Clouded Judgement 6.10.22

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Event Path for 2022

A few weeks ago I talked about an event path for 2022. Specifically, in order for valuation multiples to return to long term averages (we’re currently ~20% below long term averages), we’d need clarity on interest rates and a potential recession.

On where rates end up - the key input is inflation (CPI). This morning, we got May CPI data. Overall, it was higher than expected. What this means in oversimplified terms is that if inflation is higher than expected, rates may need to be higher than expected, which then lowers long duration asset values (like growth software stocks). Long duration means the present value relies heavily upon future cash flows. Even for growth software with FCF today (Datadog, Crowdstrike, Snowflake, etc), we still see a heavier weighting of FCFs in the future driving present value today. All this means is that as interest rates go up, the rate at which we discount these future cash flows goes up (ie they’re worth less today). A lower growth, higher FCF business today doesn’t have as high of a weighting of future FCF to present valuation (ie present value is future cash flow streams that are fairly constant each year vs increasing dramatically each year), so interest rate moves impact their valuation less.

In terms of the CPI numbers - overall CPI for May came in at 8.6% (expectations were 8.3%, CPI rose 8.3% in April). Core CPI (CPI ex energy and food) rose 6% (expectations were 5.9%, core CPI rose 6.2% in April).

One interesting call out - Core CPI continues to come down month to month (6.5% in March, 6.2% in April to 6.0% in May). I believe when it comes to rates, the Fed cares most about Core CPI. Energy and Food inflation are more supply side dependent, meaning there’s not as much the Fed can do to control these prices with rates (rates help limit prices by impacting the demand side of the equation, not supply). Unfortunately for energy and food, we’re seeing a huge supply side shock from the war. So seeing Core CPI come down is a good sign, and may actually be a net positive for where rates will end this year (but maybe I’m just searching for optimism:) ). However, energy (gas) and food (grocery store prices) are the pieces of inflation the everyday American will feel the most

Net net - I said at the beginning, the event path to a rebound to long term average multiples requires clarity on where rates (and thus inflation) will settle. Clarity, in particular, to where the worst case scenario could land. Until the worst case scenario (when it comes to rates) comes down, we’ll have increased volatility. We have less clarity today than we did yesterday. So the event path for a “rebound” is pushed further out into the future. 10Y is up to 3.1% today.

As far as I can tell, software fundamentals have not been impacted much and we’re almost through Q2 for companies with June quarter ends. While a recession does appear to be looming, we’re not there yet. There’s talk of budget freezes, but not many have been implemented. I expect the discourse around software fundamentals in a recession to pick up in the coming months, however we won’t have clarity on performance in a down market until at least Q3 earnings (given it’s not looking like Q2 will be recession-impacted at all). With that being said, guidance for Q2 during Q1 earnings has been quite weak. The median guidance raise for Q2 was +0.7%. Historically, the median guidance raise for software companies is ~2%, so we’re definitely seeing weakness in guides.

Net net - I think the period of uncertainty will last longer than I originally envisioned. When all is said and done I think the best software businesses will prove quite resilient in a recession, and rates won’t have to go >3%. In this scenario, we’ve definitely overshot the bottom. However, we won’t have data to “prove” this until late this year / early next at the earliest. Until then, buckle up!

