’ve seen the 10Y drop from 4.2% to 3.9%. So what happened this week? Here’s a quick recap on some of the data

CPI:

Nov CPI YoY was +3.1% vs expectations of +3.1% (and +3.2% in October)

Nov CPI MoM +0.1% vs expectations of +0.0% (and +0.0% in October)

Nov Core CPI (ex Food/Energy) YoY +4.0% vs expectations of +4.0% (and +4.0% in October)

Nov Core CPI (ex Food/Energy) MoM +0.3% vs expectations of +0.3% (and +0.2% in October)

PPI

Nov PPI YoY +0.9% vs expectations of +1.0% (and +1.3% in October)

Nov PPI MoM +0.0% vs expectations of +0.0% (and -0.5% in October)

Nov Core PPI (ex Food/Energy) YoY +2.0% vs expectations of +2.2% (and +2.4% in October)

Nov Core PPI (ex Food/Energy) MoM +0.0% vs expectations of +0.2% (and +0.0% in October)

So overall on inflation we’re not seeing it get worse.

Then we had the FOMC meeting where we got increased commentary on how the Fed is thinking. Here were some of the main comments from Powell and other members:

Tagline - they did not increase rates, but held them constant

“Inflation has eased without significant increase in unemployment”

“While we believe our policy rate is likely at or near its peak for this cycle we have been surprised in the past”

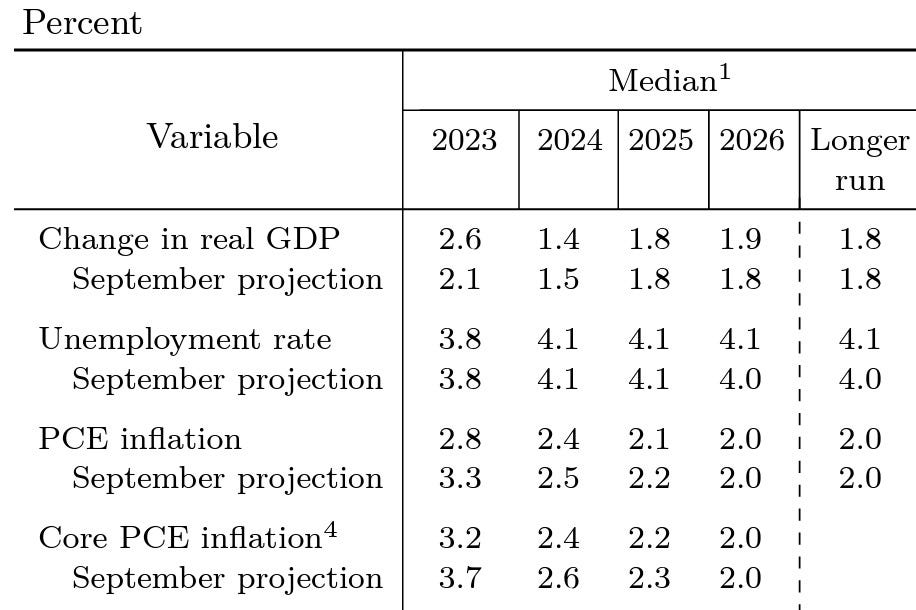

On top of this, we received the Fed’s economic projections for the next few years (in the image below)

So if we wrap all of this up, what are the takeaways from this week’s data? The TLDR - the “soft landing” case was bolstered with this week’s data

Inflation, while still above the target, is moderating and not showing signs of rebounding up

Unemployment is not expected (according to Fed’s projections) to baloon next year

GDP is expected (according to the Fed) to grow next year (ie no recession)

Core PCE inflation (according to the Fed) is expected to hit 2.4% next year

Wrapping all of this up - the Fed expects inflation to come down back to around it’s target without the economy contracting or unemployment spiking. This would be a perfect soft landing!

If we look at where rate projections are today (yellow line in the chart below), the market believes we’ll see 7 rate cuts by Jan ‘25! These projections have also changed drastically in just the last 2 months

Top 10 EV / NTM Revenue Multiples

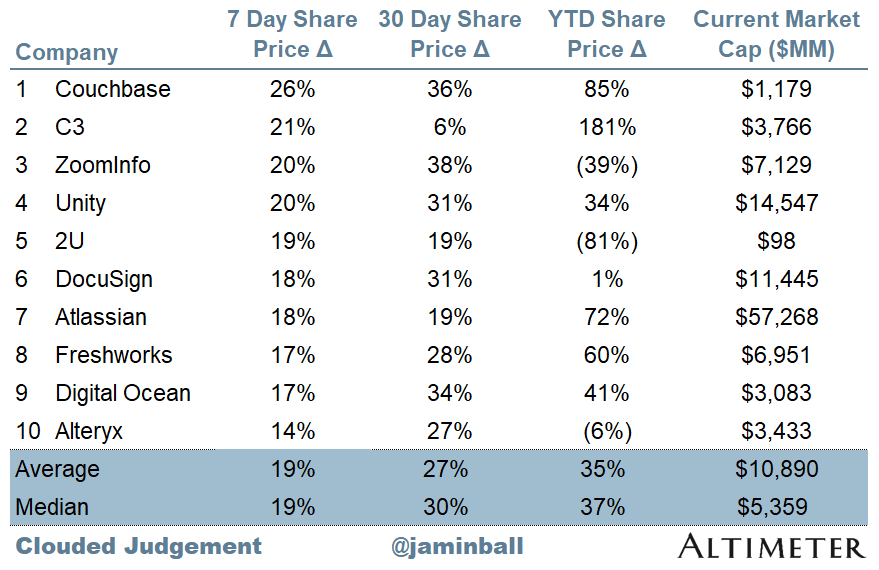

Top 10 Weekly Share Price Movement

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 6.3x

Top 5 Median: 16.9x

10Y: 3.9%

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 15.8x

Mid Growth Median: 9.3x

Low Growth Median: 4.1x

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the line chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 14%

Median LTM growth rate: 20%

Median Gross Margin: 75%

Median Operating Margin (13%)

Median FCF Margin: 8%

Median Net Retention: 112%

Median CAC Payback: 39 months

Median S&M % Revenue: 43%

Median R&D % Revenue: 26%

Median G&A % Revenue: 17%

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Great insights as always! Would be interesting to represent profitability on the NTM revenue growth vs NTM Revenue multiple chart maybe through a bubble chart.

Fantastic coverage and A+ commentary. I noted that this work was cited frequently in the recent all-in podcast. Highly relevant and informative to the current climate.

May as David said we are out of the SaaS recession - time will tell!

Thanks For all the time you take to do the work and share it with the community. It’s greatly valued.

Looking forward to your next publication