Clouded Judgement 8.5.22

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Is This a Bear Market Rally or Have We Passed the Bottom?

What a crazy few weeks. Over the last ~6 weeks the WCLD ETF is up ~25% and Nasdaq is up ~20%. People often say we won’t know we’ve hit the bottom until it’s clear in hindsight. Was mid June the bottom? Or is this just another bear market rally? My head is spinning trying to connect the dots, but I’ll try and make sense of it here. First, let’s try and dissect what is driving this rally, and if we think it’s “sustainable.”

I think there are 3 primary reasons for this rally:

A perceived Fed pivot. As I’ve talked about before, rates are a primary driver of growth software valuations. Whether you agree or not, in the last Fed meeting they said the current fed funds rate is a neutral rate, and further hikes will be data dependent. Before this meeting, every month we knew big rate hikes were coming. Now? It’s data dependent. We will get more hikes, it’s just not clear what magnitude (and current thinking is they’ll be lower than feared). The Fed may see signs of inflation rolling over (one reason to be less aggressive on hikes), or they’re worried about a contracting economy / recession and don’t want to keep hiking rates in the face of that. Either way, there’s a lot more doubt that we’re actually headed to a new regime of higher rates (4-5%) for a sustained period of time. The 10Y is currently 2.7%, down from 3.5% in mid June. Maybe, just maybe, we’re heading to a rate environment that looks a lot like the 10 years preceding Covid (10Y was 2.3% on average over that period). The market seems to be weighing more to this outcome. To hard for me to say, but this is what the market believes at this moment in time.

Results “better than feared.” Another concept I’ve talked at length about is the concept of earnings revisions. What impact will a down market / recession have on the trajectory of software companies? So far, there has clearly been some impact, growth is slowing, but it’s been better than feared. This quote from Confluents earnings call sums it up nicely: “So I would say maybe more finance inspection, a little bit longer, another round of review kind of inspection of TCO. We saw that across geos and segments.... I think we haven't seen any of those deals that kind of went through further review be lost, but they have been delayed." Confluent called out a $5m headwind to revenue from macro in their full year guide which represents <1% of their expected revenue. So a pretty immaterial effect from the macro they’re expecting in the back half of the year. Generally there is more weakness in SMB customer bases, and more scrutiny on procurement, but the demand environment remains healthier than expected. We have definitely seen weaker guides - but it feels like the reason for these weaker guides is more conservatism and unknowns related to the macro vs companies actually seeing a slowdown. So far early signs show more resiliency for leading software companies.

The “pain trade.” Most institutional investors have very little exposure to software / growth right now. When we get these rallies, there can be a (positive) trickle down effect of short covering / momentum that pushes the market even higher. When companies have higher short interest, and some external factor pushes prices up (say something like a Fed pivot), you start to see more short covering (buying to cover shorts). This covering then pushes prices up, which triggers more short covering. At the same time, because so many firms are “offsides” (meaning low exposure to growth), they don’t want to miss the beginning of the rally. It’s much much harder to put exposure on than take it off. So if there is any chance that the bottom was mid June, no one wants to miss the beginning of the rally - meaning, they may start buying in more of a momentum trade. This of course pushes prices up, and triggers more short covering. In these moments markets move in the direction of most pain, and given most are offsides, the direction of most pain is up

So how do we digest all of this? On the first point - the risk is that inflation is stickier. Rent in particular is quite sticky and a big component of CPI. IF inflation doesn’t roll over we may see another Fed pivot, but this time back to more aggressive hikes. It may sound crazy, but there’s current talk of rate cuts in the back half of ‘23. To the extent there’s more signal that rates will in fact go up more than expected (and potentially stay in that 4-5% range) we definitely have another big leg down from where we are. My take? I think the market has over-rotated and misinterpreted (to some extent) what they believe to be now a dovish Fed. The Minneapolis Fed Pres said - “Some financial markets are indicating that they expect us to cut interest rates next year. I don’t want to say it’s impossible but it seems like that’s a very unlikely scenario. Right now, given what I know about the underlying inflation dynamics a more likely scenario is we would continue raising.” I don’t think the Fed is as dovish as the market is saying, but I also don’t think we need to sustain 4-5% rates (rationale being I do think inflation wanes through next year). A 10Y in the 3-4% makes more sense to me.

