Clouded Judgement 6.21.24 - What it Takes to Be Valued at >10x Rev

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

What It Takes For A Premium Multiple

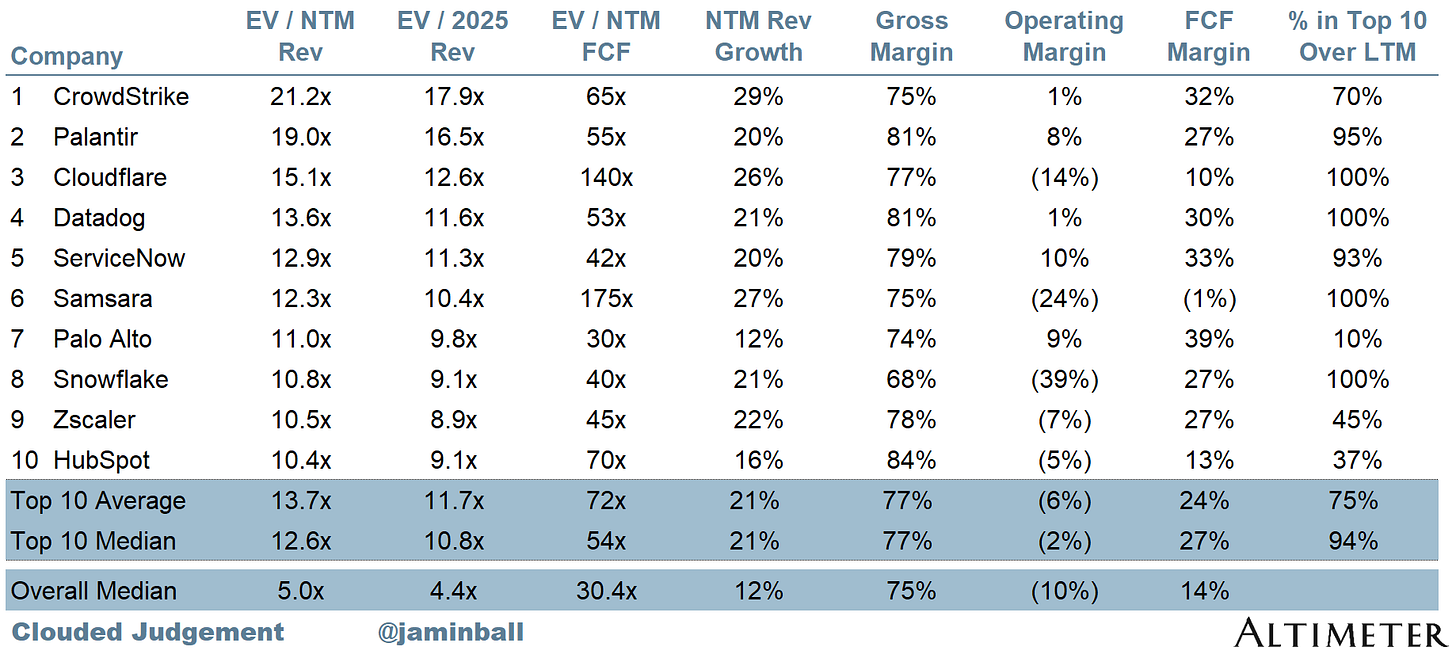

Private companies often *think* they’ll exit at a >10x revenue multiple because “that’s where Snowflake is trading and we’re also a data infra business.” Or they’re a security company and “that’s where Crowdstrike and Zscaler trade.” It’s never that simple, so I wanted to lay out what it really takes to receive a premium multiple in the public markets. This is obviously based on markets today, which can fluctuate.

