Every week I’ll provide updates on the latest trends in SaaS valuations, earnings announcements, and highlight any noteworthy news. Follow along to stay up to date!

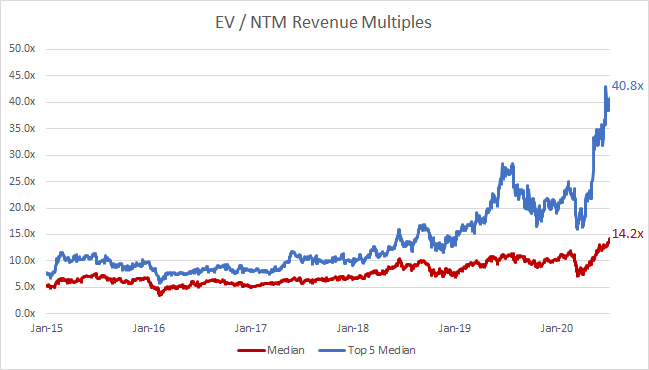

Another week, more all-time high SaaS valuations. The median SaaS forward revenue multiple is now ~14x. It wasn’t that long ago that a multiple that high was reserved for the high growth SaaS businesses. It may seem crazy, but only this year Zoom and Datadog traded at 16x, Coupa and Okta traded at 15x, Bill.com traded at 10x, and Crowdstrike traded a <10x! The multiple expansion we’ve seen this year has been astronomical. If you look at the 3 month trailing average multiple it’s widening its gap from the 1 year trailing average multiple which highlights just how fast multiples are expanding recently.

Highlight of the Week - IPO Pops

So far this year we’ve seen some huge pops on day 1 of trading from a few notable names. ZoomInfo popped 62%, Agora popped 153%, and Lemonade popped 139%. For many reasons I described in my article here these day 1 pops can be misleading. The right way to evaluate a true IPO pop is looking at the share price after the lock-up expires, and the full supply of shares are tradable. Below you can see the “pops” from IPO price to share price post lockup of all SaaS IPOs from the last ~3 years (plus a few more). The data suggests to me IPO are being under-priced.

