Clouded Judgement 8.14.20

Every week I’ll provide updates on the latest trends in SaaS valuations, earnings announcements, and highlight any noteworthy news. Follow along to stay up to date!

*A quick aside - some readers have mentioned that my newsletter is getting filtered to their “Promotions” or “Marketing” filters on gmail. I’ve reached out to Substack support, and they’ve recommended manually dragging my email from one of those folders to your inbox (which should fix future deliveries). Unfortunately the gmail sorting algorithms are a bit of a black box.

Highlight of the Week - Multiples Compressing

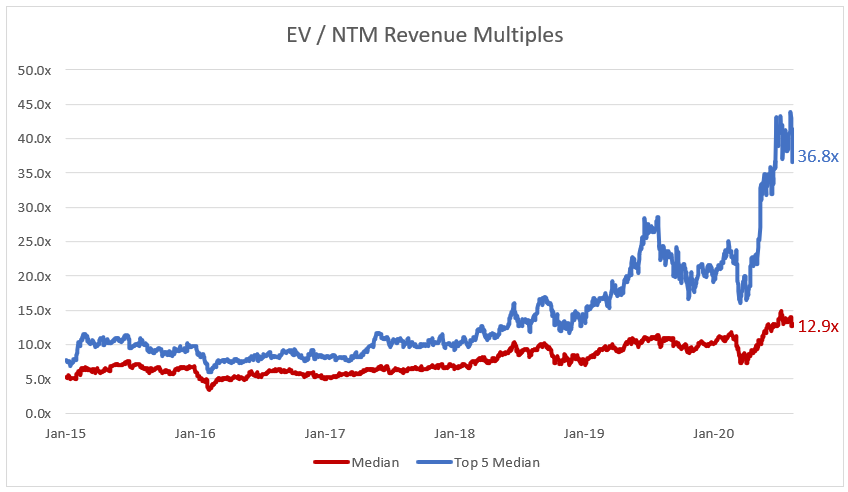

Over the last week we saw SaaS multiples start to come down across the board. We hit all time highs with median SaaS NTM revenue multiples hitting 15x just a month ago, but now sit just under 13x. Historically SaaS multiples fluctuate between 5-10x, so we’re still quite a bit above historical norms. After looking through all the companies to report Q2 so far I think one thing is clear - the immediate, short term effect of Covid has not been as beneficial for SaaS companies as people (myself included) anticipated. While digital transformations are in fact accelerating, larger enterprises are doing what they can the cut back expenses, while simultaneously forcing vendors through longer procurement cycles. Outside of Shopify and Fastly just about every SaaS business saw revenue growth decelerate (or remain relatively flat) from Q1 to Q2. The anticipated “Covid Bump” for SaaS businesses has not played out (but current prices / multiples assumed it would!), and investors reacted by pulling back on a number of SaaS names (thus dropping multiples). The big question that remains - are we due for a big Q3 as many Q2 deals were pushed out 1 quarter, or is this the start of a regression back to historical SaaS multiples of 5-10x? Only time will tell!

Earnings Summary

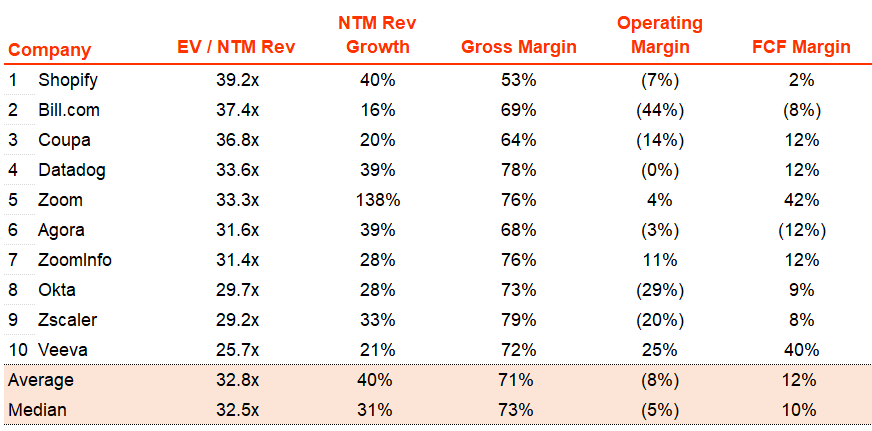

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

SaaS businesses are valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

Overall Stats:

Overall Median: 12.9x

Top 5 Median: 36.8x

3 Month Trailing Average: 12.8x

1 Year Trailing Average: 10.7x

Bucketed by Growth:

High Growth Median: 27.2x

Mid Growth Median: 15.5x

Low Growth Median: 8.2x

Operating Metrics

Median NTM growth rate: 19%

Median LTM growth rate: 30%

Median Gross Margin: 73%

Median Operating Margin (15%)

Median Net Retention: 117%

Median CAC Payback: 29 months

News

Salesforce Announced Work.com For Schools and $20 Million to Help Schools Reopen Safely and Support Student Learning Anywhere

Datadog announced a slew of new products: 1) Compliance Monitoring To Continuously Monitor Production Environments for Misconfigurations. 2) Application Marketplace - an online platform for Datadog Partner Network (DPN) members to develop and sell applications and integrations built on Datadog. 3) Error Tracking to Aggregate, Triage and Prioritize Frontend Application Errors. 4) Continuous Profiler for Low-Overhead Application Code Profiling

New Relic announced a partnership with Grafana (a leading private company in the observability space)

SurveyMonkey launches tech partner program, an expanded partner platform that addresses enterprises’ growing and evolving needs to generate stakeholder feedback and channel it into direct action

Comps Output

Rule of 40 shows LTM growth rate + LTM GAAP Operating Margin