Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Big Tech Rotation

For the last 18 months Big Tech has been on a tear. So much so that the market created a separate name for them - The Magnificent 7. This group includes Apple, Microsoft, Google, Amazon, Nvidia, Tesla and Meta, and has been responsible for a significant percentage of the overall gains of the Nasdaq. Today, their combine weighting in the Nasdaq is ~40%. If we rewind the clock back to the start of 2023, here’s how the Magnificent 7 has performed from then till now:

Apple +73%. Microsoft +82%, Google +103%, Amazon +119%, Nvidia +722%, Tesla + 108% and Meta +295%

Historic returns! The “trade” over the last 18 months has clearly been to “buy big tech.” Over that same period of time the Nasdaq was +71%.

Big tech benefited greatly from a few things. First, AI tailwinds uniquely advantaged these players. Nvidia is obvious here. But the hyperscalers also saw their cloud computing segments accelerate on the backs of selling large GPU cloud instances. Second, Big Tech showed a lot of operating leverage. We saw significant cuts and layoffs (with simultaneous revenue tailwinds) so bottom lines expanded. Both of these points also happened while the rest of the market broadly struggled. Smaller software companies went through a “SaaS recession.” Non tech companies broadly felt economic pressure as well. So not only was Big Tech seeing tailwinds of their own, but they also looked better RELATIVE to everything else. They were a safe haven. While the Nasdaq was up 71% from the start of 2023, the IWM index (Russell 2000) was up only 27%. The IWM index represents the small-cap segment of the U.S. equity market. It includes a diverse range of companies across various industries, such as healthcare, technology, consumer discretionary, financials, and industrials. To summarize, the last 18 months saw large inflows of investment into Big Tech (and at the expense of other segments). Big Tech really diverged (positively) from the rest of the market.

However, something really interesting happened over the last week. The Big Tech trade reversed. The Nasdaq was down 4%. Apple was down 1%. Microsoft was down 3%. Google was down 4%. Amazon was down 6%. Nvidia was down 5%. Meta was down 7%. Tesla was the lone survivor at +3%. Meanwhile the IWM was up 3%. Big Tech was down big, and the IWM was up big (the absolute figures might now seem big, but remember these were only 1 week changes). So what happened?

It’s hard to say for certain, but I think it boils down to one thing - the markets perception of the relative strength of Big Tech vs the rest of the market weakened. Big Tech squeezed a lot of costs out over the last 18 months. Are there more costs to squeeze (I personally think there could be). The AI tailwind has been huge, but will it continue? Will companies keep spending on GPUs without the clear revenue showing up? Regardless of what you think the answer to these questions are, the fact that the questions themselves are popping up more is a signal of sentiment. At the same time, there appears to be broadening optimism that non-magnificent 7 companies will see earnings tailwind. Look at the tweet below - for the last few quarters the light blue bars (S&P 500 excluding Magnificent 7) have been negative / flat. But the expectation for Q2 is that earnings will tick positive

At the same time, the Nasdaq is trading close to 30x PE, which is very expensive relative to historical averages (closer to 20x).

So in summary - a view started to emerge that the Magnificent 7 may be at a point in time of peak earnings and peak multiple. While the rest of the market was relatively cheaper, and not at peak earnings (meaning earnings could inflect up, as reflected in the tweet). This created a perception of relative strength of non Big Tech (IWM) to Big Tech. And in the same way the relative strength of Big Tech benefited the Magnificent 7 over the last 18 months (large fund flows wound up in Big Tech), those large flows started to leave Big Tech to potentially the perceived next area of strength - IWM.

I don’t necessarily have a view myself. If I had to guess, I think a bit of this “rotation” was a bit overdone? I’m not sure we’re quite at peak earnings yet for Big Tech (earnings start next week!), and I’m not sure we’ll really see the rest of the market inflect up yet (if I had to guess I think we’re false starting that a bit). However, markets will move ahead of either of these shifts, so maybe we see these things play out in next 6 months and the market is simply moving ahead of that 6 month forward look. A lot of people have made a lot of money in Big Tech over the last 18 months, and that “trade” can’t last forever. Big Tech also is not cheap by any stretch. I’m sure there’s a lot of happy folks who are more than will to take some profits off the table. Regardless, next week should be another interesting kick off to earning season!

