Clouded Judgement 5.16.25 - Net New ARR Trends

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Net New ARR Trends

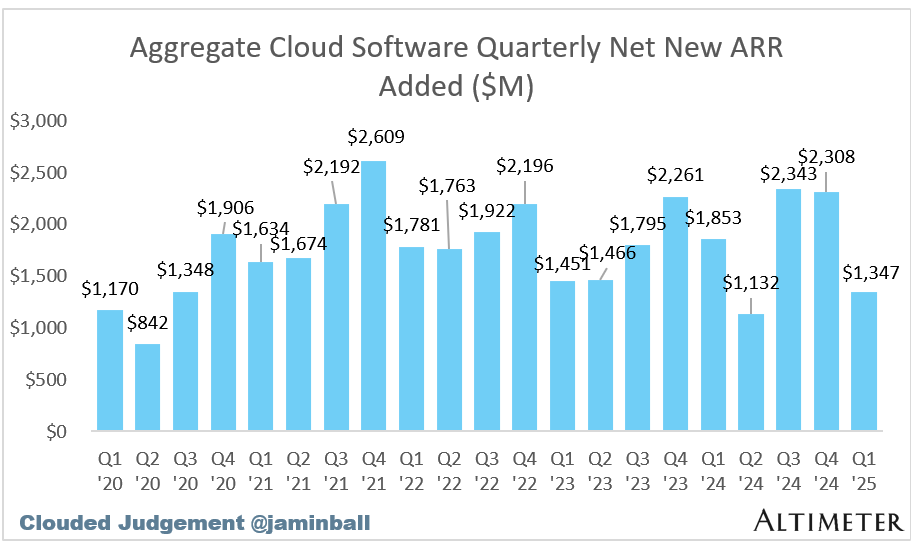

We’re about halfway through Q1 ‘25 earnings season. As you all know, one of my favorite metrics to look at is net new ARR added in a quarter. For some public companies, they disclose ARR. For those who don’t, I will take quarterly subscription revenue x 4 as a proxy for ARR. The quarterly net new ARR figure is calculated as: Q1 ‘25 ARR - Q4 ‘24 ARR. So far, 30 companies have reported Q1 ‘25 that I analyze in the net new ARR calc. Unfortunately, the trends have not been good! The below charts show the aggregate net new ARR added across that set of 30, and the YoY growth in quarterly net new ARR (so the most recent data point shows Q1 ‘25 net new ARR / Q1 ‘24 net new ARR)

As you can see, net new ARR this quarter was down meaningfully from Q1 ‘24. Now, this may be more indicative of the companies who have reported so far (we’re about halfway through), but the trend still stands out. Q1 ‘24 was a high point (and did count an extra day from leap year!), but regardless, it’s not great to see net new ARR fall this much. Of the 30 companies, 5 saw ARR decline from Q4 ‘24 to Q1 ‘25. I’m not entirely sure what’s driving this, but it’s a trend to monitor going forward. Through Q1 ‘24 the graph had a very nice “smile curve” recovery.

Quarterly Reports Summary

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

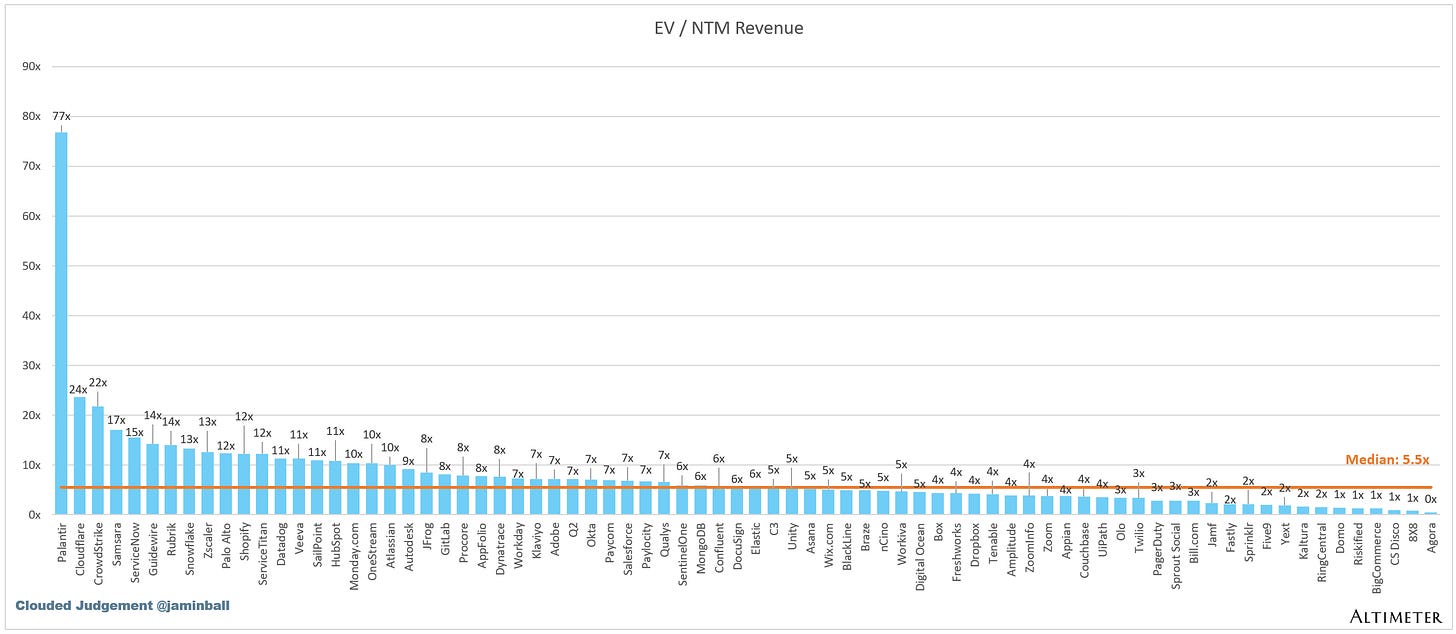

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.5x

Top 5 Median: 21.8x

10Y: 4.4%

Bucketed by Growth. In the buckets below I consider high growth >25% projected NTM growth, mid growth 15%-25% and low growth <15%

High Growth Median: 18.8x (small sample set of companies, only 4 in this bucket now)

Mid Growth Median: 10.0x

Low Growth Median: 4.2x

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 11%

Median LTM growth rate: 15%

Median Gross Margin: 76%

Median Operating Margin (4%)

Median FCF Margin: 17%

Median Net Retention: 108%

Median CAC Payback: 43 months

Median S&M % Revenue: 38%

Median R&D % Revenue: 24%

Median G&A % Revenue: 16%

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Yep, this tracks with my experience, having been in an agency during this period and downstream from SaaS revenues. Our business volume maps almost perfectly to this ARR chart.

Very useful observations, Jamin. Perhaps all is not rosy in the tech world, even though their stocks are being bid up by short term traders and retail FOMO...BFTD on hopium is not a prudent strategy in these times.