Clouded Judgement 8.1.25 - The AI Operating Model

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

The AI Operating Model

One of the biggest debates in every platform shift is: do the incumbents win, or do the startups take over?

On one hand, incumbents have massive advantages. They’ve got customer relationships, distribution, brand, and deep integration into existing platforms. But they also carry a lot of baggage. There’s the classic innovator’s dilemma, sure. But even more importantly, it’s just harder for them to adopt entirely new operating models. They’ve got headcount. Process. Politics. Comittees. etc. They’re optimized for the last paradigm. Not the next one.

And that’s where startups (can) win.

It’s not just because they’re more agile or better at writing code with the latest SDK or quicker to embrace the benefits of the newer technologies. It’s because in every major transition, there’s a completely new way of working, and startups adopt it earlier. That shift in how the company operates day to day ends up compounding into way more output, way more speed, and way more upside!

You saw this during the SaaS transition. The old on-prem software companies were built around field sales, flying across the country, taking clients to dinner, sitting courtside with the CIO. SaaS startups flipped the script. They ran inside sales, drove demand through digital ads, optimized self-serve funnels. It wasn’t just new products. It was a new playbook. And the companies that adopted it faster ran laps around the ones who didn’t.

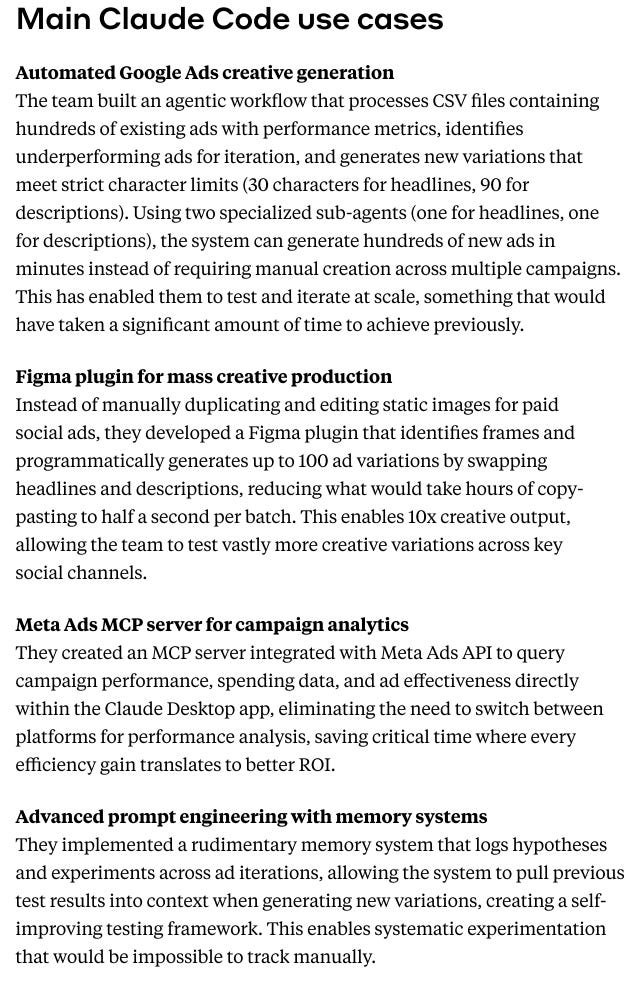

We’re about to see the same thing happen again in AI. I got motivated to write this post after scrolling through this thread on X. Which led me to this paper from Anthropic on how they’re using Claude Code. Some excerpts below on use cases for Claude Code on growth marketing:

Imagine company A that does growth marketing the “old way” and company B that does growth marketing this way. How could company A compete?? Now extrapolate this out to every layer and department of the org.

The advantage isn’t just “we’re using better models” or “we built a smarter chatbot.” The real edge is building a company that runs differently because of AI. One where AI shows up in every corner of the org, not as a bolt-on, but as part of the muscle memory.

That means code gets written faster because engineers are pair-programming with AI. GTM teams are prepping accounts and personalizing outreach with the help of agents. Forecasts are AI-generated. Customer support is automated. Internal tools have copilots by default. The whole company moves faster, not by grinding harder, but by operating differently.

That’s what most incumbents miss. They see AI as a product feature. But the real unlock is rethinking the operating model. And often times it’s really hard to rethink the operating model because org structures are so rigid and internal politics are impossible to get rid of. That’s the real playbook shift. And that’s where the alpha is.

For startups, I think you have to adopt these new playbooks or you just won’t run at the right speed. This is your true advantage! And hiring “industry veterans” who were experts in the old playbooks might not be as relevant anymore. Keith Rabois’ tweet from Tuesday nailed it:

Cloud Giants

AWS (Amazon), Azure (Microsoft), and Google Cloud (Google) all reported earnings this week. Summary below.

