Clouded Judgement 1.3.25 - Domain Specific Models

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

The Rise of Domain-Specific Models in 2025

It’s prediction season! Here’s mine:

2025 is shaping up to be the year that domain-specific AI models take center stage. While 2024 celebrated the triumph of generalized models OpenAI, Anthropic, Meta and others trained on vast public datasets, this year’s breakthroughs are emerging from a different source: models pre-trained and fine tuned on private, highly specialized data. These domain-specific models are set to revolutionize industries that require deep expertise, precision, and contextual understanding. It’s also just the beginning of the enterprise AI trend - one that will see every enterprise develop their own models. Whether they are domain specific models, or models specific to their company (like a model for customer support interactions specific to their business), the market for enterprise AI will explode.

The shift is driven by the limitations of generalized AI when applied to highly specialized challenges. Fields like protein engineering, agriculture, advanced engineering, supply chain optimization, aerospace and defense, energy, finance, regulatory and molecular biology (among many others) demand models that understand complex, domain-specific contexts—nuances that generalized models, even the best ones, cannot grasp. This is where domain-specific models thrive. By training on proprietary datasets, such as confidential industry reports, operational data streams, or decades of domain-specific research, these models achieve levels of understanding and accuracy unattainable by broader systems.

The innovation doesn’t stop at access to private data; it’s in how these models evolve. Companies are not only integrating pre-trained models with proprietary data but also building systems that continuously improve through incremental feedback. This feedback loop might include customer interactions, field performance data, or operational insights generated in real time. For instance, a model designed for precision agriculture could learn from both historical climate data and immediate sensor readings from equipment in the field.

Why does this matter? Because domain-specific AI bridges the gap between theoretical capability and real-world impact. A generalized model might offer a plausible answer; a domain-specific model delivers the right answer. This precision can mean the difference between identifying a subtle defect in semiconductor manufacturing versus missing it, or between finding a promising drug candidate versus overlooking it.

2025’s AI breakthroughs will showcase how specialization transforms industries, enabling unprecedented efficiency, unlocking innovative solutions, and solving challenges once considered insurmountable. The AI future isn’t just smarter—it’s finely tuned to solve the world’s most specific and pressing problems.

