Clouded Judgement 7.21.23 - Are Software Companies Bad Businesses?

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Are Software Companies Bad Businesses?

There was some talk last week on the All-In podcast about software companies. Specifically Chamath said this: “From an OpEx perspective these businesses just suck. They don’t generate any free cash flow.” Quite the claim! Does the data support it? Below I’ll talk about why I disagree, but also why there are bits of truth to it.

When I look at a basket of 80 software companies I track, the median 1 year trailing (LTM) free cash flow margin is 5%. When we look at the quarterly trends (below) the data is even better

So no, software companies don’t suck. And they do generate free cash flow. And for everyone screaming “but what about SBC?!?” - SBC absolutely needs to be accounted for. However, treating SBC as a “cash expense” and subtracting it from FCF doesn’t make sense because it simply isn’t cash. The gold standard for all public software companies is GAAP net income in the fullness of time. Every startup and public company should be acutely aware of their SBC expense and dilution. I’d recommend every startup track and report fully diluted share count in every quarterly board meeting in the same way they track and report ARR. It’s important to build the right hygiene early. In general, targeting 1% annual dilution is the gold standard. The right way to think about SBC, in my opinion, is through dilution. SBC is a tax on shareholders that can run out of control. Share dilution can significantly hamper shareholder returns. If we instead looked at FCF per share (FCF / fully diluted share count), that more accurately gives us a view on overall business health that factors in FCF growth as well as share dilution.

There’s a broader discussion here about software companies over their lifecycle. If we had to break apart software companies into two phases of life I’d call those two phases growth mode and maturity mode. In growth mode software companies are early in their S Curve and market penetration. They’re often rapidly hiring engineers (to build more features) and sales reps (to sell the product) in attempts to capture the majority of a market against their competition (both other startups and incumbents). Investing in growth is not only normal, is essential. But there’s a downside to investing in growth: FCF is generally negative. In growth mode most of a companies sales reps are unproductive (recently hired and either not retiring quota, or only retiring a fraction of a full quota). Said another way, the revenue they bring in is less than the salary they’re paid. But this is ok! It takes reps time to ramp up to full efficiency. The challenge is when you have a majority of reps who are ramping, FCF takes a hit. A similar dynamic plays out on the engineering side. When new products are being built and engineers are hired you’re paying those engineers compensation when the products they’re building aren’t generating any revenue (because they haven’t been built yet…). So FCF takes another hit.

But what’s the alternative? Not building more products? Not hiring sales reps and letting competitors take market share? Dinging software companies in growth mode for not attacking their market and building long term moats, seems silly.

This brings us to maturity mode. The promise of software companies is that as they capture market share and further penetrate their S Curve, growth will start to slow (there’s less new business to sell). As growth slows companies will hire fewer sales reps, and the ratio of ramped to un-ramped reps will heavily skew towards ramped. This should really push profitability and FCF generation up. One thing we’ve absolutely seen over the last few quarters is that software companies of all stages can turn down the growth dial and turn up the profitability dial. Wherever you stand on the SBC topic, what’s clear is that in 3 quarters software companies have drastically improved their margins. And this isn’t just a few outliers. The entire basket has drastically improved margins. You can see this in the two charts below as growth has tapered significantly and FCF picked up. The first few quarters on the chart are skewed by Covid pull forward growth + margins.

The big caveat / assumption here is that by the time software companies get to maturity mode they have enough of a moat to not get disrupted (and thus farm FCF). Many software companies will get disrupted before they hit maturity mode (which means they never generate meaningful FCF!). And for most of the software universe today, their present valuation is more heavily weighted towards outer year cash flows. If those cash flows don’t come in the magnitude assumed today (~20%+ FCF margins at maturity), then their valuation today is inflated. Unfortunately for many, the assumptions built into their current revenue multiple will never come true as they get disrupted before they can become a platform with enduring moats

The other challenge is that rarely are companies, even the most mature software companies, truly operating in maturity mode. Just about every business looks to stack S Curves. Let’s look at Salesforce - they may be in maturity mode in their core CRM business, but they also have marketing, commerce and data cloud products that are not in maturity mode. So even the most mature software businesses are still operating, to some extent, in growth mode. We therefore have to make assumptions about future profitability and FCF generation. I’d argue the data we have today heavily supports the claim that for the right businesses FCF generation will be meaningful in maturity mode.

