Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

The Year of “Enterprise AI”

One of the biggest challenges facing AI systems in enterprises today is the “last mile” problem: how do you make AI both reliable and accurate for specific enterprise use cases? While cutting-edge language models have demonstrated remarkable capabilities, most are primarily trained on open internet data. This general-purpose foundation often leads to gaps in handling highly specific or specialized queries—an issue that becomes especially critical when your enterprise’s reputation is on the line in customer facing applications.

A core question is whether these powerful reasoning models truly “generalize” well. In AI terminology, “generalizing” refers to a model’s ability to apply learned knowledge to new tasks or unseen data. For many current large language models, once they are exposed to domain-specific challenges or niche inquiries—like in-depth product troubleshooting or compliance-related questions—they can stumble. That’s because their training data, while vast, may lack the level of granularity found in specialized enterprise environments.

However the pace of innovation in large language models is extraordinary. We’re seeing continuous improvements that might allow these models to become more adaptable and generalizable in the near future. This means future versions could readily handle a broader range of enterprise queries without requiring extensive customization - a more horizontally applicable agent / model. Still, for many organizations, relying on purely general-purpose models in mission-critical scenarios is risky.

That’s why another route is gaining traction: combining enterprise-specific data with general-purpose AI models. This is what I’m calling “Enterprise AI.” By fine-tuning or distilling large models on a company’s unique dataset, organizations can achieve higher accuracy and more trustworthy outputs. Distillation involves taking a massive, resource-heavy model and creating a smaller, more specialized one that retains the “knowledge” relevant to an enterprise’s domain. Early research, including projects like R1 from DeepSeek, has shown promising results in this area.

Use cases for fine-tuned AI systems are remarkably diverse. For example, a tailored model could streamline compliance checks by scanning internal documents for potential policy violations or regulatory gaps. It might also boost sales forecasting accuracy by using your enterprise’s historical transaction data to predict future trends more reliably. In addition, organizations could harness these models to automate and optimize supply chain operations—anticipating shipping delays or inventory shortfalls before they become issues. By applying enterprise-specific data to powerful language models, companies can unlock deeper efficiencies and maintain a decisive competitive edge in their markets.

By bridging the gap between general-purpose capabilities and domain-specific expertise, fine-tuning and distillation strategies can help large enterprises move past the last mile problem—ensuring AI solutions truly meet the standards for reliability and accuracy. And then finally, there’s the boogeyman in the room - do the large models in future releases become so powerful they begin to generalize better. The pace of innovation is crazy at the leading AI labs, so I wouldn’t count this out!

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

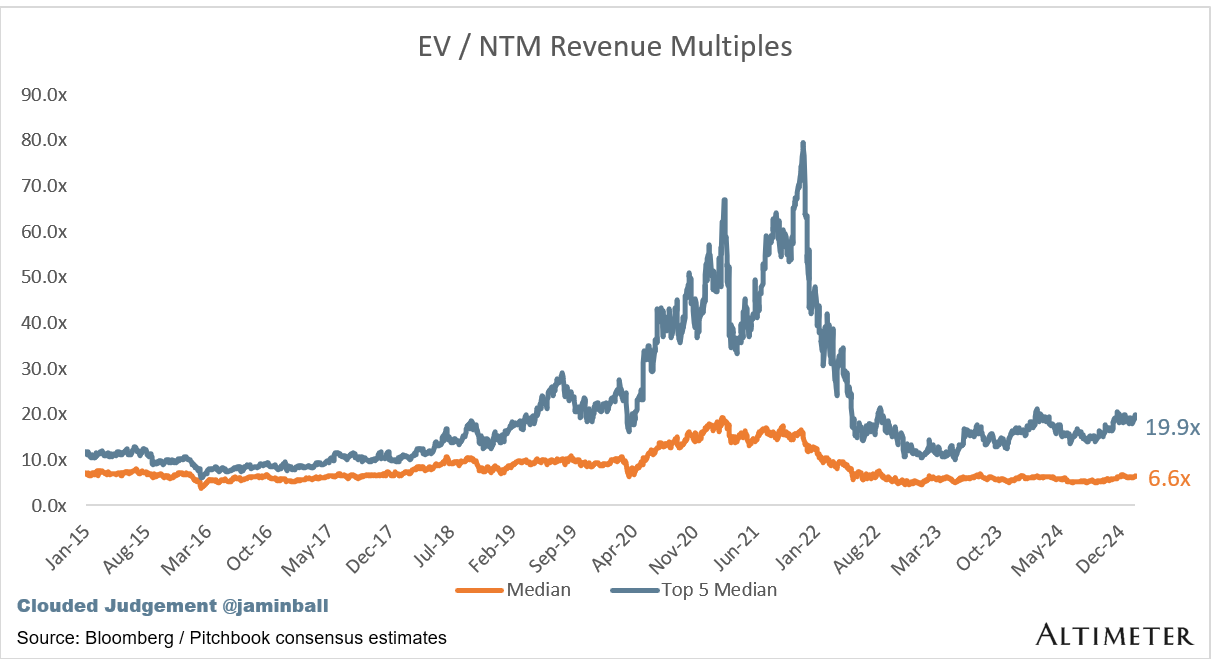

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 6.6x

Top 5 Median: 19.9x

10Y: 4.6%

Bucketed by Growth. In the buckets below I consider high growth >27% projected NTM growth (I had to update this, as there’s only 1 company projected to grow >30% after this quarter’s earnings), mid growth 15%-27% and low growth <15%

