Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Is Seat Based Pricing Dead?

If AI delivers on its promise, it may spell the end of the SaaS business model as we know it. Historically, cloud software businesses charged a recurring fee based on the number of users of their software - the SaaS model. Then infrastructure / dev tools software companies took a different approach - more of a consumption based pricing model (I’m generalizing, not all infra is consumption based). Look at Twilio - they charge per message sent. Or Snowflake who charges based on compute used or data stored. At the end of the day, software vendors want to align value delivered with price charged. Back to the Twilio example - let’s say I, as a solo developer, built an application on Twilio that sent messages. And that app took off and was used by millions of end users sending messages every day. If Twilio charged per seat, I only would have paid Twilio for one seat, irrespective of how popular my app became. Twilio would have massively undercharged me! On top of this, every message end users received in my app through Twilio would push costs to Twilio (these are the Twilio COGS). So not only would Twilio be undercharging relative to the value I’m receiving, but Twilio would also be incurring incremental marginal costs that they’re not recognizing revenue for.

In summary, for a lot of infra / dev tools, seat based models:

Don’t align value delivered with price charged (ie they undercharge)

Blow up the margin structure of the vendor as product usage creates incremental marginal costs without generating incremental revenue

With historical app based software the usage of applications closely mirrored the number of people (seats). There’s only so much work 1 person can do, and as you hire more and onboard more seats the usage grows linearly. That linear growth can then turn exponential if you push more product SKUs to the end users. But with AI, that will almost certainly change. The promise of AI is that it will allow you to do “more with less.” The less here is people. As a vendor, if you’re customers are now able to do “more” (ie use the product more / get more value) with “less” (ie seats), then the two issues I laid out above will start to apply to application software providers. They will get squeezed on ACV, and will see their margins degrade. I don’t think it will be long before application software companies, who become AI application software companies, pivot their business models to consumption based. They’ll have no choice! Look at Zendesk - they operate in an industry that will certainly get disrupted by AI (as human agents are slowly replaced with AI agents). In that future, they can’t charge per HUMAN seat. And they’re getting ahead of that with a different pricing model for their AI Agent product (see this article). In summary, they will start pricing based on the number of automated tickets fully resolved by their AI bot without human intervention. This includes chat / email. Their overall business will be a hybrid pricing structure. They still charge per seat for human use, but charge differently for their AI product. As their customers shift to consume Zendesk more through AI agents vs human agents, the mix shift of their overall business will almost certainly tilt to consumption. I think as every application software company becomes an AI Agent application company we’ll see more of the entire industry transition to consumption models. In reality, the world will look more hybrid than pure consumption, but I do believe the prevalence of consumption models will go up significantly.

This also brings up a (separate) conversation about the future of software. A lot of the value of these SaaS applications are in their “easy to use UIs.” For Zendesk, the product needs to be easy for a human to use. All the information they need to resolve a ticket needs to be at their fingertips. But if an AI agent is solving tickets, the UI becomes a whole lot less important… What becomes more important is the underlying data structure of the application. Is the data structure organized in a way that an AI agent can scan through it all, and quickly deliver the answer with low latency? The best end user experience will come from a better underlying data architecture, not an easy to use UI. The leading application vendors today have become systems of record that workflows are built around. A system of record is just a database. And the workflows will be carried out by agents and API calls.

This is why one belief I have is that the future of application software in a world of AI agents probably looks a whole lot more like database software…These worlds are merging (database and applications). At the end of the day, most software today is just a UI on top of a database. We need the UI for human consumption. But we don’t need it for AI agent consumption. I’ve long STRONGLY believed that data and data infra are one of the core beneficiaries of AI. Most of my venture career has been spent investing in data businesses. One of which, Tabular, was just acquired by Databricks for >$1b. Others, like dbt Labs, Clickhouse, Airbyte, Prisma, etc are seeing really strong growth. The value of differentiated, high quality data infra has never been higher.

But let’s take this one step further. Both Databricks and Snowflake have heavily foreshadowed (or released products) that enable applications to be built on top of them. I think this is clearly the future. Applications built more for AI agent consumption, built on top of leading data platforms. The data platform companies will BECOME the application providers themselves. I’m excited for this future!