AWS (Amazon): $123B run rate growing 17% YoY (last Q grew 17%)

Azure (Microsoft): ~$86B run rate (estimate) growing 39% YoY (last Q grew 35%)

Google Cloud (includes GSuite): $54B run rate growing 32% YoY (last Q grew 28%, neither are cc)

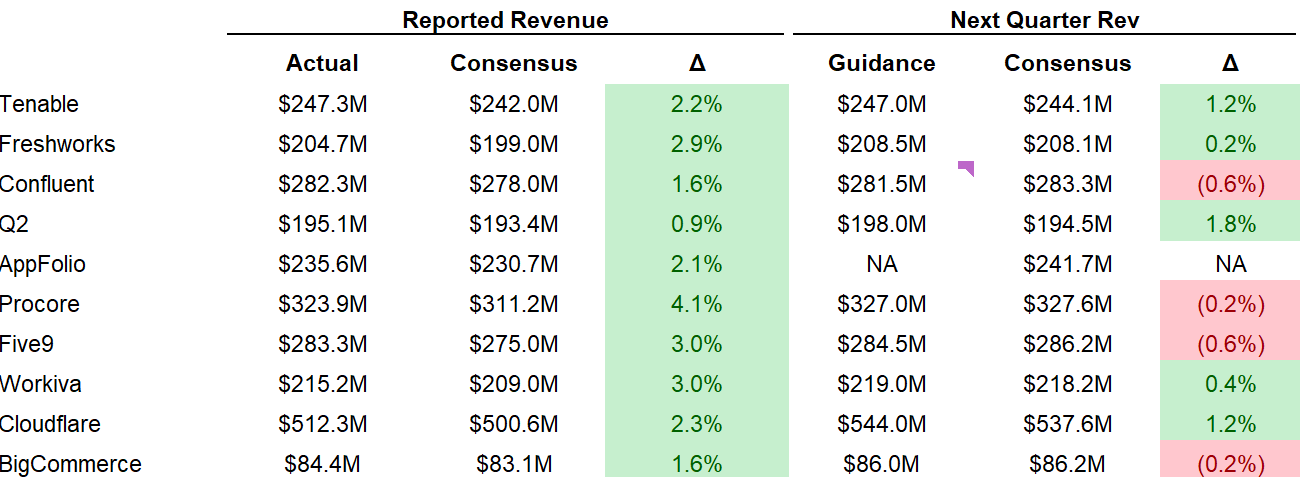

Quarterly Reports Summary

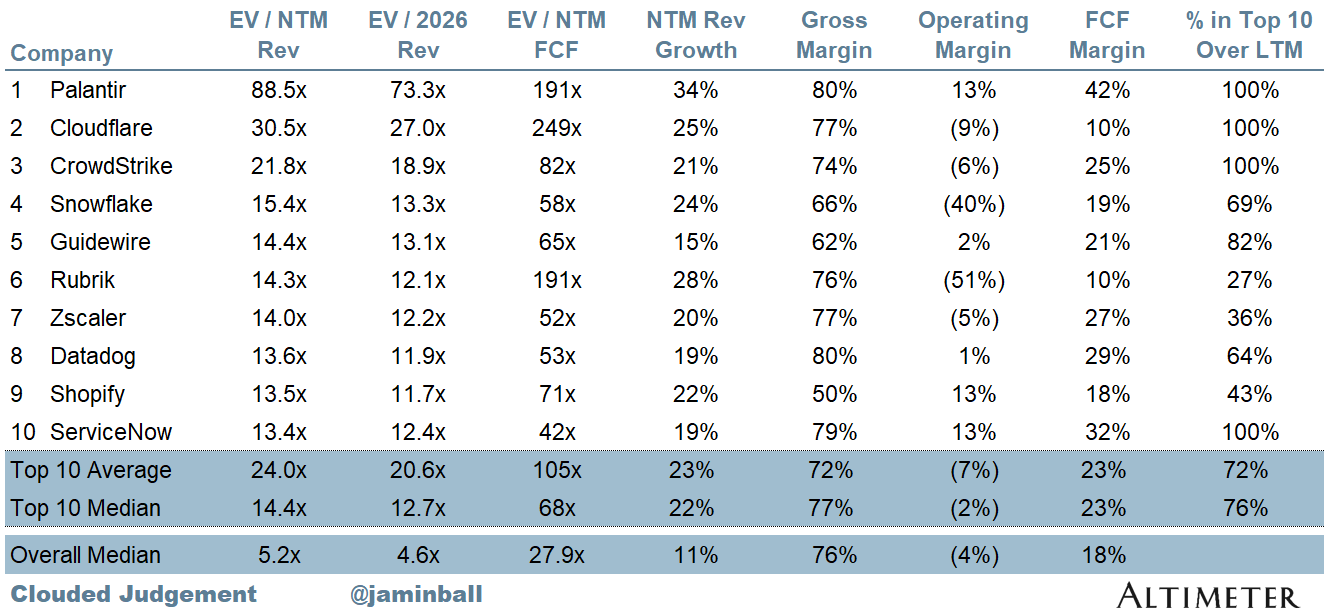

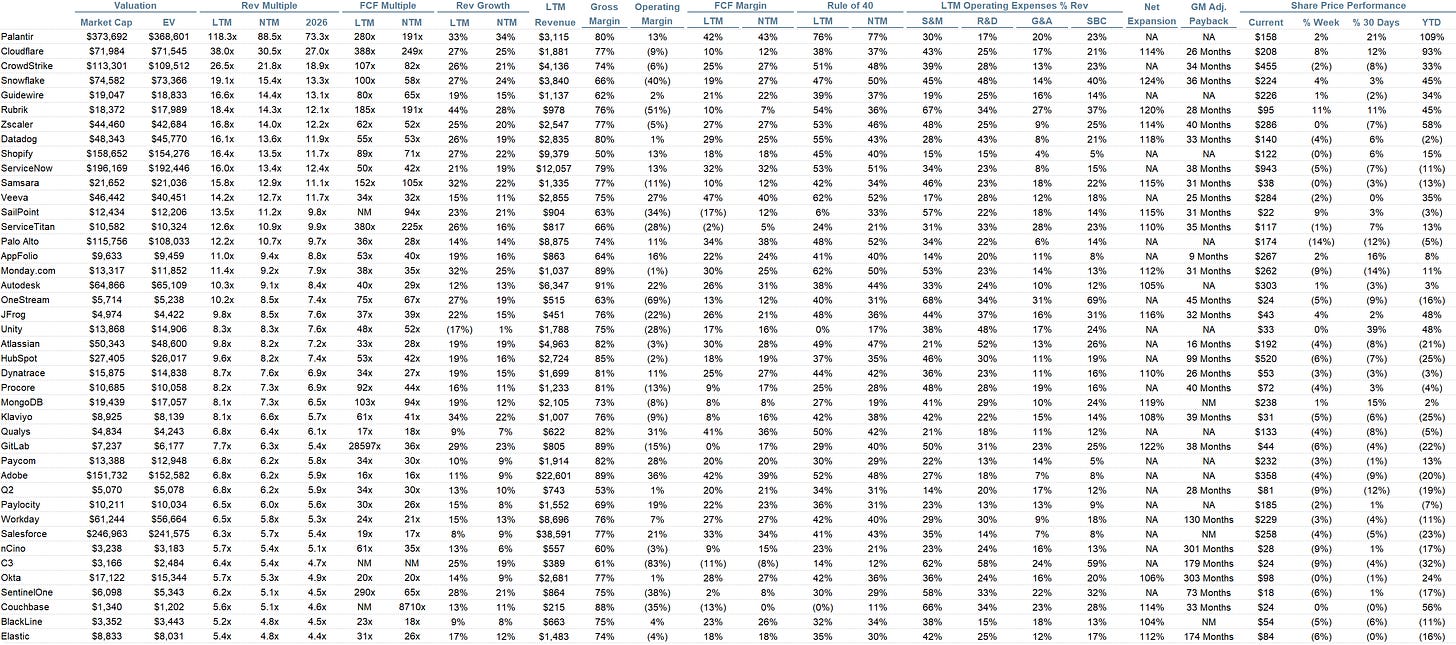