On the earnings revision point - unfortunately I’m not sure we’ve gotten much clarity. Push comes to shove come Q3 / Q4. Solid results so far, but they’re a bit backwards looking, and only so far for companies with June quarter ends. Some of the forward looking metrics like billings / RPO / guidance have actually been light which could be a signal for more issues to come. Datadog guided very conservatively for full year, and it’s unclear if that’s a macro issue, or they’re just being conservative prepping for the “unknown.” On the call they made it clear it was the former vs the latter, but hard to know if that’s posturing or reality.

Net net - I don’t think this is the start of a sustained move up. The looming risk of the true nature of earnings revisions in a recession are still out there. Datadog made it clear on their earnings call that they’re not seeing the sharp drop off they saw at the onset of Covid. At the same time, because I’m not as negative on what needs to happen with rates I’m not sure another leg down would need to take us much lower than where we were 6 weeks ago. Feels like there’s data that comes out weekly that either makes me less or more confident about this, so I reserve the right to have a different view point next week :)

Earnings Quotes

Some positive / negative quotes from Confluent and Datadog:

Positives

Datadog: “We believe that software is a deflationary force and we are confident in our ability to help our customers do more with less, should economic conditions worsen…We recognize the macro environment is uncertain as we look into the back half of 2022. But we also see no change to the long-term trends toward cloud-based services and modern DevOps environments, and observability remains critical to that journey.”

Confluent: “Confluent continues to see strong demand despite economic headwinds.”

Confluent: “Well, we're very pleased with the record performance in Q2 sequential for cloud. We didn't see anything unusual or a pull forward. We just saw a broader adoption in consumption patterns across really our entire customer base, which is very good to see.”

Negatives

Datadog: “But we did see some customers beginning to manage costs in response to macroeconomic concerns, which impacted our usage growth with some of our existing customers…We saw usage growth with some existing customers decelerate in Q2 and that deceleration was concentrated in our larger spending customers as opposed to our lesser spending customers, where growth remained steady year over year. Amongst our industries, we saw relative deceleration in consumer discretionary customers, which represents low teens percent of our ARR.”

Datadog: “In addition, we observed that some customers aren't changing their level of usage growth but are being more conservative in their commitments, which impacts billings and RPO growth but not revenue growth.”

Confluent: “Towards the back half of June and through July, we saw an increased scrutiny on deal approvals. We believe this is driven by customers' cautious view on the current macro environment balance with their need to continue with the digital transformation initiatives with data in motion being a must-have capability.”

