Clouded Judgement 2.4.22

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Highlight of the Week - Cloud Earnings!

What if I told you best in breed cloud businesses could asymptote at 40% annual growth? How would that change outer year valuations for companies today? Most analysts project linearly decelerating revenue for almost all businesses, getting to something like 10% in outer years. For so many cloud businesses we’ve seen durability of growth that is truly remarkable. Look no further than the 3 cloud giants who reported earnings over the last 2 week. AWS within Amazon, Azure within Microsoft, and GCP within Google. All are great proxy’s for the overall cloud software market, and all had monster quarters. None more impressive than AWS - they’re at a $71B run rate growing 40% YoY! Think about that scale and that growth rate. It’s truly remarkable, and a testament to how durable growth can be in best of breed software companies. I can very confidently say there are a number of cloud software companies who have impressive growth today, where just about everyone is underestimating what revenue they will do in 2025 and beyond

Here’s an update on the cloud giants:

So Why Are Software Stocks Getting Pummeled This Year?

There’s an old saying - don’t fight the Fed… Through the pandemic the fed pumped >$1T into the economy and took rates to zero. Growth and risk assets skyrocketed because of this. Now - as we see the light at the end of the tunnel around Covid, and with inflation rising dramatically, the Fed pricked the asset bubble and signaled rate hikes across 2022 and QT. This caused growth and risk assets to plummet. All the while the fundamentals of cloud software have never been stronger. But it doesn’t matter, the Fed rules all :)

The big question - have we overshot the bottom and due for a correction up, or do we have more pain ahead? It’s a tough question to answer! There are some out there who predict we’ll have more than 4 rate hikes this year. I tend to disagree here, but will continue to collect data over the coming months. To go beyond the 4 rate hikes we’ll really need to see signs of economic growth. I’m not sure we’re their yet. Pairing increased rate hikes with a slowing economy is the last thing the Fed will do. The rate hikes have done exactly what they intended - the economy is normalizing. My gut tells me we’re either at the bottom, close to it, or already hit it and passed it. I don’t have a crystal ball! I could be wrong. Economic growth may rip, inflation stays high, and the Fed may institute incremental rate hikes this year. In that scenario, we have more pain ahead.

In any scenario the market is still churning. I’m hopeful before long cloud software stocks will be driven by business fundamentals and not Fed policy. In the meantime, I’ll continue to own great businesses that I think present opportunities for longer than expected durable growth.