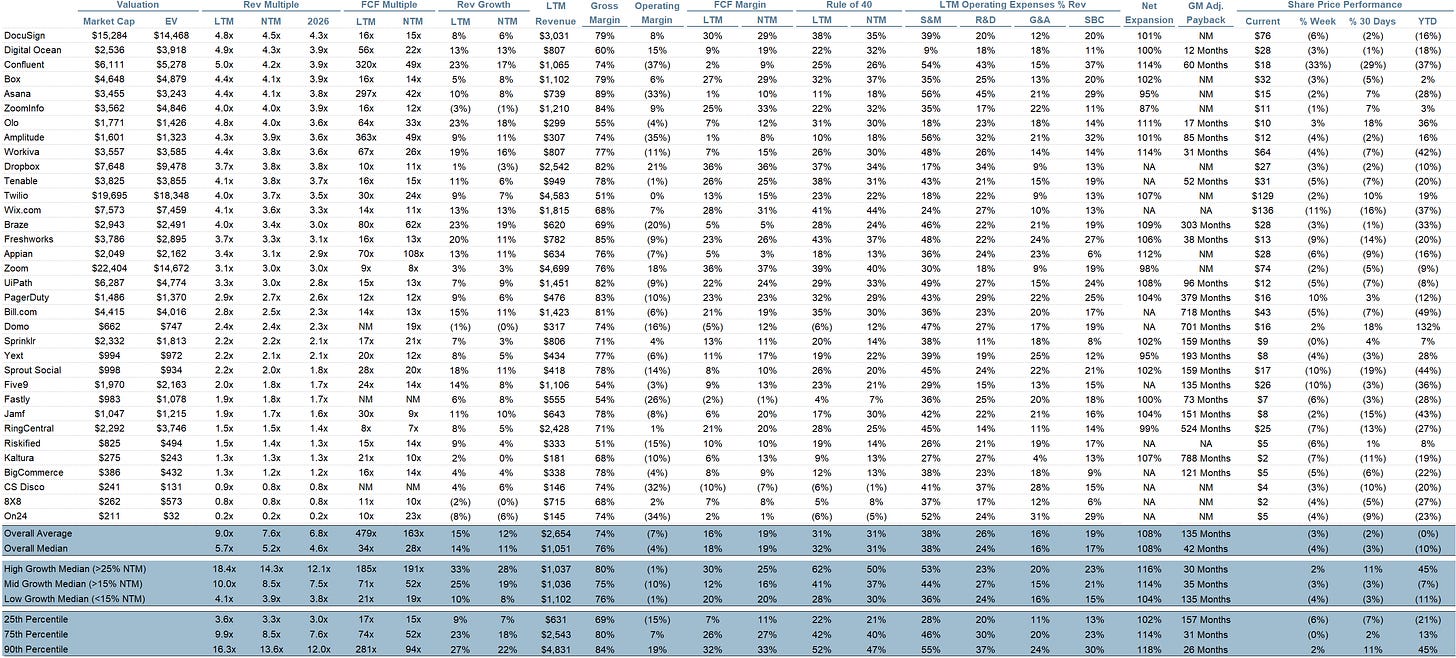

Top 10 EV / NTM Revenue Multiples

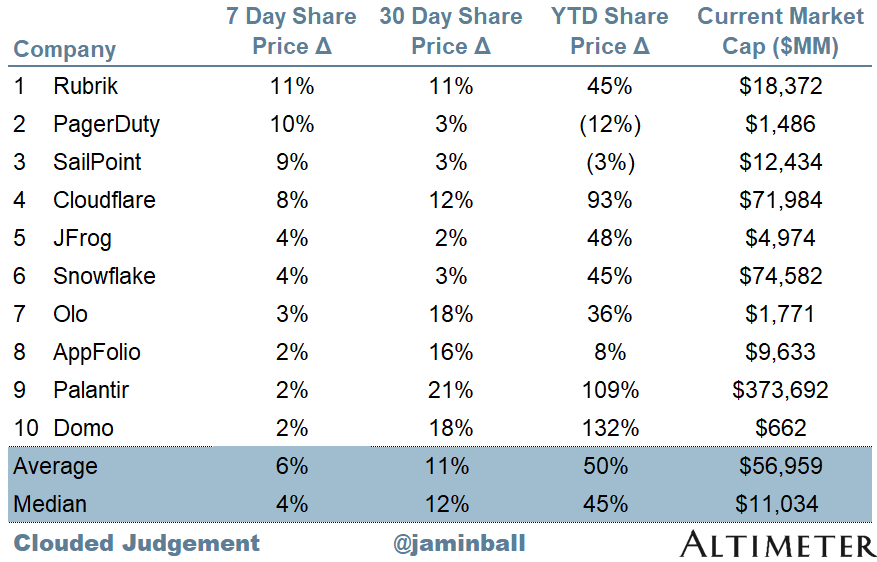

Top 10 Weekly Share Price Movement

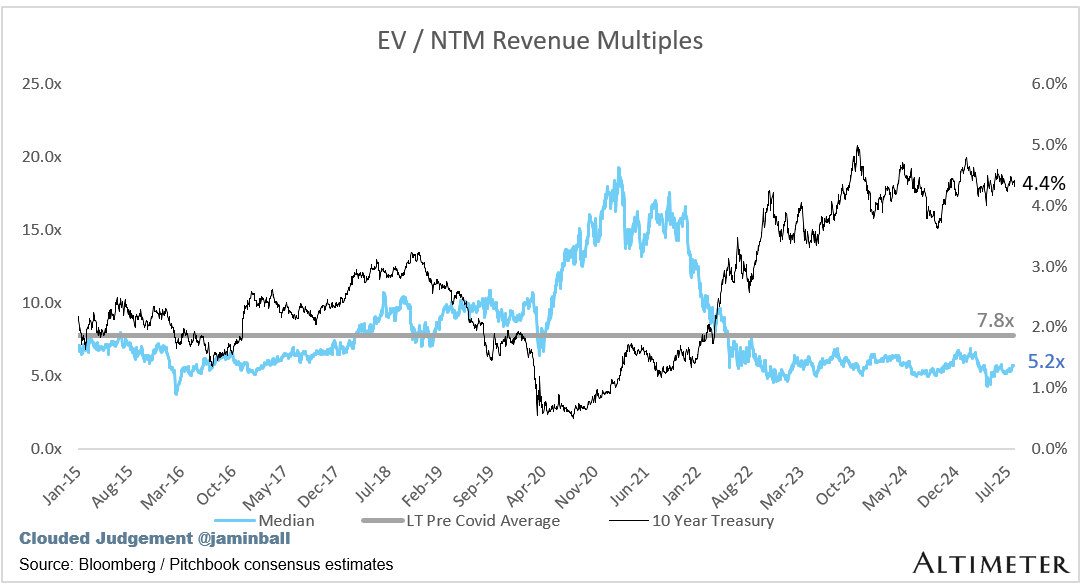

