Clouded Judgement 5.31.24 - Software Sentiment Crumbles

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Software Sentiment

Software sentiment is incredibly low at the moment - and rightfully so. Q1 earnings have been a disaster, and they’ve gotten worse as companies with April quarters started reporting. Nearly 70% of software companies who reported Q1 with an April quarter end guided Q2 below consensus! That figure is worse than the onset of Covid when everyone guided low because they weren’t sure if the world was ending! Of the companies with March quarter ends ~51% guided Q2 below consensus. That figure is still quite bad, but the environment in software land definitely got worse in April. What’s a bit more confusing, is despite the Q2 guide downs, full year guides haven’t come down that much, and in some cases have been raised. So there’s a bit of a “trust us back half acceleration is coming.” Time will tell… Data in chart below show’s the change in full year guide from this quarter vs last quarter.

Looking at the basket of ~80 software companies that I track, the median year-to-date (YTD) performance is down 17%. No one has been spared, not even the larger cap software companies. Workday / Salesforce both fell >15% after earnings, with larger drops coming in the days after earnings. . Cloudflare and Datadog both fell >10% the day after earnings and have dropped a lot more since then. Mongo dropped >30%. Here’s a quote from Salesforce’s earnings on Wednesday:

“Now let me briefly address the buying environment. We continue to see the measured buying behavior similar to what we experienced over the past 2 years and with the exception of Q4 where we saw stronger bookings. The momentum we saw in Q4 moderated in Q1 and we saw elongated deal cycles, deal compression and high levels of budget scrutiny.”

As growth starts to slow, it gets harder and harder to justify using revenue multiples as a primary valuation metric. In theory, companies in ex-growth mode are starting to hit the outer bounds of their maturity curve. And the promise of the software business model is as companies mature and go out of growth mode the profits will show up. And when this happens, growth companies transition to more of a value based valuation metric (FCF or PE). The challenge is, while FCF has definitely improved across the board, there are still many companies who’s growth has slowed significantly and FCF generation hasn’t followed suit (or the FCF generation is just low). This can lead to an airpocket of valuation as companies transition to a different primary valuation metric

Outside of the hypserscalers (Azure, AWS, GCP) who have uniquely benefited from AI revenue (mainly selling compute), everyone else has largely struggled. Coming in to Q1 there was broader optimism. Q4’s were generally good! And people thought that trend would continue in to Q1. In hindsight, the Q4 strength may have just been companies flushing unused budget for the year as opposed to a return to stronger buying patterns. Couple points to highlight on the struggles of software companies so far this year:

Growth Hasn’t Rebounded - there was no v shaped recovery. In fact, forward estimates are starting to go down, not up. Sure, the strong headwinds have abated, but the headwinds haven’t been replaced with tailwinds. Everyone is still waiting for growth to “re-accelerate,” and a number of companies are implying this will come in the back half of the year, but will it? Feels like investors are broadly more comfortable waiting for the data to show up. What’s more likely is the current state we find ourselves in is likely to be the equilibrium. Best practices around procurement, vendor evaluation and software spend management have become embedded in large organizations coming out of 2022 / 2023. The “power of the bundle / platform” is very real. Those aren’t likely to go away any time soon, which means we most likely won’t see a sharp change in software spend, but rather a more gradual increase more in line with typical budget growth. It’s never been harder for point solutions to find incremental customers. There are more companies than I ever remember with net retention <100% right now

AI Revenue Hasn’t Shown Up - It has in some pockets (and these pockets largely relate to compute), but for the most part AI has not been a catalyst to forward estimate revisions (ie consensus projections going up). There’s promise of this, but how patient are investors willing to be?

AI Investment Cycle Picking Up - Companies are (rightfully) investing in building out their capabilities around AI. You don’t want to get left behind and put on the fast track to irrelevance! But these investments aren’t cheap. Any kind of inference really can rack up bills quickly (see growth in hyperscaler revenue…), and AI talent isn’t cheap. This leads to an investment cycle where costs hit before revenue shows up, leading to margin degradation. For some companies, these investments will be well worth it and will form the backbone for the next leg of growth. For others, these investments won’t be as fruitful. Right now, investors aren’t sure who will be the AI winners or losers, and frankly don’t really have the patience to hang out and own name they’re unsure about while the dust settles.

Macro - At the start of the year, the market expected a number of rate cuts this year (tailwind to software valuations). Today it’s not clear if we’ll get any cuts this year. The 10Y has risen from 3.9% at the start of the year to just over 4.6% today. As the expectations for cuts have diminished, we’ve seen interest rates go up pressuring valuations.

It all sounds gloomy, but software goes through cycles just like every industry. The recurring nature of software companies (who can keep net retention above 100%, and ideally above 110%) really creates great businesses. Its never been harder for smaller software companies to compete, but the prize for breaking through and becoming the next platform has never been higher. There’s less greenfield than there was 4-5 years ago (and Covid pulled forward a lot of demand), so companies can’t compete by being marginally better. They have to be materially better or they’ll be bundled away. I’m as excited as ever about the long term cloud software markets. This moment in time too shall pass.

One thing we have learned from this cycle, is software companies can turn up the profitability while turning down growth. The graph below shows the median quarterly FCF figures (Q1 shows the median of the companies who’ve reported so far).