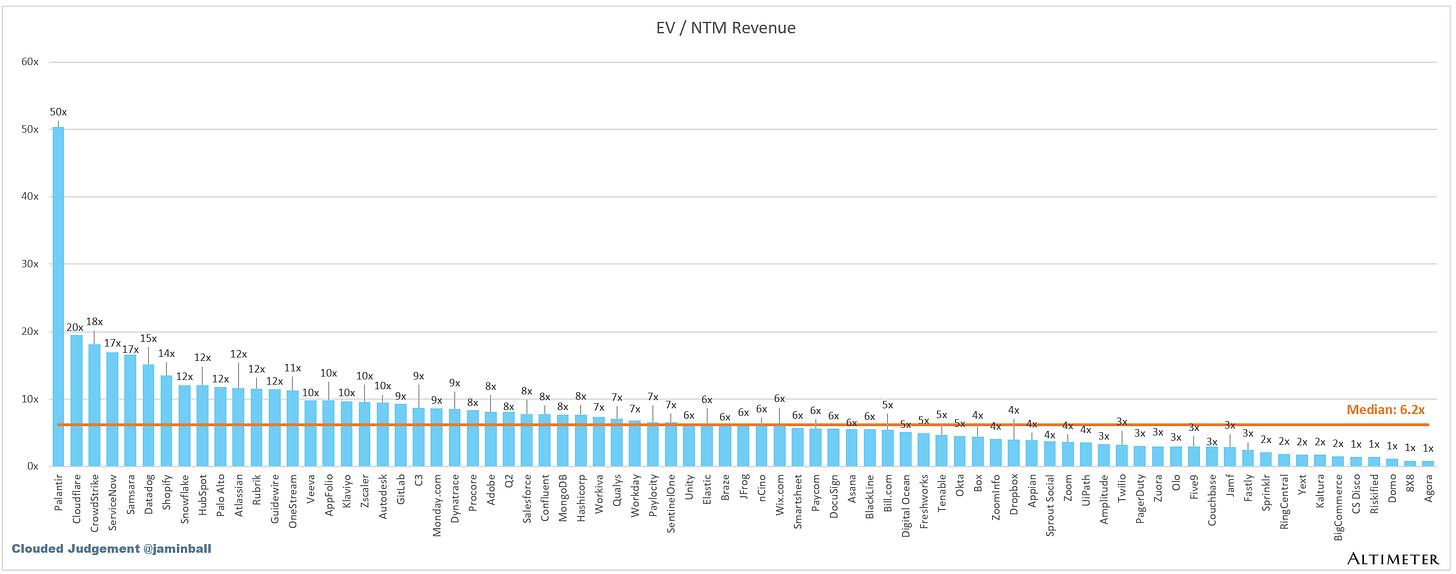

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 6.2x

Top 5 Median: 18.2x

10Y: 4.6%

Bucketed by Growth. In the buckets below I consider high growth >27% projected NTM growth (I had to update this, as there’s only 1 company projected to grow >30% after this quarter’s earnings), mid growth 15%-27% and low growth <15%

High Growth Median: 9.7x

Mid Growth Median: 10.6x

Low Growth Median: 4.4x

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 12%

Median LTM growth rate: 14%

Median Gross Margin: 76%

Median Operating Margin (7%)

Median FCF Margin: 16%

Median Net Retention: 109%

Median CAC Payback: 37 months

Median S&M % Revenue: 40%

Median R&D % Revenue: 24%

Median G&A % Revenue: 17%

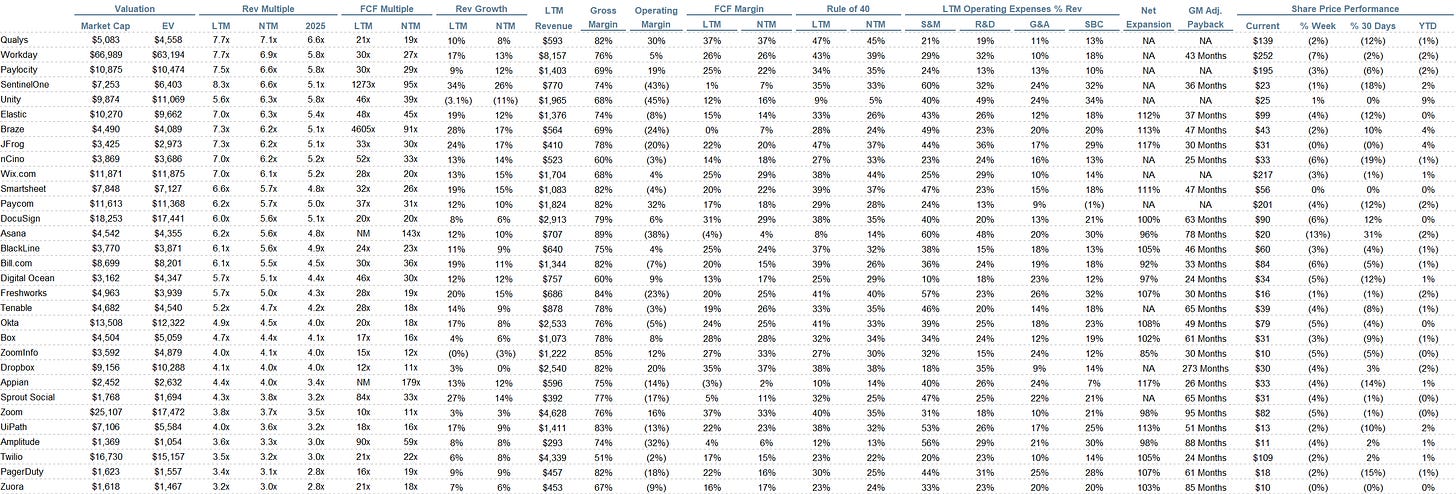

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Agree - some nice references to use cases close to my heart.

Nice post Clouded! I think about it like this. General purpose LLMs are like the desktop PC. They can be for specific use cases or general. They can have different specs, “context window” = RAM. System prompts (and controller prompts) are the OS of an LLM telling it what it knows, how to behave, what to prioritize. This is similar to a computer OS which knows, the file system, the boot instructions, drivers and so on. Finally, the user’s prompts are like software, which tell the PC or in this case the LLM what the user needs. Today, I need a recipe for pulled pork :). It’s all pretty cool.