Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

The Great Services-To-Software Rotation

There's a lot of debate right now about the economic impact of GenAI. Some critics argue that it's deflationary—that by making it possible to do more with less, GenAI will shrink markets, particularly in software. They contend that AI agents, capable of handling infinite workloads, will ultimately reduce the need for software spend. I believe this view is (dramatically) missing the bigger picture .

In reality, GenAI is poised to drive an epic shift from services spend (both internal and external services) to software spend. And that shift will dramatically expand the size of software markets (and the equity value created). I’m certainly not the first (or thousandth..) to have this view, but I wanted to flesh out why.

Let’s discuss why this matters.

Consider a hypothetical budget scenario. Today, IT budgets are roughly broken down into: ~50% headcount / personnel, ~25% software, ~15% hardware, and ~10% outsourcing / consultants. An even more nuanced (and important) dynamic is ~80-90% of IT budgets from one year to the next are just “maintenance.” What I mean by that is 80-90% of spend is just carried over from one year to the next. The amount of “up for grabs” spend might only be ~15% of budgets plus the 2-4% of annual IT budget expansion. So while overall IT budgets are large, there’s not nearly as much “up for grabs” spend available each year, and there’ a (fast growing) set of software companies competing for that finite pool of up for grabs spend.

This is the “why” behind why this conversation matters. I believe GenAI creates a very dramatic potential for software markets to EXPAND significantly.

As GenAI matures, the budget ratio I described above could shift software from ~25% to ~50% of overall IT budgets. As software grows as a percentage, I think we see headcount / outsourcing shrinking. In many markets, the spend on services (both internal dev services and spend on outsourcing) dwarfs the spend on software. One of the clearest examples of how lopsided the services-to-software dynamic can be is from Mulesoft’s S1 filing in 2017. At the time, Mulesoft estimated their market opportunity at $29 billion. In the same year, Forrester estimated (as laid out in their S1) an additional $394 billion was spent on systems integration project work—services that supported the kind of software Mulesoft provided. That’s a 14:1 ratio of services spend to software spend. And this doesn’t even include the substantial budgets allocated to internal development teams who effectively serve as "internal consultants." Here’s the direct quote: “We estimate our current market opportunity to be $29 billion...Separately, Forrester estimates an additional $394 billion will be spent in 2017 on systems integration project work [services], which does not include the spending on custom-coded integrations by internal development teams."

Many markets have similar dynamics where a disproportionate amount of spend goes to services rather than software. GenAI is poised to disrupt this by replacing many of those services with more scalable, automated solutions. AI-driven software will increasingly handle the tasks that used to require armies of consultants and developers, leading to a greater percentage of spend shifting toward software itself.

The natural next question here is “well just because software spend is going up, that doesn’t mean overall spend is as well?” It’s a great question - if an IT budget was $10 ($2 of which was going to software), one could argue that GenAI could create a scenario where IT spend goes down to $9 but software spend goes to $4. I also don’t fully agree with this. When you make something cheaper and more efficient, you often increase demand for it. This is known as Jevons’ Paradox, which observes that as technological advancements improve efficiency and lower costs, consumption often increases rather than decreases. GenAI follows this same pattern. By making certain processes significantly more cost-effective, GenAI will unlock new opportunities and expand use cases that were previously too costly or labor-intensive to pursue.

This dynamic is similar to what we’ve seen in other technological revolutions. Consider cloud computing: by lowering the cost of infrastructure, the cloud didn’t just shift spend from hardware to cloud services, it expanded the overall market by enabling new companies and applications to emerge. The shift from on prem to cloud data warehouses is a perfect example of this. Vertica / Netezza and other on prem data warehouses were very expensive! There was a large portion of the market that simply didn’t have the balance sheet (or technical know how) to operate one. When Redshift / Snowflake came out, a massive amount of latent demand was unlocked (both on cost and technical expertise vectors). As a result, while cloud data warehouses were “cheaper” on a unit basis, the market size for cloud data warehouses was far greater than that of on prem data warehouses.

GenAI will create a similar expansion by driving down the cost of sophisticated processes, thereby increasing demand for them. As AI reduces friction and cost, businesses will naturally want to consume more of it, broadening the potential use cases and expanding the total market size.

