Clouded Judgement 9.22.23 - What's Going On With Interest Rates?

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Rates! Rates! Rates!

This week was quite interesting. We had the FOMC meeting on Wednesday, and it wasn’t a surprise that the Fed did not hike rates any further. However, we saw the 10Y spike to 4.5%. This continues a trend from April that has seen the 10Y steadily rise from 3.3% to 4.5%. So what’s going on?

A few weeks ago I wrote about 3 scenarios for the economy. While the May / June / July sentiment was quite rosy (strong economic growth and falling inflation and thus falling rates), the consensus started to shift to rates higher for longer (strong economic growth and stick inflation requiring rates to stay elevated). This week really furthered the more recent hawkish sentiment.

It may sound counterintuitive, but in this moment strong economic data, and signs of a soft landing, may actually be a bad thing for software valuations (and equity valuations more broadly), because it implies rates will be held higher for longer. The Fed has been very clear that they do not plan to cut rates anytime soon, and this message was really hammered home in their meeting on Wednesday. The dot plot shows the Fed officials projections for future fed funds rate moves (they are the ones who set the fed funds rate, so their projections are meaningful). This summer the dot plot showed 4 rate cutes next year. Now? The dot plot is only projecting 2 rate cutes next year. At the same time, the Fed is projecting a ~5.6% fed funds rate to end 2023 (1 more hike), vs the market’s expectations of ~5.4% (so market expecting no more hikes). Similarly, the fed is projecting a 5.1% rate by end of 2024 (2 cuts), but the market is projecting ~4.7% (3 cuts). Said another way - the Fed is telling us they plan to keep rates higher for longer.

Then on Thursday we got incremental economic data - jobless claims came in at 201k vs expectations of 220k (ie the job market was better than expected). The jobless rate is expected to hit 4.1% by year end vs projections of 4.5% from the summer (ie unemployment rate by year end is expected to stay lower). What do these data points tell us? The economy is staying (or appearing) strong! A strong economy can support higher rates (if we were heading to a recession / slowing economy we’d most likely see the Fed cut rates). So in this case, as I mentioned above, strong economic data is actually a short term negative for stocks as it provides further evidence that the Fed will (and can) keep rates higher for longer. This data point pushed the 10Y up to 4.5% Thursday morning.

Jury is still out if the economy is actually strong… I’m increasingly thinking it’s showing many signs of cracking. Default rates on corporate bonds are rising incredibly quickly and signs of consumer weakness are showing up all over the place. However, everything the Fed has been saying is rates will stay higher for longer…And we have to believe them until they change their tune. As a reminder, in the summer of 2021 they were saying they wouldn’t hike rates through the end of 2022…We all know how quickly that changed when they skyrocketed rates very shortly thereafter. The Fed is saying they’re data dependent - so if the data starts to change (ie economic growth slows faster than expected, or inflation keeps falling and we don’t need rates this restrictive) then the Fed will almost certainly change their posture. But for now, we have a 10Y at 4.5% and software valuations getting punished. As I said last week, until Q3 data starts to roll in from the next earnings season in ~2 months, we’ll see software valuations much more closely tied to short term move in rates. And this week we saw a huge move upwards in the 10Y.

Other Software News

In other software news, Cisco bought Splunk for $28B, and Klaviyo went public breaking the nearly 2 year drought of software IPOs. Consensus estimates will be made public in about a month (so I’ll have true consensus estimates for them then). Below you can see a valuation matrix with rough multiples based on future growth expectations. $30 is the price they went public at.

Top 10 EV / NTM Revenue Multiples

Top 10 Weekly Share Price Movement

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.6x

Top 5 Median: 12.8x

10Y: 4.5%

Bucketed by Growth. In the buckets below I consider high growth >30% projected NTM growth, mid growth 15%-30% and low growth <15%

High Growth Median: 11.2x

Mid Growth Median: 8.1x

Low Growth Median: 3.8x

EV / NTM Rev / NTM Growth

The below chart shows the EV / NTM revenue multiple divided by NTM consensus growth expectations. So a company trading at 20x NTM revenue that is projected to grow 100% would be trading at 0.2x. The goal of this graph is to show how relatively cheap / expensive each stock is relative to their growth expectations

EV / NTM FCF

The line chart shows the median of all companies with a FCF multiple >0x and <100x. I created this subset to show companies where FCF is a relevant valuation metric.

