Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Threads

Meta’s Twitter alternative was released this week (Wednesday), and it appears to be a smashing success. Thursday was day 2 , and as of this writing (10pm on Thursday) there are 58m accounts already created. That’s already ~15% of Twitter’s monthly active users! We’ll have to wait and see what retention is like a few weeks / months, but initial signups have been super impressive.

If you want to follow along I’ll be testing out Threads, and my profile is: here https://www.threads.net/@jaminball

Macro Update

This week we saw the 10Y rate go >4%. What is driving this? Couple things. First, we got the FOMC Minutes (Fed participants). The key headline was almost all officials expected more rate increases in ‘23 and they saw the possibility of avoiding a downturn almost as likely as a mild recession. That second piece is quite significant. On Thursday morning we got another data point - the ADP jobs data. That report showed the economy added 497k jobs in June vs expectations of 225k. That was the second largest ADP jobs report in 12 years! The strength was driven primarily by a jump in leisure, hospitality and construction.

These data points point to a strong economy, and a strong economy gives the Fed more wiggle room to hike rates further. Why? A strong economy generally means consumers have the capacity to keep spending, and the capacity to absorb future hikes. A strong labor market also is a leading indicator for inflation staying sticky. For inflation to come down consumers need to stop spending. And to put it bluntly, generally people need to either loose their job see their income stream decrease before they stop spending. All of this to say - the jobs report data from ADP suggest the opposite - the labor market is incredibly strong. This all points to an increased chance of more rate hikes in the future.

There are two ways to look at this as it relates to the impact on growth software stocks. On one hand - strong economy points to a potential soft landing. Great! But at the same time, as discussed above, strong economy points to further rate hikes (bad for software multiples as I’ve discussed at length in the past). Software stocks have already seen quite a bit of multiple expansion since the start of the year. It’s looking like the headwind of rising rates should overcome the tailwind of a soft landing (in the short term). This will be even more true for unprofitable growth software stocks without much FCF valuation support.

We getting closer to Q2 earnings season, so we’ll see if fundamentals have improved enough to see companies raise full year guidance.

Top 10 EV / NTM Revenue Multiples

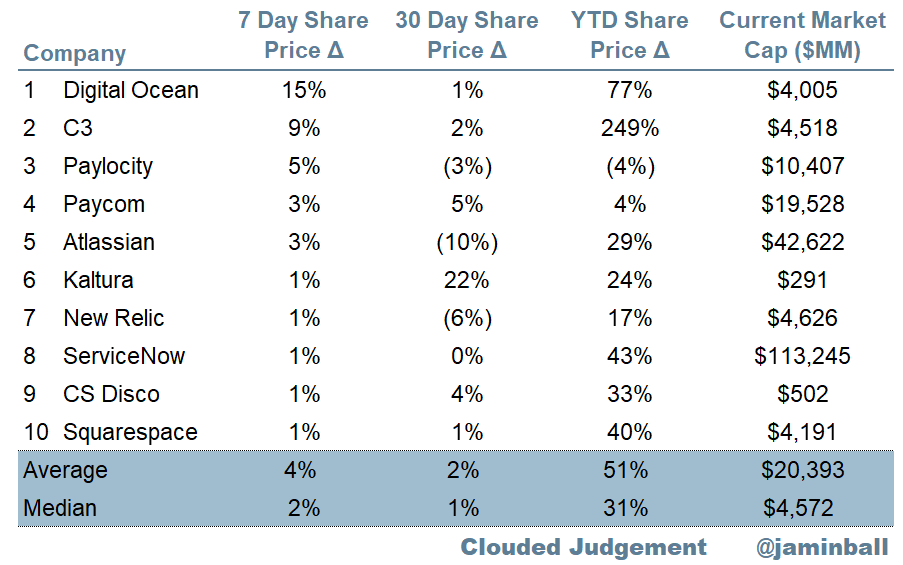

Top 10 Weekly Share Price Movement

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 6.0x

Top 5 Median: 15.2x

10Y: 4.0%

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 9.3x

Mid Growth Median: 8.4x

Low Growth Median: 3.5x

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

EV / NTM FCF

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 15%

Median LTM growth rate: 24%

Median Gross Margin: 75%

Median Operating Margin (20%)

Median FCF Margin: 5%

Median Net Retention: 115%

Median CAC Payback: 57 months

Median S&M % Revenue: 46%

Median R&D % Revenue: 27%

Median G&A % Revenue: 18%

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

🤝

Hi Jamin,

This is amazing work and really insightful! Can you please share the source data you used to create the EV/NTM Revenue and EV/NTM Revenue Multiples charts? Would love to recreate in a different format, and of course, will give you attribution credit!