I also think there’s a compounding effect on equity valuation creation. Today, services businesses typically trade at lower multiples than software companies. As spend shifts from services to software, we’ll see equity value shift from low multiple to high multiple. The incremental market cap created by this shift could be enormous, as more revenue is reclassified into higher-multiple software categories rather than lower-multiple services categories. In essence, by converting services spend into software spend, GenAI isn't just expanding the pie—it’s helping the pie grow much faster in terms of valuation.

So while the total spend on individual processes or tasks may shrink as automation improves efficiency, the opportunity for software companies is enormous. GenAI will capture more of what was once service-related spend, driving growth in the software market. And critically, this isn't just about changing how the pie is sliced—it's also about making the pie bigger. GenAI will empower companies to do more with software than ever before, and it will also increase the value of the software itself, unlocking new areas for innovation and investment.

In summary:

GenAI will increase the size of software markets by rotating spend from headcount / outsourced services to software

Despite lowering the “unit cost” or cost to complete a tastk, GenAI will increase the size of software markets by unlocking latent demand

GenAI will create a compounding effect on software equity value growth by moving low multiple revenue to high multiple revenue

I don’t think this is a radical or controversial take. It's a natural evolution of how businesses allocate resources as technology advances. GenAI will empower companies to do more with software than ever before, paving the way for long-term market expansion, both in revenue and market value.

Quarterly Reports Summary

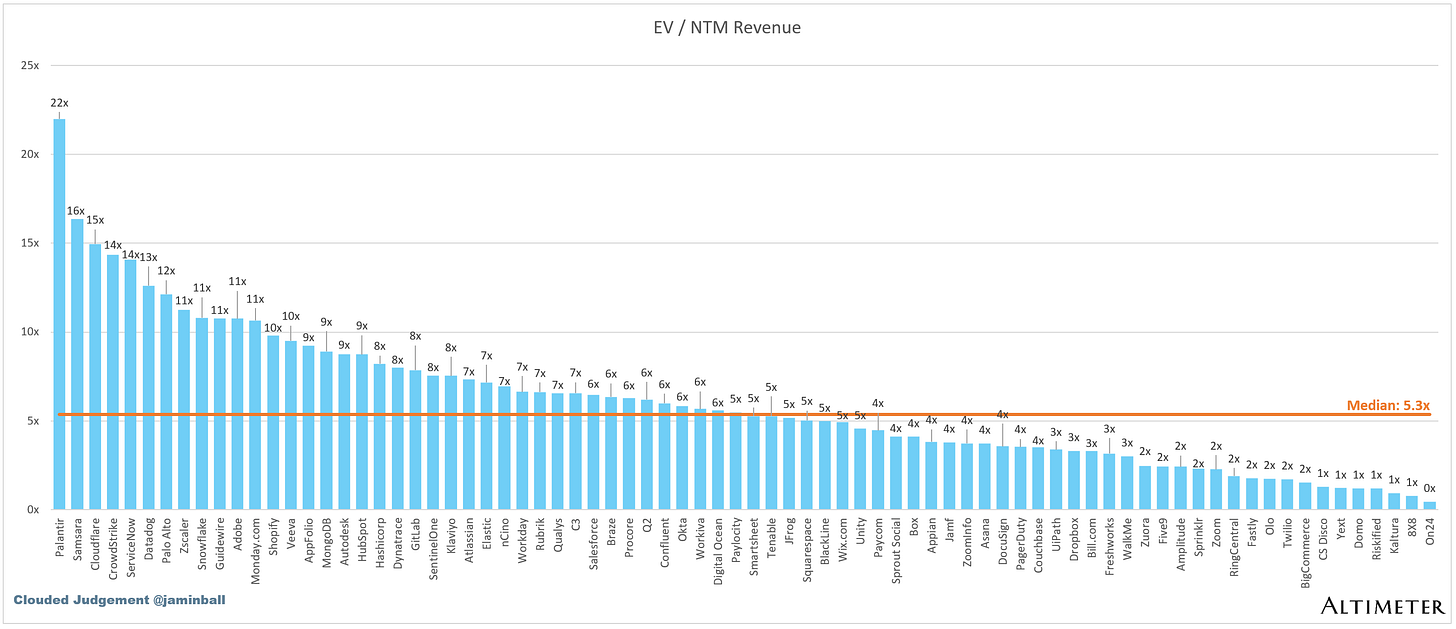

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.3x

Top 5 Median: 15.0x

10Y: 3.9%

Bucketed by Growth. In the buckets below I consider high growth >27% projected NTM growth (I had to update this, as there’s only 1 company projected to grow >30% after this quarter’s earnings), mid growth 15%-27% and low growth <15%

