Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

The Red Queen Effect

I strongly believe in two competing truths with respect to AI and its impact - the size of the prize will be bigger than we imagine now, BUT we’ll overestimate it in the short term. I believe this sums up a lot of the debates around “too much capex too little revenue.” It’s just too early draw any long term conclusions. I also think looking at AI “software” revenue over the course of time will drastically understate its impact. AI will lead to new drug development, new autonomous vehicle /robotics technologies, better ad targeting (yawn, but real impact!), and other things we can’t even imagine now. And maybe most importantly, it will lead to dramatic cost reduction in certain industries. Take customer support - is the right way to look at AI’s impact as the spend on AI contact center solutions, or the human costs that were removed? Obviously it’s both, but framing it as one other the other looks at revenue generated vs costs saved. And I think (for now) the latter is much larger.

But there’s bigger forces at play here - The Red Queen Effect.

The Red Queen effect is a concept that originates from evolutionary biology and is often applied to business and economics. It describes a situation where entities must constantly adapt and evolve, not just for progression, but simply to maintain their current position relative to others who are also evolving. This concept is also derived from the Red Queen's race in Lewis Carroll's "Through the Looking-Glass," where the Red Queen says, "It takes all the running you can do, to keep in the same place." Consider the smartphone industry, where companies like Apple and Samsung are in a constant race to release new and improved smartphones. Even if a new feature or model does not significantly increase immediate profits, releasing it may be necessary to maintain market share and prevent customers from switching to a competitor's newer offering.

Right now the world is evolving - AI is a massive platform shift. And by NOT adopting / spending on it, you risk loosing market share and slowly becoming irrelevant. Because your competitors are investing in AI efforts, you also have to invest in AI efforts. At the end of the day these investments might not immediately result in better business outcomes (ie more revenue), but they certainly lead to better end user experiences. And very well may lead to better “other” metrics like retention or churn. If you’re competitors are building better end user experiences and you’re not, then you may find yourself in trouble in the short / medium term.

IF you believe the first part of my competing truths - that the size of the AI prize will be bigger than we imagine now - then you have no choice but to invest in AI given your competitors are. Failure to do so implicitly means you’re giving up on the race and ceding ground and market share to you competitors. This is the Red Queen Effect. I do believe, however, that those who “win the race” in their respective markets will see orders of magnitude returns on their early CapEx. Industrial revolutions don’t last a couple years. They last decades. The first industrial revolution was categorized as the period from 1760 - 1840. The Second Industrial revolution lasted from 1870 to 1924. The Third Industrial revolution lasted from 1960 - early 2000’s. These are all 40+ year revolutions. Depending on your start date for this Industrial Revolution (follow up post coming titled “The Fourth Industrial Revolution: the Intelligence Revolution”), we’re only 5-10 years into this one. I’m either wrong on the size of the prize here, or you can’t stop investing in AI efforts. Imagine if a lack of cargo, passengers, rails, etc stopped companies from investing in steam engine technology in the 1760s. I believe this is a similar analogy to today. Again, I’m a big believer that the size of the prize here will be massive and worth it.

June Inflation (CPI) Update

We saw the 10Y fall to 4.25% this week on lighter May inflation (the lowest since March). This pushed a lot of software stocks higher on Wednesday.

June CPI:

June CPI YoY was +3.0% vs expectations of +3.1% (and +3.3% in May)

June CPI MoM +0.1% vs expectations of +0.1% (and +0.0% in May)

June Core CPI (ex Food/Energy) YoY +3.3% vs expectations of +3.4% (and +3.4% in May)

June Core CPI (ex Food/Energy) MoM +0.1% vs expectations of +0.2% (and +0.2% in May)

