Clouded Judgement 3.25.22

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Inflation - Transitory-ish or Something More?

There's broadly two opinions out there on inflation:

1) Inflation is "transient-ish" and will wane the back half of this year and be back to 2% target early next year

2) De-globalization will drive sustained high inflation over the coming 3-5+ years

As a growth investor it's imperative to have a point of view. Inflation impacts rates, and rates impact software multiples. Ive largely been on the transient-ish side, but it's important to see the other point of view And by transient-ish I mean inflation lasting ~12 more months. The transient-ish argument - we had a one time massive shock to the financial system with stimulus & fed pumping money into the economy. Consumer savings went way up, as did their purchasing of goods and services (first goods, and now services). At the same time, covid had devastating supply chain implications. Example - The cost to ship a container from China to the US skyrocketed. Fuel costs only played a small role. The reality? People weren't working ports. So what happens here? As we re-open / return to normal post covid a lot of the covid imposed supply chain issues go away (over simplification). At the same time, no more stimulus / QE driving consumer saving / spending up. Inflation started to really go up towards the end of 2021. This means the comps (year-over-year) comparison for inflation get "tougher" in the back half of 2022. Right now CPI figures compare an inflationary month in 2022 to a non inflationary month in 2021 (oversimplification). You can see this in the chart below. Each cell shows the % YoY change in inflation. Once we get to May the inflation YoY comps will be much tougher.

So what happens in months like December 2022 is we'll compare the CPI in an inflationary month in 2022 to an inflationary month in 2021. This will naturally drive inflation down (ie tougher comps).

However - we can't ignore the effects of the Ukraine / Russia conflict. Without the war, I think decent / high odds inflation wanes back half of this year. But the war changes everything. The calculus is different now! The biggest counter argument to the above point I made is that the world is about to "de-globalize." The main point here - globalization has given us the largest free lunch ever over the last 20+ years. We've been able to take advantage of cheap overseas labor, materials, production, energy, food, etc that have kept prices of goods low. IF that ends and all of that is on-shored (ie domestic production), prices will skyrocket (ie inflation skyrockets). And this will take a long time and present persistent inflation. You can't move a semi fab to the US overnight. It'll take 3-5 years.

To recap - if you believe inflation naturally wanes in the back half of this year we probably end the year closer to 3% inflation (Fed target 4.1% core) If you believe in de-globalization we probably have persistent 5%+ inflation for years. What's the impact? Raising rates is the primary tool the fed uses to fight inflation. So if you believe inflation is transient-ish, then the fed won't need to raise rates that much, and software valuations will largely be what they've been for the last decade. If de-globalization happens and inflation soars, the Fed may have to raise rates to 5%+ (and hold them there). We haven't seen this since pre GFC. It would massively change software valuations

However there's a bogey in the room - economic growth is slowing. Raising rates during slowing economic growth can cause a recession. The probability of this goes up by the day The Fed may choose to not raise rates too much regardless of inflation to avoid a recession. BUT - if de-globalization happens, and inflation goes up, and the fed doesn't raise rates too much it could lead to stagflation. It's a tricky needle to thread! Then at the same time we may be headed for a demand-income spiral. The phenomenon refers to an increase in demand for goods driving an increased demand for labor, which results in higher employment / wages It's dizzying trying to lay out all the potential paths forward...

So what's my take? Call me an optimist but: I think Ukraine resolution happens sooner than later, china comes onside, an de-globalization risks are overblown. The result would be inflation naturally wanes and the Fed doesn't have to go crazy with rate hikes. And in a world where inflation doesn't wane and I'm wrong, I think the Fed choses a recession over high inflation. Yesterday Powell said fighting inflation is their #1 priority. Unfortunately I do think the odds of an impending recession go up every day…

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

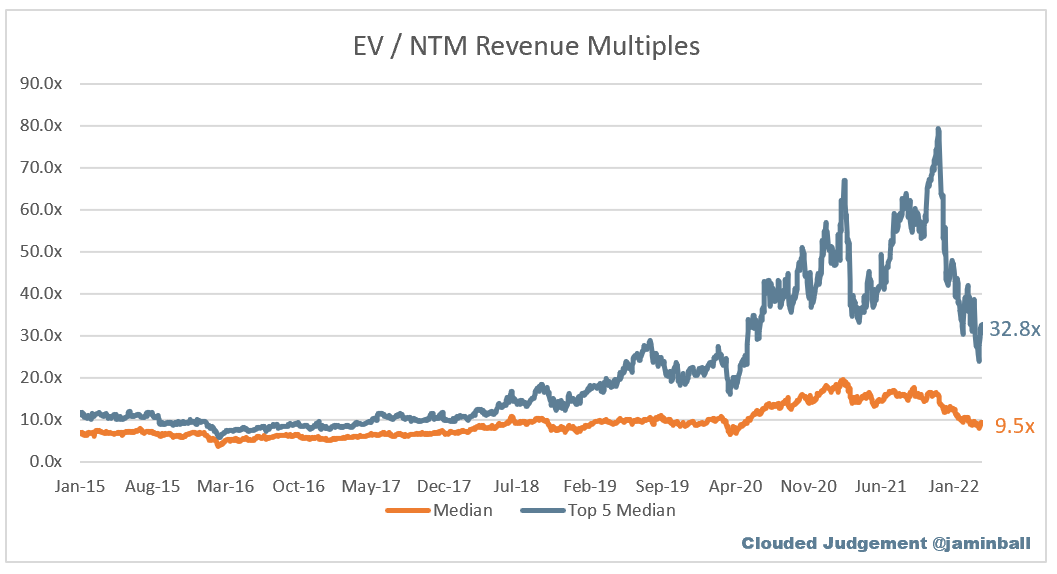

SaaS businesses are valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 9.5x

Top 5 Median: 32.8x

3 Month Trailing Average: 10.29.6x

1 Year Trailing Average: 14.0x

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 13.7x

Mid Growth Median: 9.5x

Low Growth Median: 4.1x

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Growth Adjusted EV / NTM Rev

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

Operating Metrics

Median NTM growth rate: 26%

Median LTM growth rate: 33%

Median Gross Margin: 74%

Median Operating Margin (22%)

Median FCF Margin: 2%

Median Net Retention: 120%

Median CAC Payback: 23 months

Median S&M % Revenue: 45%

Median R&D % Revenue: 26%

Median G&A % Revenue: 19%

Comps Output

Rule of 40 shows LTM growth rate + LTM FCF Margin. FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Excellent summary of the inflation argument!

Great analysis as always. Any reason to leave TTD out of SaaS discussions here?