Clouded Judgement 8.30.24 - Incrementalism vs Transformative Leaps

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Incrementalism vs Transformative Leaps

Over the last 5-10 years, software markets have become increasingly crowded. Simultaneously, venture markets have expanded dramatically, contributing to this overcrowding. In a world without venture capital (or other sources of external financing for startups), each company would have to grow solely based on the merits of their product and sales. Growth would be slower, but market share would likely be more concentrated among leading companies (though one could also argue for more fragmentation among a smaller number of players). It would be harder for inferior companies to compete. On the flip side, this might lead to slower innovation cycles as “incumbents” face less pressure from a smaller number of challengers.

In a world where venture markets are flush with cash, it’s common for five or more companies to receive funding in a single category (or even more!). And venture markets are as cash-rich as they’ve ever been. Given this dynamic, there’s one question I always ask myself when evaluating a private company: “Compared to competitors, is this company’s approach incrementally better, or is it a transformative leap?” Competitors could be legacy incumbents or modern startups. Transformative leaps can stem from platform shifts, major technological advancements, or the creation of entirely new categories.

An example of a platform shift is the creation of the cloud. Many companies achieved a transformative leap by taking an on-prem solution and migrating it to the cloud, reaping all the associated benefits. A technological shift is exemplified by what happened in endpoint security, where rules-based solutions from Trend Micro and Symantec were replaced by AI-based anomaly detection from CrowdStrike and SentinelOne. Finally, category creation often involves taking an existing workflow or process that isn’t digital or is handled by internally built tools and developing a scalable software solution to replace those internal efforts.

Creating transformative leaps is not easy. I worry that many of today’s startups are merely incrementally better than existing alternatives, leading to the proliferation of the “zombies” I’ve been writing about. This reached a fever pitch in 2021 when every incrementally better company was funded with large rounds of capital. These companies then competed with each other, leading to intense pricing battles. The companies with the best products had to compete with those offering inferior products that tried to undercut on price because it was their only way to stay competitive. Coming out of that period, there was hope that we’d move on and return to “only funding the best startups.” However, the surge of AI and foundation models has triggered another wave of FOMO in venture capital, leading to an increasing number of incrementally better startups getting funded once again. There’s also the dynamic of many venture funds shifting their main KPI to “deploy dollars quickly” instead of “maximize the return on each fund,” but I’ll save that for another post…

It’s particularly tricky because this wave of AI will certainly lead to transformative leaps. However, everyone knows this, and it’s easier than ever to start a company. So we’re back to five or more companies getting funded in the exact same space because the promise of a transformative leap is so real. Just this week, multiple AI coding copilots announced rounds exceeding $100 million. There are numerous startups in this space, and one will have to prove why they’re a transformative leap relative to their AI-native modern competition.

Over the long term, the best products and teams will win. But in the short term, overcrowded markets will lead to a lot of noise and margin compression. To revisit an earlier example, 7-10 years ago, there were (mainly) four players competing for leadership in “modern endpoint security”: CrowdStrike, SentinelOne, Cylance, and Carbon Black. It took the market quite some time to settle on the two eventual leaders (CrowdStrike and SentinelOne went public, while Cylance was acquired by BlackBerry and Carbon Black was acquired by VMware). And for a while, SentinelOne was considered “in 4th place.”

Every founder and board should be intellectually honest in asking themselves whether they represent a transformative leap relative to the competition or are just incrementally better. This could ultimately determine if becoming a zombie is in your future.