Companies with negative NTM FCF are not listed on the chart

Scatter Plot of EV / NTM Rev Multiple vs NTM Rev Growth

How correlated is growth to valuation multiple?

Operating Metrics

Median NTM growth rate: 15%

Median LTM growth rate: 21%

Median Gross Margin: 75%

Median Operating Margin (17%)

Median FCF Margin: 7%

Median Net Retention: 114%

Median CAC Payback: 35 months

Median S&M % Revenue: 42%

Median R&D % Revenue: 27%

Median G&A % Revenue: 16%

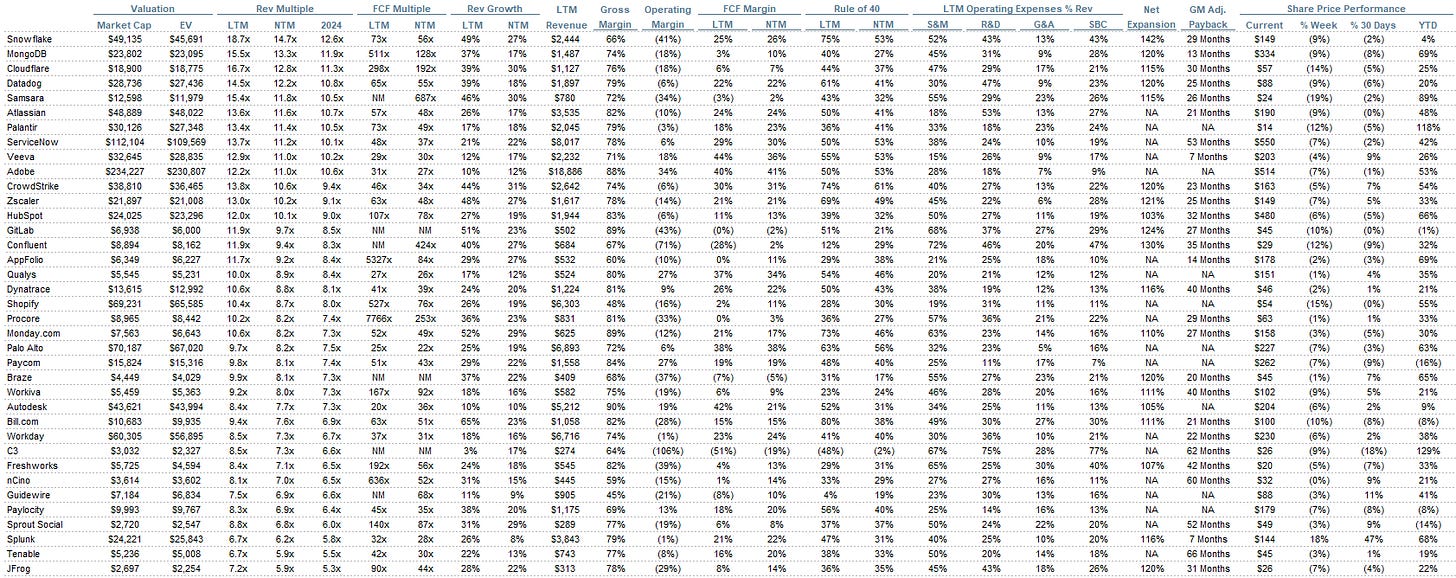

Comps Output

Rule of 40 shows rev growth + FCF margin (both LTM and NTM for growth + margins). FCF calculated as Cash Flow from Operations - Capital Expenditures

GM Adjusted Payback is calculated as: (Previous Q S&M) / (Net New ARR in Q x Gross Margin) x 12 . It shows the number of months it takes for a SaaS business to payback their fully burdened CAC on a gross profit basis. Most public companies don’t report net new ARR, so I’m taking an implied ARR metric (quarterly subscription revenue x 4). Net new ARR is simply the ARR of the current quarter, minus the ARR of the previous quarter. Companies that do not disclose subscription rev have been left out of the analysis and are listed as NA.

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

Well put...and sad 😢

“in this moment strong economic data, and signs of a soft landing, may actually be a bad thing for software valuations (and equity valuations more broadly), because it implies rates will be held higher for longer.”