Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Hype Rounds vs Fundamental Rounds

The show Silicon Valley is one of my favorites - just so many nuggets of humor in that show. A favorite clip of mine is when Russ Hanneman is talking about how pre-revenue businesses are the best kind of businesses. You can find the clip here. Here’s part of his quote:

“If you show revenue people will ask how much and it will never be enough…If you have no revenue you can say you’re pre revenue. You’re a potential pure play. It’s not about how much you earn, it’s about how much you’re worth.”

What Russ is describing I’ll call the “Hype Round.” For startups, their valuation follows an arc from pure hype based valuations (all on potential) in the earliest days when you’re just a team and and idea, to pure fundamental based valuations in the public markets when you’re given a valuation multiple against a financial metric like revenue or free cash flow. There are of course caveats to this - public markets go through periods of hype and irrationality as well. As companies mature their valuation starts to transition from hype based to fundamental based, and this usually happens gradually over time. Another way of saying this, is the valuation metric applied to a startup gradually starts to converge on the multiple they’ll trade at in the public markets as they get later and later stage. If we were to come up with a hypothetical software startup that will trade at 10x revenue in the public markets, their seed round might be done at a NM (not meaningful) multiple, as they have no revenue. Maybe the Series A is done at a 50x ARR (~$750k of ARR at ~$40m post), the Series B done at 25x ARR ($4m of ARR at $100m post), the Series C done at 15x ARR, etc etc.

However - what I’ve seen recently (which is eerily similar to 2021 times), is that private companies valuations are remaining disconnected from ultimate exit multiple (ie the most likely public market multiple they’d trade at) for longer and longer periods. Said another way, Hype Rounds are lasting further and further out in a companies lifecycle.

There are many ways to build a successful and enduring business, and I won’t pretend to prescribe “the only way” that it’s possible. However, I would like to make the point that raising Hype Rounds later and later in a companies lifecycle can introduce risk that wouldn’t otherwise exist. At some point the public markets act as an overwhelming gravitational force when it comes to a valuation multiple. In venture markets it “just takes one” firm to set the valuation. And there are many reasons this figure can get artificially high - competitive pressures with multiple funds bidding on a round, large fund dynamics where funds feel pressure to deploy and a sense of “we have to be in every deal," newer partners wiling to pay up to win a round, funds playing for “option value” and not caring about the entry price, funds wanting to buy relevance in a category (like AI) and paying higher prices than the next highest bid to win, etc. This list goes on. But in the public markets none of this exists. “Mr Market” sets your valuation, and it’s usually grounded in a multiple around 6-12x NTM revenue for software companies.

The reason hype rounds can introduce risk when they happen at later stage valuations, is that the sheer growth companies need to achieve in order to truly be worth their private valuation (let alone make investors / employees money) is staggering. Take a company that raises at a $1B valuation. There will probably be ~30% dilution (or more) from that point forward. An IPO alone will probably take up ~10% dilution, then you have future equity rounds and employee option grants on top of that. So the $1B entry valuation is really more like a $1.3B entry valuation. And for investors / employees to see a 3x, the company would need to be worth ~$4B in the public markets. With an 8x revenue multiple, that implies a company would need line of sight to $500m in revenue to get a 3x from that initial $1b valuation (again, when factoring in dilution which ends up being larger than anyone things for software companies). Hashicorp today has a ~$5B market cap, and ~$600m of revenue over the last year. Everyone likes to look at a Crowdstrike, Datadog, Snowflake and say “they trade at 15x revenue, so should we!” The challenge is those companies have demonstrated an ability to grow 30%+ at billions of dollars of ARR with FCF margins of 30%! That’s super unique. They’ve shown they can hit escape velocity, at scale, with profitability. It will be very hard for subscale (revenue wise) and unprofitable companies to fetch those kind of multiples

Now, of course it is possible to succeed in spite of raising a hype round, but if you’re raising that round at a $1B valuation, and you have $15m in ARR, you may need to grow topline >30x to see a 3x from that $1B valuation. And everyone feels that pressure - your exec team, your employees, your board, etc. Startups are never a straight line up and to the right - there’s bumps and bruises along the way. The biggest takeaway I’ve learned over the last few years is that these bumps and bruises become exponentially more painful as the gap between your private valuation and assumed public valuation widens. Investors start to loose faith and flip flop on their conviction. Employees think their equity has no upside and either leave or create pockets of uneasiness in the employee base. Competitors start telling prospects you’re competing on that “that company will screw you in the future because their VCs will force them to price gouge you so they can make money.” Acquisitions become tougher because the preference stack is higher. We’ve all learned these lessons over the last few years.

