Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Rate Cut!

It finally happened! The Fed cut rates by 50bps. This represents the first rate cut since the start of the Covid pandemic, and one that has been highly anticipated. There was a little debate on if this cut would be 25bps or 50bps, but we ended up with 50bps. The target fed funds rate now has a range of 4.75% to 5%. The 10Y didn’t change at all, in fact it was slightly up (3.68% last week to 3.72% as of this writing). This goes to show the rate cut was no surprise to the market.

This cut signals a transition from the Fed's aggressive inflation-fighting stance to a more balanced approach. The decision to implement a cut on the large end of expectations reflects the Fed's growing confidence that inflation is moving sustainably toward its 2% target. Fed Chair Jerome Powell stated, "We have gained confidence that inflation is moving toward 2 percent." However, he also noted that inflation "remains somewhat elevated," indicating ongoing vigilance.

This rate cut comes against a backdrop of mixed economic signals. While the Fed acknowledged that economic activity continues to expand at a solid pace, they also pointed out that job gains have slowed and the unemployment rate has increased, albeit remaining low. The unemployment rate currently stands at 4.2%, having drifted upward over the past year. This trend in the labor market was a key factor in the Fed's decision, as they aim to prevent further job losses and maintain maximum employment.

The Fed's updated economic projections reflect these developments. Officials adjusted their unemployment rate forecast for this years end from 4% to 4.4% and revised the inflation outlook downward from 2.6% to 2.3%. For core inflation, which excludes volatile food and energy prices, the committee lowered its estimate to 2.6%, reflecting a 0.2 percentage point decrease since June.

Despite these concerns, the overall economic backdrop remains relatively robust. The Atlanta Fed is currently projecting a 3% growth rate for the third quarter, driven by sustained consumer spending. This resilience in GDP growth likely contributed to the Fed's confidence in implementing a more substantial rate cut.

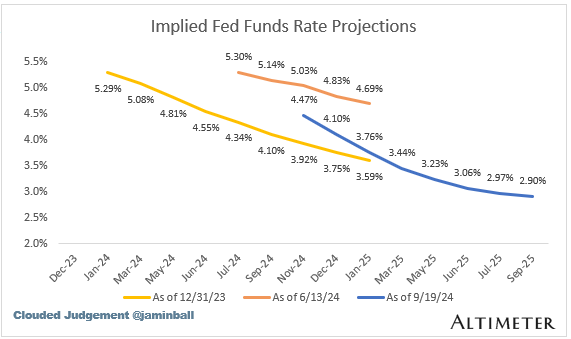

Looking ahead, the FOMC signaled potential further cuts, indicating through its 'dot plot' (I’ve talked about the dot plot before, but this represents the individual projections of each fed member) an expectation of 50 additional basis points in reductions by the end of the year. The projections from individual officials suggested a total of one percentage point in cuts by the end of 2025 and a half-point in 2026. This implies a gradual easing cycle over the next few years. To put this in perspective, at the start of the year, the market was expecting the fed funds rate to end the year at 3.75%, which would have represented a ~1.5% drop from the start of the year. After the cuts this week, and with the forecasts for the rest of the year, the fed is telling us there will be ~1% of aggregate cuts this year. So the expectations at the start of the year were too aggressive. You can see how the markets expectations for rate cuts have changed over the year. The yellow line shows expectations at the start of the year, the orange line from June, and the blue line from today. Overall the Fed started cutting later than expected, but the magnitude of cuts is expected to be greater. The expectations today for the ending rate in Jan ‘25 are not that far off from expectations at the start of the year.

The implications of this rate cut are far-reaching. For consumers, it could mean lower borrowing costs for mortgages, auto loans, and credit cards. This could stimulate spending and investment, potentially boosting economic growth. For businesses, cheaper loans could encourage hiring and expansion plans. Or companies with adjustable rate debt on their balance sheet will see their interest burden decrease.

However, the rate cut also presents challenges. Savers may see lower returns on their deposits, and there's a risk that easier monetary policy could reignite inflationary pressures if not carefully managed. The financial markets responded with initial volatility to the announcement. The Dow Jones Industrial Average experienced significant swings as investors processed the implications for the economy and corporate profits. Then on Thursday the markets traded up massively, with the Nasdaq trading up 2.5%.

In summary, the Fed's decision to cut rates by 50 basis points represents a significant shift in monetary policy. It reflects a delicate balancing act between supporting economic growth and maintaining price stability. As we move forward, all eyes will be on upcoming economic data and the Fed's future decisions to gauge the effectiveness of this new approach in navigating the complex economic landscape.

