Clouded Judgement - 7.24.20

Every week I’ll provide updates on the latest trends in SaaS valuations, earnings announcements, and highlight any noteworthy news. Follow along to stay up to date!

Highlight of the Week - Earning Season!

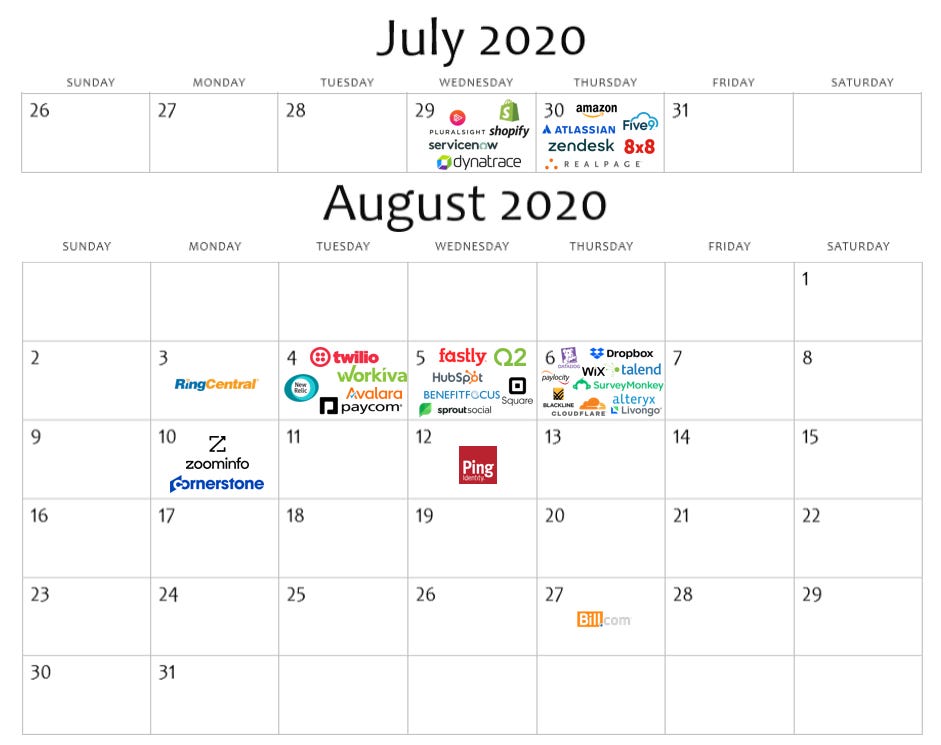

Next week kicks off SaaS earnings season. Below is a calendar of earnings dates. Many SaaS businesses pulled back some last week, and then recovered a bit in the first half of this week before experiencing a smaller pullback end of week. Lots of movement going into earnings! In almost poetic fashion Shopify (who has held the top spot for the highest SaaS multiple for the entire quarter) will kick off earnings season with a PRE MARKET release on Wednesday 7/29. Buckle up! Every SaaS company to report will have gone through an entire quarter of Covid-affected business. We’ll really see how immune software is to the pandemic shortly! My take is the tier 1, cream of the crop, companies will surprise us even more than expectations (I really think the forward revenue estimates for a number of businesses are WAY to low), while many companies will fail to live up to elevated expectations. And I don’t simply mean this group will “miss earnings.” I think the buy-side has already factored in heavy beats for the universe of SaaS businesses (why pretty much every SaaS stock has run up over the last couple months), and I don’t think every businesses will beat with the margin they’re expected to. I’m not anticipating Covid to be a tide that lifts all ships. I think it’s a tide that will disproportionately lift some ships!

Earnings Summary

Microsoft announced earnings this week. For the quarter ending 6/30/20 they did $38B of revenue, beating consensus estimates of ~$36B. Intelligent Cloud (includes Azure) revenue was $13.4B (+19% YoY). Azure revenue grew 50% YoY. Productivity and Business Process (includes Teams) rev was $11.8B (+8% YoY)

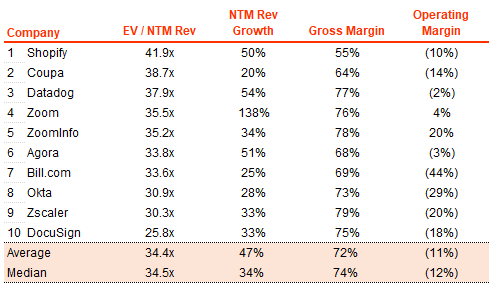

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movers

Update on Multiples

SaaS businesses are valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

Overall Stats:

Overall Median: 12.9x

Top 5 Median: 37.9x

3 Month Trailing Average: 11.9x

1 Year Trailing Average: 10.5x

Bucketed by Growth:

High Growth Median: 25.2x

Mid Growth Median: 13.3x

Low Growth Median: 9.1x

Operating Metrics

Median NTM growth rate: 22%

Median LTM growth rate: 34%

Median Gross Margin: 73%

Median Operating Margin (15%)

Median Net Retention: 117%

Median CAC Payback: 28 months

News

Slack filed an EU competition complaint against Microsoft. The main claim is that “Microsoft has illegally tied its Teams product into its market-dominant Office productivity suite, force installing it for millions, blocking its removal, and hiding the true cost to enterprise customers.”

Shopify / Affirm announced that Affirm will exclusively power Shop Pay installments in the US

Twilio hired Michelle Grover as their first CIO

New Relic announced they are open sourcing a number of their instrumentation agents

SPACs are all the rage as an alternative way for companies to go public. If you’d like to learn more about the SPAC process I suggest reading my friend John Luttig’s great post

Comps Output

Rule of 40 shows LTM growth rate + LTM GAAP Operating Margin

Gross Margin Adjusted Payback: [(Previous Q S&M) / (Net New Quarterly Implied ARR x Gross Margin)] x 12

Thanks for the weekly reports! Will $LVGO be added to the reports?

@Jamin excellent content and great inside in Saas growth to understand in multiples can we also post on India Saas Data which we have have big community here and they would be equally excited to follow .. Your Thought ?.We can help on some data points if you would need so ..Population is too large who's moved to Bay but local Founders are looking the data points as well ...