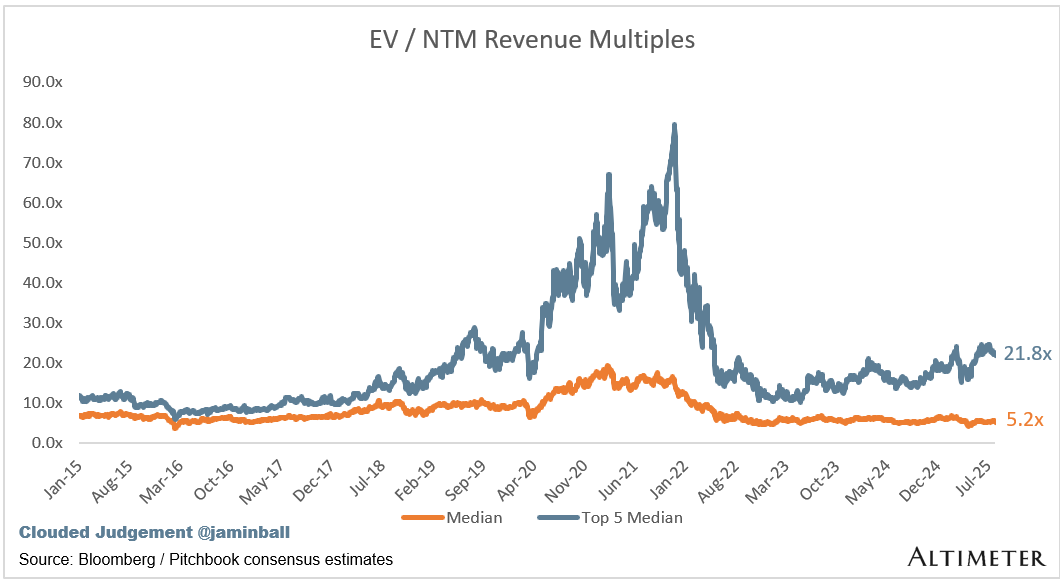

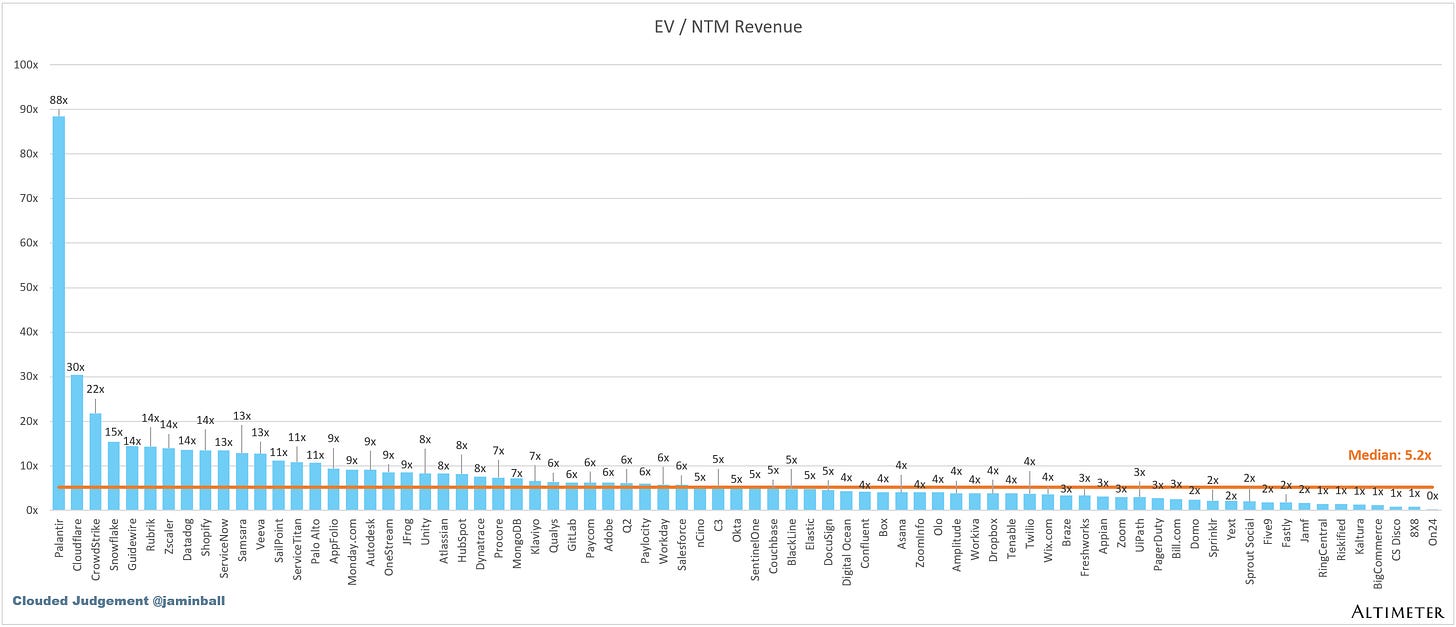

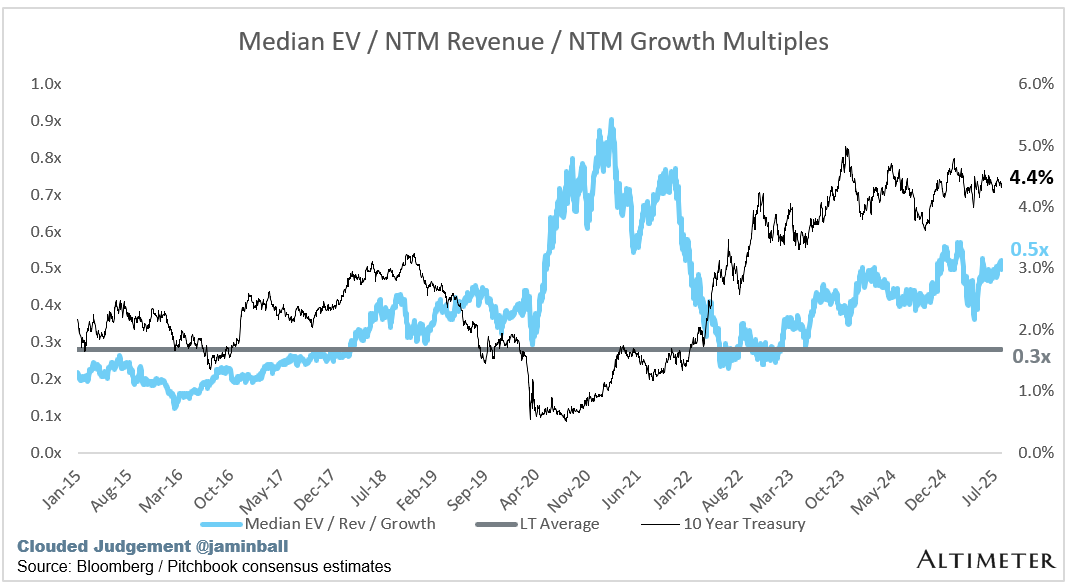

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.2x