Quarterly Reports Summary

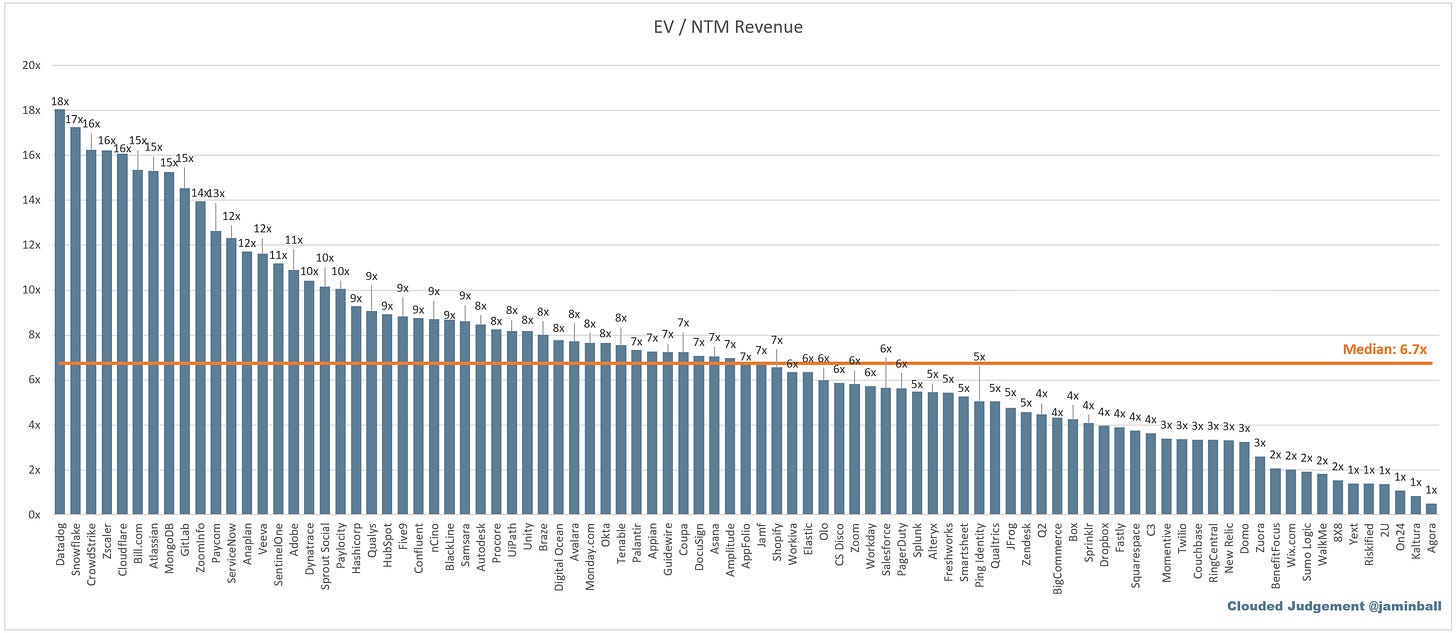

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

SaaS businesses are valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 6.7x

Top 5 Median: 16.3x

3 Month Trailing Average: 8.0x

1 Year Trailing Average: 12.5x

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 8.7x

Mid Growth Median: 6.7x

Low Growth Median: 3.6x

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Growth Adjusted EV / NTM Rev