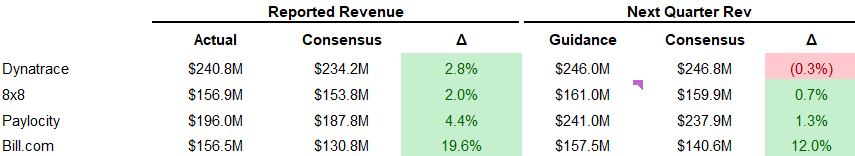

Quarterly Reports Summary

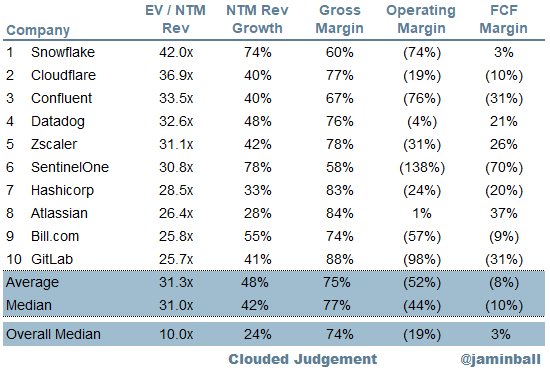

Top 10 EV / NTM Revenue Multiples

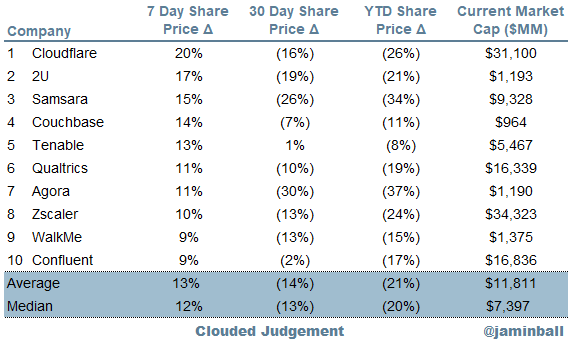