Top 5 Median: 21.8x

10Y: 4.4%

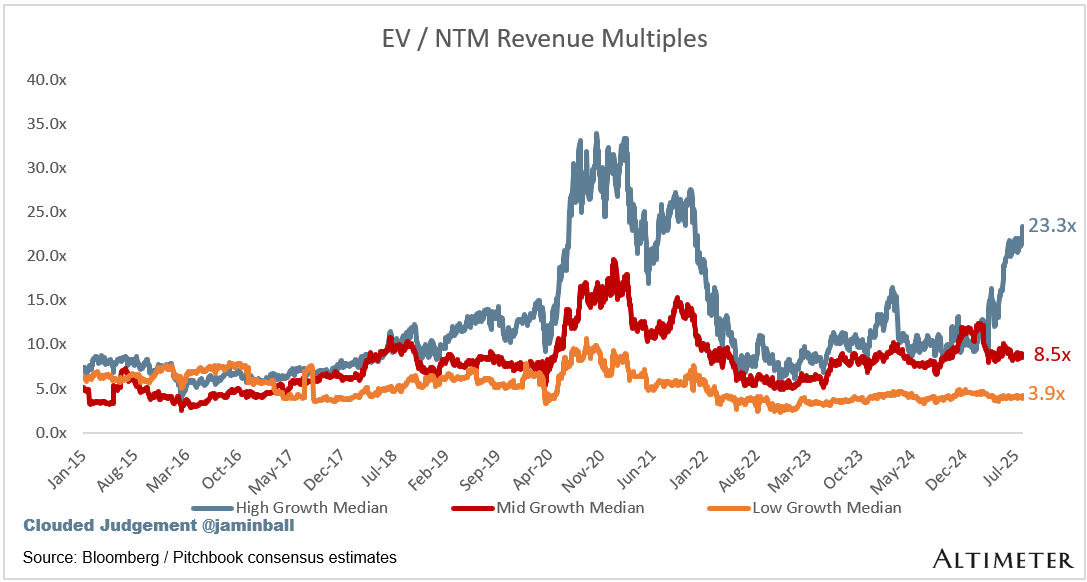

Bucketed by Growth. In the buckets below I consider high growth >25% projected NTM growth, mid growth 15%-25% and low growth <15%

