Clouded Judgement 3.24.23 - 2023 Guides on Q4 Call vs Consensus

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Fed Update

This week the Fed hiked rates 25bps. The current fed funds target is 4.75-5%. While the expectation was for a 25bps hike, there was some doubt given the banking crisis. I read a couple articles that stated the effects of a tighter credit market given the banking crisis would have a similar effect in the economy as a 50-150bps hike in rates. Given that, there was a debate on what the Fed would do on Wednesday. The end result was the expected result prior to the banking crisis - a 25bps hike

2023 Full Year Guides

We’re nearly through Q4 ‘22 earnings season. For companies who’s calendar year aligns with their fiscal year (either a December or January fiscal year end), we got an early glimpse into how those companies expected to preform in 2023 relative to consensus estimates. The chart below shows 2023 guides vs 2023 consensus estimates to star the year. As you can see, the median guide was only 1% below consensus estimates. For come companies, this was more pronounced. But for the industry, the median was “don’t expect things to get worse than currently expected.” It does seem like Q1’s will be bad across the board. But was that factored into full year guidance? My gut tells me yes. Companies like Snowflake and Gitlab who offered surprisingly bullish 2023 guidance one quarter ago offered more tepid guidance this quarter. It felt like guides assumed no improvement to macro / buying patterns (ie no back half acceleration!). The back half acceleration of software always sounded good, but I’m not sure the market will turn that quickly. More likely outcome, imo, is more of a slog for the rest of the year.

Excluded from the chart above are companies who’s fiscal year ends do not align with the calendar year. The point of the chart was to look at full year expectations, and for companies who only guide through June (if their FY ends June), we don’t get the full year look.

