Clouded Judgement 8.2.24 - Uncertainty Everywhere

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Uncertainty Everywhere

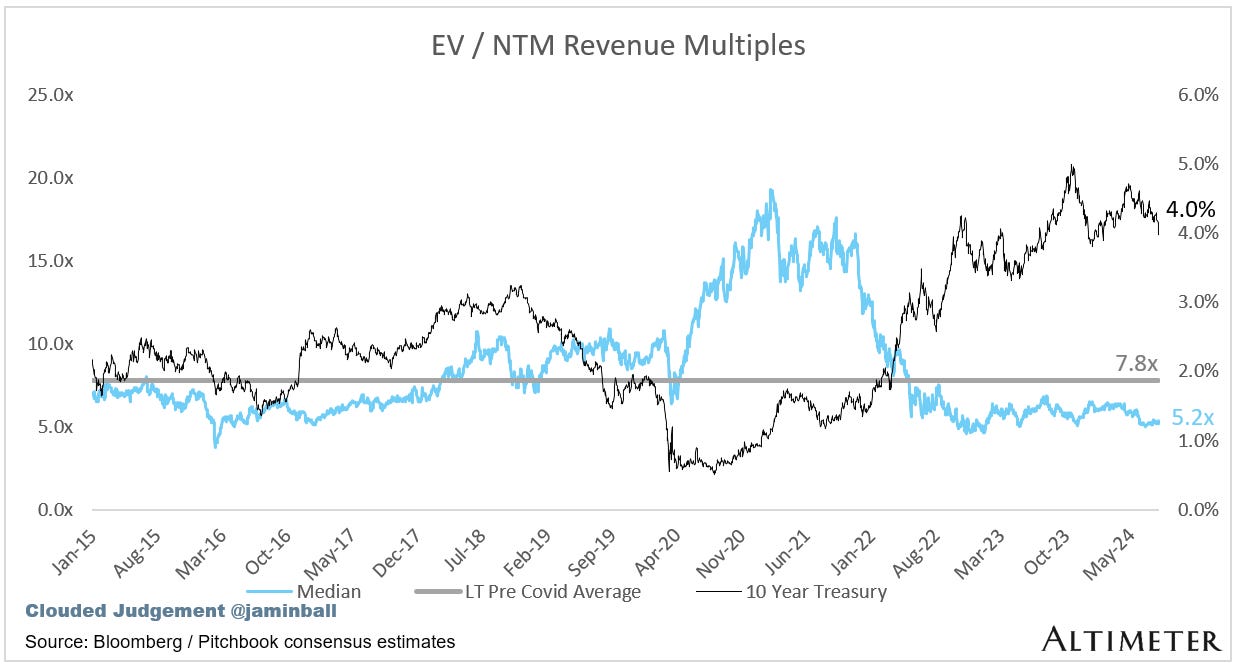

The 10Y has been falling recently, and dipped below 4% for the first time since early Feb. Back then the median software NTM rev multiple was ~6x. Today it’s ~5x. Interestingly, as rates have fallen (10Y went from 4.5% at start of July to 4.0% at end of July) multiples have stayed flat. Over the last few years there has been plenty of talk about the relationship between rates and multiples, and their inverse relationship. However, rates are just one variable. Today, the market seems a lot more worried about business fundamentals / growth. There’s a number of “canaries in the coal mine” with regard to a potential slowing economy. Consumers appear to be slowing down.

Wayfair CEO compared the drop in spend to home goods to the 2008 financial crisis: “Customers remain cautious in their spending on the home and our credit card data suggests that the category was down by nearly 25% from the peak we saw in the fourth quarter of 2021. This mirrors the magnitude of the peak to trough correction the home furnishing space experienced during the great financial crisis”

Another home goods company, Whirlpool, said: “…we have continued to see discretionary demand impacted by a depressed existing home sales and a weary consumer…”

The Europe economy seems to be in worse shape. Booking called out weakness in Europe. Amazon international eCommerce missed. Confluent called out weakness in Europe (more on that shortly).

Overall - there’s more questions about the broader economy, and what that could mean for growth. At the same time, there’s political uncertainty and global conflict uncertainty. Wrapping it all up, there’s lots of uncertainty right now which makes it harder to feel great about owning risky stocks.

Then there’s software specific data points. Confluent was one of the first software companies to report Q2 and they said this: “"After the stabilization in Q1 and a healthy start in Q2, we saw increased short-term cloud cost controls and focus on driving efficiencies in this customer cohort in the month of June." Later the followed it up with: “I would say towards the latter half of the quarter, we did see cost efficiencies and focus on just driving some cost efficiencies from some of these customers, which actually continued into the month of July." Confluent is telling us things got tougher in June, and it didn’t let up in July.

Then there’s the broader software universe. We’re still early into earnings (in week 2). BUT - of the 16 companies who guided for Q3 (quarter ending September ‘24), 9 guided below consensus. 56%! If we look at the basket of companies who have reported Q2 so far, and compare their aggregate net new ARR added in Q2 vs prior quarters (chart below), you’ll see that Q2 has been quite bad (again, only for the companies who have reported so far)

In summary - there’s lots of uncertainty in the world, and in software land. Falling rates have not been enough to move multiples. A lot of companies report next week, we’ll see if they’re able to quell any fears!