High Growth Median: 10.7x

Mid Growth Median: 7.2x

Low Growth Median: 3.7x

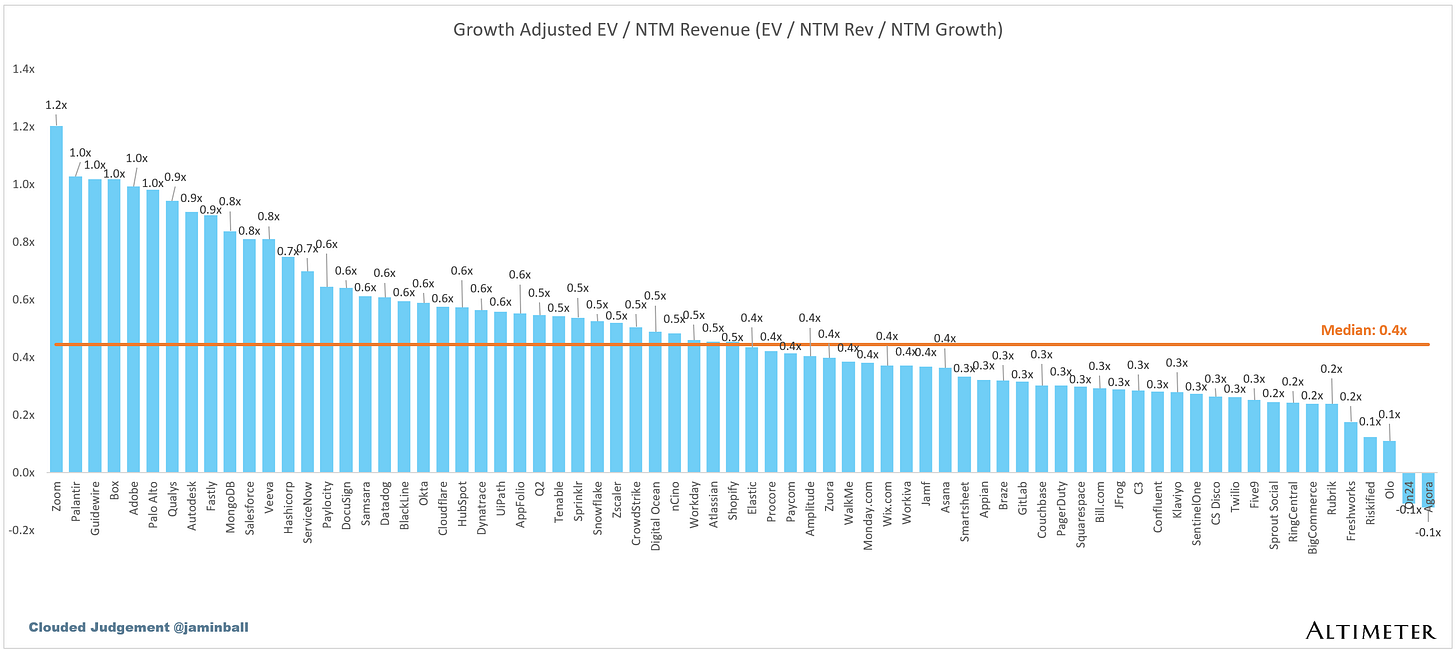

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 11%

Median LTM growth rate: 16%

Median Gross Margin: 75%

Median Operating Margin (10%)

Median FCF Margin: 16%

Median Net Retention: 110%

Median CAC Payback: 58 months

Median S&M % Revenue: 40%

Median R&D % Revenue: 25%

Median G&A % Revenue: 17%

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Good insights! Thanks for sharing.

I think my favorite piece of yours I have read. Great analysis, thanks!