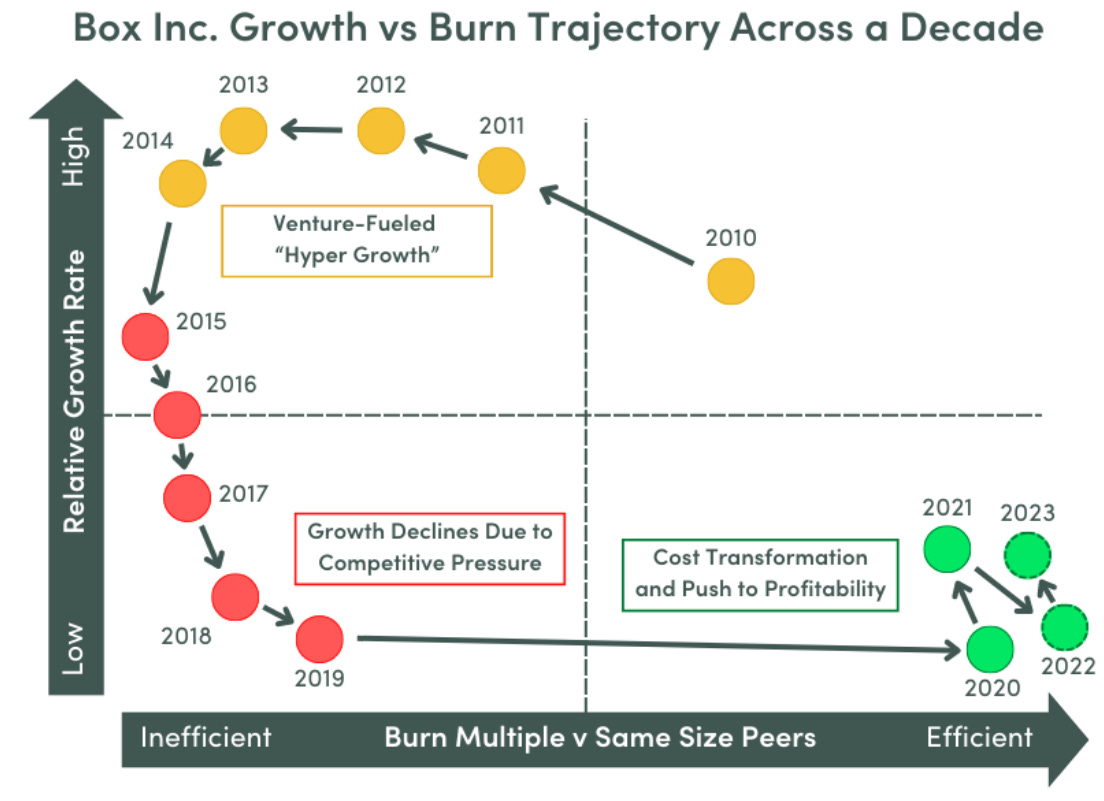

If we’re looking for a case study on how software companies transition from growth mode to maturity mode, Box gives us a good example. When Box went public it was growing at 70% with negative 60% FCF margins (negative 80% if you subtract SBC). Today it’s growing at 10% with 30% FCF margins, and trading at ~15x NTM FCF. The tradeoff from growth mode to maturity mode is quite clear! And this is in the face of stiff competition from large players like Microsoft. We can ask the question - was this type of transformation predictable? Can we expect software companies today operating in growth mode (shi*ty software companies as Chamath would call them) to follow a similar trajectory? I went back and looked at an old research report from Morgan Stanley from 2015 (believe this was after their first quarter as a public company). What I found was incredibly interesting. In March 2015 the Morgan Stanley model predicted Box would generate $400m of FCF in 2025. If I look at the most recent Morgan Stanley research model (from May 2023), the current prediction for FCF in 2025 is $468m! It really hasn’t changed much from 8 years ago! In other words, these transitions can be in fact predictable. Here’s the snipped from their March 12, 2015 base case assumption:

What’s interesting is that despite this transformation, the stock is only up ~120% from it’s IPO price of $14 in early 2015. Despite making this transition successfully from growth mode to maturity mode the stock hasn’t been rewarded. Why? Well, for one, the expectations for FCF haven’t really gone up! The numbers have largely stayed the same. And while the FCF number is on pace, revenue is actually lower than expected (comparing to 2015 estimates). In other words, the company has grown slower, but become more profitable (FCF margin is high).

I’ll end with a takeaway - every software company should plan to hit terminal FCF margins (~30%) by the time revenue growth slows to ~10%. If you can’t, or this isn’t possible, your multiple today should be dinged meaningfully (think trading at1-2x revenue). This is where Chamath is absolutely correct - there are a number of software companies today who will never hit these kind of terminal margins (products aren’t defensible enough, market isn’t big enough, point solutions not platforms, etc) to support even 10% growth at scale (or terminal FCF margins). The reality is these companies today should be trading ~2x revenue. Most of them aren’t, and are trading much higher. It’s hard to know who will and won’t make the transition to hitting terminal FCF margins at scale, but for those unsuccessful the penalties will be harsh (see Twilio stock and how it’s re-rated to 2x revenue).