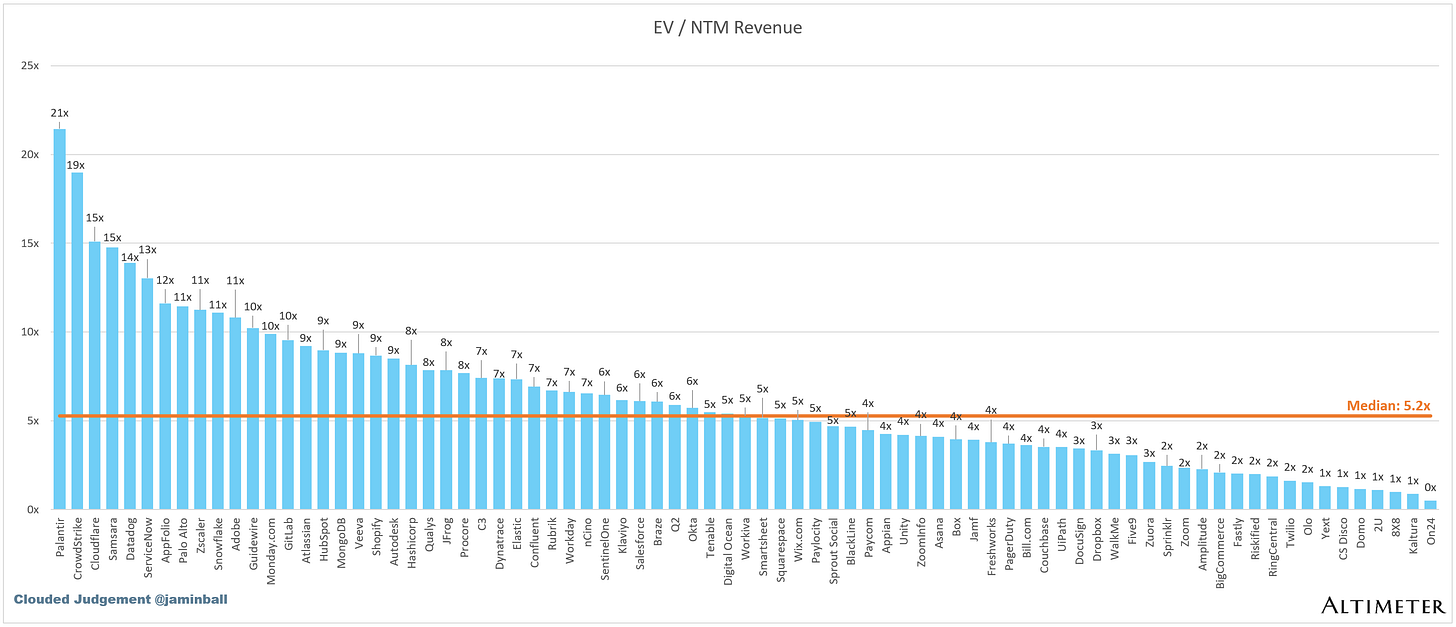

Top 10 EV / NTM Revenue Multiples

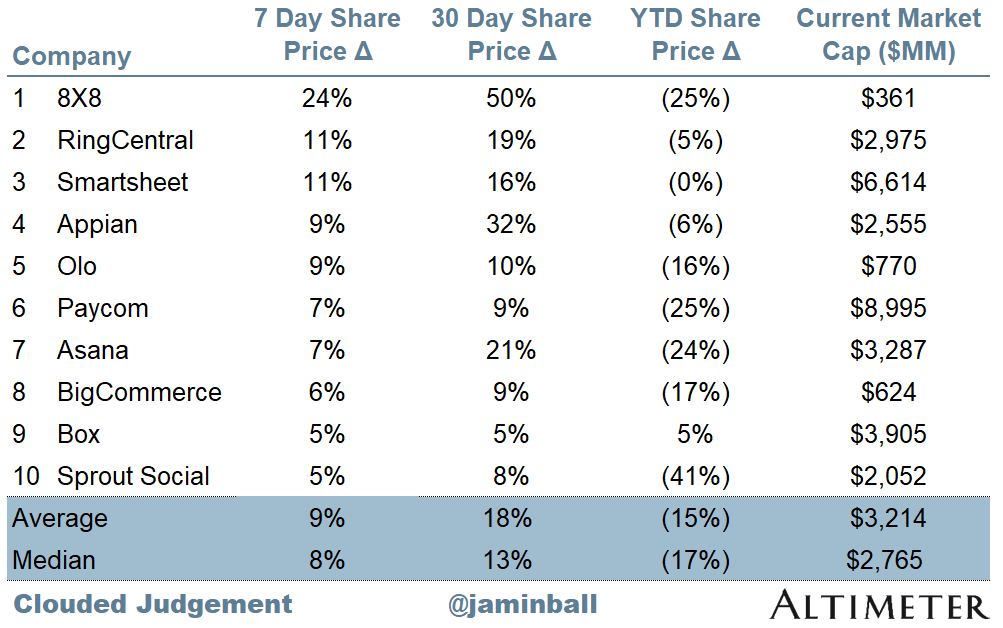

Top 10 Weekly Share Price Movement

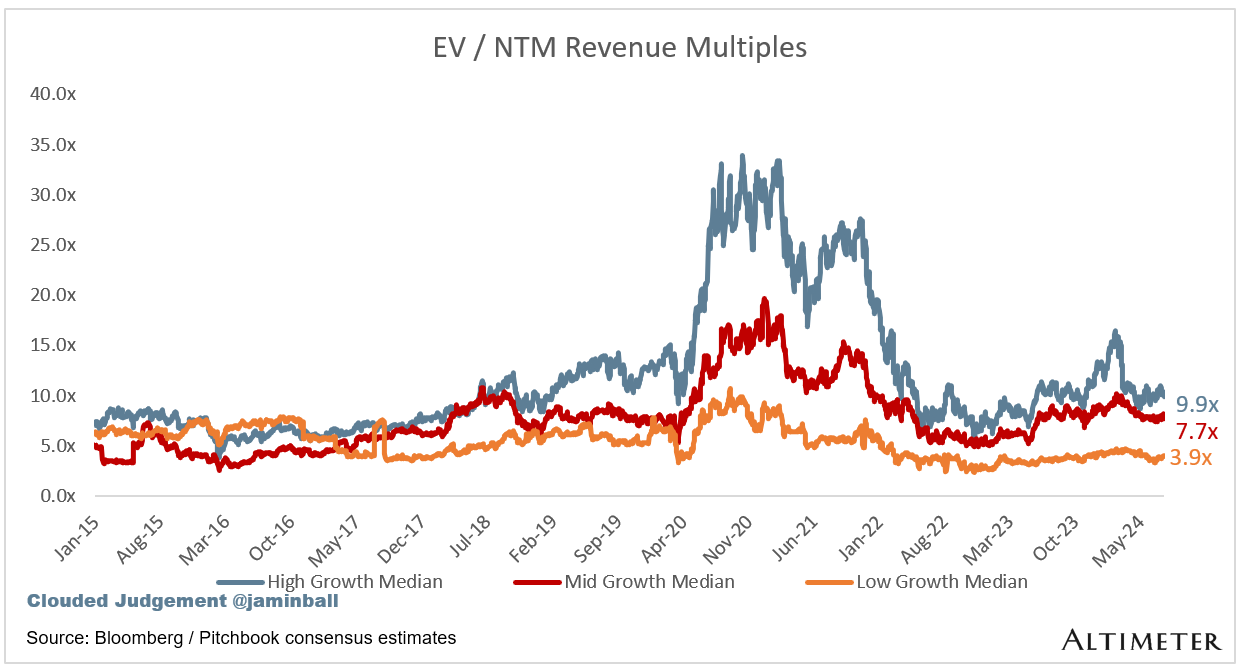

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.2x

Top 5 Median: 15.1x

10Y: 4.2%

Bucketed by Growth. In the buckets below I consider high growth >27% projected NTM growth (I had to update this, as there’s only 1 company projected to grow >30% after this quarter’s earnings), mid growth 15%-27% and low growth <15%

