Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

2023 Forecasts

There are 2 primary questions that matter right now for software stocks - are rates going up or down, and are numbers (foreword estimates) going up or down. Covid was a period where rates were going down, and numbers going up. A beautiful combination!

In my opinion, we’re reaching a point where rate expectations are now a known risk with an upper bound more or less established. As I’ll talk about later, they’ll most likely stop going up soon (won’t be coming down, but will stop going up). The big risk still on the table remains 2023 estimates - specifically are they too high. So far, we haven’t really seen numbers come down for 2023 in software (although it’s starting). This primarily due to the fact that companies haven’t given guidance for 2023 yet. There’s a prevailing view in the market (I think) that numbers need to come down, but we won’t see it broadly in software until companies start giving 2023 guidance. When will that happen? Most likely in Q4 earnings calls (that will happen in Feb - Mar ‘23). I do think there is a chance we could be lulled into a false sense of security from now until then. However, Crowdstrike came out on their call and gave a mix of qualitative and quantitative commentary about 2023. Here’s how expectations for 2023 changed before / after the earnings call.

Crowdstrike 2023 Expectations pre-earnings

2023 ARR of 37% growth, with ~$950m net new ARR added, and ~10% growth in net new ARR added in 2023 vs 2022

Crowdstrike 2023 Expectations post-earnings

They gave rough directional guidance on the call of “low 30’s” ARR growth for 2023, and net new ARR in Q4 this year 10% below Q3. The 2023 guidance would imply closer to $780m of net new ARR added, and flat / down net new ARR added in 2023 vs 2022

In summary - 2023 expectations went from roughly $3.55B ARR (37% growth) to $3.3B (low 30’s growth). This is a reduction in 2023 estimates by ~7%. Net new ARR added went from ~$950m to ~$780m. It is important to note that these numbers are quite rough, back of the envelope calculations. I don’t mean to provide a level of false precision, but tried to be as “accurate” as I could given the comments on the call. It’s also important to note that the “guidance” Crowdstrike gave was just that - guidance. Generally there’s a cushion baked into guidance, so more likely than not Crowdstrike will end up preforming better than what they’ve guided to (but again, maybe recession cuts deeper and there’s further cuts to come). FWIW - Morgan Stanley is projecting 28% ARR growth in ‘23, so below company guidance. They were already on the low end of ‘23 projections prior to the call, and still took their numbers down.

I write all this out to pose the following question - will we see the same thing out of the rest of the software universe, and Crowdstrike is just the first to talk about it? The proverbial canary in the coal mine? If so, we definitely have real cuts to ‘23 numbers still in front of us. Remember, Crowdstrike is one of the best preforming software companies out there, and they’re seeing this slowdown.

Then again - Snowflake had a very bullish 2023 guide. They called for 47% growth (while simultaneously raising FCF guidance). The impressive part of the ‘23 guide is that they guided for ~49% growth in Q4 this year. This implies they expect to see no deceleration in growth from Q4 YoY to the full year 2023. In fact, there’s most likely a cushion built into the ‘23 guide so we may even see acceleration. That type of performance into a recession is quite impressive.

Powel Speech

On Wednesday Powell gave a speech that ended up lifting the market. He commented that rate hikes will likely moderate in December, essentially confirming a 50bps hike in December when we’ve had 75bps hikes the last few months. He also mentioned that the rate peak will likely be somewhat higher than Sept forecasts (4.6%), and that we’ll need restrictive policy for some time. The current fed funds rate target is 3.75-4%, and what feels most likely at the moment is a 50bps hike in December followed by a 25 or 50bps hike in January (feels more like the former at the moment).

His overall tone seemed to be that we’re seeing progress, but have to see structural change, not a few data points here and there to feel better. He said a few times the lower-than-expected CPI print in November was a good surprise, but in isolation only one data point. He’s hesitant to call this a true trend given many market participants have been predicting declining CPI for quite some time. Here’s a relevant quote: “inflation forecasts of private-sector forecasters or of FOMC participants, which broadly show a significant decline over the next year. But forecasts have been predicting just such a decline for more than a year, while inflation has moved stubbornly sideways.”

Overall, while rate increases will start to slow, the Fed has clearly taken a stance that they will keep a restrictive policy for quite some time until they’re certain inflation is headed in the right direction. He also made comments that he’s acutely aware of the risk of overtightening, but also still thinks there’s a possibility for a “softish” landing.

Basically confirmed 50bps in Dec. Framework will rates will be held there for longer. Going to remain high until we see inflation coming down. If inflation does come down, they’ll have greater range of motion. But they won’t make any changes with single months of data. Will need to believe we’re structurally lower

One other relevant quote on the labor markets I wanted to share: “In the labor market, demand for workers far exceeds the supply of available workers, and nominal wages have been growing at a pace well above what would be consistent with 2 percent inflation over time. Thus, another condition we are looking for is the restoration of balance between supply and demand in the labor market.”

Net net - while Powell has said in the past that he’s data dependent, this actually felt like the first time he’s truly data dependent (which is a good thing). Historically he’s pounded the pavement on rates need to go higher, etc etc. He wasn’t pounding the pavement on that one singular message on Wednesday. Instead, he felt truly data dependent.

You can find his prepared remarks here: https://www.federalreserve.gov/newsevents/speech/powell20221130a.htm

Quarterly Reports Summary

**Snowflake guide represents product rev guide / product rev consensus (not total rev)

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

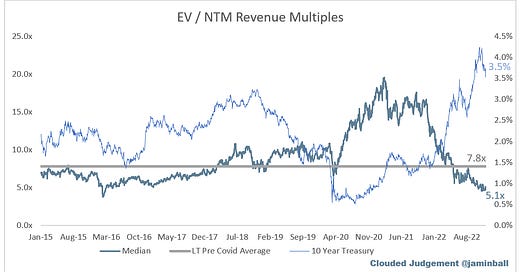

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.1x

Top 5 Median: 13.2x

10Y: 3.5%

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 9.0x

Mid Growth Median: 5.7x

Low Growth Median: 3.0x

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Growth Adjusted EV / NTM Rev

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

Operating Metrics

Median NTM growth rate: 18%

Median LTM growth rate: 30%

Median Gross Margin: 74%

Median Operating Margin (26%)

Median FCF Margin: 1%

Median Net Retention: 120%

Median CAC Payback: 35 months

Median S&M % Revenue: 48%

Median R&D % Revenue: 28%

Median G&A % Revenue: 20%

Comps Output

Rule of 40 shows LTM growth rate + LTM FCF Margin. FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

I'm not familiar with a couple of your abbreviations, can you provide a glossary?

That would be very helpful as I really enjoyed your article but need assistance with

the your abbreviations. Thank you

Any reason why Sentinel One is such an outlier on the Growth vs Rev Multiple regression?