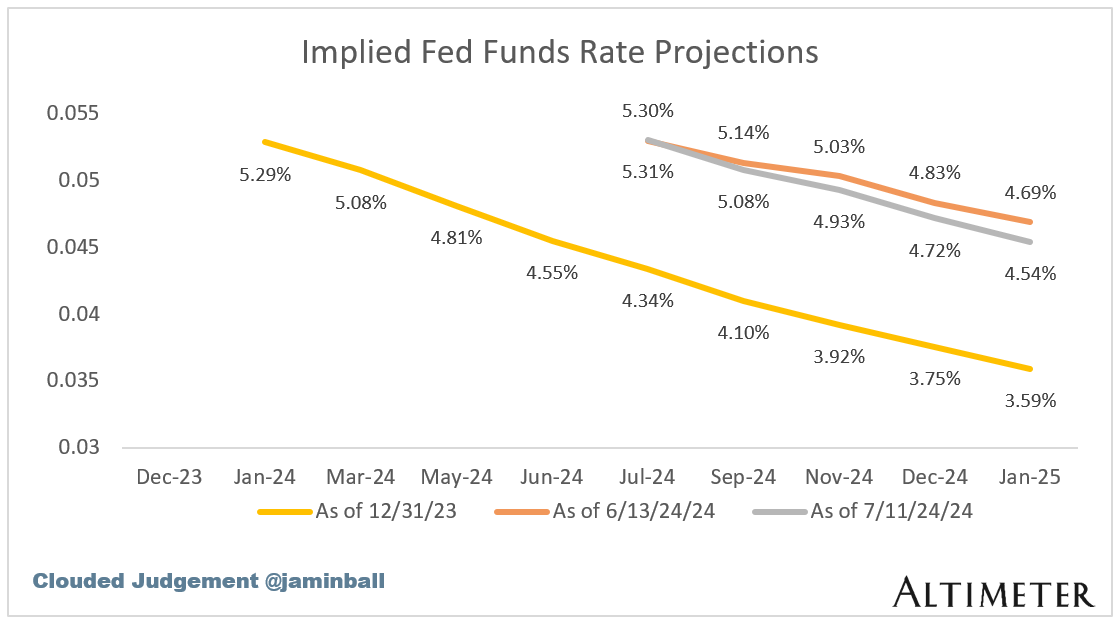

The grey line in the chart below shows the market’s expected future Fed Funds rate (current rate is ~5.33%). The yellow line shows the market’s expectation at the beginning of the year. The orange line shows the expectation from about a month ago after the May CPI figures came out.