Top 10 Weekly Share Price Movement

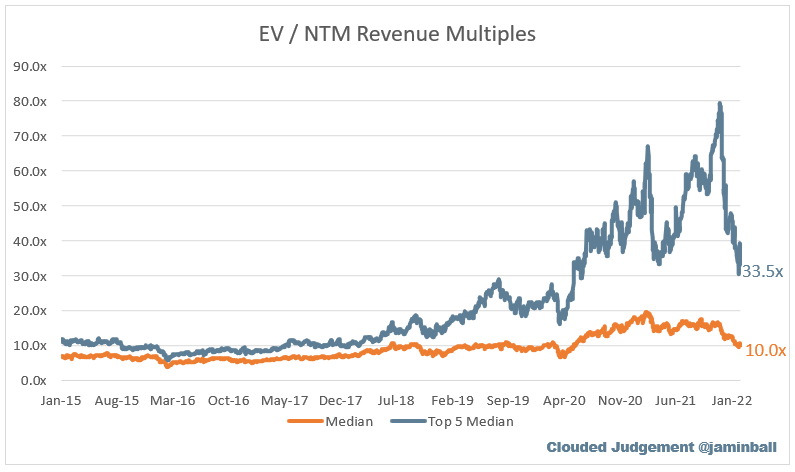

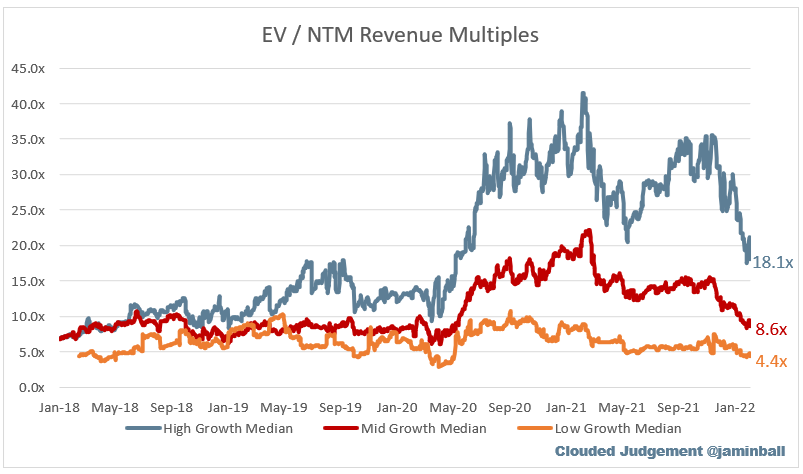

Update on Multiples

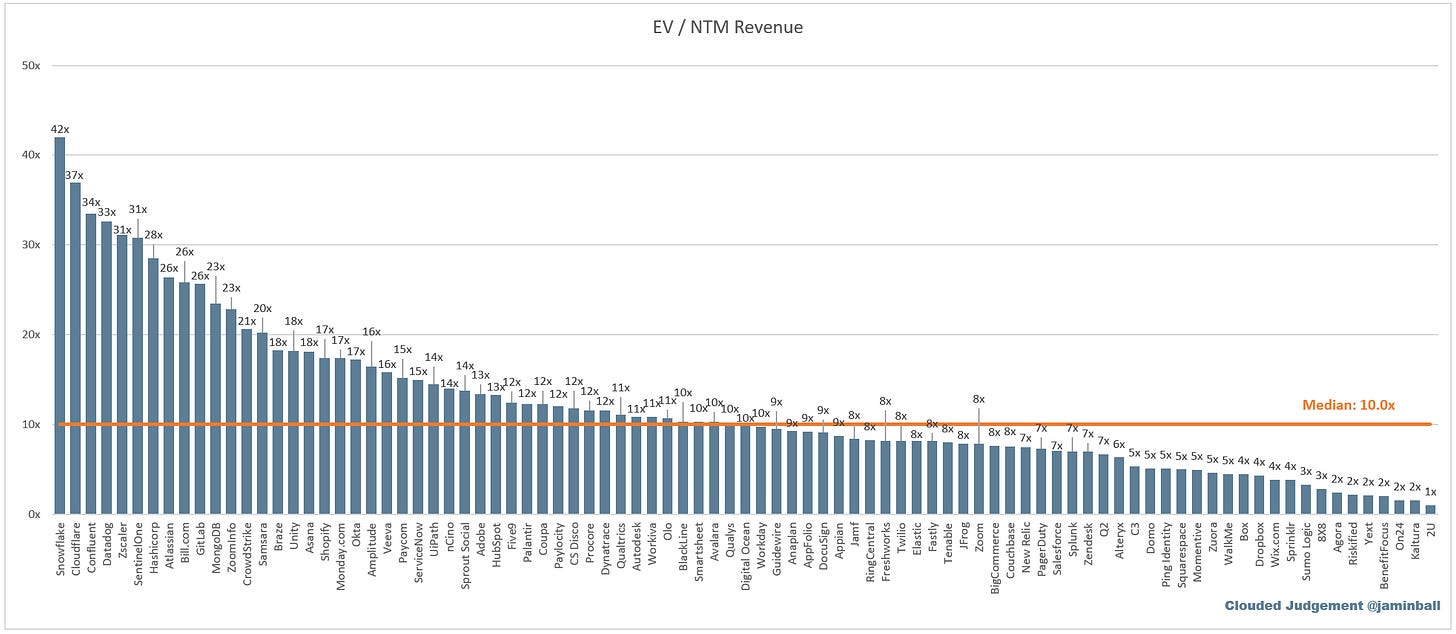