When looking at the top 20 software companies with the highest NTM revenue multiples, the range spans ~8x (Mongo) to 21x (Crowdstrike). A couple interesting characteristics:

They are all FCF positive. Median LTM FCF margin is 27%. Samsara is the only one not FCF positive over the last 12 months (they have a (1%) LTM margin), but they were FCF positive in Q1

They all have LTM revenue >$600m, and 16 have >$1B in LTM revenue (the top 10 all have LTM revenue >$1B)

LTM growth ranges from 11% to 42% (median of 25%)

18/20 have market caps >$10B

What does this tell me? The surefire way to receive a premium multiple is to show FCF margin leverage and profitability at scale, with modest growth. Easy enough :) What’s most interesting is scale (ie revenue scale) and FCF are more of a consistent factor than growth (which ahs a much wider range)

Revenue multiples are tricky. On one hand, they’re a great shorthand that allows us to line up 80+ software companies and evaluate them relatively with a single metric. You can’t do that with a FCF multiple as not all have positive FCF. And they all have similar enough business models where using a single metric can make sense. BUT, a revenue multiple is just a shorthand valuation framework. Baked into a revenue multiple are assumptions around growth, margins, market opportunity, competitive dynamics, etc. And most importantly, looking at those assumptions 5-10 years out vs today. Why the long time horizon? If you were to come up with the intrinsic value of a software company (present value of future cash flows), most of the value would come from the outer years. More often than not, the short term years are either cash flow negative or slightly positive as the company still operates in growth mode, and profitability is turned on later in the companies life. So to believe in the intrinsic value calculation, you really have to believe in your outer year assumptions (where most of the present value is concentrated).

What is the market telling us today? Those outer year assumptions are a lot more unknown and uncertain today. And when uncertainty goes up (on something these valuations are more heavily dependent on), multiple goes down. There are many examples of software companies who never were able to hit FCF profitability / steady state FCF margins of 20-30% as they scaled revenue and growth slowed. Or growth decelerated significantly faster than anticipated, as many companies have been revealed to be mere point solutions at the mercy of “bundlers.” And we all know the compounding effects in outer years of slowing growth in the near term. For these companies, their higher revenue multiples from the past never ended up making sense (ie the assumptions baked into the revenue multiple never came to pass).

All of this to say - not all software is created equal. There really should be A LOT of dispersion when it comes to revenue multiples. We can’t simply assume every cloud software company will eventually hit 20%+ FCF margins, and can grow 20% at scale. The last two years have made this abundantly clear.

The market today is simply saying “we don’t want to make assumptions about your profitability or growth at scale. We’ll pay the high multiple once the company is established.” The fact that 80% of the 20 highest revenue multiple companies have >$1B in revenue (and 100% of the top 10 are >$1B in revenue) shows this. IF you’re able to hit platform scale, and IF you can show FCF leverage, then and only then will you be rewarded with a premium multiple. For everyone else, they find themselves in a “prove it” stage.

There are moments in time where the market will be more “optimistic” or forward leaning. Today, the market doesn’t want to make a bet on which subscale software companies will end up breaking out into enduring platforms. There’s been too many foot faults in the last couple years, and we’re also in the middle of a major platform shift that leaves the future more uncertain.

Final point - there has been lots of discussion around “has the bar gone up to go public.” Said another way, companies with $100m in revenue went public all the time 5+ years ago. But is the bar higher today? It’s all a matter of perspective. You can certainly still go public today with $100m of revenue, you just have to be willing to accept the market clearing price. And that very well may be 6x revenue if you’re sub scale. The most recent software IPO, Rubrik, grew ARR 46% to $850m in the last quarter. And they trade at 5.8x NTM rev.

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

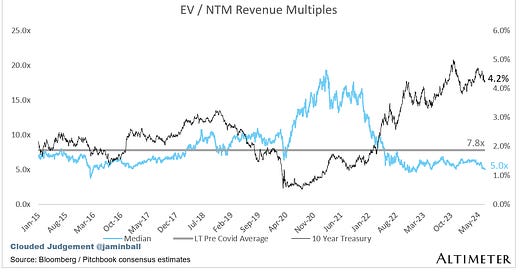

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.05x

Top 5 Median: 15.1x

10Y: 4.2%

Bucketed by Growth. In the buckets below I consider high growth >25% projected NTM growth, mid growth 15%-25% and low growth <15%

High Growth Median: 9.4x

Mid Growth Median: 7.4x

Low Growth Median: 3.3x

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 12%

Median LTM growth rate: 17%

Median Gross Margin: 75%

Median Operating Margin (10%)

Median FCF Margin: 14%

Median Net Retention: 110%

Median CAC Payback: 53 months

Median S&M % Revenue: 40%

Median R&D % Revenue: 25%

Median G&A % Revenue: 15%

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.