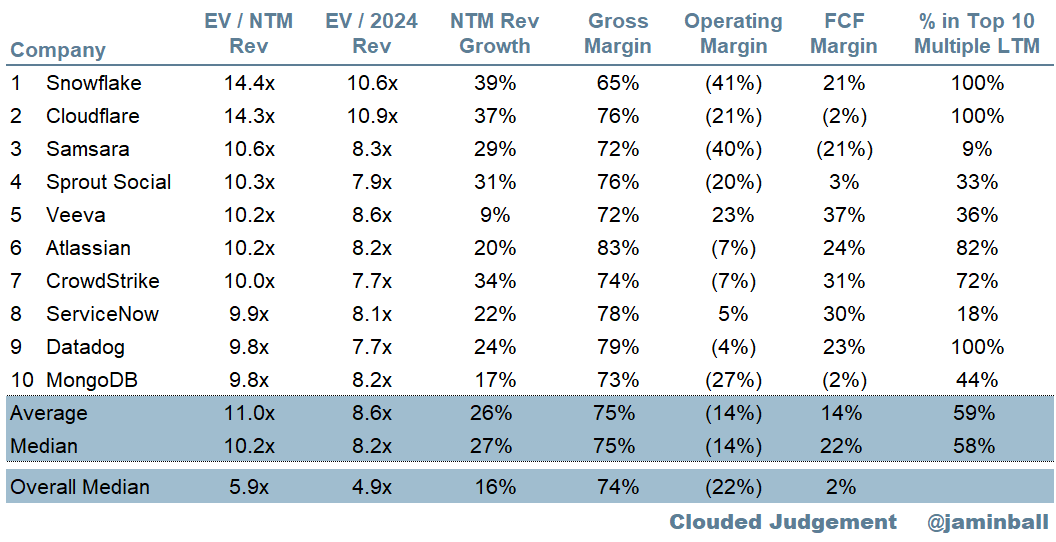

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.9x

Top 5 Median: 10.6x

10Y: 3.4%

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 8.7x

Mid Growth Median: 6.2x

Low Growth Median: 3.4x

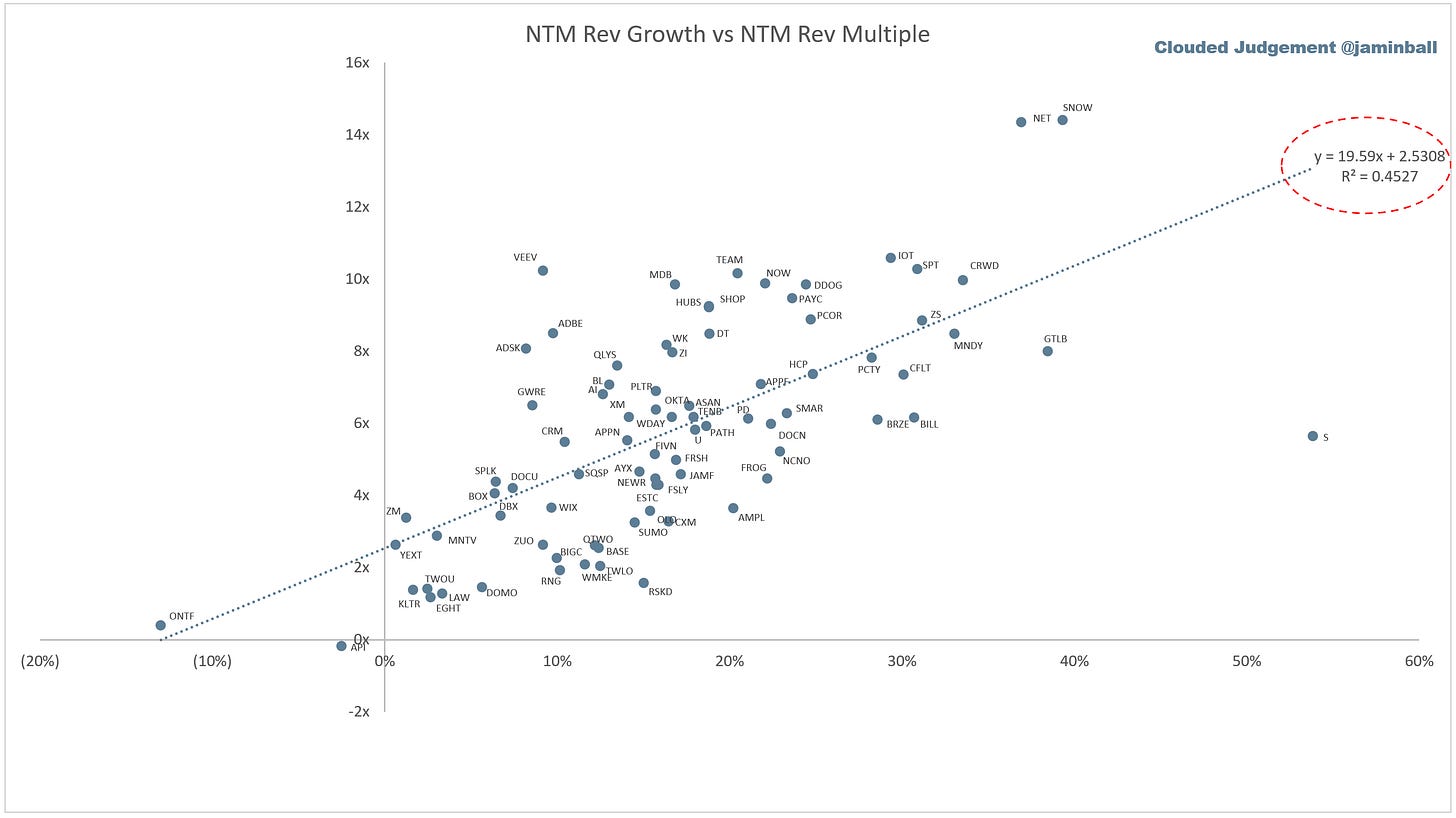

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Growth Adjusted EV / NTM Rev