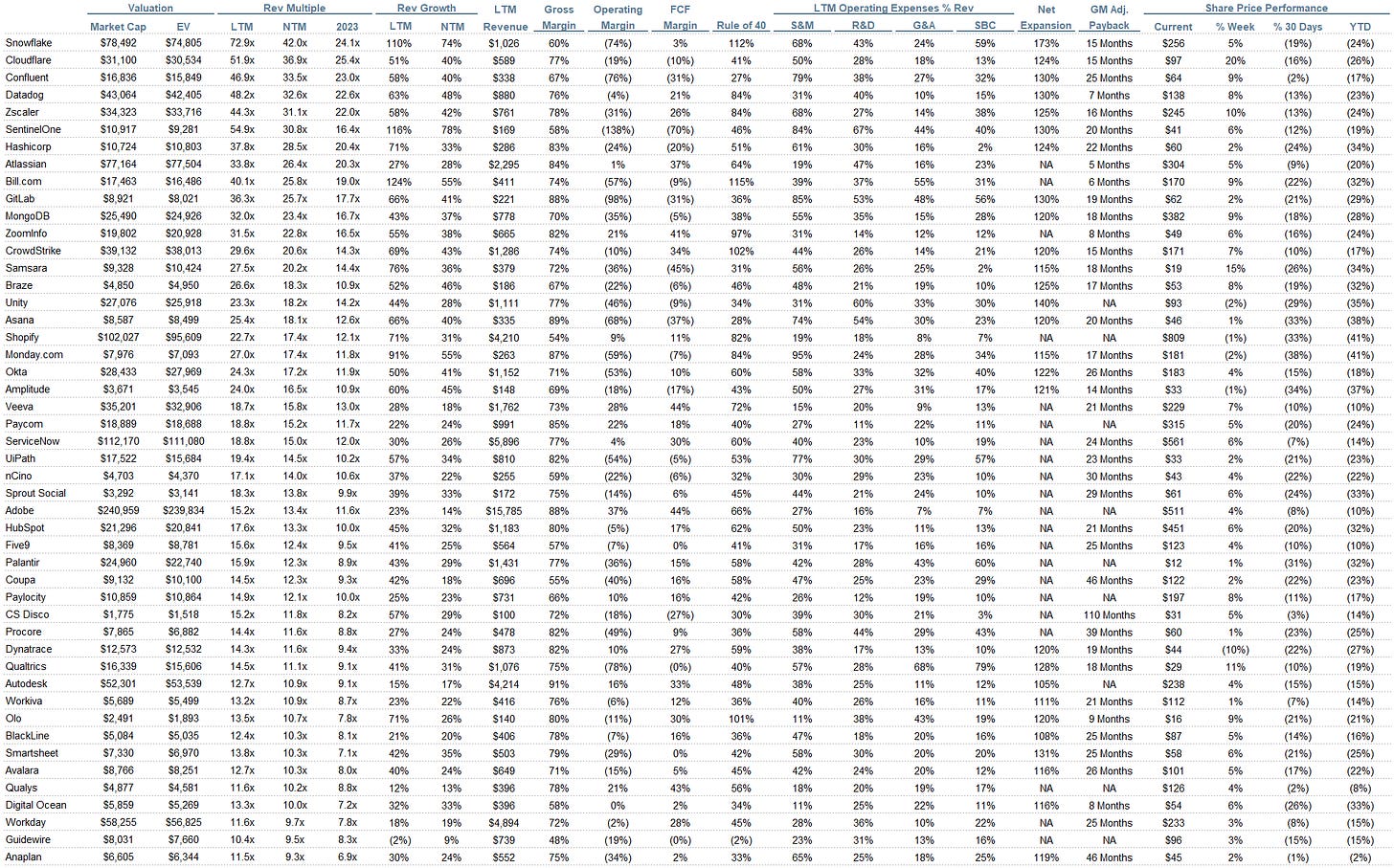

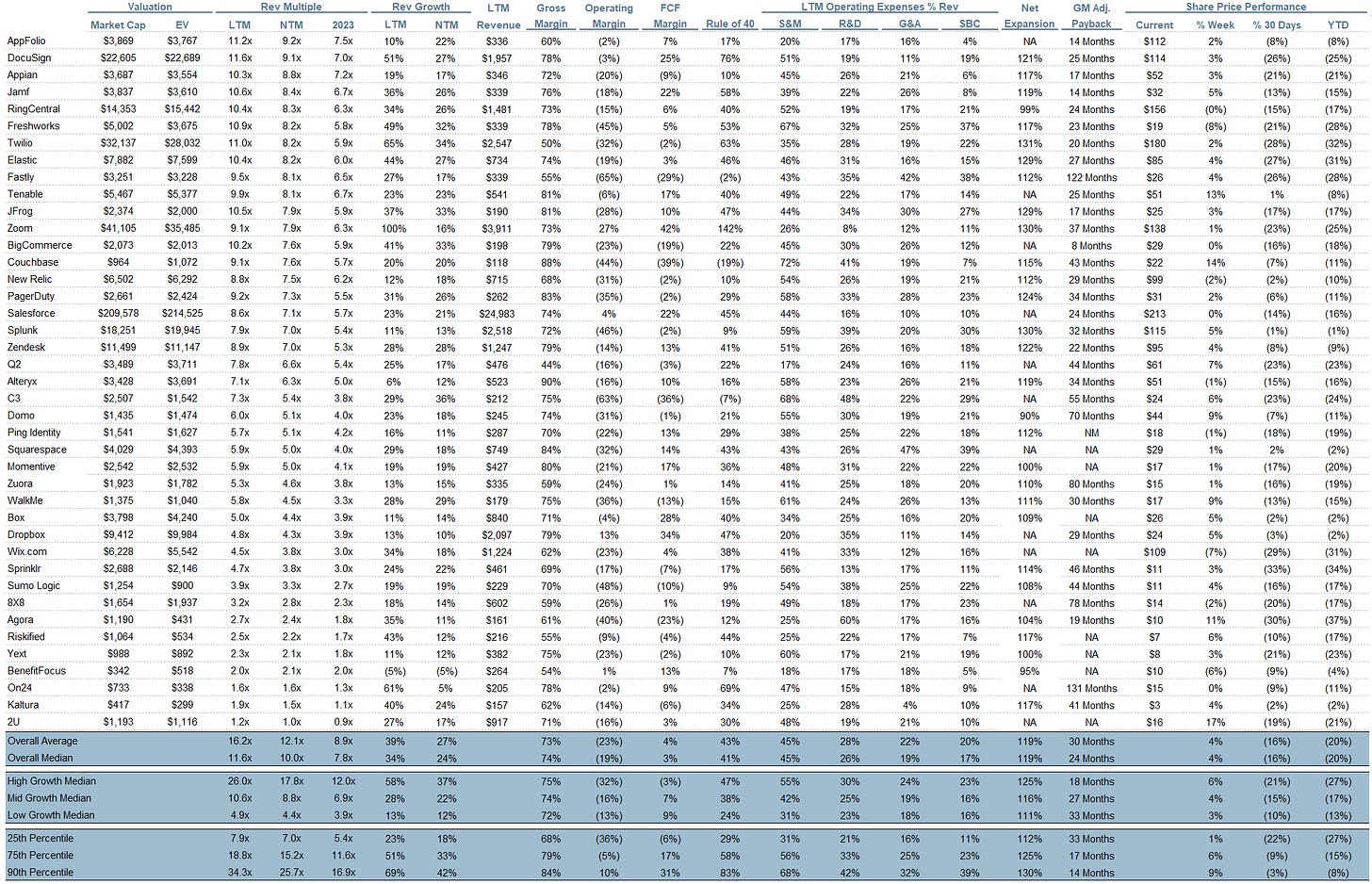

SaaS businesses are valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 10.0x