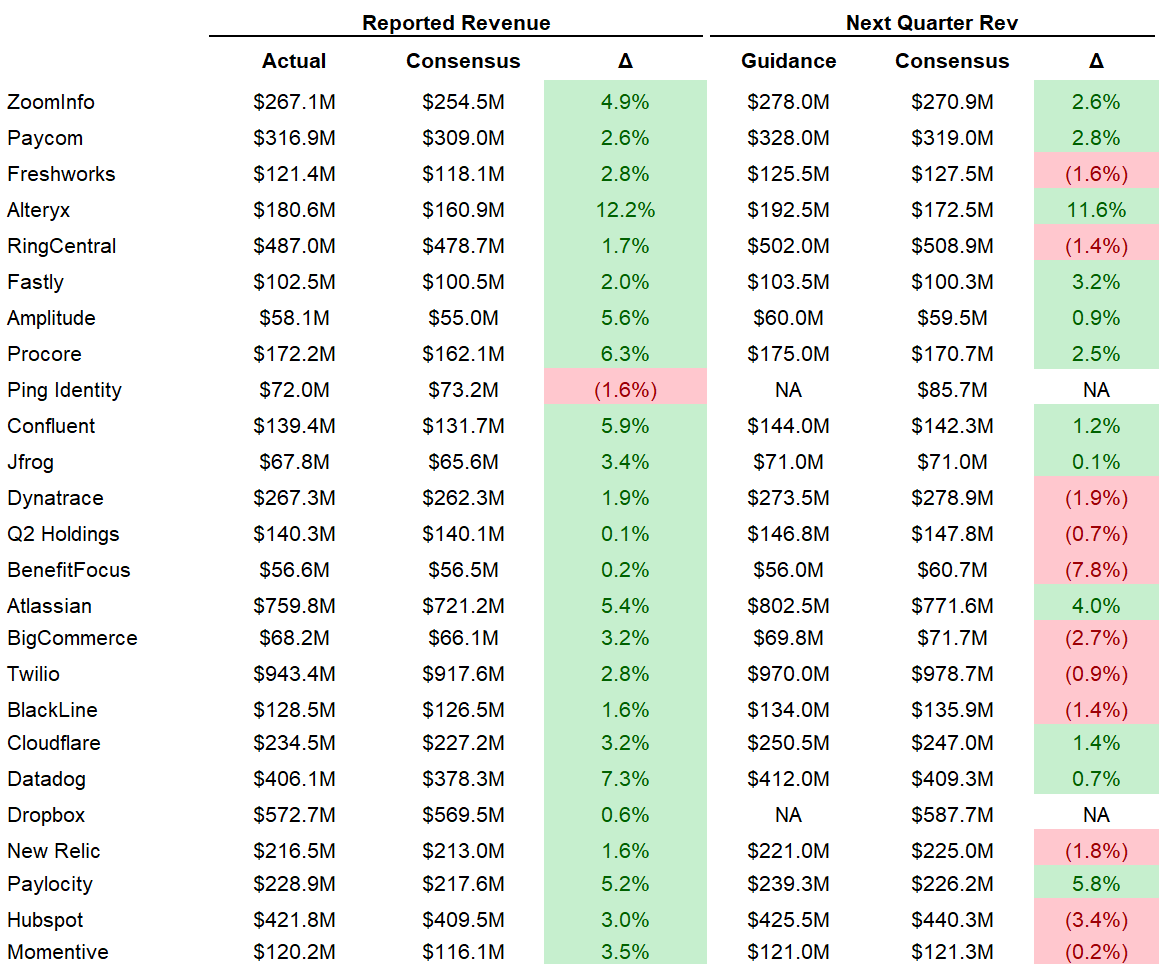

Quarterly Reports Summary

Top 10 EV / NTM Revenue Multiples

*Datadog, Cloudflare and Atlassian all reported this week, so their NTM estimates have not been updated yet to reflect Q2 (ie NTM growth rate will be higher than shown, and NTM multiple will be slightly lower than shown)

