Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Early Look at May Consumption Trends

This week kicked of Q1 earnings reports for companies with April quarter ends. This means we got commentary for the first time on May trends. As many of you know, the data points I’m looking for are any signs of consumption trends starting to tick back up. Azure / Confluent / Datadog reported a few weeks back (they all had March quarter ends), and their commentary suggested the worst was behind us. While no one said the environment was improving, they also didn’t say it was getting worse. This left the door open for the next wave of companies to report potentially incrementally more positive data (with April quarter ends)

Snowflake was the big report everyone was looking out for. What did we learn?

They called out April / May as WEAKENING consumption trends relative to Feb / March. Not great

Larger customers who have been customers longer showed the slowest growth (this is contrary to the previous quarter where weakness came from newer cohorts of customers who were ramping slower)

The biggest driver in consumption weakness in April / May was customers changing their data retention policies. ie instead of storing 5 years of data they store 3 years. This reduces storage costs, but also compute (queries run faster as they run against smaller data sets).

They called out having no visibility on when these consumption headwinds slow down. As such, they REDUCED their full year guide from 40% growth to 34% growth (a drop of ~$100m in expected revenue for the year)

There were some positive data points:

Number of queries actually grew 57% YoY (product rev grew 50% YoY). So usage growth outpaced revenue growth (revenue growth lagged as queries got more efficient given data retention changes I described above)

Newer cohorts of customers are growing faster

Overall, the biggest takeaway from their report is questioning the timing of a back half acceleration in consumption software. It’s clear we shouldn’t expect it anytime soon, and we’re now getting close to the “back half” of the year. An element of re-acceleration is definitely priced in to current 2024 estimates, so we may see 2024 estimates fall. 2023 estimates seem de-risked at the moment (although Snowflake has taken down their 2023 YoY growth guide from 47% to 40% to 34% in last 2 quarters…so can’t be certain it’s truly de-risked).

At the same time some of the leading indicators in Snowflake’s report were positive - namely the growth in query volume, and newer cohorts exhibiting more “normal” behavior (in terms of growth). It’s hard to say if the larger customer cohort headwinds is a fresh new wave of optimizations starting, or more of a one-off. Only time will tell.

What’s more clear than ever - consumption models are way more cyclical than many imagined. There’s a lot more volatility baked into these models, and they’re quite hard to forecast.

Final quote I’ll leave you with from Frank Slootman on the earning scall: “But you know what, the cost concern is prevailing at the moment because of the general sentiment that we are. In 2020 and 2021, it was growth at all costs and the mentality was let it rip. Now we're in the complete inverse of that situation where we have strong certainly predictability on cost and so on. I don't think it will last. We're just on the other side of the spectrum right now, and we will reconverge to the mean at some point here.”

Quarterly Reports Summary

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

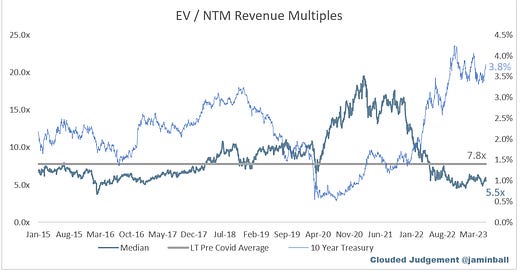

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.5x

Top 5 Median: 13.0x

10Y: 3.8%

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 9.6x

Mid Growth Median: 7.4x

Low Growth Median: 3.2x

EV / NTM FCF

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Growth Adjusted EV / NTM Rev

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

Operating Metrics

Median NTM growth rate: 15%

Median LTM growth rate: 25%

Median Gross Margin: 75%

Median Operating Margin (21%)

Median FCF Margin: 3%

Median Net Retention: 115%

Median CAC Payback: 41 months

Median S&M % Revenue: 46%

Median R&D % Revenue: 27%

Median G&A % Revenue: 18%

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

I love living in a world where query volume is a legitimate metric to measure and forecast the future

🤖👾

@jamil You have some window overlay hiding the names of 5-6 companies in the first screenshot of the Comp Output.