Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Growth Adjusted Software Multiples

The last 6 weeks (since the start of May) has been quite the run for software companies. The WCLD index is up 30%! The Nasdaq is up 12%. Given this move, where do multiples stand today? And how do today’s multiples relate to interest rates and the underlying growth of these software businesses?

First some context. If we look back over a ~10 year period (excluding 2020-present) the:

Median NTM Revenue Multiple was 7.8x

Median NTM Growth Rate was ~25%

Median 10Y was ~2.3%

Fast forward to today and the:

Median NTM Revenue Multiple is 6.0x

Median NTM Growth Rate was ~15%

10Y is ~3.7%

Said another way, the median NTM revenue multiple is ~23% below it’s historical average, but forward growth expectations are the lowest ever (~40% below historical average), and the 10Y is ~40% higher than it’s historical average (from the period 2010-2020). I’m using the period of 2010+ given that’s really when cloud software came about.

The chart below shows this detail:

So what does this mean? Clearly we SHOULD be at depressed multiples - growth expectations are at all time lows, and the 10Y is meaningfully higher. But is the multiple discount representative of growth expectations and interest rates? In a vacuum I’d say no. Given the set of facts behind expected consensus growth rates and interest rates I’d expect multiples to be lower. However - in this moment in time one could say we’re at the bottom of growth expectations and rates. There’s an argument to be made for acceleration in revenue growth in the back half of this year. At the same time, it’s most likely rates will go down, not up (as inflation continues to fall meaningfully). So the expectation is that growth expectations and interest rates will become a tailwind for software multiples in the near future.

Clearly this is what the market is pricing in. Consensus estimates will lag market sentiment, and the market will move ahead of consensus estimates changing. If we look at the light blue line (NTM consensus growth median) it lags the dark blue line (NTM rev multiple) by about 6-8 months (at least from the 2020 period forward). So the recent jump in multiple we can assume is driven by an expectation that forward growth estimates start moving. Will that happen? Time will tell! If we look at the graph around August ‘22 multiples started to tick up then, growth expectations flattened, and then both fell. Are we at a similar point today? Or is this truly the bottom of growth expectations? Time will tell, but the market has voted

Of course, there’s also the scenario where this is all just an AI infused equity bubble :)

If we wrap this up and look at a growth adjusted multiple, EV / NTM Rev / NTM Growth Rate (chart below), you’ll see that we’re now right where we were immediately before Covid. That period (Feb ‘20) and Summer / Fall ‘19 were the two peaks for the growth adjusted revenue multiple. I’ll be adding this chart to the standard weekly graphs I share.

Said another way - we’re currently trading at all-time high growth adjusted multiples. One can argue the growth expectations are “wrong” and we’re not actually as high as the multiple suggests. Of course, you could also argue growth expectations are still too high and not factoring in a deeper recession! In that case we’re well above all time highs (as growth expectations need to come down)

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

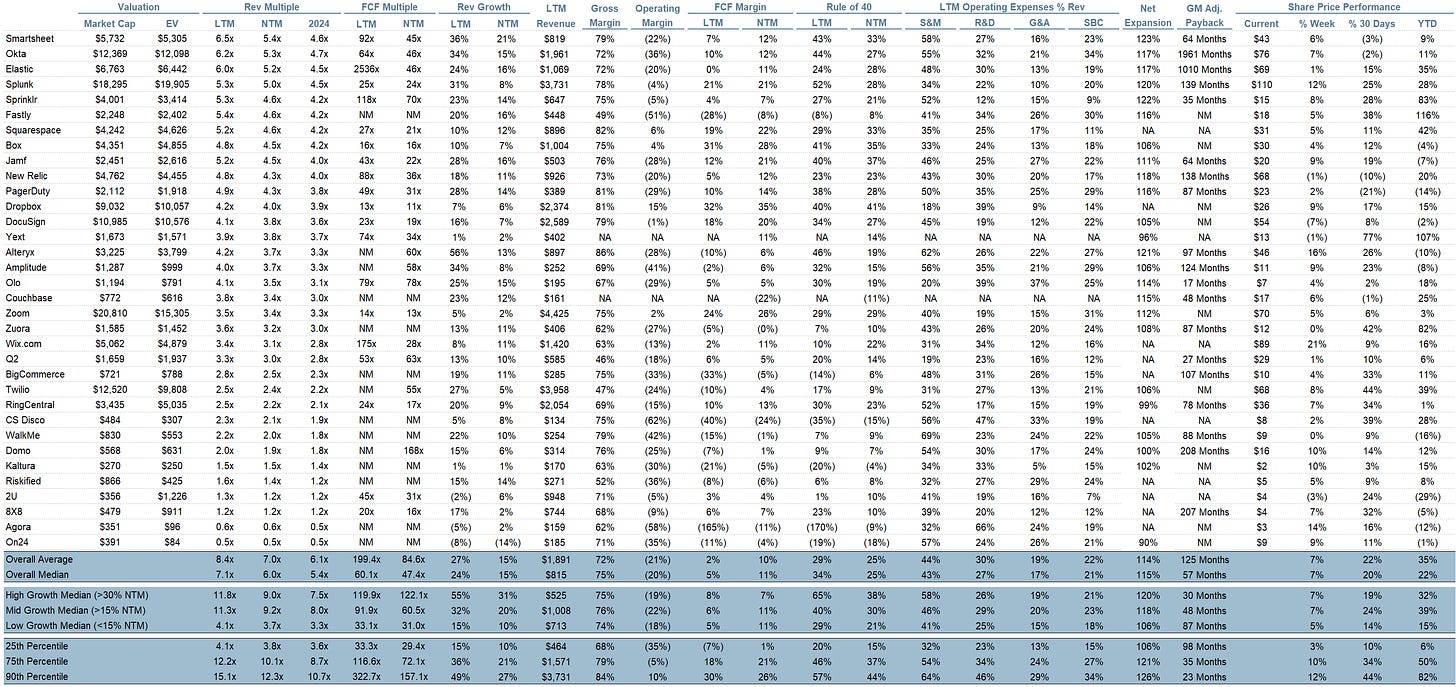

Overall Stats:

