Clouded Judgement 2.23.24 - Rule of X

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Rule of X

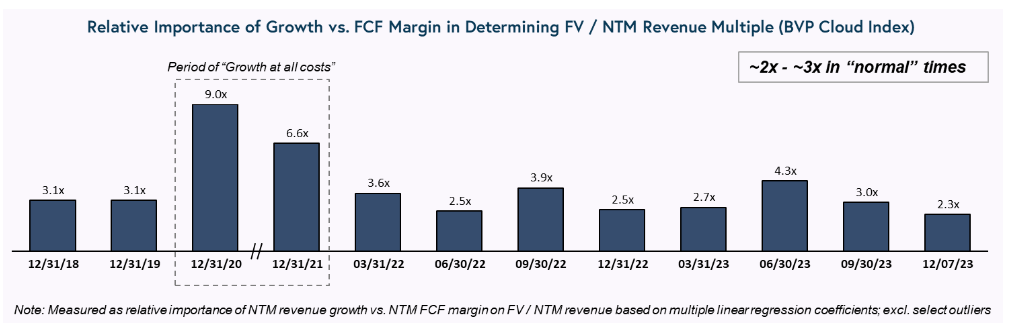

Meritech and Bessemer both recently did an analysis that looked at the Rule of 40 and asked the question “what if growth / profitability shouldn’t be treated equally in the Rule of 40?” The Rule of 40 looks at the sum of a companies growth rate and FCF margin (or some other profitability metric like EBIT margin) and says that the sum should be >40%. For both of those metrics I look at NTM (next twelve months) vs LTM (last twelve months). This could be a 30% growth rate and 10% FCF margin. Or 10% growth rate and 30% FCF margin. But should these businesses trade at the same multiple? Is the relative importance of growth and FCF margin the same? One other way to look at this, as Bessemer describes, is to put a multiplier in front of rev growth. So the formula for Rule of 40 becomes (growth multiplier) * rev growth + FCF margin. If the multiplier is <1, that’s another way of saying growth is less important. And if it’s >1 that’s another way of saying it’s more important. And when I say more / less important what I really mean is how important is it to the public market valuations at that point in time. And as we know, this fluctuates

Bessemer and Meritech both looked at historical data (images below) to see what that multiplier has been in the past. It’s pretty clear which point in time was the “growth at all costs” period!

So what if we look at the data today?

The data today suggests that the growth multiplier is 3.0x. Said another way, the public markets today are weighing growth 3.0x as much as FCF margin when it comes to valuation multiples. Of course, there are way more factors than just growth / FCF when determining valuation, so this is a crude metric. I like to look at this metric more to figure out on a relative basis how important growth / FCF margins are to the public markets

2024 Guides

Updating a chart I’ve shown for the last two weeks - the below chart shows 2024 guides vs consensus estimates before the earnings call. As you can see, on average full year 2024 consensus estimates are not going up after the Q4 calls. I imagine in such an uncertain time companies want to set a low bar, and so they’re being extra conservative with full year guidance this far out. However, stocks have run a bit recently (especially the high multiple ones) so you would have expected numbers to be going up. The second part is a nuanced point - the median cloud software stock is down 2% year-to-date. So the 2024 guides would be supportive of that. The overall median multiple has not really seen any multiple expansion so far this year. However, the top 5 multiples are currently 223% higher than the median (vs 152% higher to start the year), and the top quartile multiple is 60% higher than the median (vs 40% to start the year). Said another way, overall median multiples have not expanded, but the highest multiples have expanded quite a bit. The dispersion has been high so far this year

The below chart shows the specific multiple expansion / contraction for each cloud software company in my index from the start of the year to today

