Clouded Judgement 8.7.20

Every week I’ll provide updates on the latest trends in SaaS valuations, earnings announcements, and highlight any noteworthy news. Follow along to stay up to date!

Highlight of the Week - More Earnings!

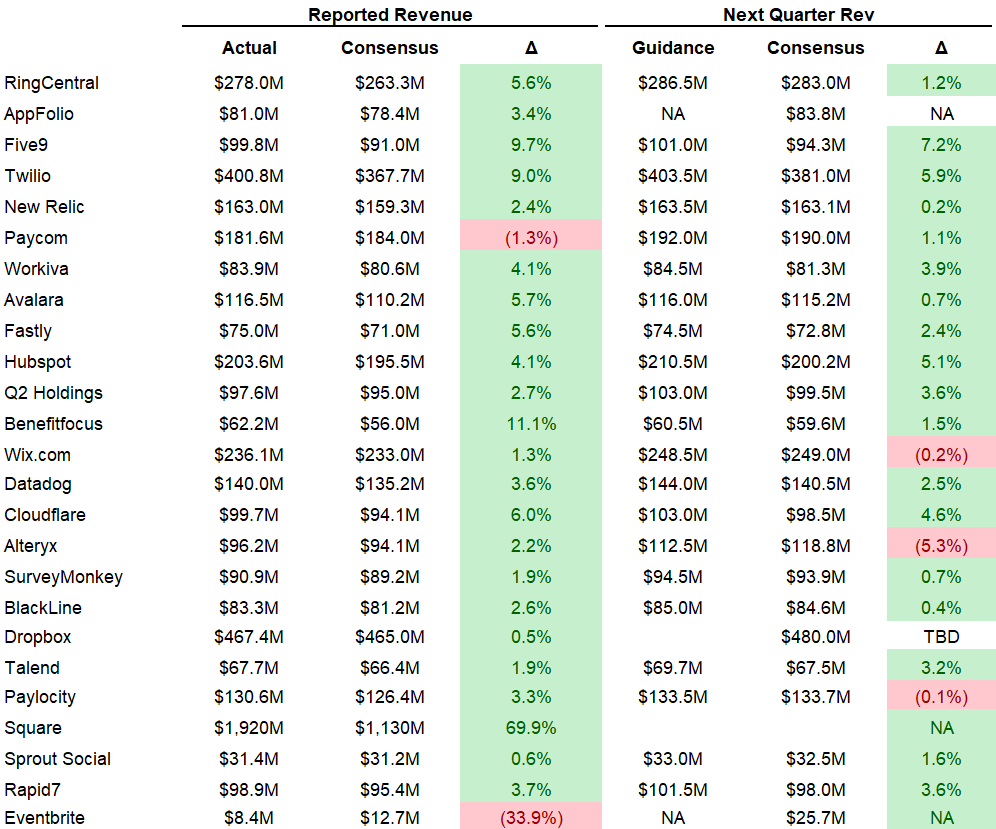

This week was a nice dose of reality for many SaaS names. Multiples have expanded so much recently that the earnings report beats required to justify these multiples were impossible to hit. Even Shopify who beat revenue estimates by nearly 40% only saw their stock go up ~5%. This shows you the types of revenue beats that are already baked into current prices. Datadog, Fastly and Twilio all delivered stellar quarters of growth (and beat consensus estimates by a wide margin). Alas, it wasn’t enough of a beat and each stock dropped. (We’ll see what happens when these stocks trade Friday, I’m writing this late Thursday night and only have after hours data to go off of). Also - you’ll see nearly every company beat their consensus estimates. However, as I’ve written before, I believe these estimates were way too low, everyone knew that, and the beats we’re seeing were already priced in. So it shouldn’t come as a surprise to see Twilio beat by such a wide margin, yet still trade down.