May Inflation (CPI) Update

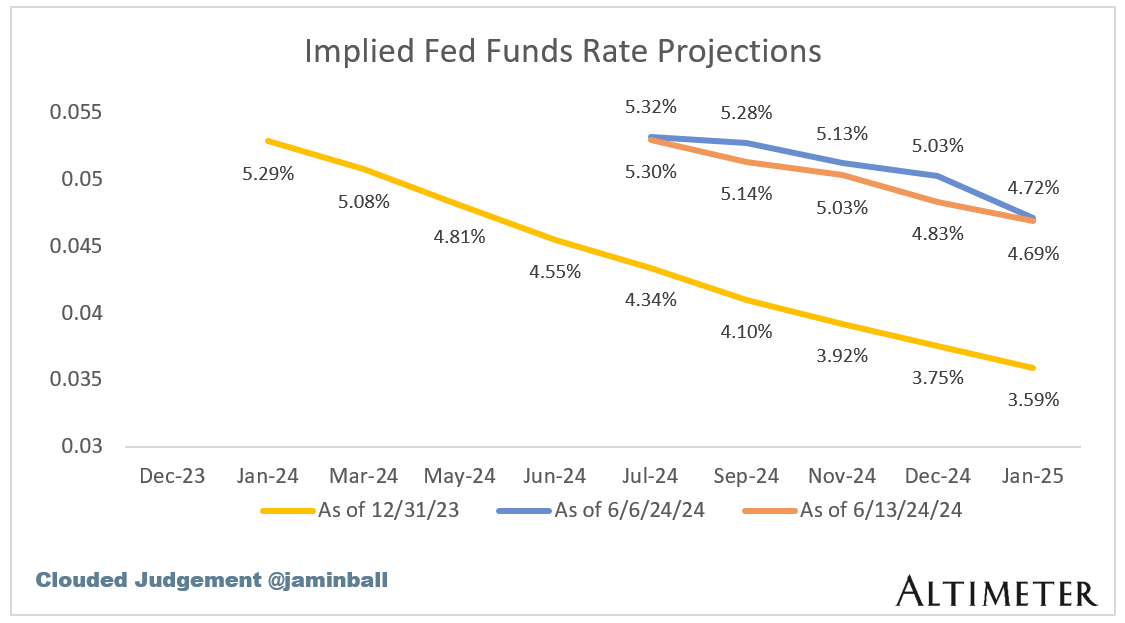

We saw the 10Y fall to 4.25% this week on lighter May inflation (the lowest since March). This pushed a lot of software stocks higher on Wednesday.

May CPI:

May CPI YoY was +3.3% vs expectations of +3.4% (and +3.4% in April)

May CPI MoM +0.0% vs expectations of +0.1% (and +0.3% in April)

May Core CPI (ex Food/Energy) YoY +3.4% vs expectations of +3.5% (and +3.6% in April)

May Core CPI (ex Food/Energy) MoM +0.2% vs expectations of +0.3% (and +0.3% in April)

The chart below shows the market’s expected future Fed Funds rate (it’s currently ~5.33%). The yellow line shows the market’s expectation at the beginning of the year. The blue line shows the expectation from a week ago, and the orange line is the current expectation. As you can see, the expectation at the beginning of the year was WAY off. Rates have not come down. When we look at the orange line (after May inflation report) vs blue line (pre May inflation report), you’ll see that the May inflation data prompted the market to expect one additional rate cut (expecting 2 rate cutes by year end vs 1 prior to the May inflation data).

