Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Don’t Wait

Two weeks ago I wrote about the growing number of private zombies. A common question I got after that post was “what should I do if I’m in that position?” A couple thoughts below. Most importantly - don’t wait. Don’t hope for things to improve. Hope is not a strategy. It’s a lottery ticket. I think there are 3 concrete things to do:

Figure out if you’re a short / long term zombie: Turnarounds are hard, but they do happen. There may be some idiosyncratic reasons your market turned on you, but you expect it to turn back. There’s no need to panic at the “bottom,” but it’s also very important to be realistic about your chances of revival

Get closer with your existing investors. At some point you will want to raise more money. It may be a down round. Or you’re hoping to raise a flat round to “validate” your high priced round from a couple years ago. Either way - don’t assume your existing investors will be willing (or able!) to give you more money. Ask each one about their reserve policy and how much they have reserved for you. They may be on to the next fund already and exhausted all the reserves from the prior fund (it’s been a weird time in venture the last few years, reserve policies have been stretched thin…). You will want to know which of your existing investors will be a “zero” in your next round. Don’t hope or assume they will give you more money. Ask what their process is to “double down” into a portfolio company. Do they need firm founders approval for that? Or another partner to “champion” it? If so - get to know those folks. What you’ll want to know is the dollar range each of your existing investors is capable of giving you, and what they’d need to see from the business to give you the high or low end of that. Too many investors will want to reserve optionality and say “ya of course we’ll give you more money!” But really push them - now is the time for radical candor.

Get to know your acquirers. Acquisitions don’t happen over night. They take time. They take relationship building. If you need a champion to close a customer / sale, you need a SUPER champion to get an acquisition done. At the end of the day, someone may be making a career bet on you. In most cases it will take 6-12+ months of “dating” before an acquirer will make a move. Don’t go to them when you have 6 months of runway. Start the convos now. These convos can be casual! At worst, it may lead to a product partnership. At best, they could be your lifeline. This is especially important as I expect corp dev teams to be flooded with inbound over the next couple years. You don’t to be at the end of the line. Everyone will want to be acquired by the high flying modern comapany. But don’t forget about the IBM / Cisco types. They are more likely than a newer company without much of a M&A muscle

Quarterly Reports Summary

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.3x

Top 5 Median: 14.7x

10Y: 3.9%

Bucketed by Growth. In the buckets below I consider high growth >27% projected NTM growth (I had to update this, as there’s only 1 company projected to grow >30% after this quarter’s earnings), mid growth 15%-27% and low growth <15%

High Growth Median: 10.7x

Mid Growth Median: 7.0x

Low Growth Median: 3.8x

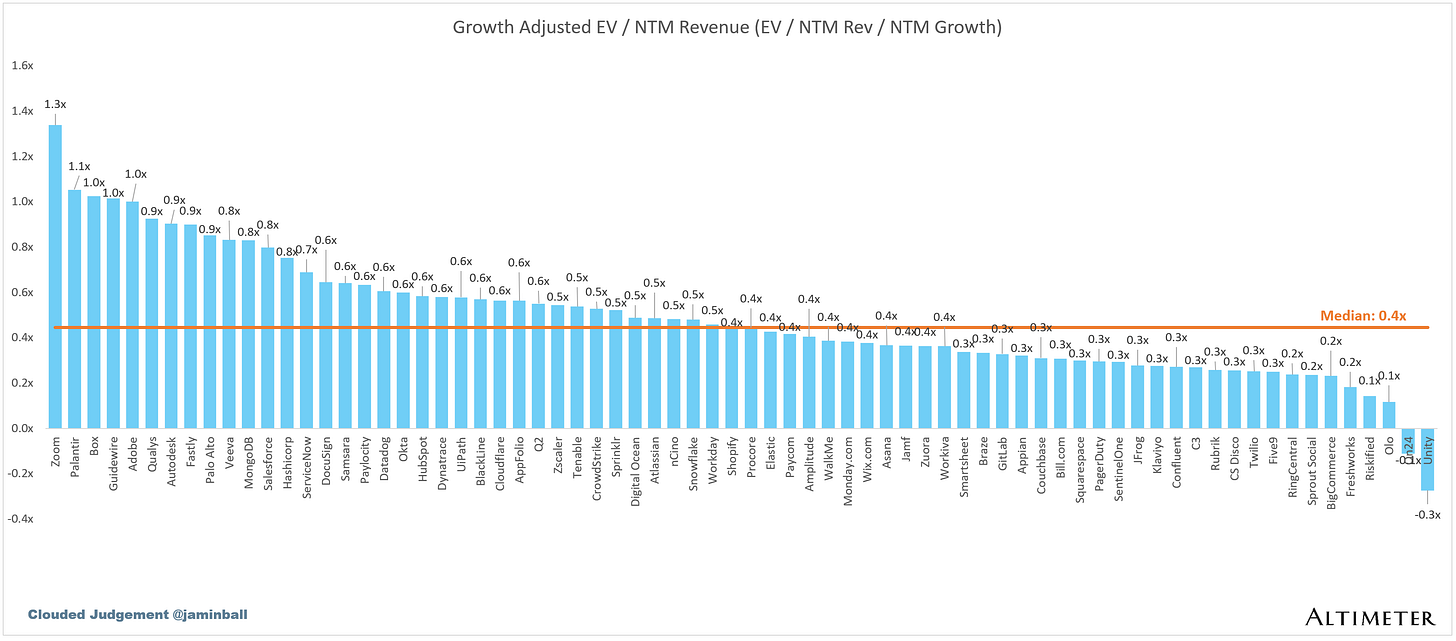

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 11%

Median LTM growth rate: 16%

Median Gross Margin: 75%

Median Operating Margin (10%)

Median FCF Margin: 16%

Median Net Retention: 110%

Median CAC Payback: 56 months

Median S&M % Revenue: 40%

Median R&D % Revenue: 25%

Median G&A % Revenue: 17%

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Thanks for another good post Jamin. Any thoughts on Similarweb (SMWB)?

Thanks for this Jamin. Love your work and following the entire Altimeter team.

Able to share any thoughts on Altimeter’s view of SentinelOne? I know you don’t own it but it’s multiple is right down there with RBRK on a growth adjusted basis. Thanks!