Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

You Own Your Data…Or Do you?

Something I’ve written a fair bit about, and something I deeply believe, is this: you don’t have an AI strategy without a data strategy.

But what if the data you think you have… you actually don’t?

Slack recently made a change to their terms of service that might look small on the surface, but could be the canary in the coal mine for something much bigger.

So what happened? The TLDR: Slack is making it significantly harder, or in some cases outright blocking, customers from using their own Slack data (stored conversations) the way they might want to. There are now tighter restrictions around storing, indexing, or copying Slack data accessed via the API. They’ve also introduced strict new rate limits: for methods like conversations.history or conversations.replies, you’re now limited to 1 request per minute, capped at 15 messages per call.

And most critically, they’re blocking third-party platforms from indexing, copying, or storing Slack data, even if the customer wants that to happen.

Practically speaking, this means it’s a lot harder to export your conversation history and train a model on it. Or to authorize an AI tool to sit on top of your Slack data and make it searchable or useful.

And this matters. Slack is where work happens.

SRE teams get alerts in Slack and kick off remediation

IT teams respond to tickets

Sales reps run deal threads

Leadership teams share updates, decisions, context

Slack is a goldmine of institutional memory and real-time workflows. If that data gets locked in, it becomes harder, if not impossible, for companies to use it in external AI workflows. Especially if you thought that data was yours to begin with.

And maybe Slack is just the first domino. What happens if every other system of record app—ServiceNow, Workday, Salesforce, Datadog—decides to close off API access in similar ways? The data is “yours,” but it’s sitting inside someone else’s closed system.

There’s a real fear among incumbents that they’ll get reduced to dumb databases as the software stack shifts from cloud apps to agents. So they’re making a defensive play: lock down the data. If you want access to it for AI workflows, you better use their agent.

But that’s the question. Will the best agents be the ones built inside these closed ecosystems? Or will they live outside them, built on top of open, composable infrastructure? If the platforms believed they had the best agents, they wouldn’t need to build a wall. In many ways, we’ve already seen an evolution of closed systems to open systems in the data infrastructure world. Large data platforms like Databricks and Snowflake enjoyed the benefits of closed systems and captive data for years. But then open table formats emerged (Databricks helped pioneer this with Delta). Iceberg also gained steam. And now open table formats are creating the foundation of open data platforms. What was once a locked down ecosystem is turning into an open one. And it greatly benefits customers!

This is now an important trend to watch in the application software space. Not just because it’s about Slack. But because it’s about control. And as the software world rewires itself for AI, control over data is the first battle.

May Inflation Update

Inflation keeps coming down!

Headline CPI: 2.4% YoY (2.4% consensus) and 0.1% MoM (+0.2% consensus)

Core CPI: 2.8% YoY (2.9% consensus) and 0.1% MoM (0.3% consensus)

