Every week I’ll provide updates on the latest trends in SaaS valuations, earnings announcements, and highlight any significant news. Follow along to stay up to date!

Highlight of the Week - Morgan Stanley Q1 CIO Survey

Morgan Stanley released their quarterly CIO survey yesterday, and it was another reminder for just how robust software markets will continue to be in the near and long term. A couple call outs from the report (I’m quoting):

“Expectations of software spending growth in 2021 saw material upward revisions from +2.6% in our 4Q survey to +4.8% in 1Q representing: 1) the sharpest rebound by industry with +630bps improvement from the -1.6% 2020 IT spending growth, 2) the fastest growing segment in 2021, and 3) a level above the 10-year average of +4.5 % software budget growth before 2020. As software-related secular growth trends continue to dominate the top of the CIO priority list in 2021 - Digital Transformation (#1), Cloud Computing (#2),and DW/BI/Analytics (#3) - we see durable tailwind to software demand, which supports the bullish tone from managements at our 2021 TMT conference. With the average software stock down ~4% YTD on the back of the recent pullbacks, multiples across the group have declined ~24% since the peak in Feb, particularly for high growth assets (top 5 most expensive names declined ~35% since the peak). Although the average software EV/Sales multiples at 12x is still ~65% higher than the 5-year average of 7.3x, with negative catalysts (interest rates, sector rotation) largely in the rearview mirror and an accelerating spending environment ahead, we see a relatively attractive risk/reward for the sector – in particular with the GARP assets in software.”

I couldn’t be more excited to continue to partner with the most innovative cloud software businesses from their earliest stages. Below is a chart from the same CIO survey calling out CIO projects with the largest spend increase in 2021. It’s no surprise what’s at the top of the list!

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

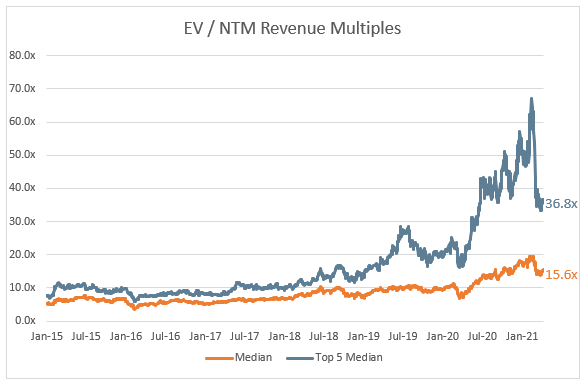

Update on Multiples

SaaS businesses are valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 15.6x

Top 5 Median: 36.8x

3 Month Trailing Average: 16.8x

1 Year Trailing Average: 14.3x

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 24.7x

Mid Growth Median: 15.3x

Low Growth Median: 6.4x

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

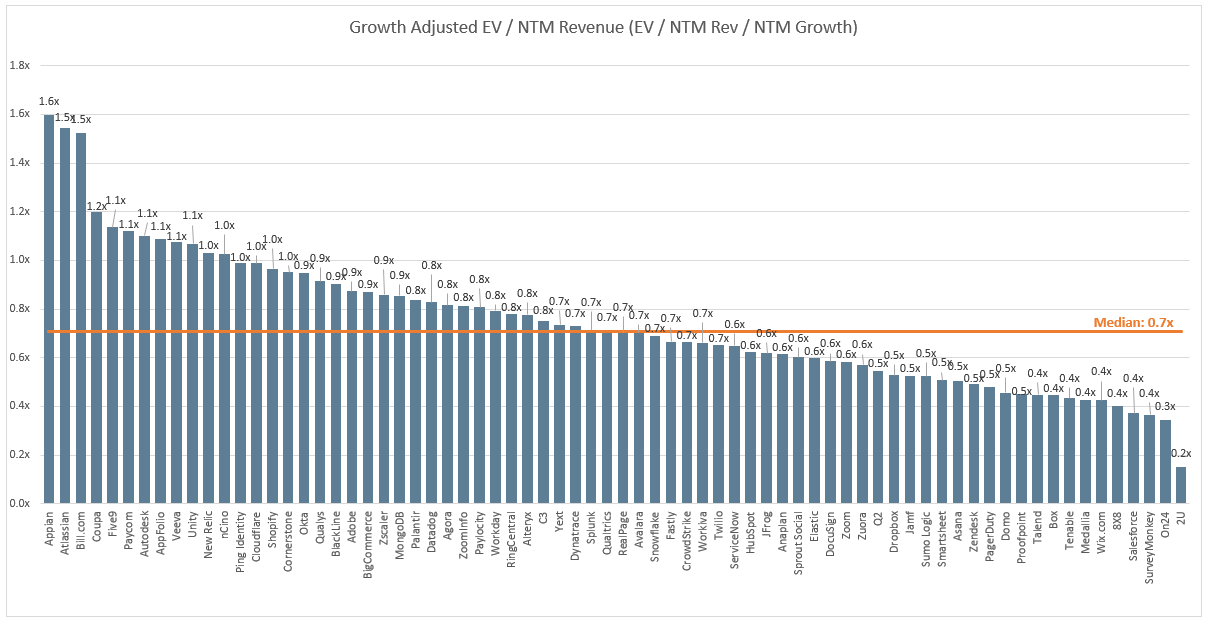

Growth Adjusted EV / NTM Rev

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

Operating Metrics

Median NTM growth rate: 24%

Median LTM growth rate: 29%

Median Gross Margin: 74%

Median Operating Margin (12%)

Median FCF Margin: 9%

Median Net Retention: 117%

Median CAC Payback: 21 months

Median S&M % Revenue: 43%

Median R&D % Revenue: 25%

Median G&A % Revenue: 18%

Comps Output

Rule of 40 shows LTM growth rate + LTM FCF Margin. FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Thx for the great posts. It is not clear to me how you calculate: "Growth Adjusted EV / NTM Rev." If i understand you correct Salesforce looks to have a better ratio (lower EV/NTM relative to grgowth) that Atlassian ?