High Growth Median: 23.3x

Mid Growth Median: 8.5x

Low Growth Median: 3.9x

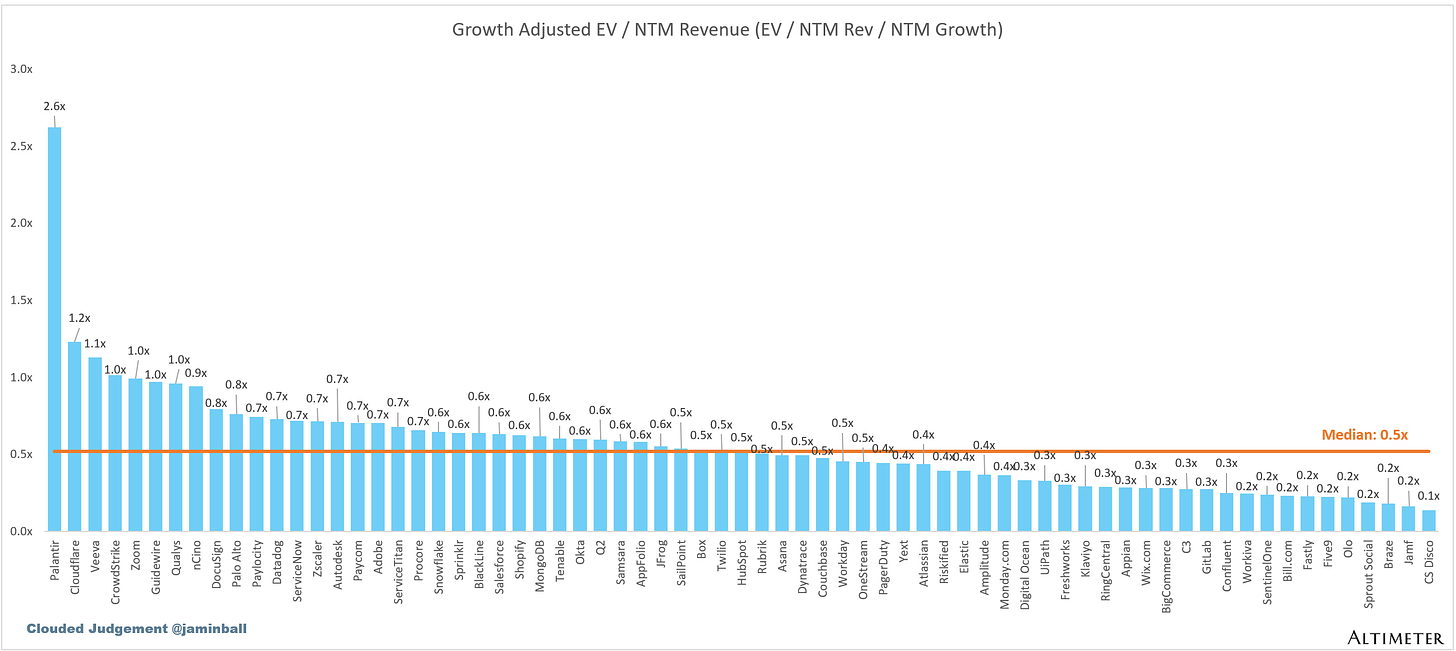

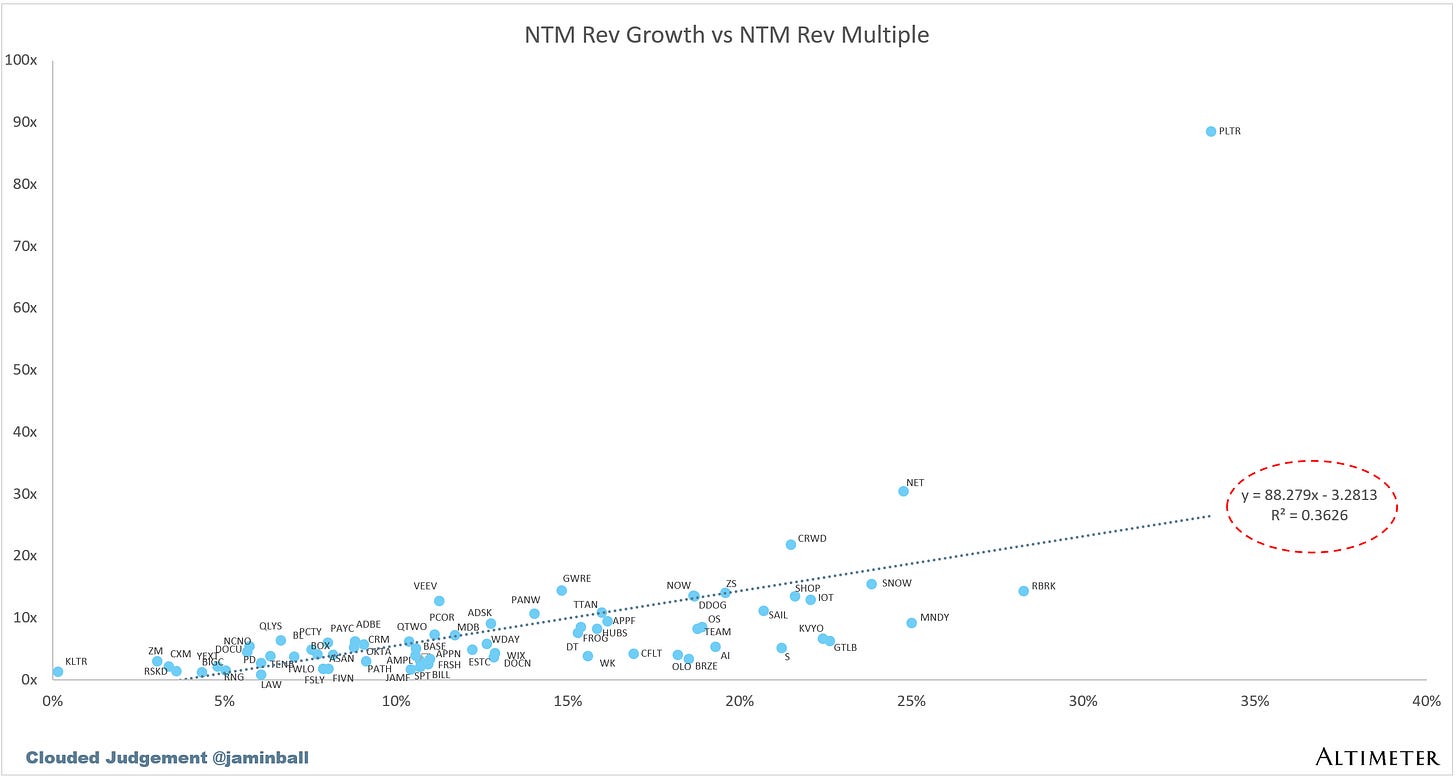

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to its growth expectations.

