Clouded Judgement 3.18.22

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Fed Update

On Wednesday the Fed gave us an update on their plans for QT and rate hikes for the rest of the year. The main takeaway - we saw our first rate hike since 2018, or 25bps. And the expectation now is that we’ll see 7 more rate hikes over the rest of 2022. This was already priced into market (it was the expectation) so we didn’t see a move downwards in the market. In fact, since the Fed meeting on Wednesday growth software has ripped higher >10%. Many are asking why? The Fed was hawkish, which should hurt growth stocks. Here’s my take - in generally software multiples are NOT correlated with interest rates over long periods of time. However, in periods of rapid change (like the end of 2018) they tend to be highly correlated. The market we’re in the middle of is highly uncertain. From the war to inflation to Fed policy there are too many variables at play. In a world of mass uncertainty we simply saw many saying “we’re going to sit out this market until there’s more clarity.” Some people were talking about 10+ rate hikes! The tone the Fed set was more clear in this meeting - and so for the first time in a couple months there’s at least a little more certainty that the Fed won’t go totally crazy with rate hikes this year. Removing the outer bound (10+ rate hikes) from the realm of possibilities narrowed the dispersion of outcomes for the end of the year. In turn, this reduced the uncertainty and we saw folks re-enter the market

The image below show the dot plot. Each dot represents each fed comittee members expectation for where the fed funds rate will be at the end of the year. On the left the survey was from December 2021. On the right from this Wednesday. As you can see, the expectation in March is much higher than the expectation from December. But again, this was already priced into the market.

The other data point we got is that the Fed expects core inflation (inflation ex energy and food) to be at 4.1% by year end. They expect overall inflation to be at 4.3%. In general, the target for each year is 2%. We’ll see where we end this year, but I’m taking the under on 4.1%

Will We Bounce Back? Was Wednesday the Bottom?

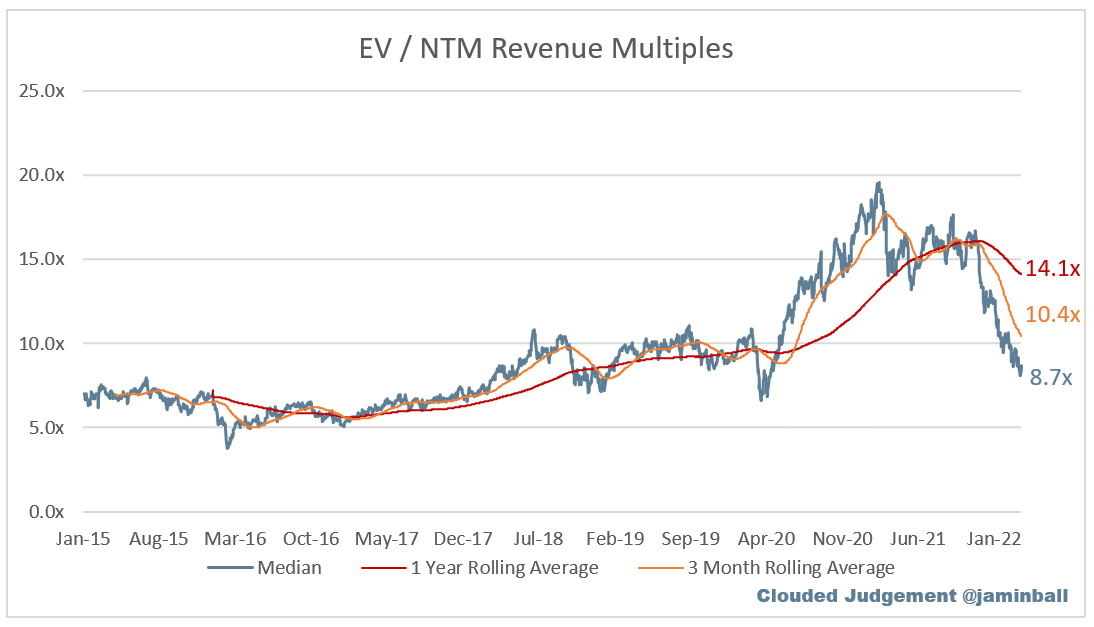

People ask me this all the time, and I always have the same answer. There’s no reason we should expect a “bounce.” Software companies are now trading at their long term average (in terms of NTM revenue multiples). I think this is the sustainable place! So I wouldn’t expect a bounce right now. The only argument I can think of for a bounce - using long term average multiples for software as the sustainable end state may not give appropriate credit to current software businesses. Pre 2016 we didn’t really have cloud software. Software businesses models were met with a lot more skepticism. In late 2016 Tableau / LinkedIn reported terrible quarters and the software market tanked. People lost even more confidence. However, in the year that followed we saw software re-rate as it started to become more clear that software business models, in particular cloud software, were great businesses! If the pre-covid long term average multiple was 8x, I could probably credibly argue that post software rerating the real “new normal” would be more like 9-10x NTM revenue. If you believe that, then we could see a 10-20% “bounce” from today (we’re sitting at 8.7x). However - the world is highly uncertain right now. In reality if you believe 9-10x is the long term average, today is a moment in time when we should probably be trading below the long term average. When things clear up (inflation, war, etc) that will be a time for multiples to trade above long term averages.

My base case is companies won’t see stock price appreciation from multiple appreciation over the coming 2-3 quarters. Instead, stock price appreciation will be purely driven by growth / performance.

Quarterly Reports Summary

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

SaaS businesses are valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 8.7x

Top 5 Median: 29.6x

3 Month Trailing Average: 14.1x

1 Year Trailing Average: 10.4x

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 12.7x

Mid Growth Median: 8.4x

Low Growth Median: 3.9x

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Growth Adjusted EV / NTM Rev

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

Operating Metrics

Median NTM growth rate: 26%

Median LTM growth rate: 33%

Median Gross Margin: 74%

Median Operating Margin (22%)

Median FCF Margin: 2%

Median Net Retention: 120%

Median CAC Payback: 23 months

Median S&M % Revenue: 44%

Median R&D % Revenue: 26%

Median G&A % Revenue: 19%

Comps Output

Rule of 40 shows LTM growth rate + LTM FCF Margin. FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.