Clouded Judgement 2.3.23 - Thoughts on a Wild Start of the Year

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Thoughts on a Wild Start of the Year

Today is a bit of a longer post, but lots to talk about. I also want to mention – I use this blog as somewhat of a personal journal. It’s a place I collect my thoughts. I’ll be right sometimes, I’ll be wrong sometimes, but it’s fun to try and make sense of what’s going on in the markets together. Now on to the content…

What a crazy start to the year. We have companies like BuzzFeed and C3 making loose announcements about how they will incorporate generative AI into their business, sending their stocks up 50-100%+. It reminds me of not too long ago when companies like Kodak and Long Island Ice Tea announced crypto related pivots resulting in similar stock moves.

Then we had the Fed meeting this week creating a huge move in the software market. So what happened? I’ll try and make sense of it all. First, the numbers. The Fed raised rates by 25bps. This was totally expected, nothing surprising here. The consensus for future rate hikes for the moment didn’t change much (a 25bps hike at the next meeting then a pause). However, there is some question here. I saw a tweet that mentioned a report from Morgan Stanley that said they don’t believe we’ll get any hike in the next meeting (and where we are currently is the peak). Clearly the market tone is getting more dovish. This was part of the big move in software on Wednesday / Thursday? If I had to sum up the rest in 3 main points it would be: Fed was more dovish, odds of soft landing (or at least a delayed recession) going up (so fundamentals not falling off a cliff yet), and most investors are offsides. Let’s talk about each.

Dovish Fed: Powell definitely had a more dovish tone. He opened his remarks by saying we’ve done a lot, the full effects of our actions have not fully been felt yet, but we’re already seeing progress. We now have a lot more clarity on future rate hikes. A fed funds rate >5% now seems like it won’t happen. The ceiling for how high rates could go is seemingly capped. His tone to me signaled that they’re confident that the actions they’ve already taken are having the desired effects. Powell even talked about how the “disinflation process has started.” All of this to say – the Fed was a headwind to markets over the last year. Today the pace of hikes is slowing and will hit it’s ceiling very soon. In other words, the Fed is no longer a headwind

Soft Landing / Fundamentals Not Falling of a Cliff (yet): Predicting a recession, its severity, and timing, is incredibly difficult. We can look at data for indicators, but predicting anything with confidence on all 3 of these vectors is very hard. What we do know – Powell continues to sound confident that a soft landing is still possible. It’s hard for me to take a strong point of view on this. My view is strong opinions loosely held is the right approach. With that being said – what seems to be the case is that even if we don’t have a soft landing, the timing for a recession (if one happens) has certainly been pushed our further in the future. A 2023 recession feels less likely, with 2024 being the more realistic timing if we do in fact get to a deeper recession. The implication here being fundamentals might hold on longer than originally anticipated. This leads into my final, and maybe most important, point. The market was offsides.

Market Offsides. Heading into the year, the market was positioned quite bearishly. From the S&P to software, consensus was 2023 estimates were too high, and set to fall meaningfully. Exposures were low. Not much software was owned. But what’s happened since? There’s a real chance the fed funds rate isn’t going >5%, and a soft landing or delayed recession is certainly possible (maybe even being priced in). Let’s imagine a world where we don’t have a recession in 2023. We started to see software optimizations and cutting starting more in earnest in Q3 ’22. How long will these optimizations take? More than a year? Doubtful. What I’m saying is at some point all the cutting / optimizations will have worked their way through the system, and that point it probably Q2 this year or sooner. Then – in the scenario I’m talking about where we don’t have a recession in 2023, the setup for software in the back half of ’23 actually looks great (but to be clear, I do expect Q1’s to be suspect / not great). Rates are not going higher than feared, earnings are not falling off a cliff (there is clearly softness everywhere but nothing catastrophic), and fed is more confident in a soft landing. In this scenario we could see software fundamentals accelerating in H2 ’23 with a Fed that’s no longer going against you. Quite the nice setup… And it’s becoming increasingly possible. If the market thinks the setup for H2 is great, it won’t wait until H2 to “price it in.” Market will move ahead of this, which is what we’re seeing now. The tricky part mentally is knowing fundamentals in Q1 won’t be great, but looking past that the H2 seems to be the market consensus. At the start of the year the consensus was bearish on rates + fundamentals, and so far neither of those bearish scenarios has played out. As a result, 2 things have happened. Folks positioned bearishly have missed this rally to start the year. The Nasdaq is up 17% (!) YTD. That’s insane for only 1 month! If you missed it, you can’t afford to miss the next leg and we’ll see a lot of chasing. As a result, we’ve seen a lot of people moving to add back some software exposure given the setup for software in H2 I discussed. This has only pushed the market higher.