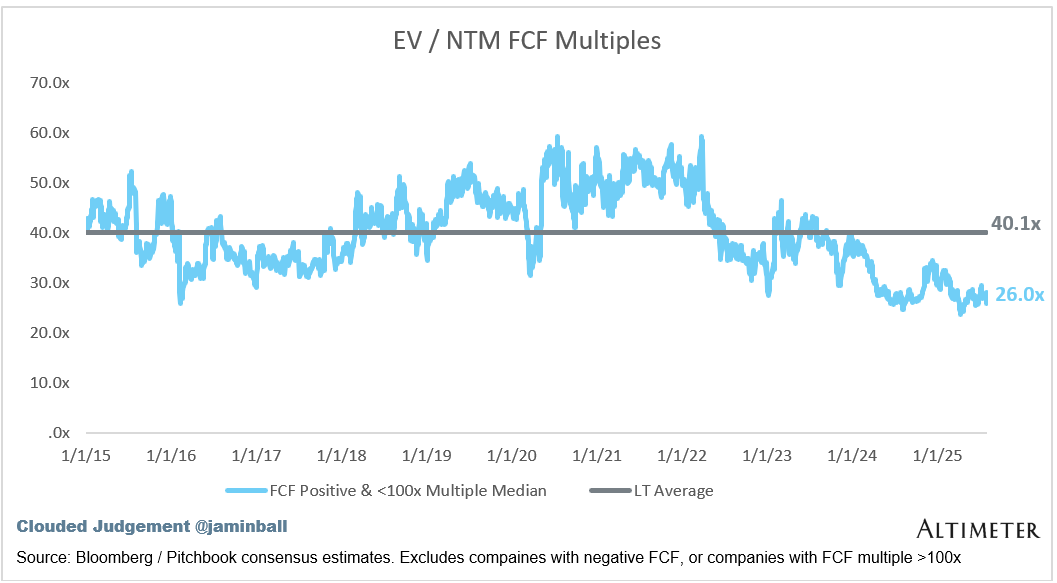

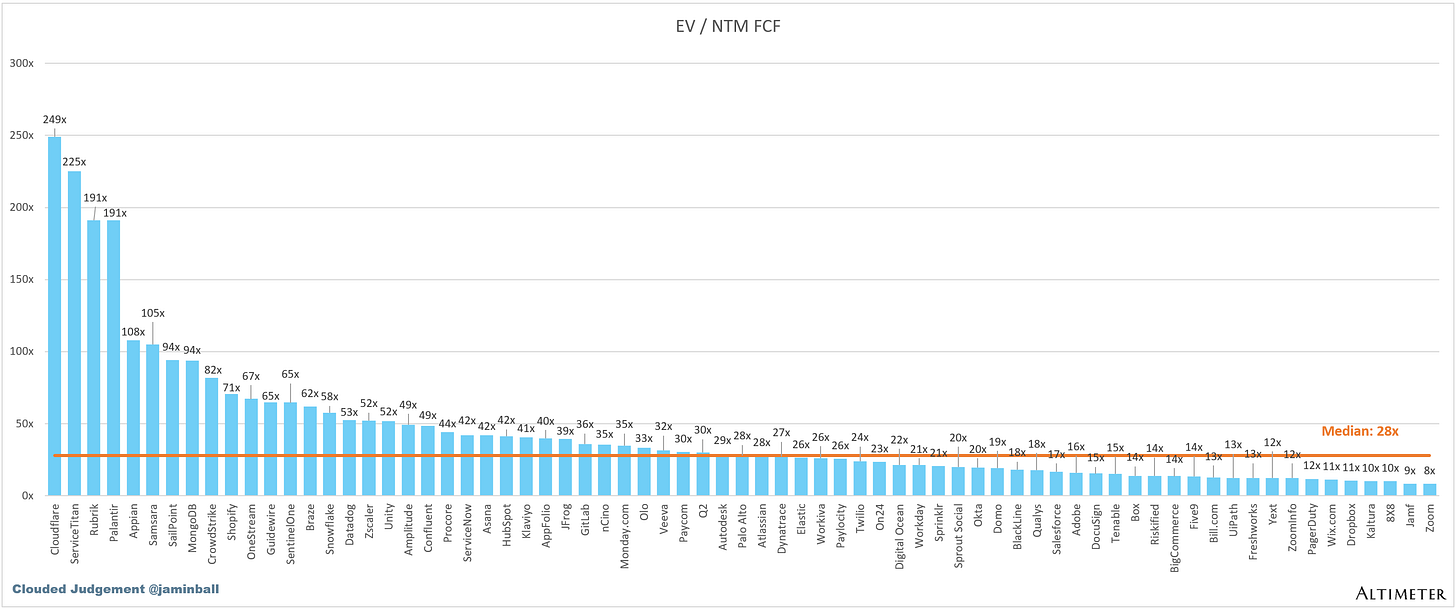

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 11%

Median LTM growth rate: 14%

Median Gross Margin: 76%

Median Operating Margin (4%)

Median FCF Margin: 18%

Median Net Retention: 108%

Median CAC Payback: 42 months

Median S&M % Revenue: 38%

Median R&D % Revenue: 24%

Median G&A % Revenue: 16%

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12. It shows the number of months it takes for a SaaS business to pay back its fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Not surprised that Cloud giants are seeing reaccelerating growth. The next leg will be the migration of physical world and oldline business compute and data processing workloads into the cloud. What is the TAM of that? Is it unreasonable to think that MSFT, GOOG and AMZN could be $10T companies within the next decade?