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

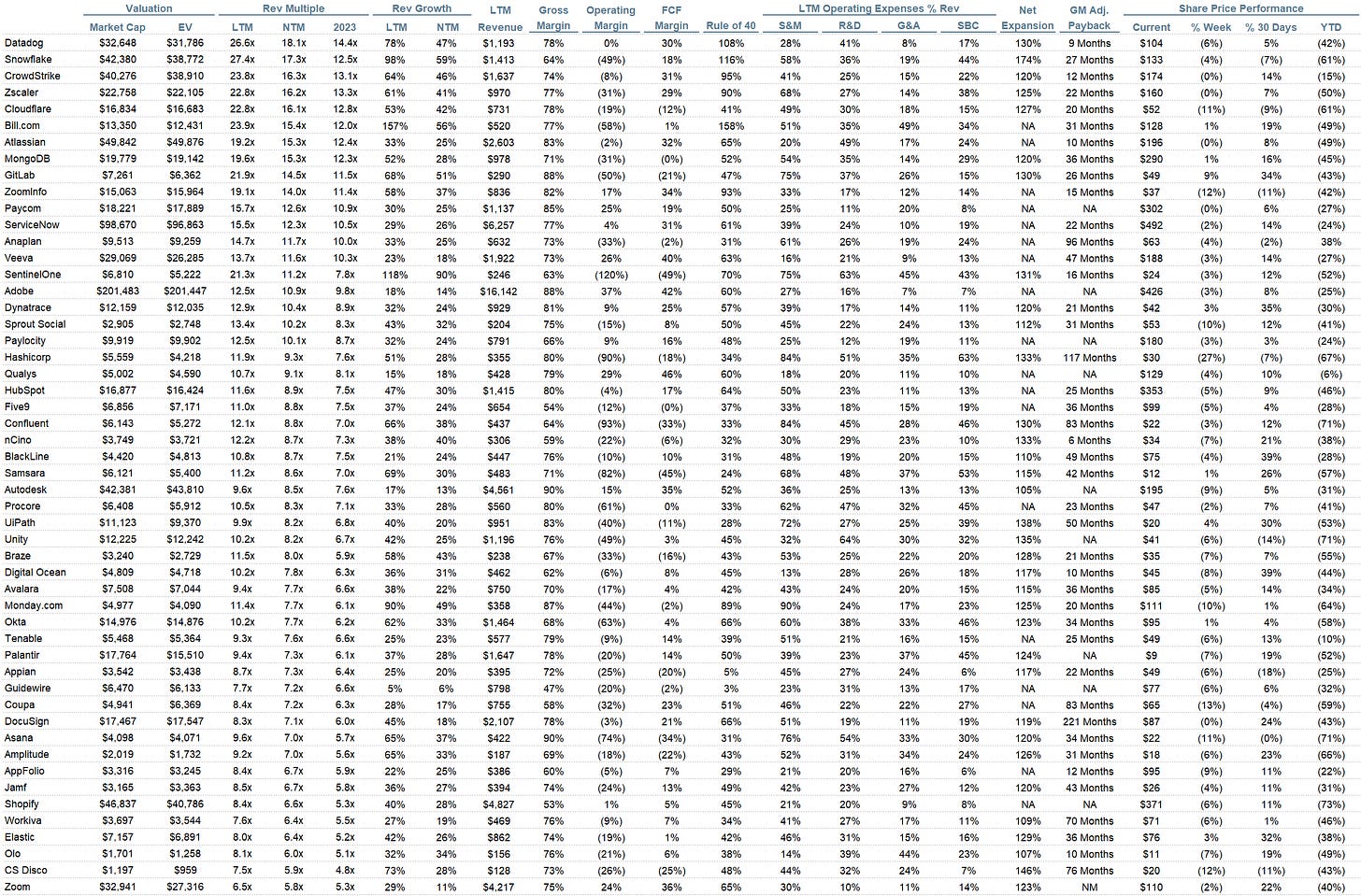

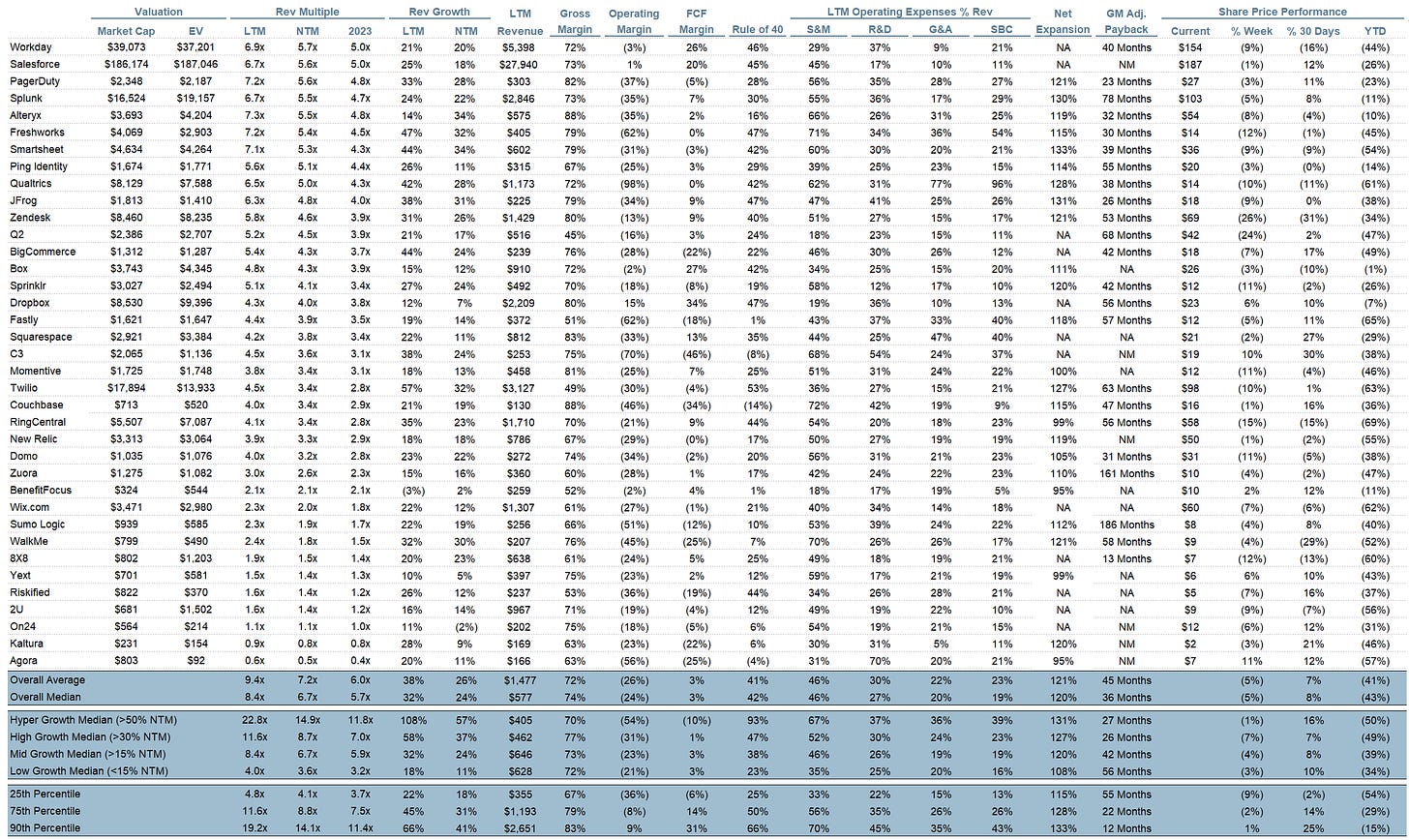

Operating Metrics

Median NTM growth rate: 25%

Median LTM growth rate: 32%

Median Gross Margin: 74%

Median Operating Margin (24%)

Median FCF Margin: 3%

Median Net Retention: 120%

Median CAC Payback: 32 months

Median S&M % Revenue: 46%

Median R&D % Revenue: 27%

Median G&A % Revenue: 20%

Comps Output

Rule of 40 shows LTM growth rate + LTM FCF Margin. FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Jamin...this para contained some great points. So important for growth investors to understand this.

"What this means in oversimplified terms is that if inflation is higher than expected, rates may need to be higher than expected, which then lowers long duration asset values (like growth software stocks). Long duration means the present value relies heavily upon future cash flows. Even for growth software with FCF today (Datadog, Crowdstrike, Snowflake, etc), we still see a heavier weighting of FCFs in the future driving present value today. All this means is that as interest rates go up, the rate at which we discount these future cash flows goes up (ie they’re worth less today). A lower growth, higher FCF business today doesn’t have as high of a weighting of future FCF to present valuation (ie present value is future cash flow streams that are fairly constant each year vs increasing dramatically each year), so interest rate moves impact their valuation less."

Agree with most of what you said but based on the DOCU commentary and from some others, public market drawdown impacting attrition which can be debilitating for both sales and product. Clearly the best cultures will win and especially those with solid FCF. Interesting times to pick winners.