My point of this post is simply to point out some of the challenges that arise from a hype round at an “at scale” valuation. Founders, execs and investors should know what they’re signing up for, and the challenges that could arise. Unfortunately, often times inventors know this and simply don’t care. They’re playing an option value game, where each investment is treated as a deep out of the money call option. And given the power law dynamics of fund math, it sometimes only takes one deep out of the money call option from hitting for the overall fund to achieve an acceptable return. For founders, the math is different - their company is their only bet. And as firms have gotten bigger and bigger and managers have shifted to chasing management fees over carry, the portion of deals that have shifted to “call options” has increased. The high valuation / low dilution sounds good in the moment but there are also hidden costs.

My hope in writing this post is to push founders to really understand a couple things. First - what are you signing up for by raising at the valuation you’re thinking of? What will it take to raise an up round at a 2-3x markup if the macro environment shifts and you need to raise a fundamental based round vs another hype round? Can you get there in a couple years? Second - understand the incentives of each fund offering you a term sheet. Is their valuation higher because they have deeper conviction? Or because they’re playing the call option game and you’re company #128 in their portfolio. Over the last 10 years money has poured into the venture markets and has changed a lot of the investor / founder dynamics. I’m always happy to chat 1:1 with folks who want to double click on any of this!

Macro Update

The 10Y has subtly crept up from 3.8% at the start of the year to 4.4% (and back to 4.3% today). What’s driving this? At a high level the market is expecting the Fed to make less cuts to rates this year than they did a few months ago. Inflation has been stickier the last few months, and the economy has remained strong. Mid day on Thursday the Minneapolis Fed leader Neel Kashkari said interest-rates cuts may not be needed this year if progress on inflation stalls. The market sold off after this. As rates have gone up, we’ve seen pressure on software valuations. Year to date, the average software stock price performance is down 6%.

The graph below shows the market’s expectation for the Fed Funds rate in October ‘23 (blue line), December ‘23 year rend (yellow line) and today (green line). As you can see, from the start of the year to today the markets’ expectations for the Fed’s actions have shifted DRAMATICALLY! The market was expecting a fed funds rate nearly a full percent lower (ie 4 more rate cuts) in Jan ‘25 at the start of the year as they do today

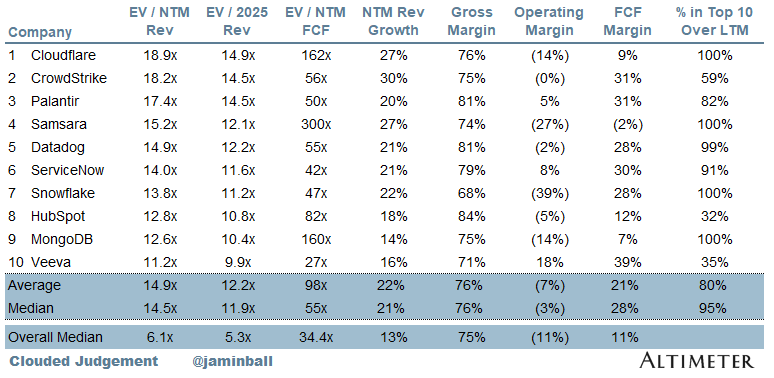

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

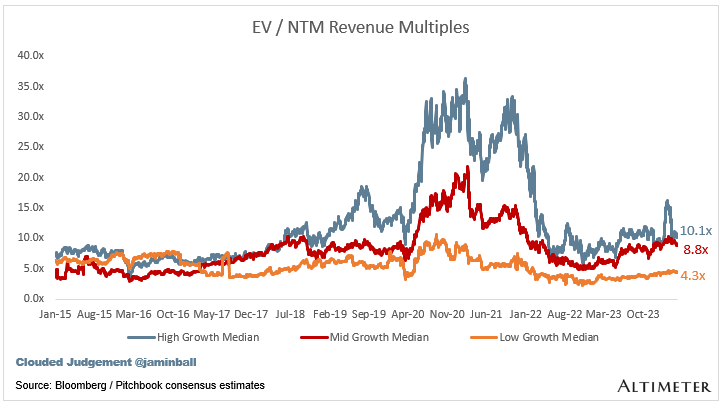

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 6.1x

Top 5 Median: 17.4x

10Y: 4.3%

Bucketed by Growth. In the buckets below I consider high growth >27% projected NTM growth (I had to update this, as there’s only 1 company projected to grow >30% after this quarter’s earnings), mid growth 15%-27% and low growth <15%