Quarterly Reports Summary

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.3x

Top 5 Median: 14.8x

10Y: 3.9%

Bucketed by Growth. In the buckets below I consider high growth >27% projected NTM growth (I had to update this, as there’s only 1 company projected to grow >30% after this quarter’s earnings), mid growth 15%-27% and low growth <15%

High Growth Median: 10.8x

Mid Growth Median: 6.9x

Low Growth Median: 3.9x

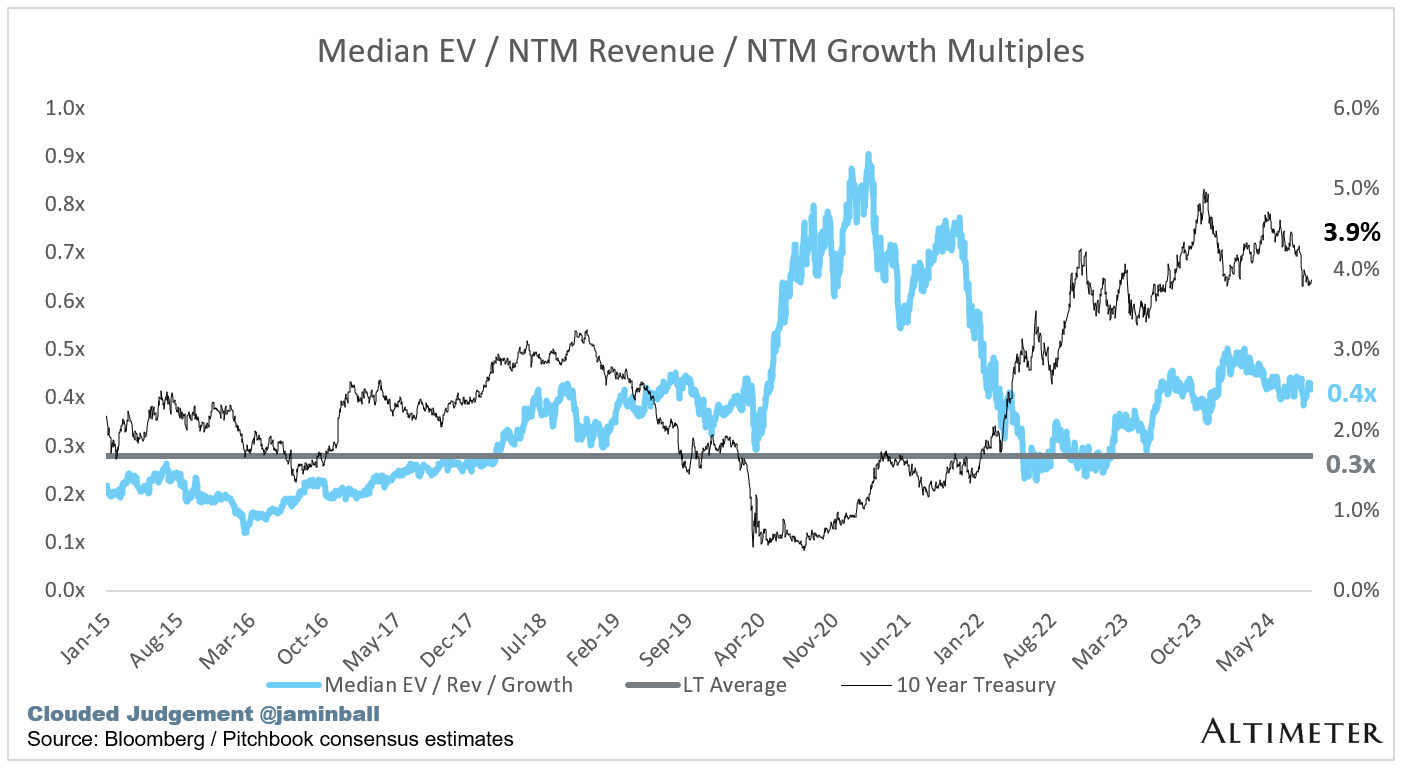

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 11%

Median LTM growth rate: 16%

Median Gross Margin: 75%

Median Operating Margin (10%)

Median FCF Margin: 16%

Median Net Retention: 110%

Median CAC Payback: 48 months

Median S&M % Revenue: 40%

Median R&D % Revenue: 25%

Median G&A % Revenue: 16%

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Thank you Jamin. It's always insightful to read from you every week. Could you add a section showing how valuation is affected by stock-based compensation across the industry?

PLTR’s EV leadership shows how much of a premium the AI story is commanding