Quarterly Reports Summary

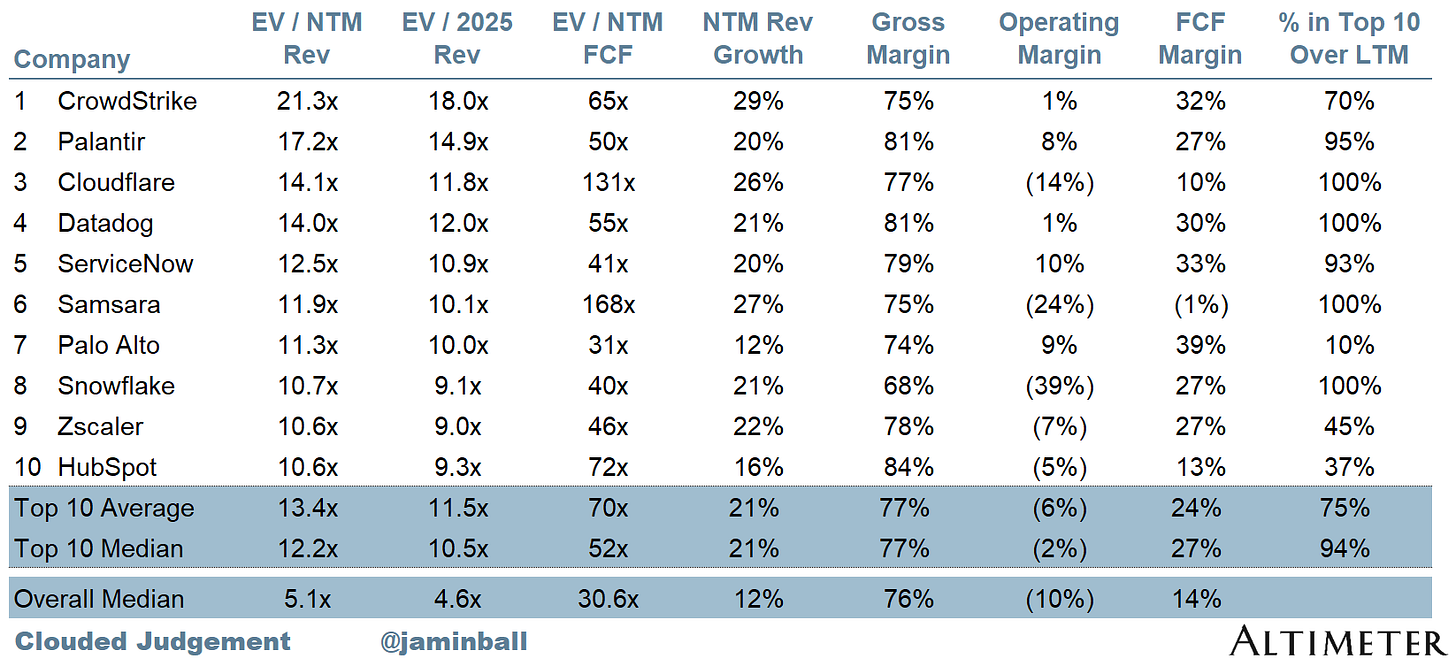

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

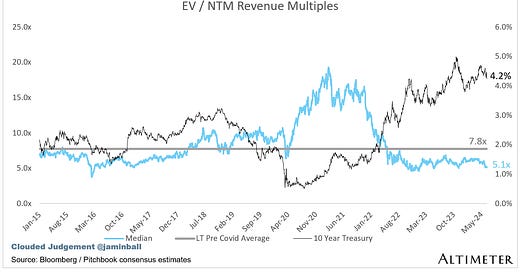

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.1x

Top 5 Median: 14.1x

10Y: 4.2%

Bucketed by Growth. In the buckets below I consider high growth >27% projected NTM growth (I had to update this, as there’s only 1 company projected to grow >30% after this quarter’s earnings), mid growth 15%-27% and low growth <15%