High Growth Median: 10.2x

Mid Growth Median: 12.2x

Low Growth Median: 4.3x

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

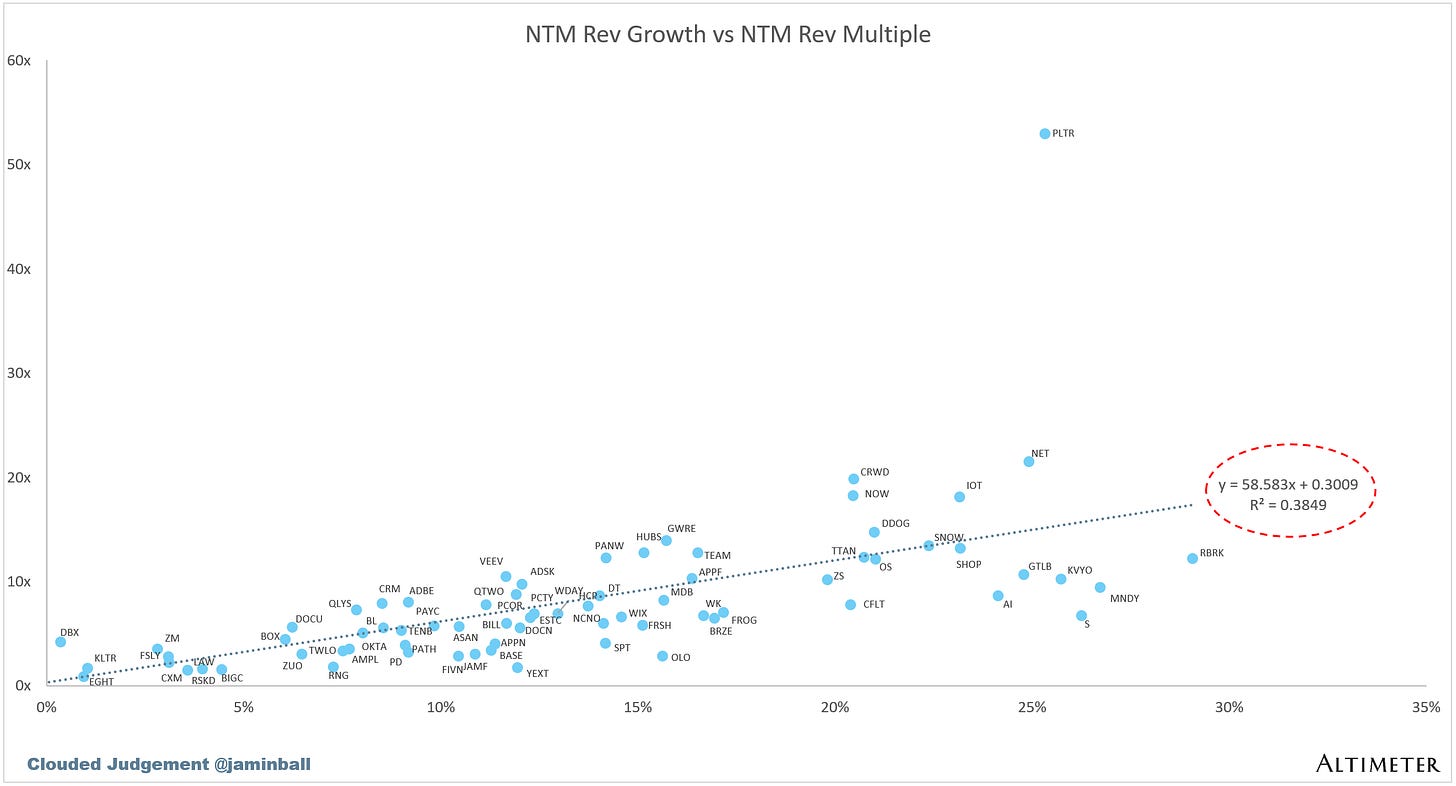

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 12%

Median LTM growth rate: 14%

Median Gross Margin: 76%

Median Operating Margin (7%)

Median FCF Margin: 16%

Median Net Retention: 109%

Median CAC Payback: 37 months

Median S&M % Revenue: 40%

Median R&D % Revenue: 24%

Median G&A % Revenue: 17%

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Jamin, I like your framing of "Enterprise AI" and think it's a great lens to evaluate technology providers serving this new market. You seem to be looking at it from the outside in, however, assuming that foundation model providers like OpenAI, Anthropic, or DeepSeek are the primary providers for enterprises looking for LLMs as raw technology. Another dimension not included here is ISVs who use these tools to offer full products built on these LLMs for CRM, ERP, enterprise productivity, etc. They will offer buy vs. build choices in the Enterprise AI market where the domain/function specific customization work is already done and easy integrations automatically personalize these tools for a specific enterprise or individual user.