Top 5 Median: 33.5x

3 Month Trailing Average: 12.6x

1 Year Trailing Average: 15.0x

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 18.1x

Mid Growth Median: 8.6x

Low Growth Median: 4.4x

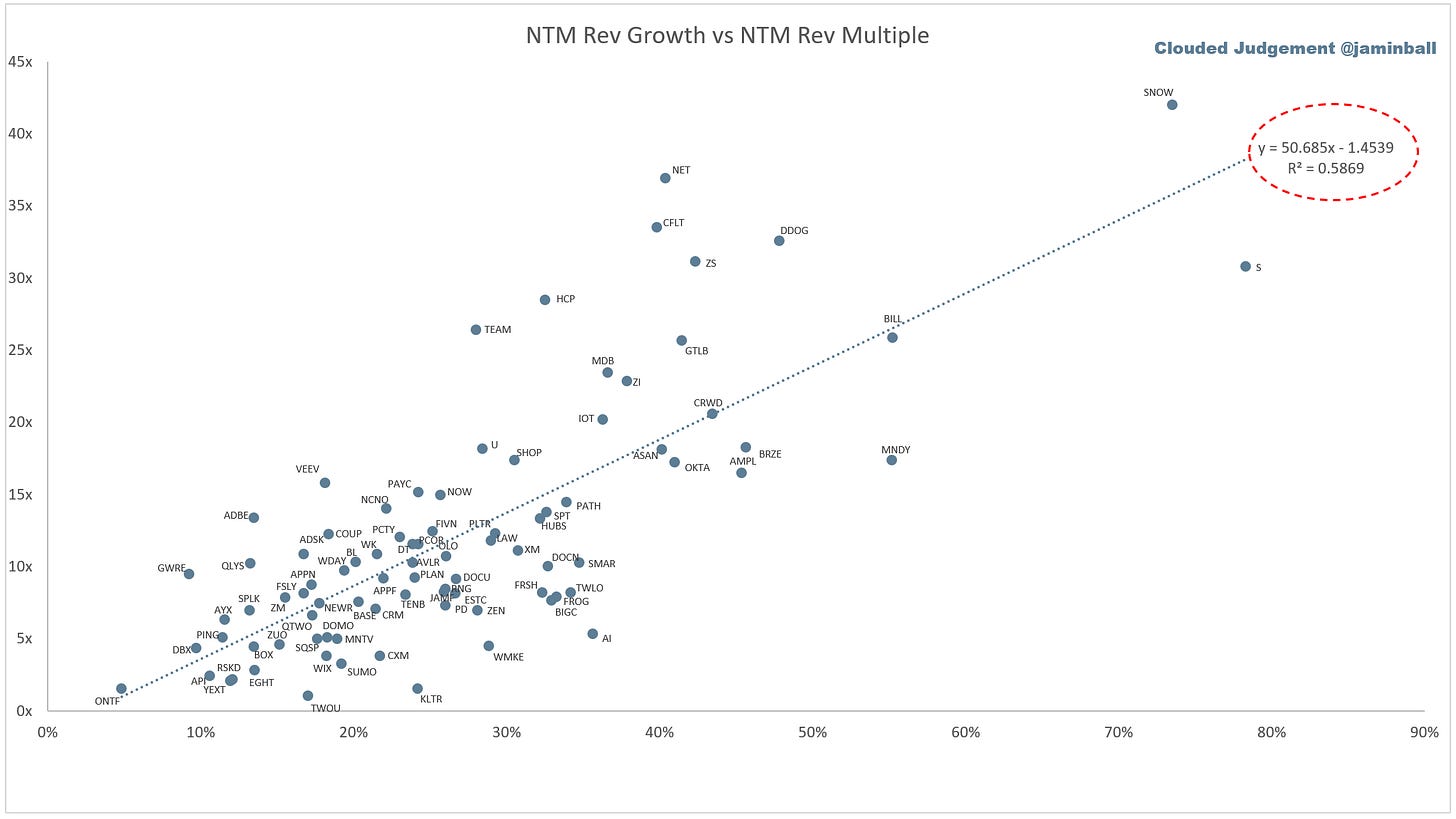

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

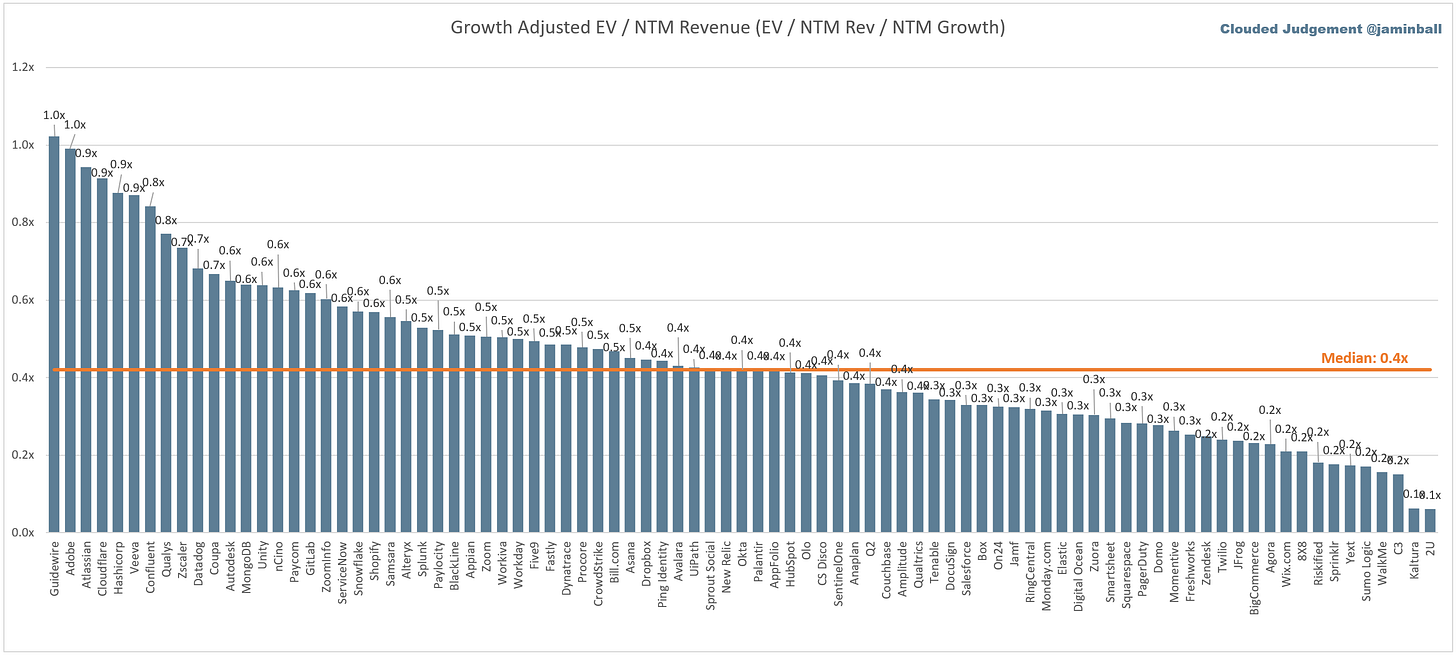

Growth Adjusted EV / NTM Rev

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

Operating Metrics

Median NTM growth rate: 24%

Median LTM growth rate: 34%

Median Gross Margin: 74%

Median Operating Margin (19%)

Median FCF Margin: 3%

Median Net Retention: 119%

Median CAC Payback: 24 months

Median S&M % Revenue: 45%

Median R&D % Revenue: 26%

Median G&A % Revenue: 19%

Comps Output

Rule of 40 shows LTM growth rate + LTM FCF Margin. FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Does your Payback calculation include existing customer Expansion ARR? Why wouldn't you look at only new Customer ARR?