Quarterly Reports Summary

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

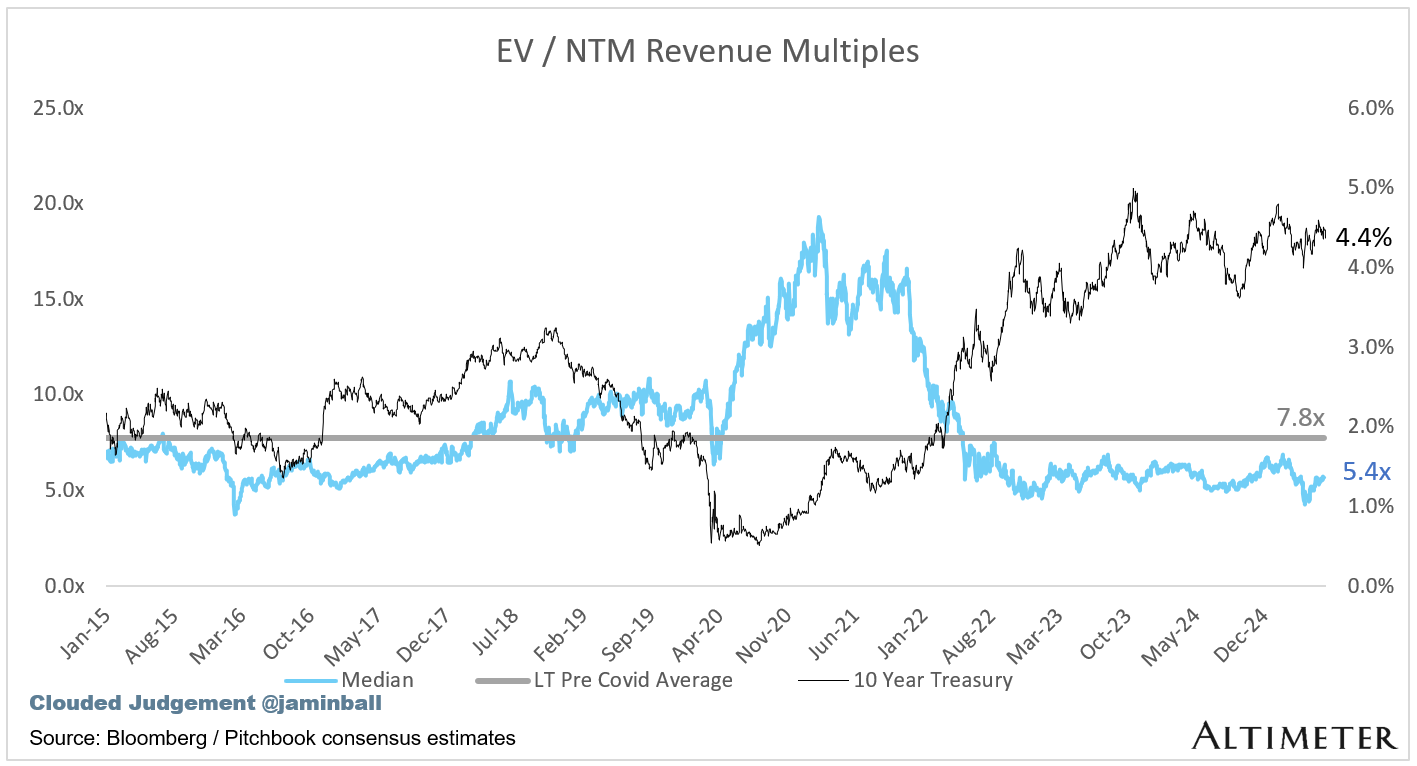

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.4x

Top 5 Median: 23.1x

10Y: 4.4%

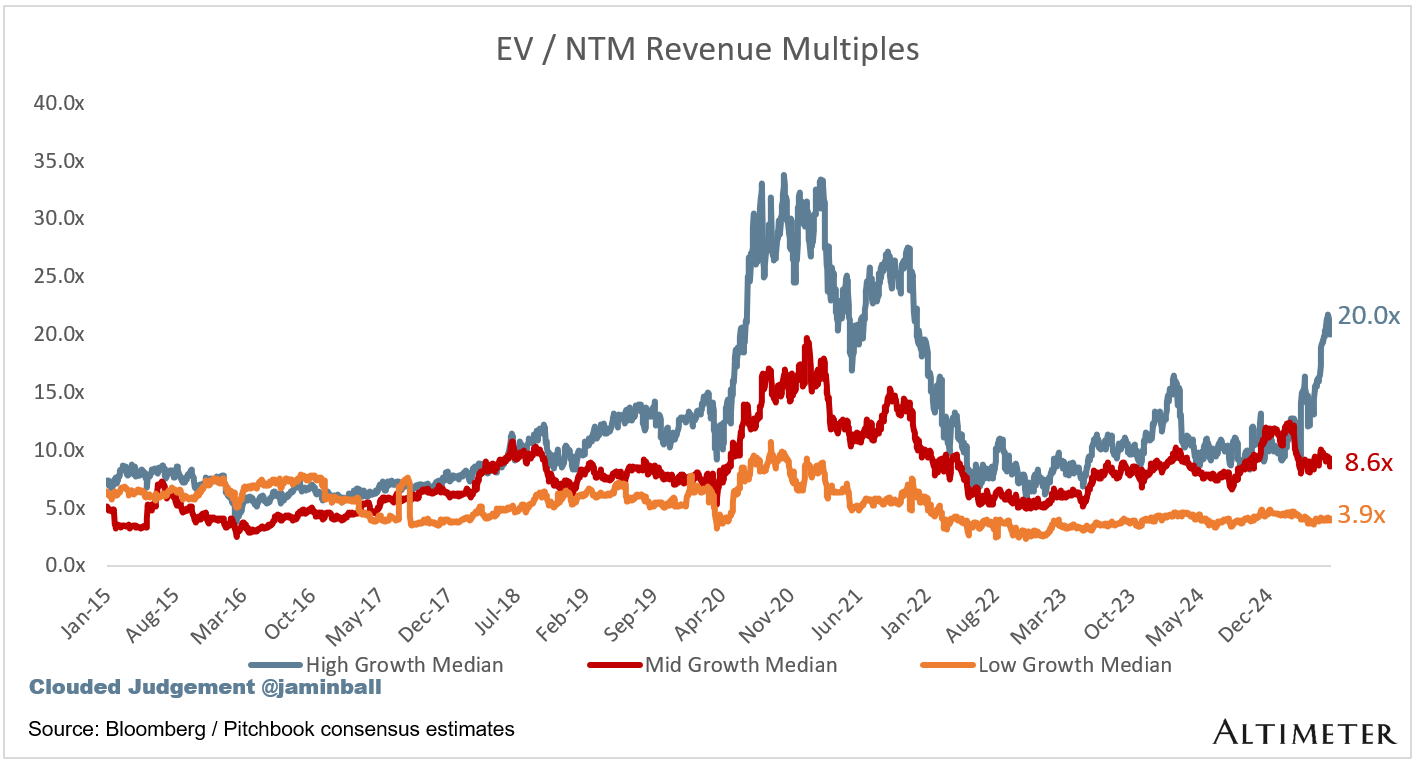

Bucketed by Growth. In the buckets below I consider high growth >25% projected NTM growth, mid growth 15%-25% and low growth <15%

High Growth Median: 20.0x

Mid Growth Median: 8.6x

Low Growth Median: 3.9x

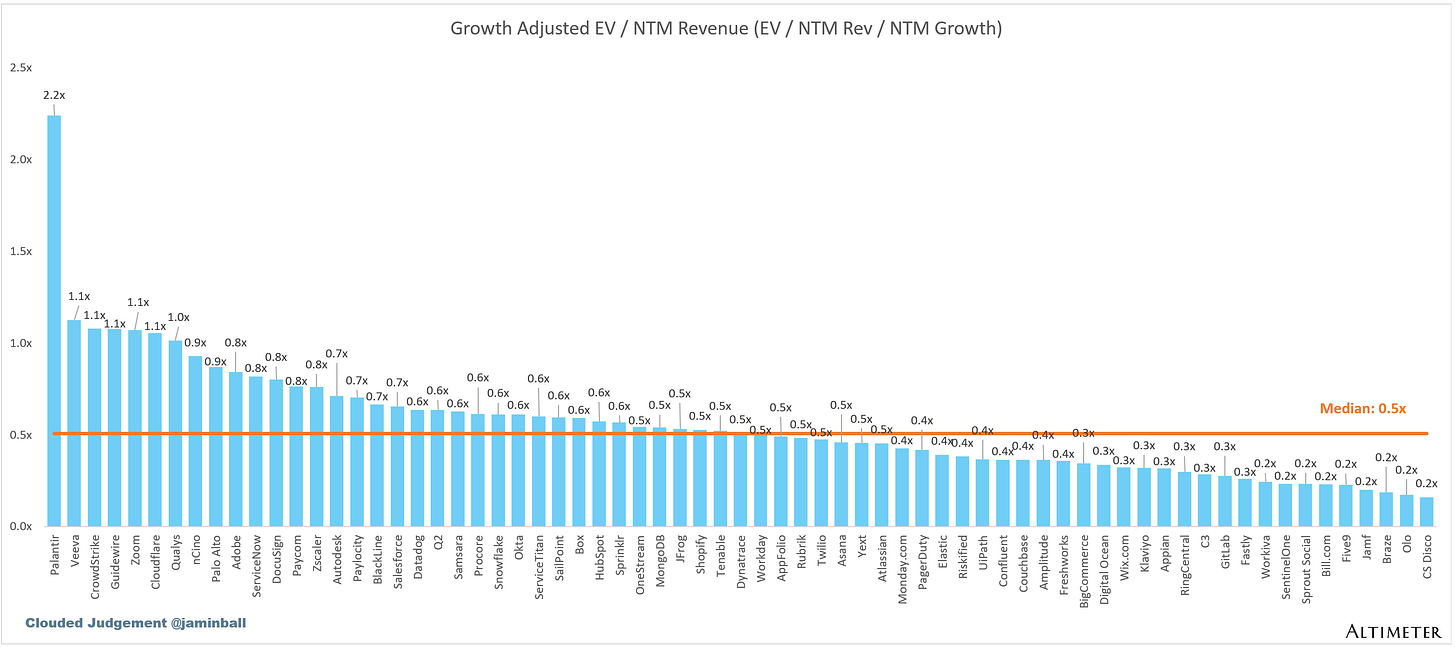

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 11%

Median LTM growth rate: 14%

Median Gross Margin: 76%

Median Operating Margin (4%)