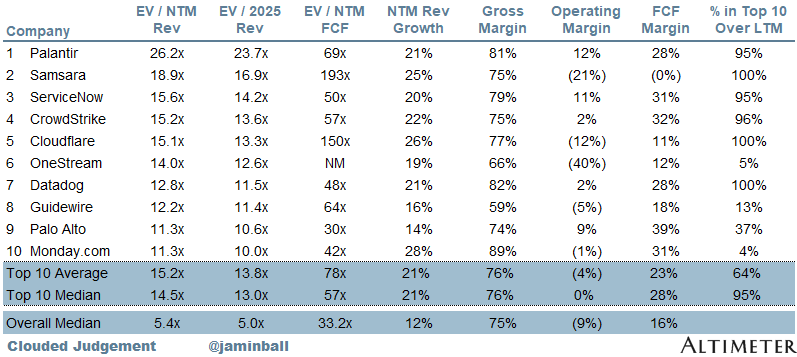

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

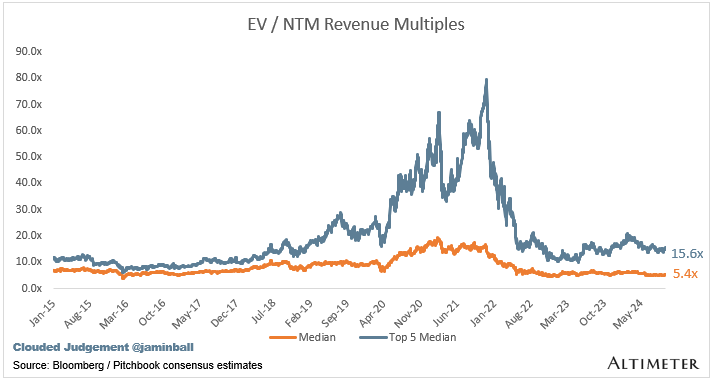

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.4x

Top 5 Median: 15.6x

10Y: 3.7%

Bucketed by Growth. In the buckets below I consider high growth >27% projected NTM growth (I had to update this, as there’s only 1 company projected to grow >30% after this quarter’s earnings), mid growth 15%-27% and low growth <15%

High Growth Median: 9.6x

Mid Growth Median: 8.6x

Low Growth Median: 4.0x

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 12%

Median LTM growth rate: 16%

Median Gross Margin: 75%

Median Operating Margin (9%)

Median FCF Margin: 16%

Median Net Retention: 110%

Median CAC Payback: 41 months

Median S&M % Revenue: 41%

Median R&D % Revenue: 24%

Median G&A % Revenue: 17%

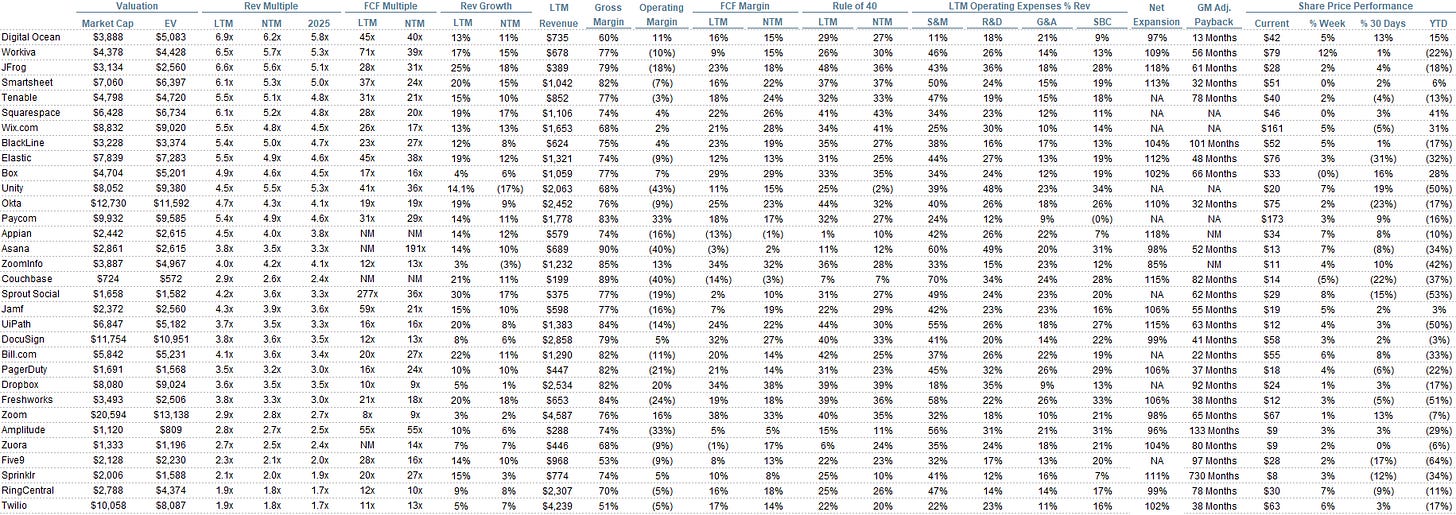

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Love how you organize the info, ests and multiples. You should add a analysis of the QQQ as well