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

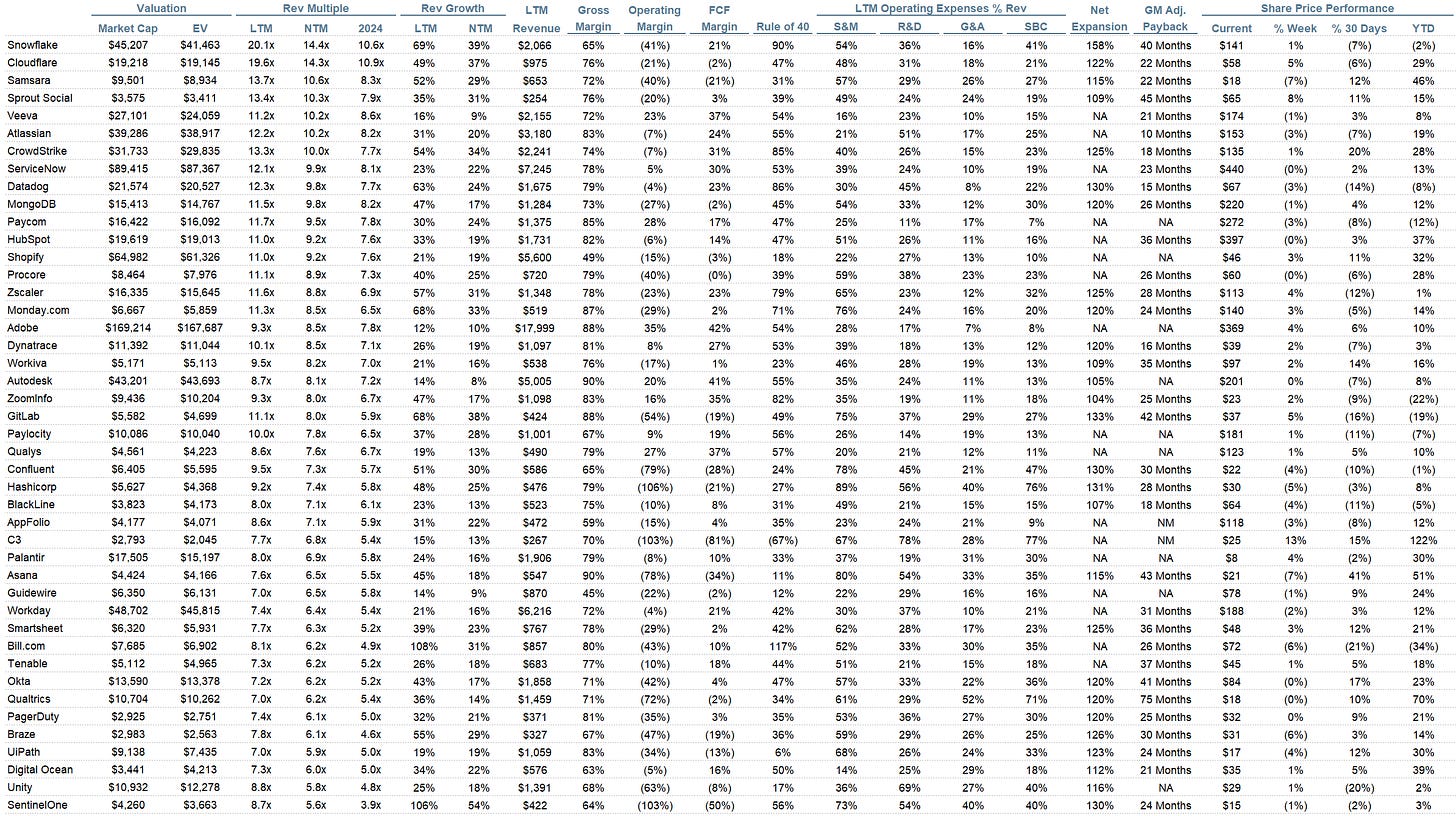

Operating Metrics

Median NTM growth rate: 16%

Median LTM growth rate: 27%

Median Gross Margin: 74%

Median Operating Margin (22%)

Median FCF Margin: 2%

Median Net Retention: 116%

Median CAC Payback: 30 months

Median S&M % Revenue: 47%

Median R&D % Revenue: 28%

Median G&A % Revenue: 19%

Comps Output

Rule of 40 shows LTM growth rate + LTM FCF Margin. FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Awesome read thanks for the share! Which startup industries do you think are ones to look out for in the next couple years? We're always interested in hearing peoples take on this as someone in the VC world.

Do you have a chart of Revenue Growth vs P/E fwd? I know that a lot of them are not profitable yet but you do have some that are and are logically way above the trend line in your chart that measures only EV/Revenue