Clouded Judgement 8.21.20

Every week I’ll provide updates on the latest trends in SaaS valuations, earnings announcements, and highlight any significant news. Follow along to stay up to date!

Highlight of the Week - Credit Suisse CIO Survey

I love looking at these surveys to get a view inside the mind of CIOs and how they’re thinking about budget. Some interesting takeaways in a few charts from the report:

The first chart below shows the tangible impact COVID has had on CIOs plans to buy cloud software (it’s accelerating)

However this second chart shows that the immediate, short term impact of COVID in reality isn’t helping as much as we’d imagine. A big reason for this is project deferrals. Buyers are cautious, and are pushing out buying decisions until there’s a little more certainty in the market. Only time will tell if these projects will be pushed by only a quarter leading to strong growth on the back half of this year, indefinitely, or ultimately canceled altogether.

Earnings Summary

Upcoming Earnings Calendar

Companies with July quarter ends start reporting quarterly earnings on Tuesday! Bill.com is the last company to report with a June quarter end.

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

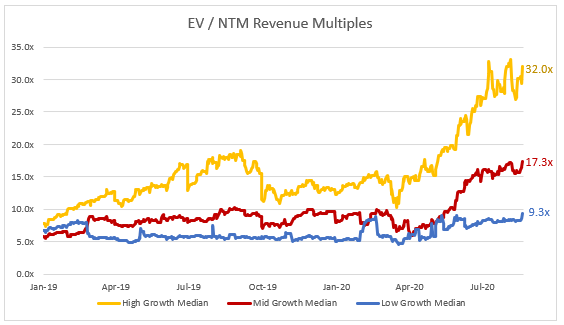

SaaS businesses are valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

Overall Stats:

Overall Median: 15.1x

Top 5 Median: 41.5x

3 Month Trailing Average: 13.2x

1 Year Trailing Average: 10.8x

Bucketed by Growth:

Operating Metrics

Median NTM growth rate: 19%

Median LTM growth rate: 30%

Median Gross Margin: 73%

Median Operating Margin (16%)

Median FCF Margin: 4%

Median Net Retention: 116%

Median CAC Payback: 29 months

News

Zoom announced Zoom Phone is now available in over 40 countries

ZoomInfo announced a ~$550M follow on offering at $37 / share. In this offering existing shareholders sold (this was a pre-lockup expiration exempt offering) to institutional investors, and the company received no proceeds. This is particularly interesting because the IPO was at $21 / share just two months ago… Seems to me like there was institutional demand at a materially higher price!

Comps Output

Rule of 40 shows LTM growth rate + LTM FCF Margin. FCF calculated as Cash Flow from Operations - Capital Expenditures. Certain businesses, like ZoomInfo, with high debt balances have much higher uFCF margins (these offset the effect of interest payments)