Top 10 EV / NTM Revenue Multiples

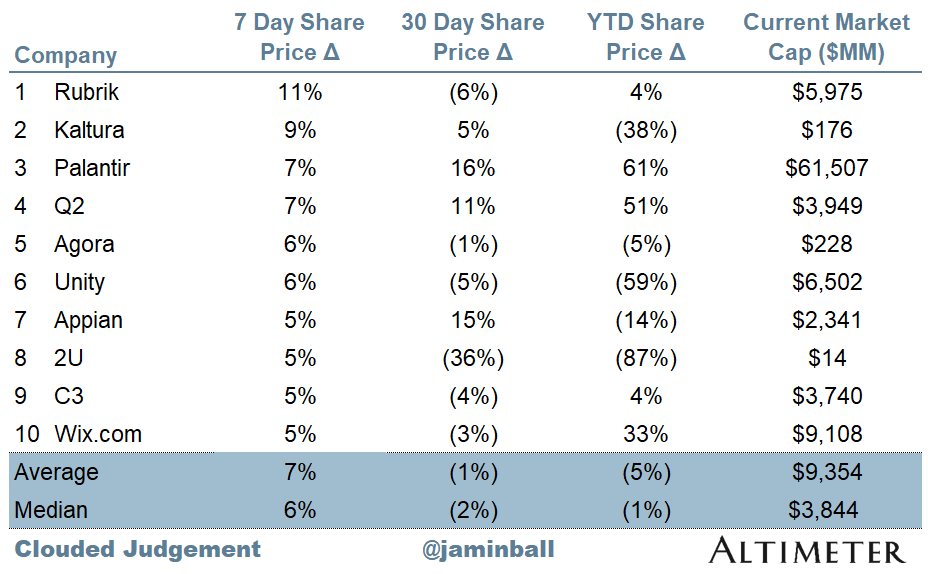

Top 10 Weekly Share Price Movement

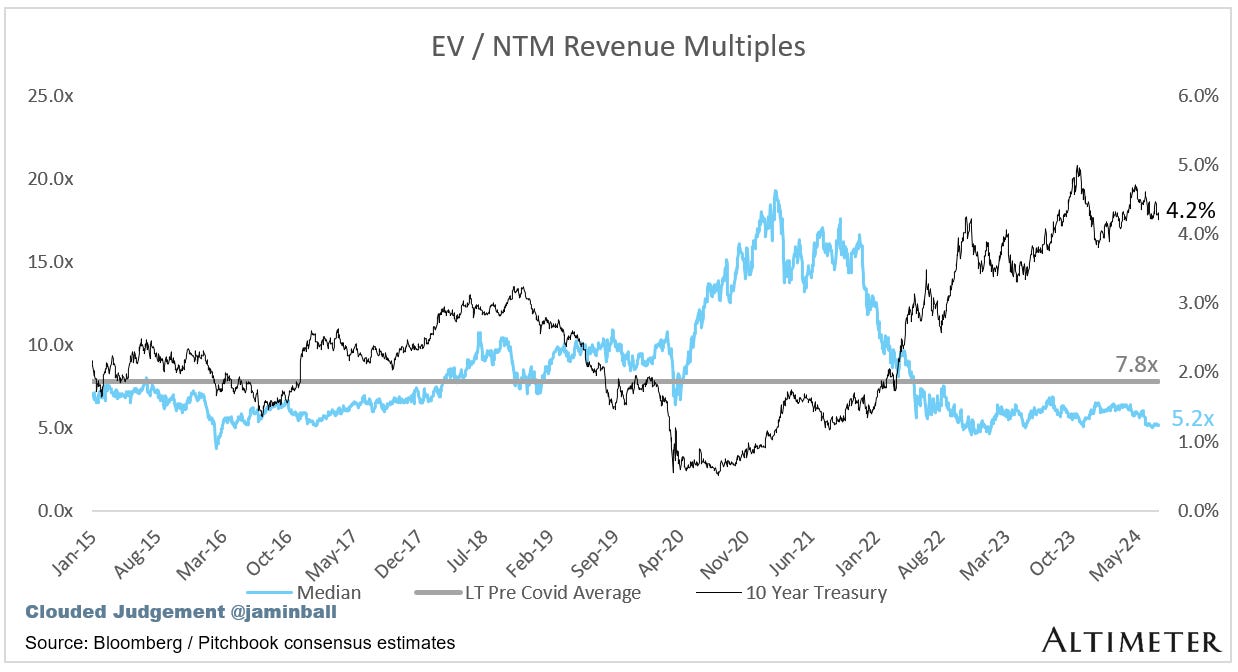

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.2x

Top 5 Median: 15.8x

10Y: 4.2%

Bucketed by Growth. In the buckets below I consider high growth >27% projected NTM growth (I had to update this, as there’s only 1 company projected to grow >30% after this quarter’s earnings), mid growth 15%-27% and low growth <15%