Median FCF Margin: 18%

Median Net Retention: 108%

Median CAC Payback: 72 months

Median S&M % Revenue: 38%

Median R&D % Revenue: 24%

Median G&A % Revenue: 16%

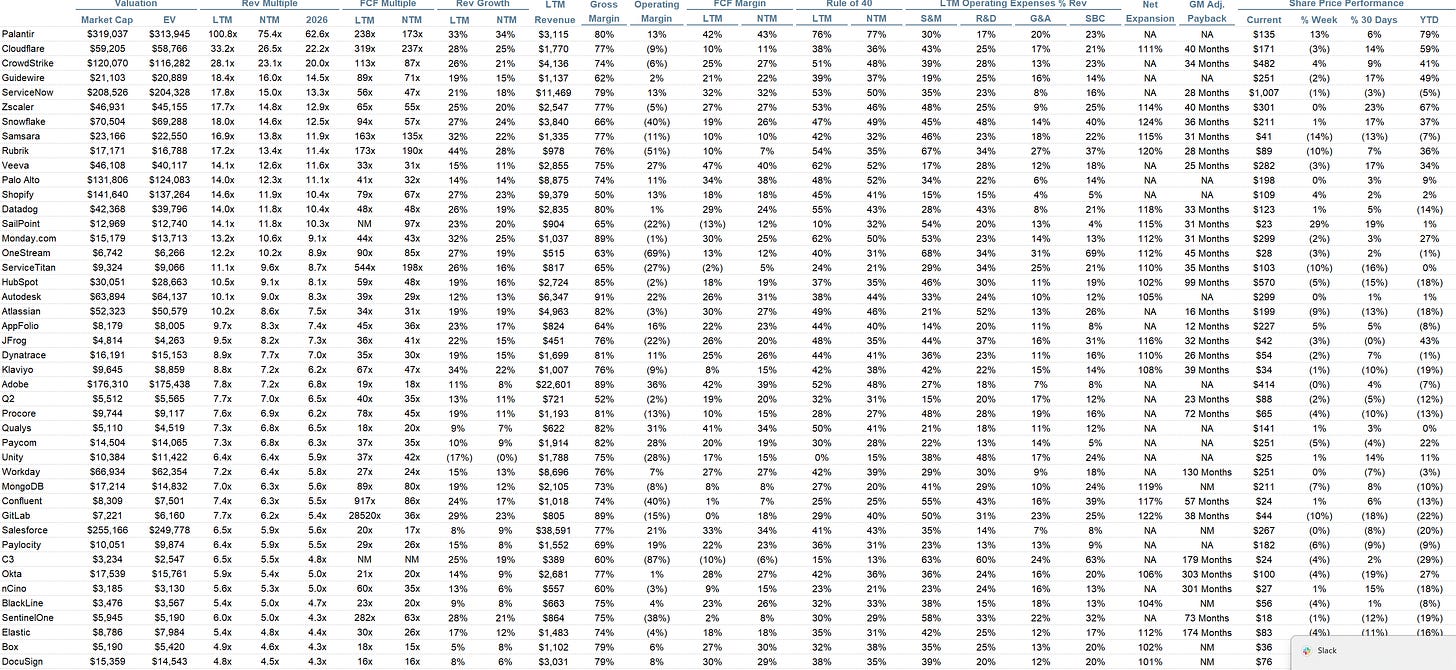

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

This was a great read!

I've been fascinated by the fact that companies like Hubspot and Linear were so quick to offer MCP servers for their products. While offering an MCP server lets you offer a cool new experience to users, and being an early 'ChatGPT Connector' is nice from a marketing perspective, it definitely also means you lose control of a lot of the data AND of the user experience. Your product risks becoming a plug-in to Claude or to ChatGPT, rather than an app in itself.

Slack is among the first to clearly push back against this, but I'm sure others will follow soon.

Personal and entity level data sovereignty should be a thing. Isn't this where BYOC is headed?