Top 10 Weekly Share Price Movement

Update on Multiples

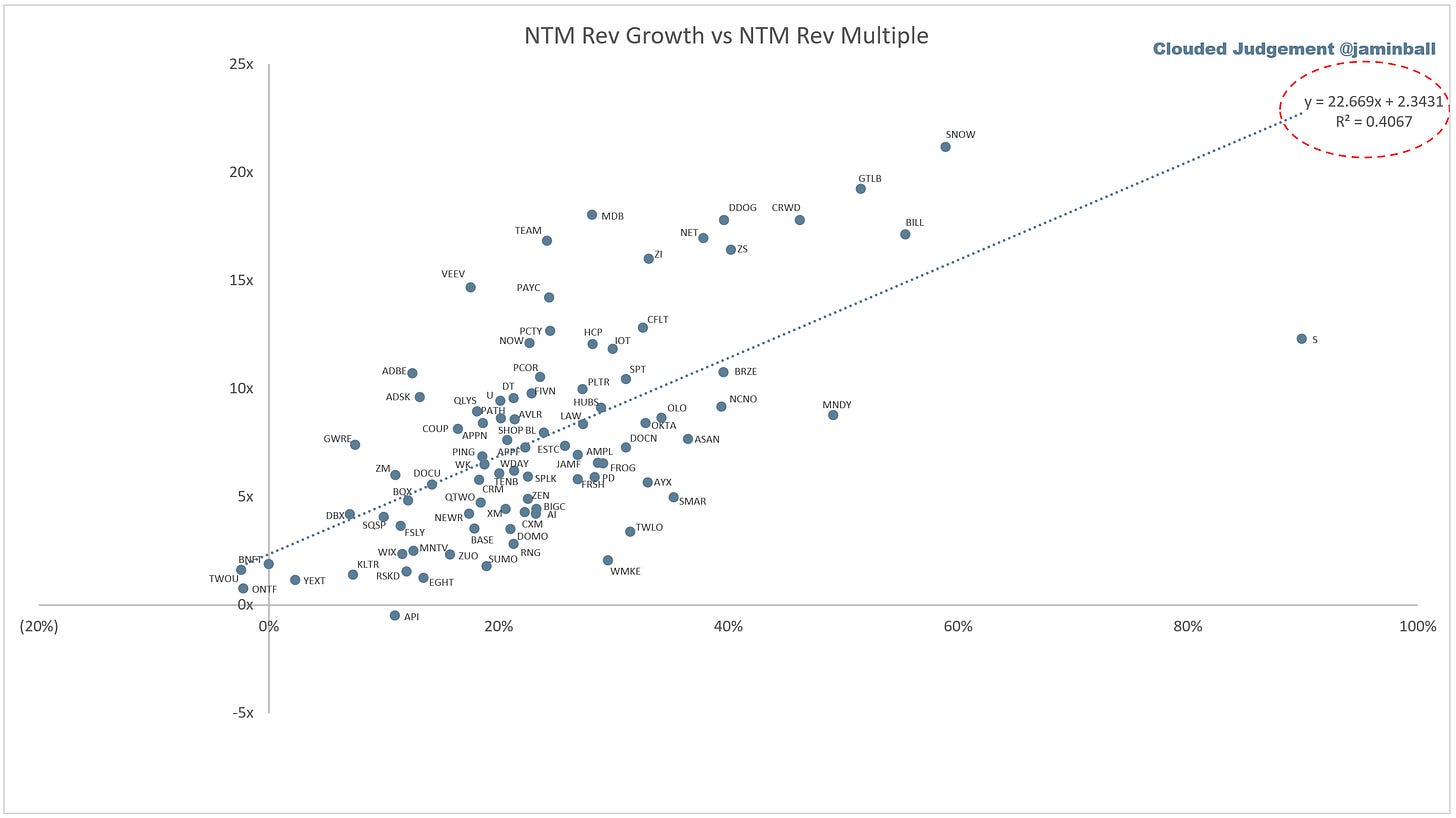

SaaS businesses are valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 7.3x

Top 5 Median: 18.3x

10Y: 2.7%

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 10.7x

Mid Growth Median: 7.1x

Low Growth Median: 2.5x

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Growth Adjusted EV / NTM Rev

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

Operating Metrics

Median NTM growth rate: 23%

Median LTM growth rate: 32%

Median Gross Margin: 74%

Median Operating Margin (24%)

Median FCF Margin: 2%

Median Net Retention: 120%

Median CAC Payback: 36 months

Median S&M % Revenue: 46%

Median R&D % Revenue: 27%

Median G&A % Revenue: 20%

Comps Output

Rule of 40 shows LTM growth rate + LTM FCF Margin. FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

HI Jaimin. Great insights as always. Do you want add another cloud company Informatica to your tracking list?