Overall Median: 6.0x

Top 5 Median: 16.6x

10Y: 3.7%

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 9.0x

Mid Growth Median: 9.2x

Low Growth Median: 3.7x

EV / NTM Rev / NTM Growth

The below charts shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

EV / NTM FCF

Companies with negative NTM FCF are not listed on the chart

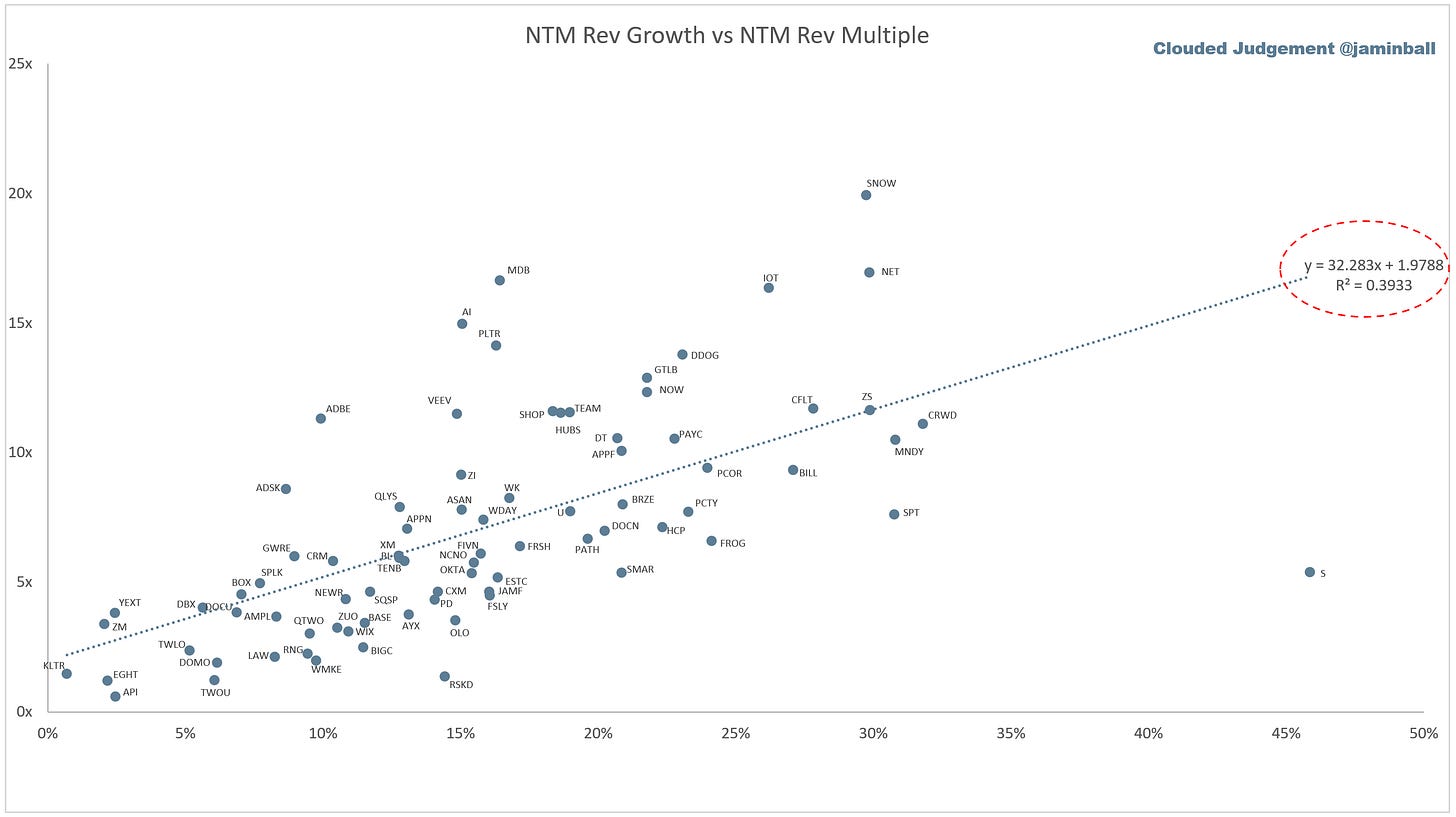

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 15%

Median LTM growth rate: 24%

Median Gross Margin: 75%

Median Operating Margin (21%)

Median FCF Margin: 3%

Median Net Retention: 115%

Median CAC Payback: 57 months

Median S&M % Revenue: 46%

Median R&D % Revenue: 27%

Median G&A % Revenue: 18%

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Great article! Two observations + questions for us to consider:

1. Your discussion and chart on Median EV / NTM Revenue / NTM Growth Multiples is helpful but don't we need to layer in a comparison to the 10 year into that chart to really have a baseline? To be at a peak when the 10 year is 40% higher means we're at an all time high by a lot no?

2. I'm noticing that the Mid-Growth Median (15-30%) has made a major move and recently eclipsed the High Growth Median (30%+). Does this mean growth correlation is being overshadowed by profitability? Looking at your historical chart this has almost never happened and would appreciate your thoughts there

As always, great stuff. Another factor likely driving the depressed NTM growth rates relative to historical levels is the dearth of IPO activity. As the last vintage of newly public Software companies continue to mature and growth tempers, the next batch of disruptive growth companies remain private.