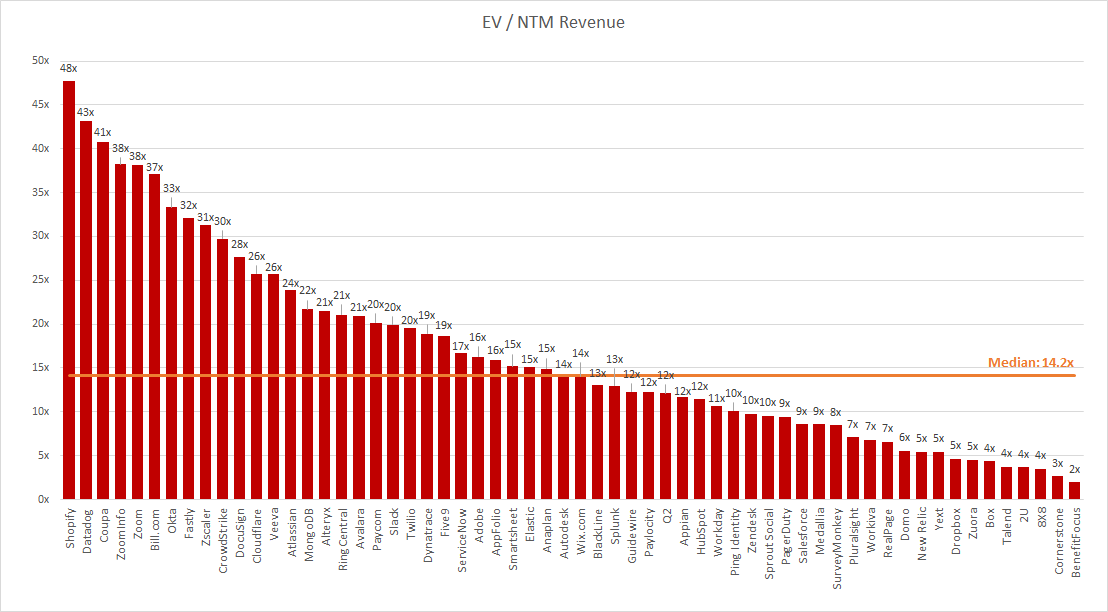

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Gains

Update on Multiples

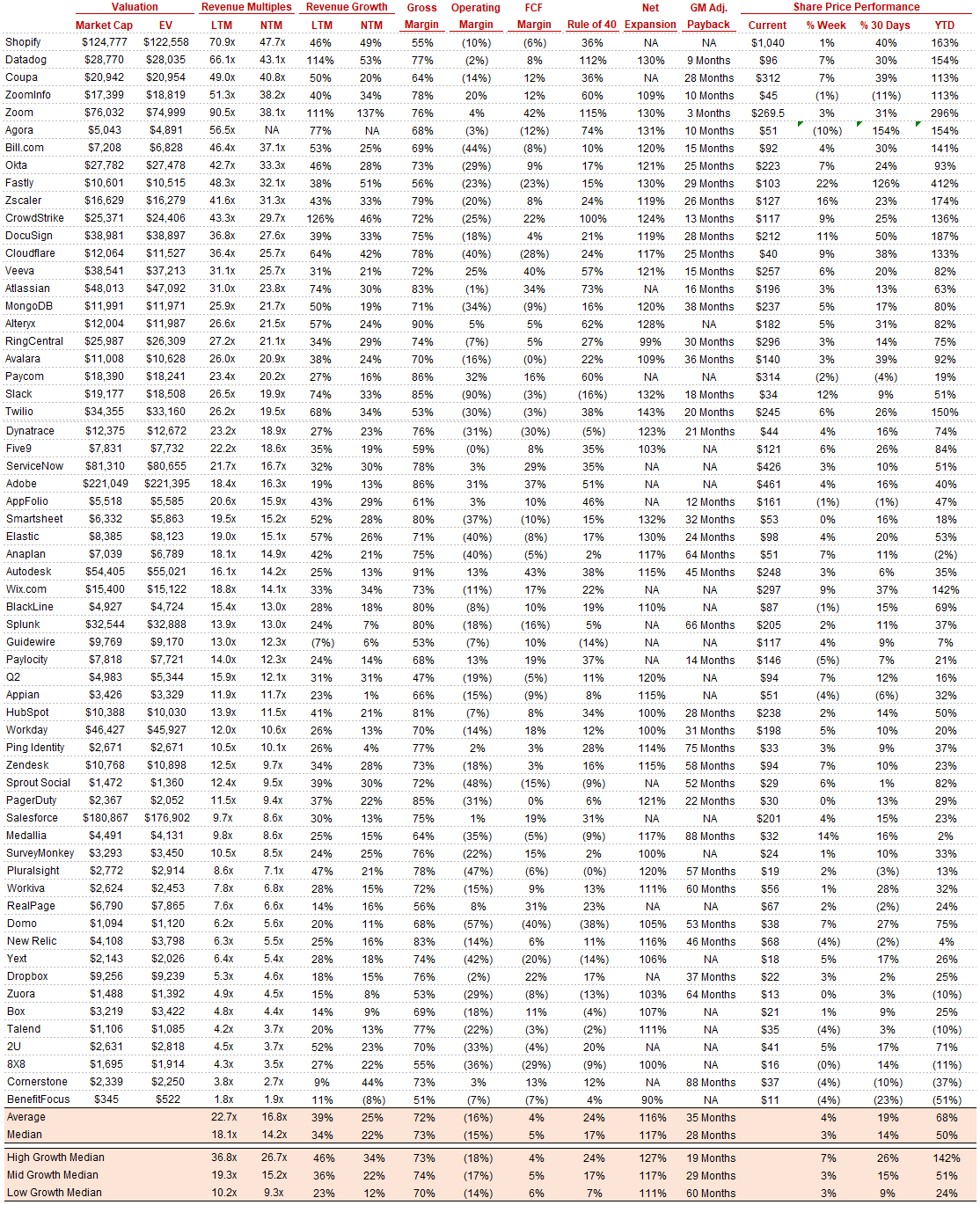

SaaS businesses are valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

Overall Stats:

Overall Median: 14.2x

Top 5 Median: 40.8x

3 Month Trailing Average: 11.3x

1 Year Trailing Average: 10.4x

Bucketed by Growth:

High Growth Median: 26.7x

Mid Growth Median: 15.2x

Low Growth Median: 9.3x

Operating Metrics

Median NTM growth rate: 22%

Median LTM growth rate: 34%

Median Gross Margin: 73%

Median Operating Margin (15%)

Median Net Retention: 117%

Median CAC Payback: 28 months

News

Slack acquired Rimeto, a business “re-imagining the business directory.” Looks like Slack is going after Microsoft Active Directory

Zoom launched their Hardware-as-a-Service product, streamlining the hardware procurement for “Zoom Rooms.” This allows customers to choose from a host of solutions for their phones / conference room hardware

Twilio announced their programmable video API is powering Doximity Dialer Video, a product that over 100,000 physicians us to power their telemedicine offering

Microsoft ups it’s product in it’s competition with Zoom

Ping Identity announced their upsized follow on offering. They originally planned to sell 7.5M shares, but ended up selling ~9M shares at $32 / share (~$287M total offering size) due to increased demand. They didn’t sell any primary (the sold shares were all existing shareholders selling), meaning the company takes on no dilution, and receives no proceeds as part of the sale.

Comps Output

Rule of 40 shows LTM growth rate + LTM GAAP Operating Margin

Great synopsis. Crazy multiples we’re seeing!