Quarterly Reports Summary

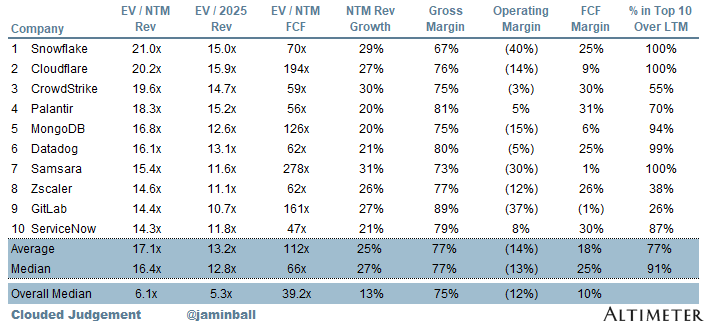

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

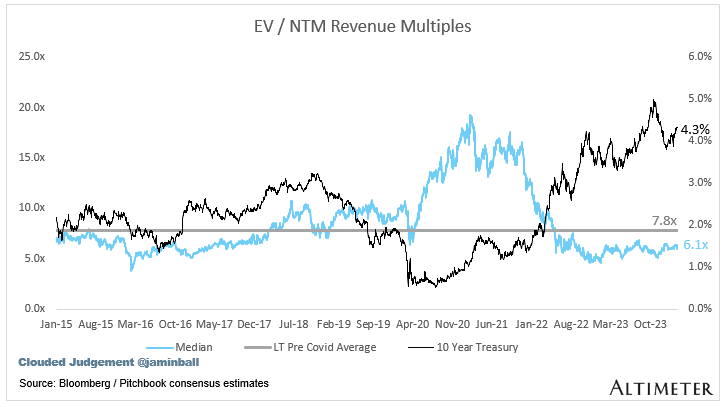

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 6.1x

Top 5 Median: 19.6x

10Y: 4.3%

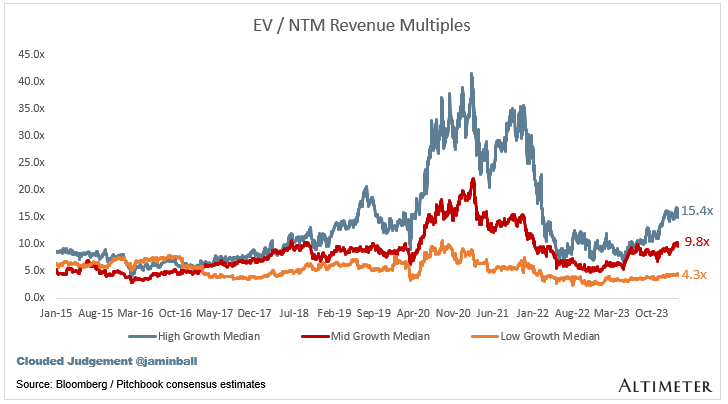

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 15.4x

Mid Growth Median: 9.8x

Low Growth Median: 4.3x

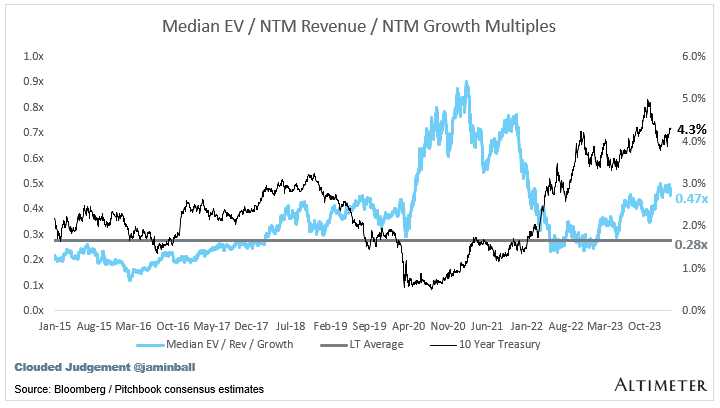

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the line chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 13%

Median LTM growth rate: 17%

Median Gross Margin: 75%

Median Operating Margin (12%)

Median FCF Margin: 10%

Median Net Retention: 110%

Median CAC Payback: 38 months

Median S&M % Revenue: 42%

Median R&D % Revenue: 25%

Median G&A % Revenue: 16%

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Your work is great Jamie, first of all thank you for it!

Why are the NTM multiples based off of the Enterprise Value?

Have you considered publishing multiples based off of Market Cap?

While EV can give us more detail like debt and etc, in the end it doesn't accurately tell you - the investor - what multiple you're actually paying.

Since we're focused on Confluent, we notice that the 10.3x NTM multiple is based off of their 9.79B EV, as only then do we get to the $950M NTM revenue that the company has projected.

Big fan of your work. Would love if you can include other profitable SaaS companies like Vimeo on this list. It appears you have their competitors.