High Growth Median: 10.1x

Mid Growth Median: 8.8x

Low Growth Median: 4.3x

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

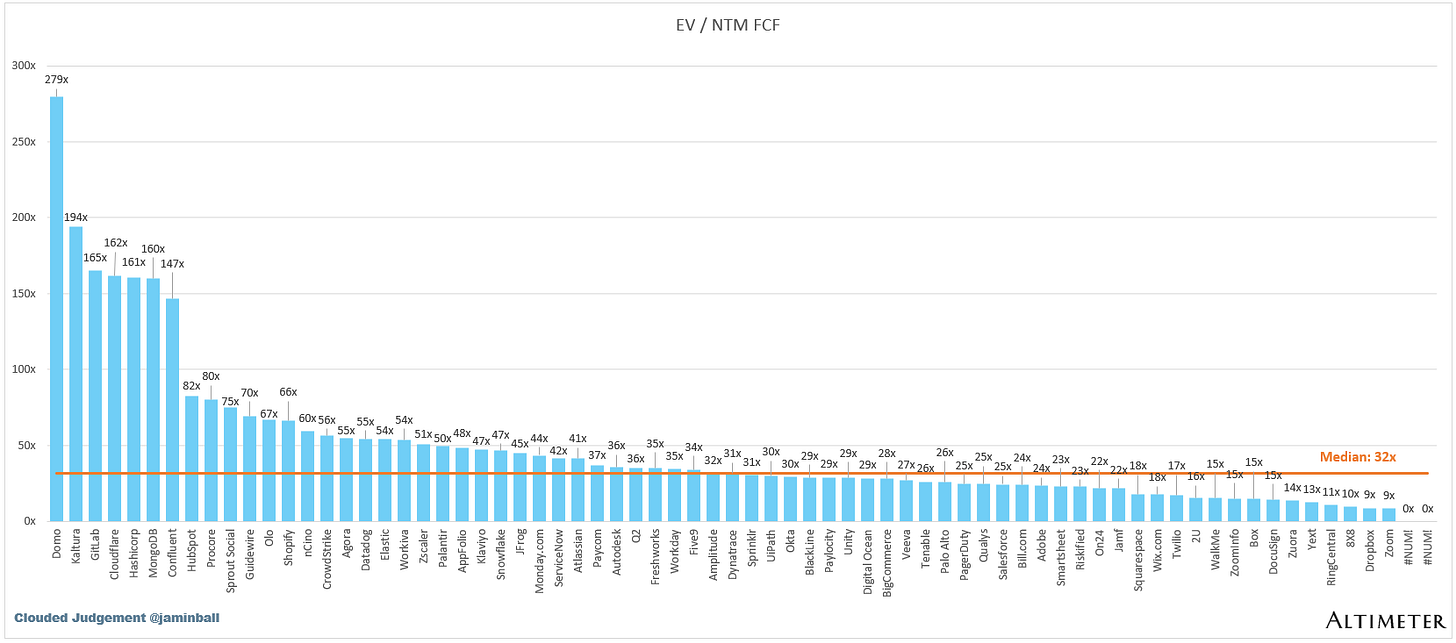

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 13%

Median LTM growth rate: 17%

Median Gross Margin: 75%

Median Operating Margin (11%)

Median FCF Margin: 11%

Median Net Retention: 110%

Median CAC Payback: 39 months

Median S&M % Revenue: 41%

Median R&D % Revenue: 25%

Median G&A % Revenue: 16%

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Jamin, thanks for the behind the curtains insight. Very interesting indeed. This is your 2nd or 3rd post on some of the froth that you are seeing first hand in the venture space. Clearly this is top of mind for you and we, investors, should take this as a warning about the risks in today's equity markets. Cheers and have a great weekend!