High Growth Median: 7.9x

Mid Growth Median: 7.9x

Low Growth Median: 3.5x

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

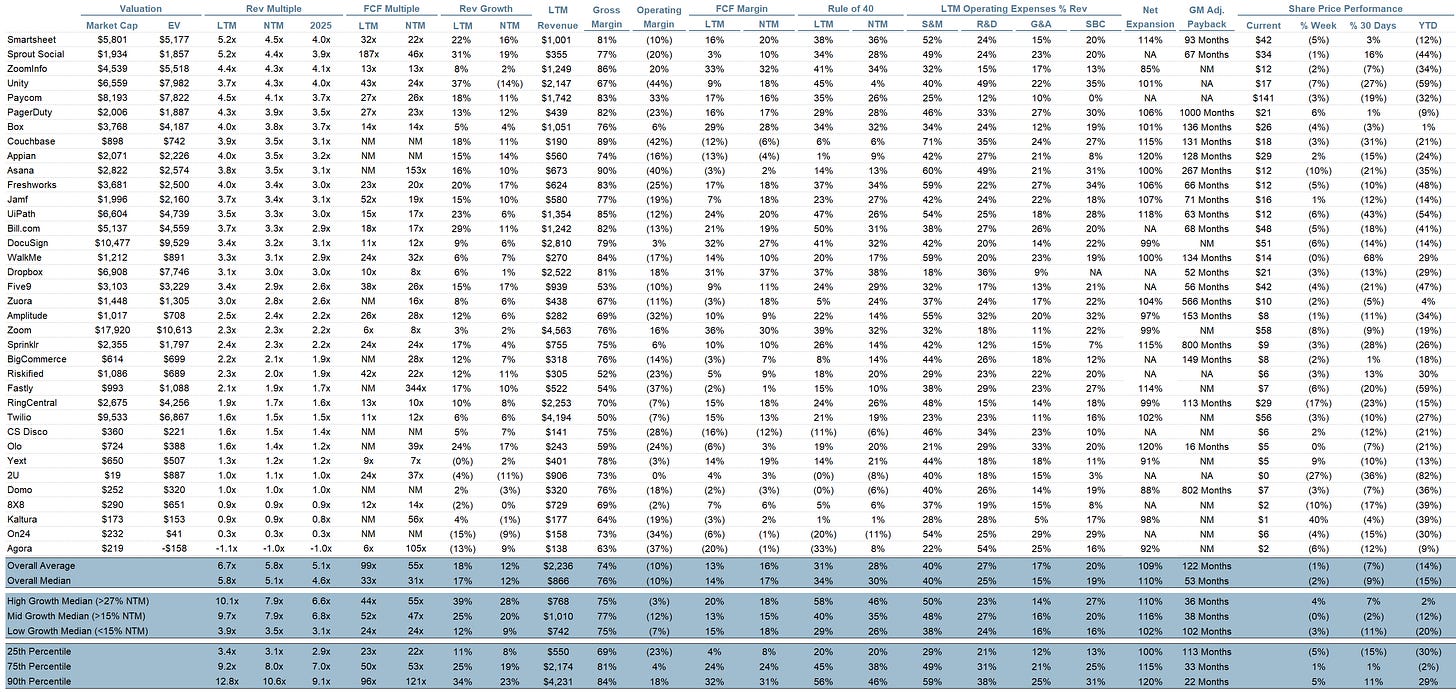

Operating Metrics

Median NTM growth rate: 12%

Median LTM growth rate: 17%

Median Gross Margin: 76%

Median Operating Margin (10%)

Median FCF Margin: 14%

Median Net Retention: 110%

Median CAC Payback: 53 months

Median S&M % Revenue: 40%

Median R&D % Revenue: 25%

Median G&A % Revenue: 15%

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Jamin - excellent insight! I served as SVP Product and GM @ Zendesk from 2016 through 2021 in a period of rapid growth and evolution of the product and the business model, including introduction of Answer Bot - an ML-based offering on top of the Zendesk Guide knowledge base designed for automatic resolution of customer requests. We ignited fiery discussions across the team about usage (consumption) pricing and what it meant for customers and our business.

We had already acknowledged that we walked a fine line every day with seat-based pricing because:

1) Every feature we introduced to make agents more efficient reduced demand for more seats

2) Seat based pricing was subject to abuse when customers shared licenses across multiple agents

When we introduced Answer Bot, we decided to realign the value metric (resolved tickets) with the pricing model ($ per resolved ticket). The challenge was the difficulty customers (and sales) faced in predicting how many successful resolutions AB would drive. It was hard to budget for in advance and felt risky. Additionally, the resolved tickets were generally simpler requests so the marginal value (and pricing) for each was low. Ultimately, we bundled "resolved tickets" in tiers discounted by volume and gave it a go. We learned a lot, but it was too early. AI advancements have brought all of this back to the front burner and there's clearly now a mandate to find a path forward to deliver value to customers with sustainable high-margin packaging and pricing.

In the 3 years since leaving Zendesk, I've been on a journey co-founding startup building an AI assistant for meetings and general productivity. I have thoughts about your view on agents + databases and how the value in the industry may shift in this new era. (Hint: it may follow a similar but slightly different path as the relational database era!)

Interesting piece. Esp interesting point that the most valuable SW will become “databases” rather than UIs. In the medium term, a lot of organizations use legacy SW with terrible API access that makes it very hard to extract the important data in these systems (DoD in particular has a huge problem with this), but these systems are critical to their workflows. Will be interesting to see how “RPA style” AI agents will be used to interact with homegrown and legacy apps with poor data integration support to enable these apps to take advantage of productivity that comes from these AI agents. Interesting research article on these RPA agents: https://arxiv.org/html/2405.03710v1

Thanks again for sharing!!