Net net - at the beginning of the year positioning was super bearish. The consensus view was soft landing not possible, recession coming sooner than later, and software fundamentals are about to fall off a cliff with ‘23 estimates way too high. So far the Fed has gotten more dovish, signaled a soft landing is possible, and earnings and guidance (while weak for sure across the board), haven’t been catastrophic at all. Consensus (or what’s being priced in) has gone soft landing not possible to soft landing now somewhat possible (but still lower odds). This is catching the market way off guard. In the soft landing scenario the setup for software in the back half of the year could be amazing (as described above). So even if you entered the year super bearish, you maybe went from thinking 0% chance of a soft landing to 15% chance of a soft landing. And now need to adjust exposures accordingly (ie add software exposure to account for this). At the same time, starting the year bearish means you probably missed the huge rally to start the year. So if the soft landing scenario does play out, we could have a lot more room to run. And if you missed the first leg of the rally, you can’t afford to miss the next leg. All of this to say - impossible to know if soft landing or recession is coming. But this rally has got a lot of people offsides who are now trying to get back onside, and its pushing the market in the direction of most pain which is up (because people weren’t position to capture value with market moving up)

One anecdote a colleague shared with me that I found very interesting (and related to everything I’ve mentioned above). On Wednesday we saw a big value to growth rotation (as folks looked to get onside). One data point to support this – the WCLD index was up >5% on Wednesday, but the S&P was up only 1%. Why? The S&P contains both value and growth. So as value was sold and growth was bought, it somewhat “canceled out” in the S&P move. Meanwhile, more growth oriented indexes like WCLD rallied hard

I do want to finish with this – we very well could have a recession, and a bad one, in 2024. I am in the camp of thinking a recession is coming, and a soft landing outcome is still way too optimistic. But the time from here to when a recession could start is growing longer and longer, so we may have these rallies in the interim (where we get a lot of chasing). There is a chance we never have a deeper recession and this rally really persists. Or we have a recession in 2024 or later, and this rally is killed as fundamentals do start to deteriorate as we get closer to a recession. In the short term, enjoy the ride as the chase continues 😊

Kind of related to all of this - we now have seen the Q4’s from AWS, Azure and Google Cloud. Lots of deceleration in growth. Summary in my tweet below:

Quarterly Reports Summary

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

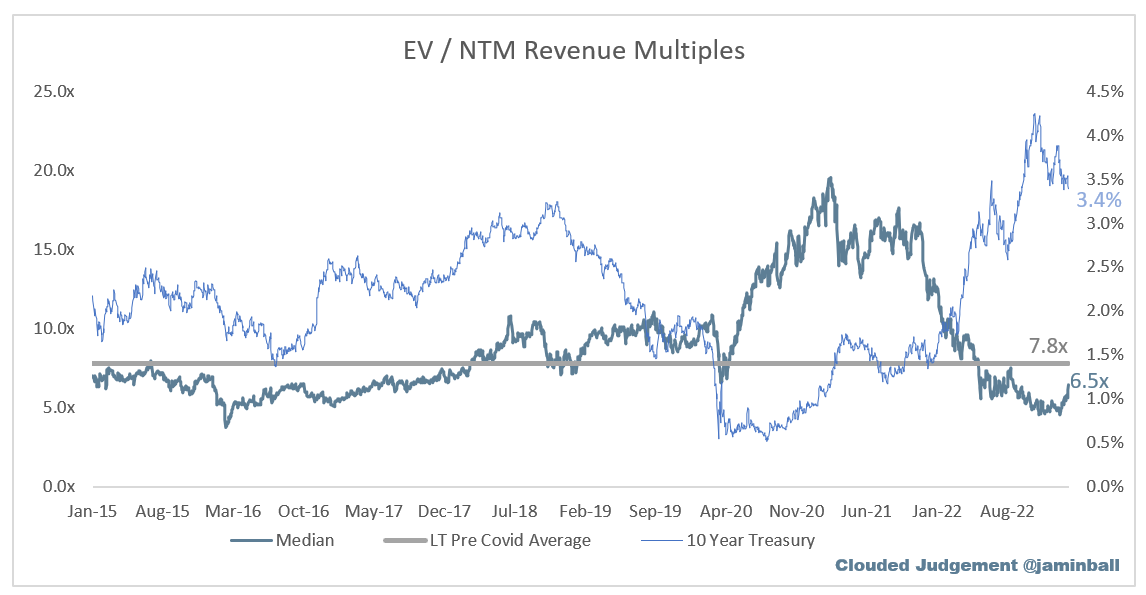

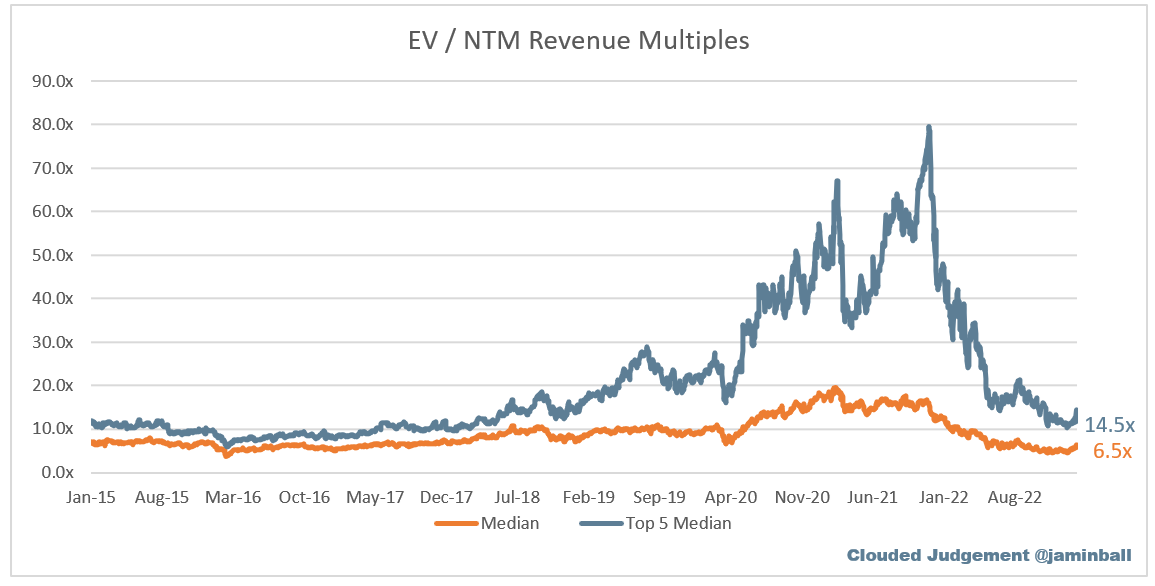

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 6.5x

Top 5 Median: 14.5x

10Y: 3.4%

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 12.0x

Mid Growth Median: 6.9x

Low Growth Median: 3.9x

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Growth Adjusted EV / NTM Rev

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

Operating Metrics

Median NTM growth rate: 17%

Median LTM growth rate: 29%

Median Gross Margin: 74%

Median Operating Margin (25%)

Median FCF Margin: 0%

Median Net Retention: 120%

Median CAC Payback: 37 months

Median S&M % Revenue: 48%

Median R&D % Revenue: 28%

Median G&A % Revenue: 20%

Comps Output

Rule of 40 shows LTM growth rate + LTM FCF Margin. FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Great thought process Jamin. Thanks for sharing. I actually think the recession might come as early as mid year. Because the 5/10/30 year bond all lower signal recession, also US dollar are weaker. Earning are deteriorating. Next year earning might look better compare to this year. But investor might already look pass the shallow recession to see second half 2023 or even 2024 at the moment. My question is how high do you think this Rally will be? 4300? 4600 or even 4800? new bull market or just bear rally?

Do you stand by the Dovish Fed analysis following the jobs report?