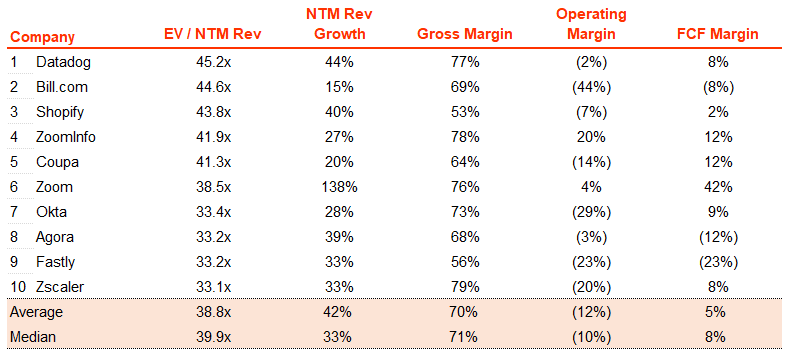

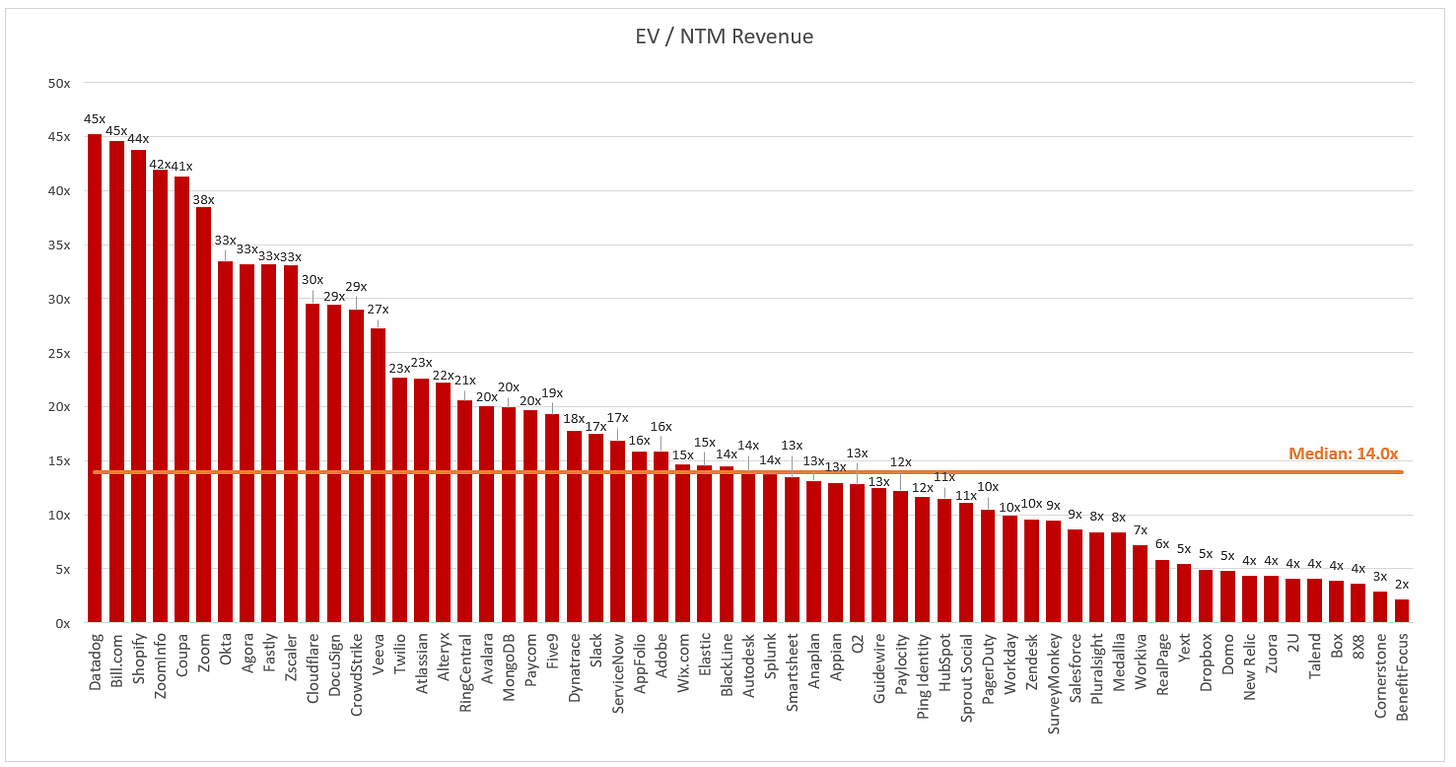

Top 10 EV / NTM Revenue Multiples

In all of the multiples charts below - please note the data is as of Thursday’s market close. So the market effect of Thursday’s earnings are not shown below (ie data as of end of Thursday trading day). Also please note that many companies that reported this week have not received updated consensus estimates projections (which will effect multiples). My back of the envelope math for Datadog / Fastly’s current multiple (as of Friday morning trading ~7:30am PT) is ~40x and ~26x. **Please note I posted an earlier version of this article that miscalculated Shopify’s multiple**

Top 10 Weekly Share Price Movement

For the first week in a while the majority of the largest weekly gains did not come from the high growth bucket.