Cloud Giants Report Q2

We also got the Q2 quarters from AWS / Azure / GCP this week! Summary below:

AWS (Amazon): $100B run rate growing 19% YoY (last Q grew 17%)

Azure (Microsoft): ~$81B run rate (estimate) growing 30% YoY (last Q grew 31%)

Google Cloud (includes GSuite): $41B run rate growing 29% YoY (last Q grew 28%, neither are cc)

AI CapEx

Meta also dropped a nice quote on the debate about AI CapEx: “We're continuing to work through what the scope of the gen AI road maps will look like over that time. Our expectation, obviously again, is that we are going to significantly increase our investments in AI infrastructure next year, and we'll give further guidance as appropriate.”

Then Microsoft said this: “To meet the growing demand signal for our AI and Cloud products, we will scale our infrastructure investments with FY '25 capital expenditures expected to be higher than FY '24. As a reminder, these expenditures are dependent on demand signals and adoption of our services that will be managed through the year.”

In summary, the big players don’t expect to slow down spend on AI Infra anytime soon - they’re seeing the demand signals, and can’t get left behind in one of the largest paradigm shifts in tech.

Quarterly Reports Summary

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

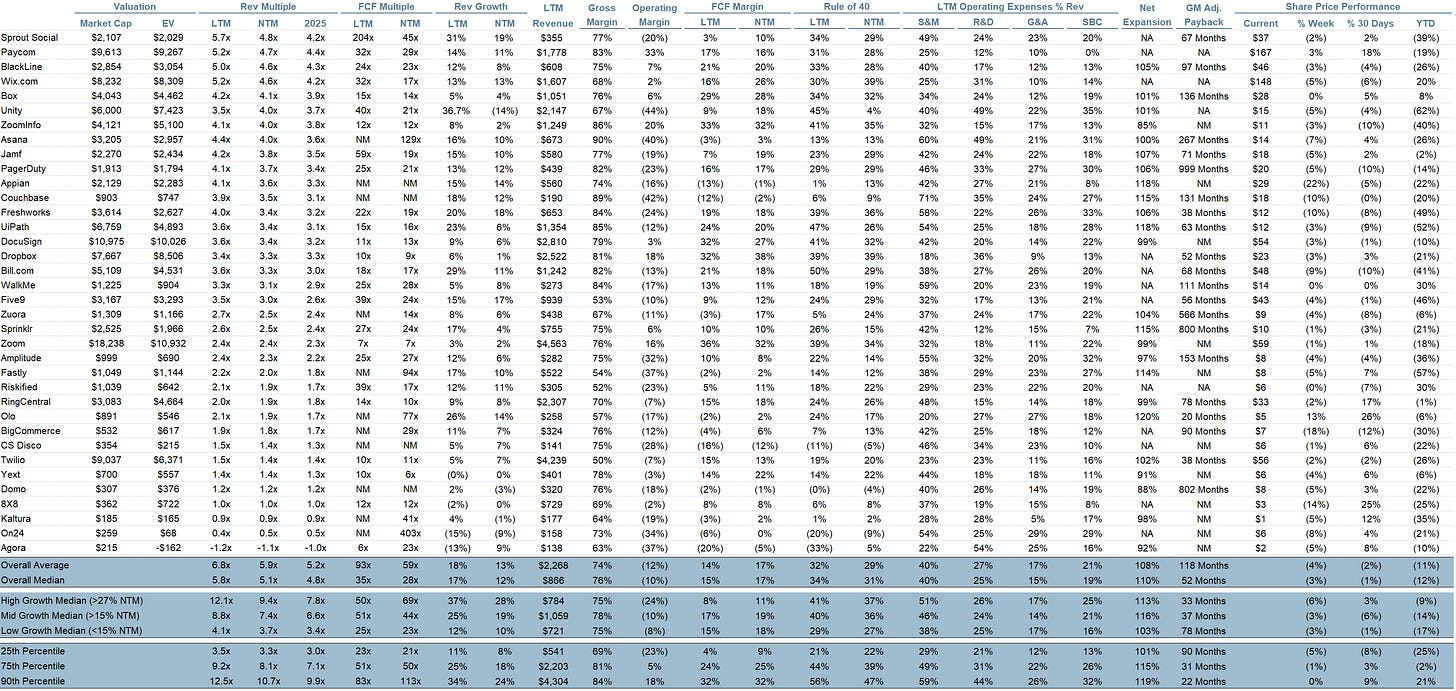

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.2x

Top 5 Median: 14.4x

10Y: 4.0%

Bucketed by Growth. In the buckets below I consider high growth >27% projected NTM growth (I had to update this, as there’s only 1 company projected to grow >30% after this quarter’s earnings), mid growth 15%-27% and low growth <15%

High Growth Median: 9.4x

Mid Growth Median: 7.6x

Low Growth Median: 3.7x

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 12%

Median LTM growth rate: 17%

Median Gross Margin: 76%

Median Operating Margin (10%)

Median FCF Margin: 15%

Median Net Retention: 110%

Median CAC Payback: 52 months

Median S&M % Revenue: 40%

Median R&D % Revenue: 25%

Median G&A % Revenue: 15%

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Thanks for this. I think your CAC payback (in Months) formula is not right. If it's right, can you please tell us more about why (Q cost / Q new ARR) * 12 tells you how many months it takes to recover your cost? For simplicity sake, if it's a 1/1 ratio, and you are using Quarterly numbers, then shouldn't it be *3, to show that it took 1 quarter = 3 months? Thanks in advance!

Thanks for the update - just to clarify, the net new ARR chart is for the same set of companies this Q and historically, e.g. same # of companies in the data sets? If so that’s shocking…can you confirm?