Quarterly Reports Summary

Lots of red in the guidance column…

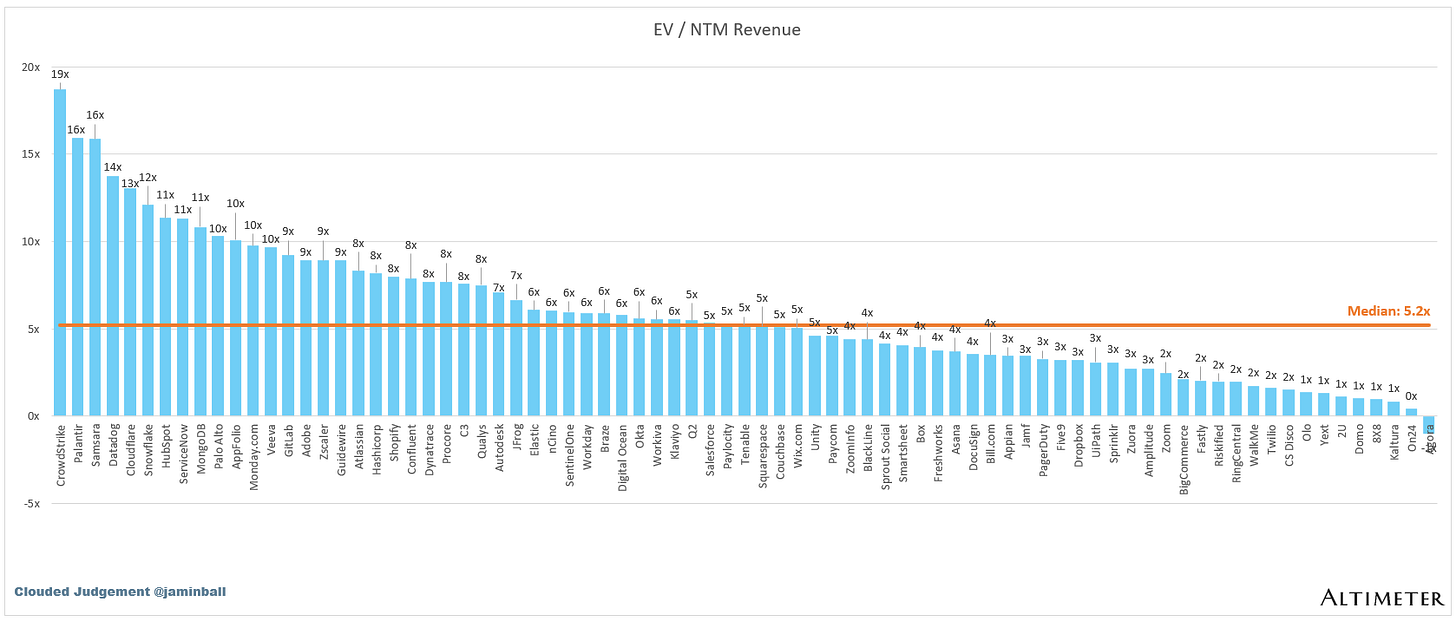

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.2x

Top 5 Median: 15.9x

10Y: 4.5%

Bucketed by Growth. In the buckets below I consider high growth >27% projected NTM growth (I had to update this, as there’s only 1 company projected to grow >30% after this quarter’s earnings), mid growth 15%-27% and low growth <15%

High Growth Median: 9.8x

Mid Growth Median: 7.8x

Low Growth Median: 3.7x

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

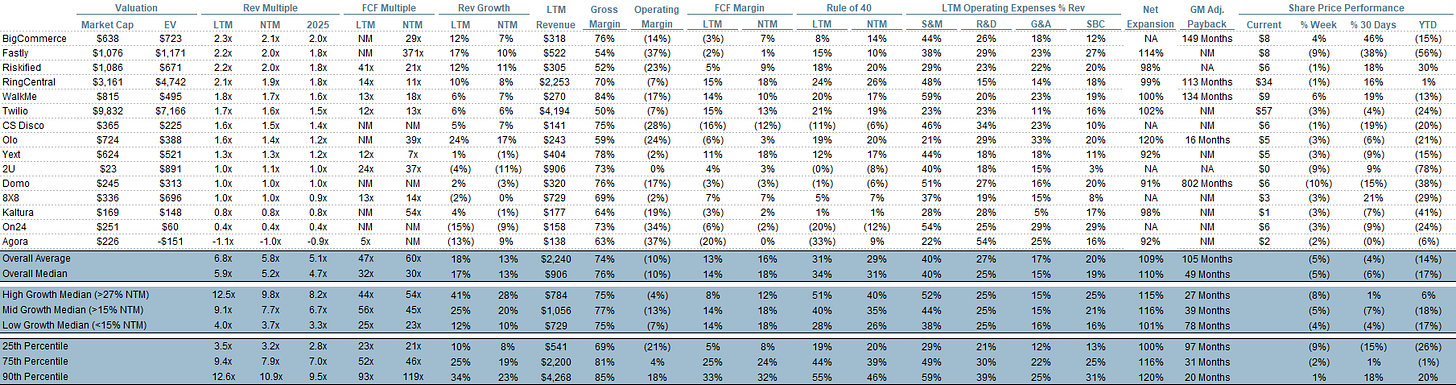

Operating Metrics

Median NTM growth rate: 13%

Median LTM growth rate: 17%

Median Gross Margin: 76%

Median Operating Margin (10%)

Median FCF Margin: 14%

Median Net Retention: 110%

Median CAC Payback: 49 months

Median S&M % Revenue: 40%

Median R&D % Revenue: 25%

Median G&A % Revenue: 15%

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Best piece I read today! What a fabulous analysis of the state of the state in growth software. Jamin - thank you! Investors are realizing that many of their darling stocks are not that mission critical anymore. Perhaps they never were in the first place. Cheers!

C