Here’s a great graphic from the Scale Ventures team on Box’s transition. Article here

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

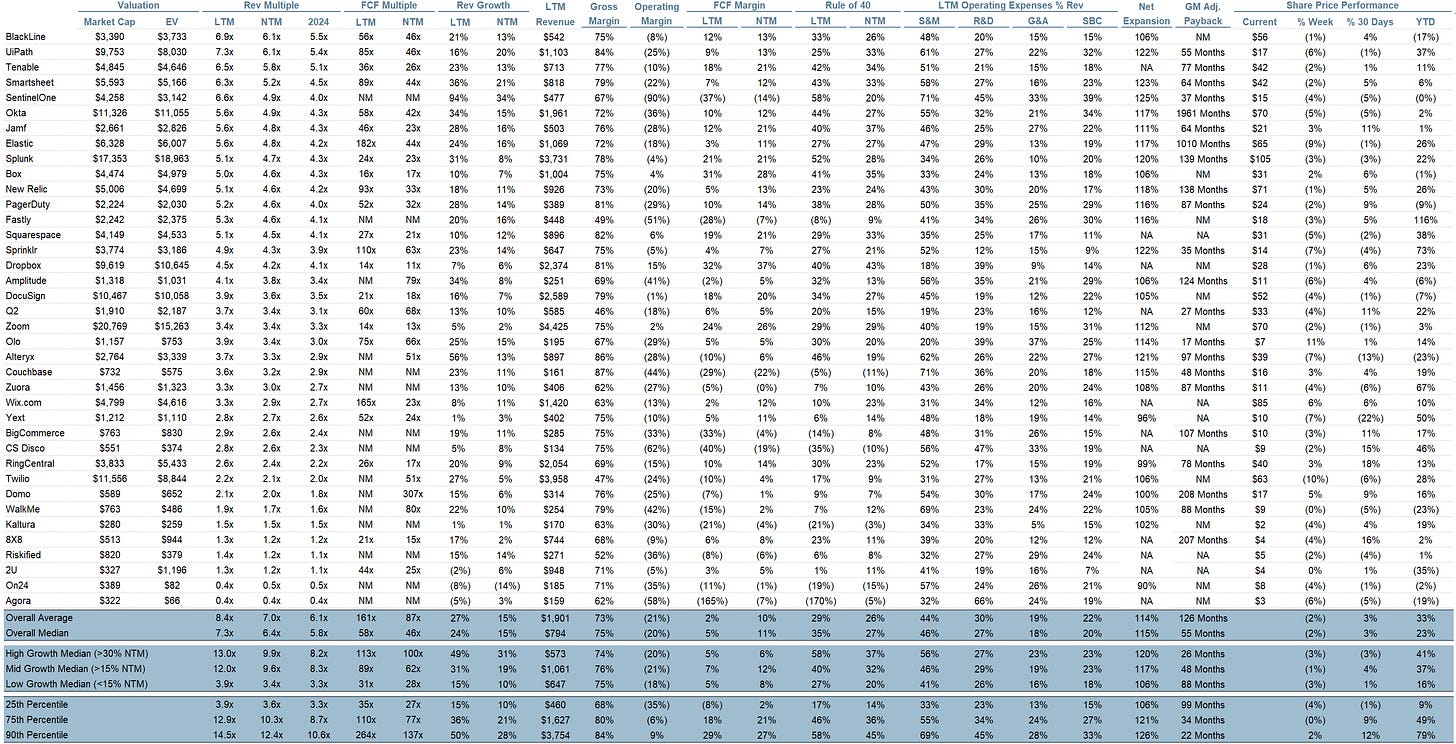

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 6.4x

Top 5 Median: 16.2x

10Y: 3.9%

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 9.9x

Mid Growth Median: 9.6x

Low Growth Median: 3.4x

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

EV / NTM FCF

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 15%

Median LTM growth rate: 24%

Median Gross Margin: 75%

Median Operating Margin (20%)

Median FCF Margin: 5%

Median Net Retention: 115%

Median CAC Payback: 57 months

Median S&M % Revenue: 46%

Median R&D % Revenue: 27%

Median G&A % Revenue: 18%

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Jamin, I appreciate your acknowledgement that SBC needs to be considered, but I believe your treatment is overly generous. Let's use your Box example.

Last year SBC was $185m. To roughly account for dilution, let's divide that by the current share price of ~$31 to get ~6m shares. That would equate to ~4% dilution, or 4x your gold standard.

I think you're also missing a step. Box's diluted share count has declined from 155.8m at end-FY21 to 150.2m at end-FY23. However, to achieve this Box spent $987m on share buybacks. That works out to $176/sh. That's a lot of shareholder cash flow out the door.

A more reasonable accounting for SBC, in my opinion, is to view it as a source of financing - you're borrowing cash from your employees in exchange for your shares. So, move the SBC impact out of operating cash flow and into financing cash flow (where the cash outflow from buybacks resides, by the way).

Now you've got a more reasonable representation of cash flow to shareholders. Under this treatment, Box's FCF margin is ~10%. And now you have a Rule of 20-25 company, which is where I believe enterprise software truly resides in maturity (maybe Rule of 30, and excepting the few exceptions with true network effects).

Jamin, one of your best articles to date IMO!

“ I’ll end with a takeaway - every software company should plan to hit terminal FCF margins (~30%) by the time revenue growth slows to ~10%. If you can’t, or this isn’t possible, your multiple today should be dinged meaningfully (think trading at1-2x revenue)”

You have noted that a number of software companies are not likely to meet this FCF margin hurdle so what predictive criteria would you suggest that identifies the failures BEFORE the market punished then with 2X revenue multiples??

Also, care to opine on the generative AI threat to software (SaaS) when coding can be accomplished with voice requests? Some 60%+ of GitHub software is generative AI created so what does this mean to the whole SaaS sector?