High Growth Median: 10.1x

Mid Growth Median: 8.0x

Low Growth Median: 3.8x

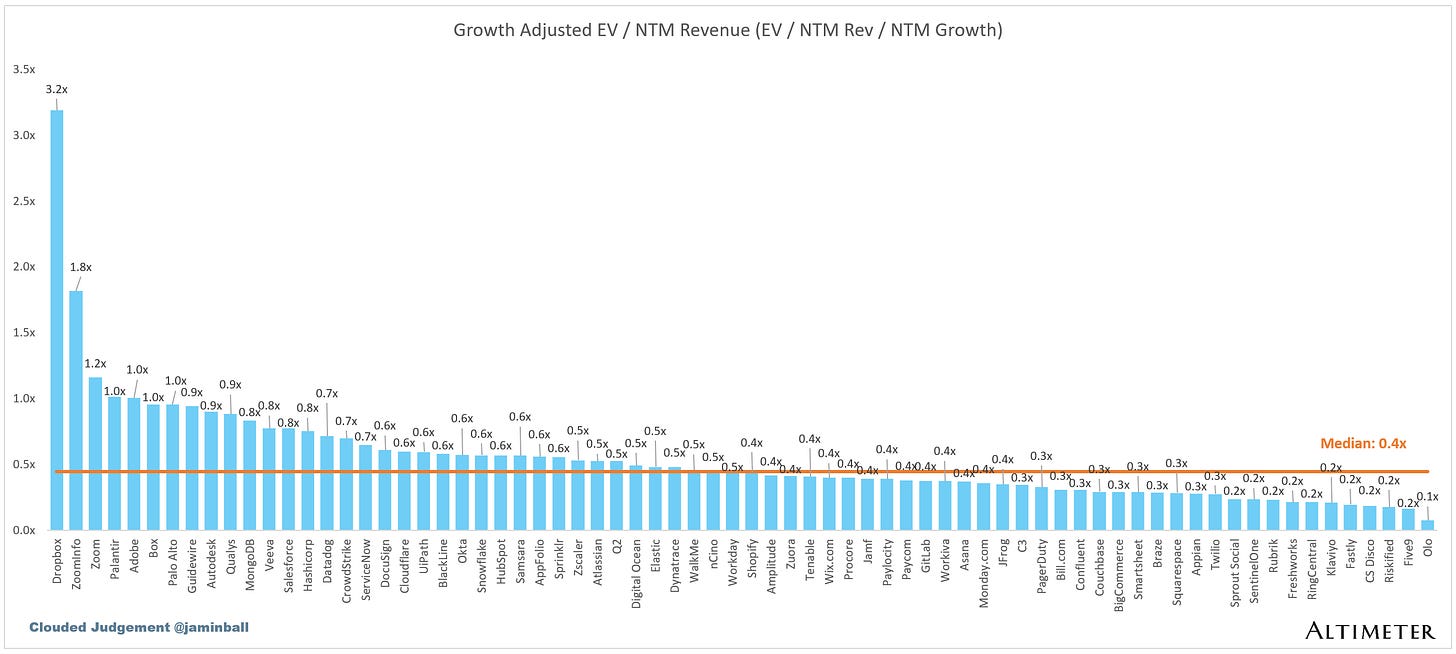

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

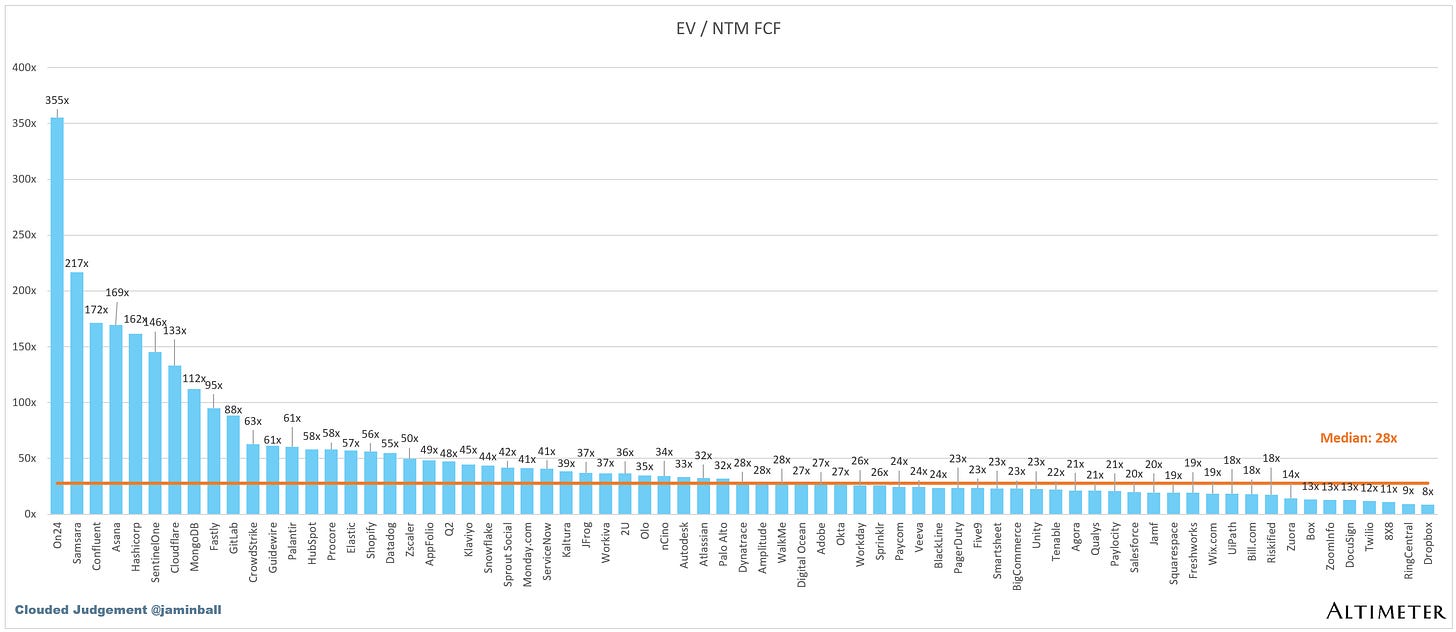

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 12%

Median LTM growth rate: 17%

Median Gross Margin: 75%

Median Operating Margin (10%)

Median FCF Margin: 14%

Median Net Retention: 110%

Median CAC Payback: 53 months

Median S&M % Revenue: 40%

Median R&D % Revenue: 25%

Median G&A % Revenue: 15%

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Great read, thank you for generating the following! One thing I noticed is one of the Comp Output data is missing, is there a chance you can post it?