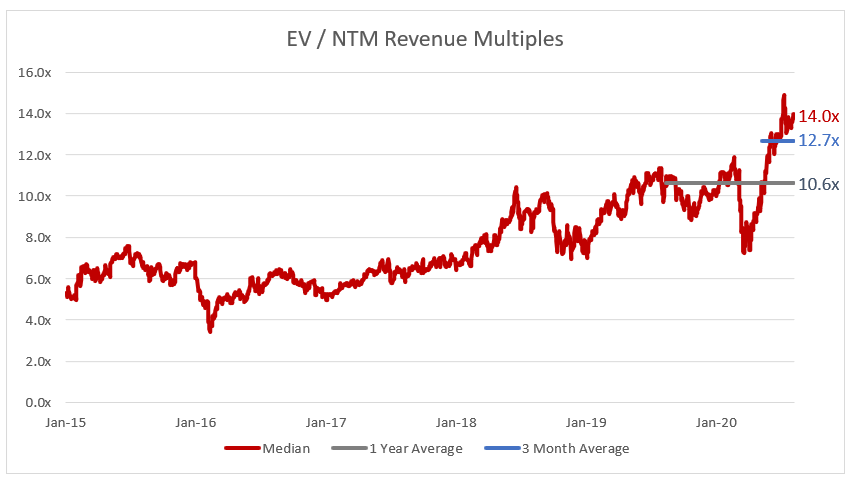

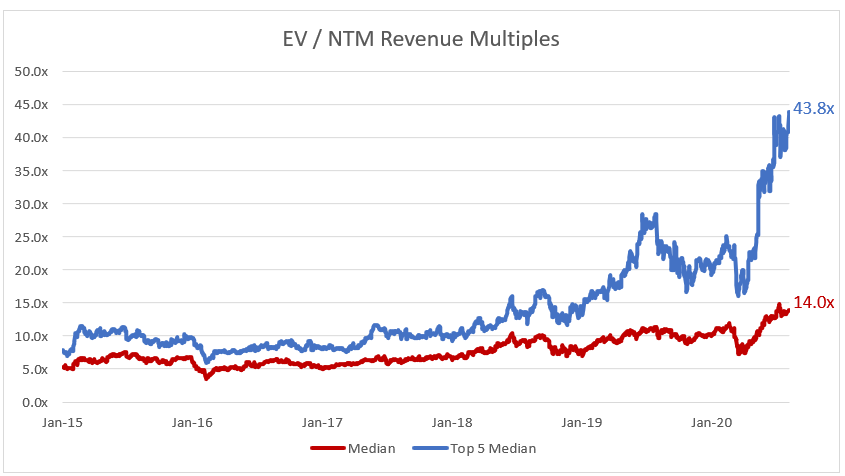

Update on Multiples

SaaS businesses are primarily valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

Overall Stats:

Overall Median: 14.0x

Top 5 Median: 43.8x

3 Month Trailing Average: 12.7x

1 Year Trailing Average: 10.6x

Bucketed by Growth:

High Growth Median: 33.1x

Mid Growth Median: 16.3x

Low Growth Median: 8.6x

Operating Metrics

Median NTM growth rate: 18%

Median LTM growth rate: 30%

Median Gross Margin: 73%

Median Operating Margin (15%)

Median Net Retention: 117%

Median CAC Payback: 29 months

News

SurveyMonkey announced (along with many other leading technology companies) that investing in diversity, equity, and inclusion will be a requirement for doing business with them (from a partner / vendor perspective)

Twilio announced a $1.25B primary follow on offering. The primary offering will raise cash for the company, and dilute existing shareholders. As is customary in these large block trades, the shares were sold at a discount to current market prices. The shares were sold at $247 / share. The stock closed Thursday at $260.

Avalara raised $500M through a primary follow on offering (same type of offering as Twilio)

Dynatrace announced a $1B secondary follow-on offering. 25M shares at $41.10 / share. Only existing shareholders sold shares, the company received no proceeds (no dilution)

ServiceNow announced they raised $1.5B of Senior Notes with a 1.4% coupon

Cloudflare announced their Cloudflare Network Interconnect product (CNI). CNI is a (super cool) product that allows customers to interconnect branch and HQ locations directly with Cloudflare wherever they are, bringing Cloudflare’s full suite of network functions to their physical network edge

Comps Output

Rule of 40 shows LTM growth rate + LTM GAAP Operating Margin. As I mentioned above, most of the forward estimates have not been updated yet. Take Twilio for example. The NTM growth rate is showing 5%. The estimates have not been revised up following their big beat of Q2 numbers. Usually takes a week or so for consensus estimates to get updated.