High Growth Median: 9.9x

Mid Growth Median: 7.7x

Low Growth Median: 3.9x

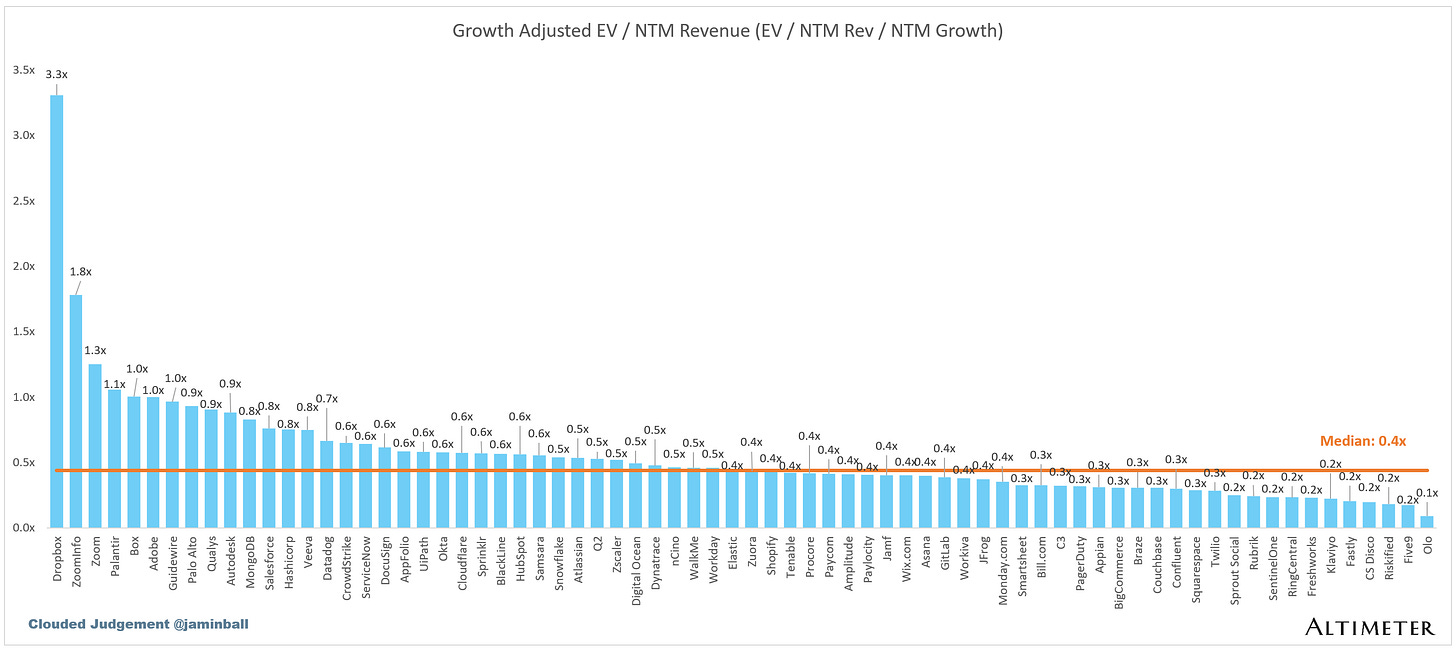

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

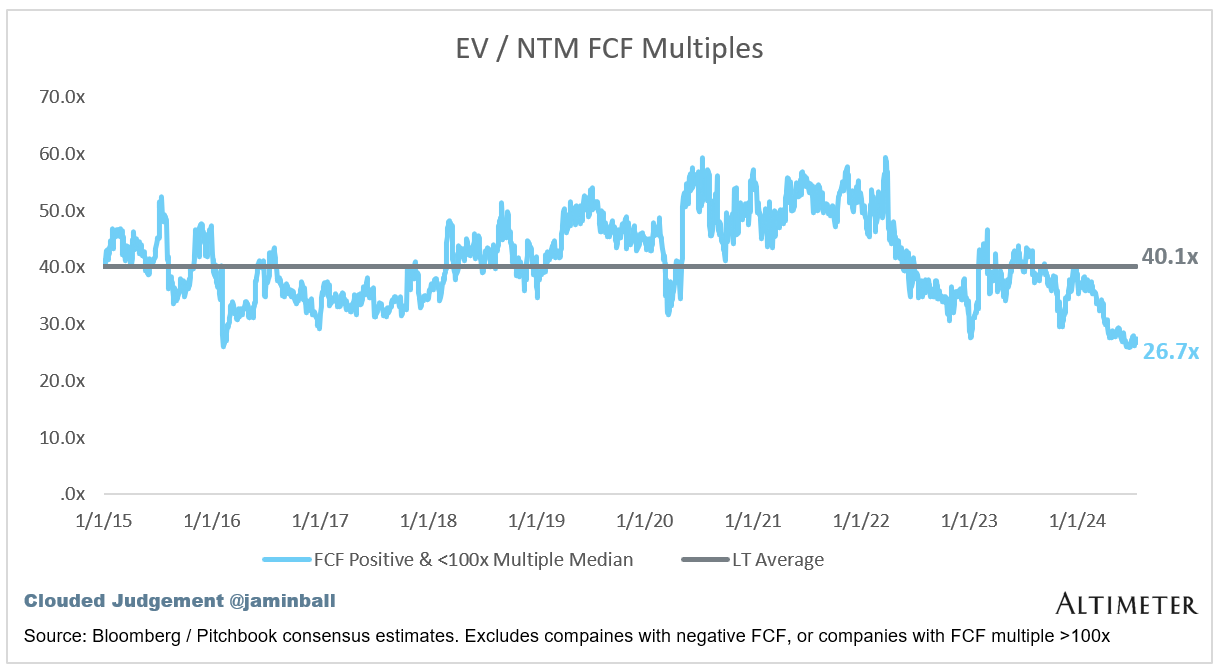

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 12%

Median LTM growth rate: 17%

Median Gross Margin: 75%

Median Operating Margin (10%)

Median FCF Margin: 14%

Median Net Retention: 110%

Median CAC Payback: 53 months

Median S&M % Revenue: 40%

Median R&D % Revenue: 25%

Median G&A % Revenue: 15%

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Interesting perspectives, Jamin, however it likely misses the fact that this week was a major monthly options expiration in the Vix, indexes and stocks. For many of the mega caps, especially NVDA, about 40-50% of their trading volume is options market driven. This week, these options positions started unwinding, market makers started removing their hedges and they had to sell their stock positions. While there was some rotation from mega caps to small caps, most of the move was options unwind in the mega caps. Additionally, on the small cap front, most of the move higher was short covering. If you see which small caps went higher, many of those names were heavily shorted and the short squeeze accentuated the “rotation” narrative.

Want more crazy stuff this week? Well two rumors hit semis. Both turned out to be untrue. #1 Xi in China as rumored to have a stroke early in the week. This is untrue. #2 Trading desks started hearing that a Taiwan invasion by China was imminent. Again untrue.

And then there is the pro-Trump trade that markets started selling stuff that was China dependent and the mega caps which are not liked by his team.

So many undercurrents played out this week…one of the most chaotic I have ever seen.

We live in interesting times and as investors we always have to be on our toes sifting through what is real and what is a mirage.

Cheers and have a good weekend!